Hire Offshore Accountants from India - Virtual Employee

Businesses outsource their accounting tasks to other countries; this practice is known as offshore accounting. It involves outsourcing bookkeeping, payroll, tax filing, financial reporting, and other accounting functions to specialized offshore accountants. Businesses utilize offshore accounting services to reduce costs, improve operational efficiency, and gain access to a global talent pool of financial professionals.

With offshore accounting, companies gain access to skilled accountants who know international financial rules. Businesses can ensure accuracy in their financial records with offshore accounting.

Many businesses opt for offshore accounting to optimize their financial processes, maintain regulatory compliance, and enhance overall business productivity. This helps them in gaining access to the latest accounting tools and software, and they benefit from cost savings by using offshore accounting providers.

Why Businesses are Switching to Offshore Accountants

In today’s globalized economy, businesses are increasingly seeking offshore accounting services to streamline their financial operations. There are several reasons why organizations are turning to offshore accountants:

- Cost Savings: Offshore accounting gives access to cheaper skilled labor, and it helps companies reduce their operational expenses.

- Expertise and Experience: Offshore accountants possess specialized knowledge in handling diverse financial matters, ensuring accuracy and compliance.

- Scalability: Offshore accounting services provide flexible solutions that adapt to business growth and changing financial needs.

- Time Efficiency: Businesses can allocate their in-house resources to core tasks while offshore account experts handle financial operations.

- Compliance and Risk Management: Offshore accounting firms ensure that financial statements adhere to local and international regulations.

