Financial Accounting Outsourcing Services vs. In-House Accounting: Which is Better?

When running a business, accounting is a core part of success. You must track income, costs, and profits. Many companies choose between financial accounting outsourcing services and keeping the work in-house. Both have pros and cons.

In the modern business environment, outsourcing has grown in demand. But in-house teams still have their place. This blog will compare both methods. It will help you choose the best fit for your business.

What Are Financial Accounting Outsourcing Services?

- Work done by outside experts.

- Covers bookkeeping, tax filing, and reports.

- Uses skilled accountants from third-party firms.

- Often uses cloud software for easy access.

- Can be short-term or long-term.

What Is In-House Accounting?

- An accountant or a full team inside the company.

- Works only for your business.

- Handles all records and reports.

- Works closely with other departments.

- Often has fixed working hours.

Benefits of Financial Accounting Outsourcing Services

1. Cost Savings

- By using financial accounting outsourcing services, you avoid salaries, benefits, and training costs.

- You pay only for the services needed.

- No need to buy costly software or tools.

2. Expert Knowledge

- Access to skilled accountants with wide industry experience.

- Teams keep up with tax law and compliance changes.

- You gain advice based on best practices.

3. Time Efficiency

- Let you focus on core business work.

- No daily tracking of staff performance needed.

- Outsourced teams work on set timelines.

4. Flexible Services

- Scale up or down based on work volume.

- Choose full or partial accounting help.

- Change service plans without major cost impact.

5. Use of Technology

- Financial accounting outsourcing services use the latest software for speed and accuracy.

- Cloud tools give real-time data access.

- Secure systems protect your data.

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

Benefits of In-House Accounting

1. Full Control

- You manage daily tasks directly.

- Easy to change priorities quickly.

- Staff can work on urgent needs at once.

2. Deep Business Knowledge

- Staff know the company’s culture and goals.

- Can give advice based on past company trends.

- Can spot issues early due to close work.

3. Quick Communication

- Face-to-face talks for faster decisions.

- No delays due to different time zones.

- Easier to handle last-minute changes.

4. Custom Processes

- Create methods that fit your work style.

- No need to adjust to the outside firm’s rules.

- Can link directly with other departments.

Drawbacks of Financial Accounting Outsourcing Services

1. Less Direct Control

- With financial accounting outsourcing services, work is handled outside your office.

- Must rely on reports from the service provider.

- Harder to make sudden changes.

2. Communication Gaps

- Using financial accounting outsourcing services may involve time zone or language differences that slow down work.

- Email and calls may cause delays.

- Urgent requests may take longer.

3. Data Security Concerns

- Financial accounting outsourcing services require sharing sensitive financial data, so strong security is crucial.

- The risk if the provider has poor security.

- Need strong contracts for data safety.

Drawbacks of In-House Accounting

1. High Costs

- Salaries, benefits, and office costs add up.

- Must invest in software and training.

- Costs stay fixed even in slow months.

2. Limited Skill Range

- Small teams may lack some expertise.

- Harder to stay updated on all tax rules.

- May need outside help for special cases.

3. Time Commitment

- You must manage staff and workloads.

- HR issues can take focus away from business.

- Staff leave can slow work progress.

Factors to Consider Before Choosing

1. Business Size

- Small firms may benefit from financial accounting outsourcing services.

- Large firms may prefer in-house for control.

2. Budget

- Outsourcing often costs less upfront.

- In-house needs more long-term funds.

3. Complexity of Work

- Complex operations may need constant in-house focus.

- Standard tasks can be outsourced with ease.

4. Growth Plans

- Fast-growing firms may find outsourcing more flexible.

- Stable firms may manage well with in-house staff.

5. Technology Needs

- Outsourcing gives instant access to new tools.

- In-house may require extra tech investments.

Cost Comparison

Outsourcing

- Pay per project or a monthly package.

- No extra cost for office space or hardware.

- Includes software in the service fee.

In-House

- Pay for salaries, benefits, and equipment.

- Extra costs for training and upgrades.

- It can be costly if the workload is low.

How to Switch to Financial Accounting Outsourcing Services

1. Review Your Current Process and Needs

- Look at your current accounting work. Spot tasks that take too long, repeat often, or cause errors.

- Know which tasks need expert skills, such as taxes or reporting. This helps you pick the right partner.

2. Pick a Reliable Provider

- Choose a firm with proven experience. Read reviews and check past clients.

- Ensure they use secure systems to handle your financial data safely.

3. Set Clear Tasks and Deadlines

- List which tasks the provider will handle: payables, payroll, reconciliations, or reports.