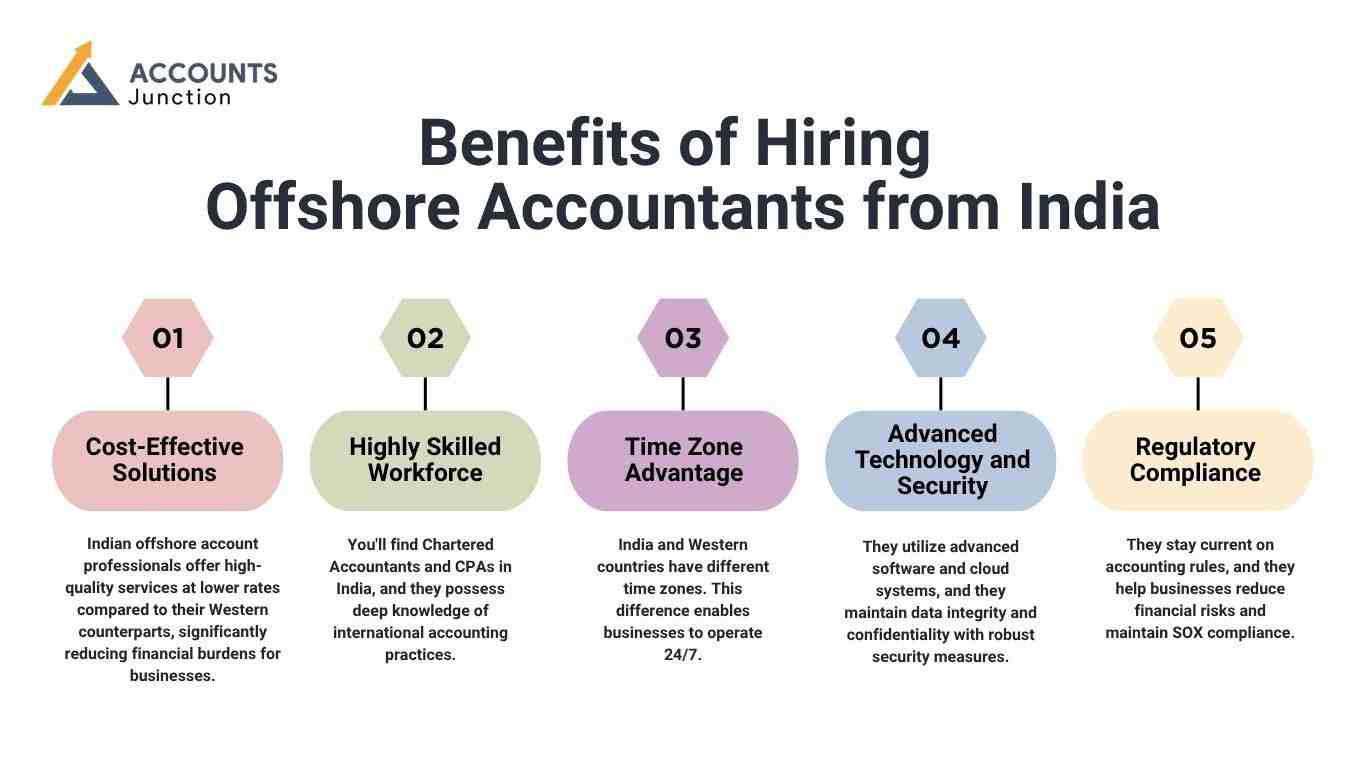

Benefits of Hiring Offshore Accountants from India

India has emerged as a global hub for offshore accounting services. Here are some key benefits of hiring offshore accountants from India:

1. Cost-Effective Solutions

- Indian offshore account professionals offer high-quality services at lower rates compared to their Western counterparts, significantly reducing financial burdens for businesses.

2. Highly Skilled Workforce

- You'll find Chartered Accountants and CPAs in India, and they possess deep knowledge of international accounting practices.

3. Time Zone Advantage

- India and Western countries have different time zones. This difference enables businesses to operate 24/7.

4. Advanced Technology and Security

- They utilize advanced software and cloud systems, and they maintain data integrity and confidentiality with robust security measures.

5. Regulatory Compliance

- They stay current on accounting rules, and they help businesses reduce financial risks and maintain SOX compliance.

Key Offshore Accounting Services Offered by Virtual Employees

Companies outsourcing their accounting tasks to offshore accountants can access a wide range of financial services, including:

- Bookkeeping and Financial Reporting: Businesses need accurate financial reports, so accountants maintain transaction records and prepare cash flow statements.

- Payroll Processing: Managing payroll calculations, tax deductions, employee benefits, and compliance with labor laws.

- Tax Preparation and Filing: Handling tax computations, returns, and compliance with local and international tax regulations.

- Accounts Payable and Receivable Management: Monitoring invoices, payments, vendor relationships, and credit control.

- Financial Analysis and Budgeting: Offering insights into financial performance, cost control, and strategic budgeting.

- Audit Support and Compliance: Assisting businesses with statutory audits, internal audits, and financial compliance.

How Offshore Accountants Help Businesses Scale Efficiently

Scaling a business requires financial stability, streamlined operations, and cost-effective management. Offshore accounting services play a crucial role in helping businesses grow efficiently by:

- Reducing Overhead Costs: Companies can allocate financial resources towards expansion instead of spending excessively on in-house accounting teams.

- Enhancing Decision-Making: Offshore accountants provide valuable financial insights and reports that support strategic business decisions.

- Ensuring Business Continuity: Offshore accounting ensures seamless financial operations, allowing businesses to focus on scaling without disruptions.

- Providing Specialized Expertise: As businesses expand, offshore account professionals offer expertise in managing complex financial transactions and international compliance requirements.

- Supporting Global Expansion: Offshore accounting services help businesses manage multi-currency transactions, taxation, and financial regulations in different countries.

Why Choose Accounts Junction for Offshore Accounting Services?

When selecting an offshore accounting service provider, businesses need a partner that offers reliability, expertise, and cost-efficiency. Accounts Junction stands out as a trusted offshore accounting firm due to the following reasons:

1. Experienced Accounting Professionals

- Accounts Junction houses experienced accountants who provide excellent financial management.