- Set clear deadlines to keep work on track and avoid delays.

4. Sign a Clear Contract

- Put all duties, fees, privacy rules, and exit terms in writing.

- A strong contract reduces disputes and protects your business.

5. Check Work Often

- Meet weekly or monthly to review tasks, progress, and issues.

- Ask for regular reports on transactions and key numbers.

6. Make Integration Easy

- Give the team access to your software and systems.

- Use cloud tools for smooth data sharing and communication.

7. Give Feedback

- Check work quality and give feedback often.

- This keeps the work aligned with your needs and goals.

How to Make In-House Accounting Work Better

1. Hire Multi-Skilled Staff

- Hire accountants who can do payroll, taxes, and reports.

- This reduces reliance on outsiders and keeps the workflow smooth.

2. Train Staff Regularly

- Teach rules, standards, and new tools.

- Well-trained staff avoid errors and stay compliant.

3. Use Cloud Software

- Cloud software gives real-time access to financial data.

- It makes tracking, reporting, and teamwork easier.

4. Set Clear Goals

Break work into daily, weekly, and monthly tasks.

- Daily: Record transactions

- Weekly: Reconcile accounts, process payroll

- Monthly: Create reports, check compliance.

5. Standardize Work

- Create clear steps for routine tasks.

- This ensures consistency and fewer errors if staff change.

6. Audit Regularly

- Check accounts to find mistakes early.

- Internal checks prepare your team for outside audits.

7. Collaborate Across Teams

- Work with sales, operations, and HR to get accurate numbers.

- Better communication lowers errors in invoices, payroll, and budgets.

Why Many Firms Outsource

1. Access Global Talent

- Hire experts worldwide for special tasks. You are not limited by location.

2. Cut Costs

- Outsourcing often costs less than in-house staff. You save on salaries, office space, and tools.

3. Use Cloud Tech

- Cloud tools allow smooth remote work. Data is updated in real time for accuracy.

4. Focus on Growth

- Delegate routine tasks to focus on sales, strategy, and growth. Less stress and better productivity.

5. Scale Easily

- Add or reduce tasks as your business grows. No need to hire or fire staff frequently.

6. Get Better Tools and Skills

- Outsourcing firms use AI, analytics, and best practices. This improves decisions and ensures compliance.

Which Works Best?

1. No One-Size-Fits-All

- Both outsourcing and in-house accounting have pros and cons.

2. Outsourcing Works For

- Cost savings

- Expert advice

- Flexibility to scale

- Less operational stress

3. In-House Works For

- Direct control

- Deep business knowledge

- Fast communication

- Private data handling

4. Choose Based on Needs

- Think of your size, budget, and tasks.

- A mix of in-house staff and outsourcing is often the best solution.

How to Measure the Success of Outsourcing

1. Accuracy and Timeliness

- Check if all reports, records, and filings are correct and delivered on time.

- Errors or late submissions can slow decisions and add extra work.

2. Cost Savings

- Compare the total cost of outsourcing with doing the work in-house.

- Include wages, software, office space, and overheads to find true savings.

3. Insight Quality

- See if the team gives clear and useful financial advice.

- Good guidance helps you plan budgets, manage cash, and grow your business.

4. Communication Speed

- Measure how fast questions are answered and problems are solved.

- Quick and clear communication keeps tasks on track and avoids risks.

5. Flexibility and Growth

- Check if the provider can handle more work or changing needs.

- A flexible partner supports growth without delays or extra hires.

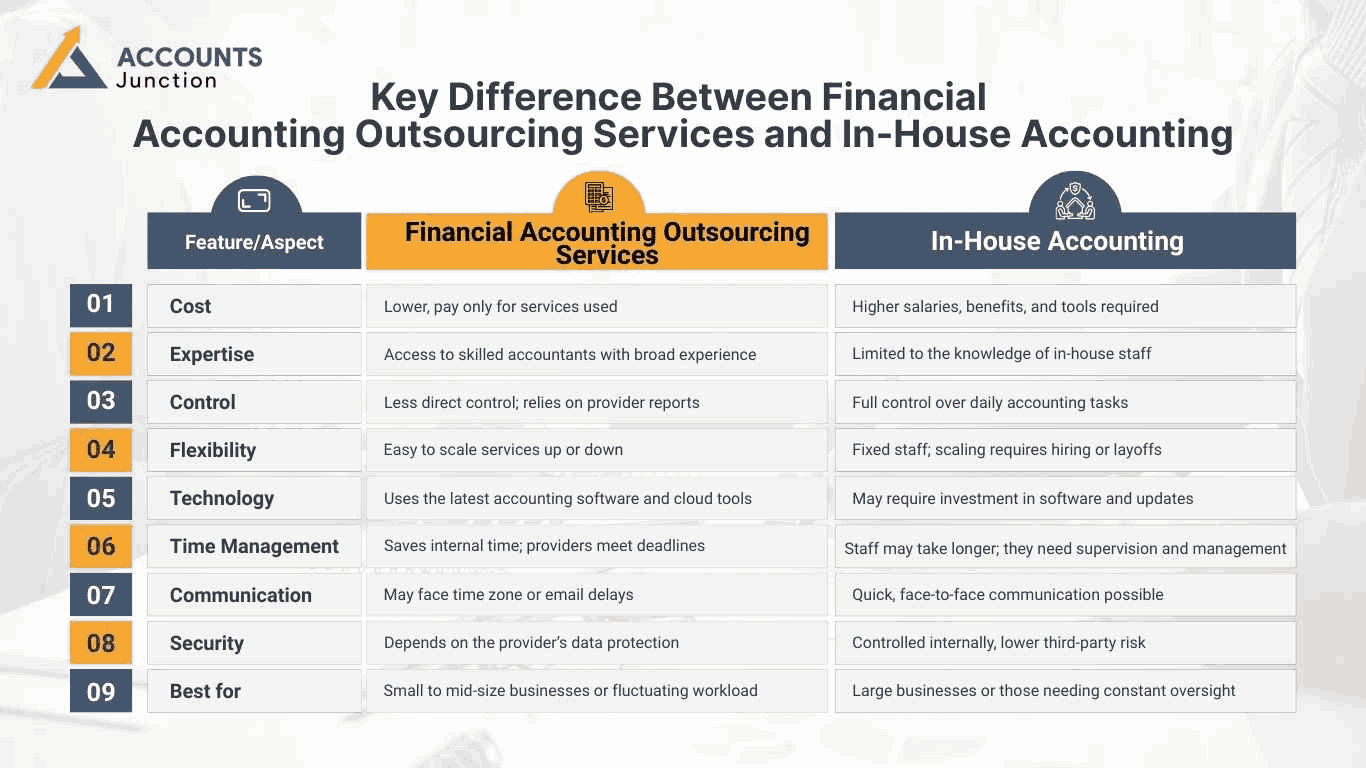

Key Difference Between Financial Accounting Outsourcing Services and In-House Accounting

|

Feature/Aspect |

Financial Accounting Outsourcing Services |

In-House Accounting |

|

Cost |

Lower, pay only for services used |

Higher salaries, benefits, and tools required |

|

Expertise |

Access to skilled accountants with broad experience |

Limited to the knowledge of in-house staff |

|

Control |

Less direct control; relies on provider reports |

Full control over daily accounting tasks |

|

Flexibility |

Easy to scale services up or down |

Fixed staff; scaling requires hiring or layoffs |

|

Technology |

Uses the latest accounting software and cloud tools |

May require investment in software and updates |

|

Time Management |

Saves internal time; providers meet deadlines |

Staff may take longer; they need supervision and management |

|

Communication |

May face time zone or email delays |

Quick, face-to-face communication possible |

|

Security |

Depends on the provider’s data protection |

Controlled internally, lower third-party risk |

|

Best for |

Small to mid-size businesses or fluctuating workload |

Large businesses or those needing constant oversight |

Accounting is key to business success. Both outsourcing and in-house have clear pros and cons. Many small and medium businesses now use financial accounting outsourcing services for cost and flexibility benefits. Large firms may keep in-house teams for control and quick access. The right choice is the one that helps you keep accurate records, follow laws, and save time for growth.

At Accounts Junction, we offer expert financial accounting outsourcing services for all businesses. Our team keeps records correct, follows all rules, and sends reports on time. You can focus on growth while we handle the accounts. Whether you use outsourcing or in-house staff, Accounts Junction gives smart and low-cost solutions.

FAQs

1. What are financial accounting outsourcing services?

- They are accounting tasks handled by a third-party firm.

2. Is outsourcing cheaper than in-house accounting?

- Often yes, because you avoid salaries, benefits, and office costs.

3. Can small businesses outsource accounting?

- Yes, it is common and helps save time and money.

4. Is my data safe with outsourcing?

- Choose a provider with strong security policies.

5. Can I mix outsourcing with in-house staff?

- Yes, many firms use a hybrid model.

6. Do outsourced accountants know tax laws?

- Yes, they stay updated with local and global rules.

7. How do I choose an outsourcing provider?

- Check reviews, skills, pricing, and security measures.