2. Customized Solutions

- We offer customized offshore accounting services that align with specific business needs, whether for startups, SMEs, or large corporations.

3. Advanced Technology Integration

- We utilize advanced platforms like NetSuite and SAP, and we provide seamless offshore accounting solutions.

4. Data Security and Confidentiality

- The firm follows strict security protocols, ensuring that sensitive financial data remains secure and compliant with industry regulations.

5. Scalability and Flexibility

- Our offshore accounting services adapt to business growth, offering scalable solutions that evolve with the company’s financial requirements.

Offshore accounting has become an essential strategy for businesses looking to reduce costs, streamline financial operations, and scale efficiently. With offshore accounting services, companies can access expert financial professionals, improve compliance, and enhance decision-making. India is a top choice for offshore accounting with affordable services and a skilled workforce.

If you’re looking to outsource your financial tasks, partnering with Accounts Junction will help you achieve long-term success. With our offshore accounting services, businesses can gain reliable bookkeeping, payroll, and tax services. Our offshore accountants provide the reliability to succeed in their business.

FAQs

1. What does offshore accounting really mean?

- It usually means letting a team in another country handle your company’s accounts. They may record, track, and review all your financial activities.

2. Why do companies hire offshore accountants?

- Many do it to save costs, gain skilled help, and keep their focus on growth. It may also bring smoother operations and better time use.

3. Can offshore accountants handle complex financial work?

- Yes, many of them can. Some have years of experience working with global clients and may know multiple financial systems.

4. Is it safe to share company data with offshore teams?

- It can be safe when the firm uses secure systems and follows strict privacy rules. Reputed providers often use encrypted platforms for extra care.

5. How much money can a business save with offshore accounting?

- Savings may vary. Some companies see a small cut in expenses, while others may save quite a lot depending on the size and tasks.

6. What kind of services do offshore accountants usually offer?

- They may handle bookkeeping, payroll, tax filing, and reports. Some also help with audits, budgeting, and cash flow planning.

7. Can offshore accounting help small businesses too?

- It sure can. Small firms may benefit the most since they often need expert help but can’t afford full in-house teams.

8. How does the time zone difference work in offshore accounting?

- For many businesses, it turns into an advantage. While one team rests, the offshore team continues the work, so progress never stops.

9. Are offshore accountants familiar with international accounting laws?

- Most are. They often train to follow both local and global standards, so the work may stay compliant across borders.

10. Does offshore accounting mean losing control over finances?

- Not really. You can still review every report, approve entries, and stay in charge while your offshore team does the routine work.

11. How soon can a business start with offshore accounting?

- Quite soon. Once the setup is done and data is shared, work can start within a few days.

12. Can offshore accountants use the same tools my company uses?

- Yes, most of them can. They work with popular software like QuickBooks, Xero, and NetSuite, so switching is usually smooth.

13. What should a company look for before hiring offshore accountants?

- It may help to check their experience, data safety process, and past client feedback. A short trial run can also show how they work.

14. How do offshore accountants manage payroll and taxes?

- They usually calculate wages, handle deductions, and prepare tax reports. With proper tools, everything stays clear and updated.

15. Is language a problem while working with offshore accountants?

- In most cases, it isn’t. Many offshore teams from India and other regions speak fluent English and understand global business terms.

16. Can offshore accounting help in scaling a business faster?

- Yes, it may. When finances are managed well, businesses can focus on bigger goals and faster growth.

17. Do offshore firms provide reports on time?

- Most do. Timely reporting is often part of their service, and regular updates keep clients informed.

18. How can offshore accounting improve decision-making?

- By giving accurate reports and insights, it may help leaders make smart financial choices and plan better for the future.

19. What industries can use offshore accounting services?

- Almost any. From retail to tech firms, from startups to large enterprises — all can use offshore accountants for their financial needs.

20. Why is India known for offshore accounting?

- Because it offers skilled accountants, affordable rates, and strong tech support. Many global firms find it a reliable and steady choice.