How finance outsourcing simplifies your finance accounting processes?

Managing a company’s financial accounting process can be complex and time-consuming. Many teams spend long hours on invoices, bills, payroll, and reports. Handling all of this inside may take staff away from key business tasks. It may also slow down work and cause mistakes, especially for small and medium-sized firms.

Hiring outside help can ease these challenges. By sending tasks to an external team, a company may save time, cut errors, and focus on growth. Teams can get expert help, use better tools, and keep finance work smooth. This blog explains how sending finance work out may make it simpler and faster.

Why the Financial Accounting Process Is Complex

-

Many Complex Tasks

Handling bills, payments, and rules in the finance accounting process can be confusing for small teams. Teams may struggle to keep up with changes and deadlines.

-

Small Staff Teams

A few staff members can be busy during peak months or years. Hiring extra people costs money and may not solve issues.

-

Tools and Technology Gaps

Without modern tools, tasks take longer and are more prone to errors. Manual spreadsheets often cause mistakes and slow down work.

-

Risk of Errors

Manual data entry leads to frequent mistakes in reports. Errors may cause wrong payments or tax problems.

-

Distraction from Core Work

Staff spend time on tasks rather than growth strategy. Leaders may not have time to plan or decide fast.

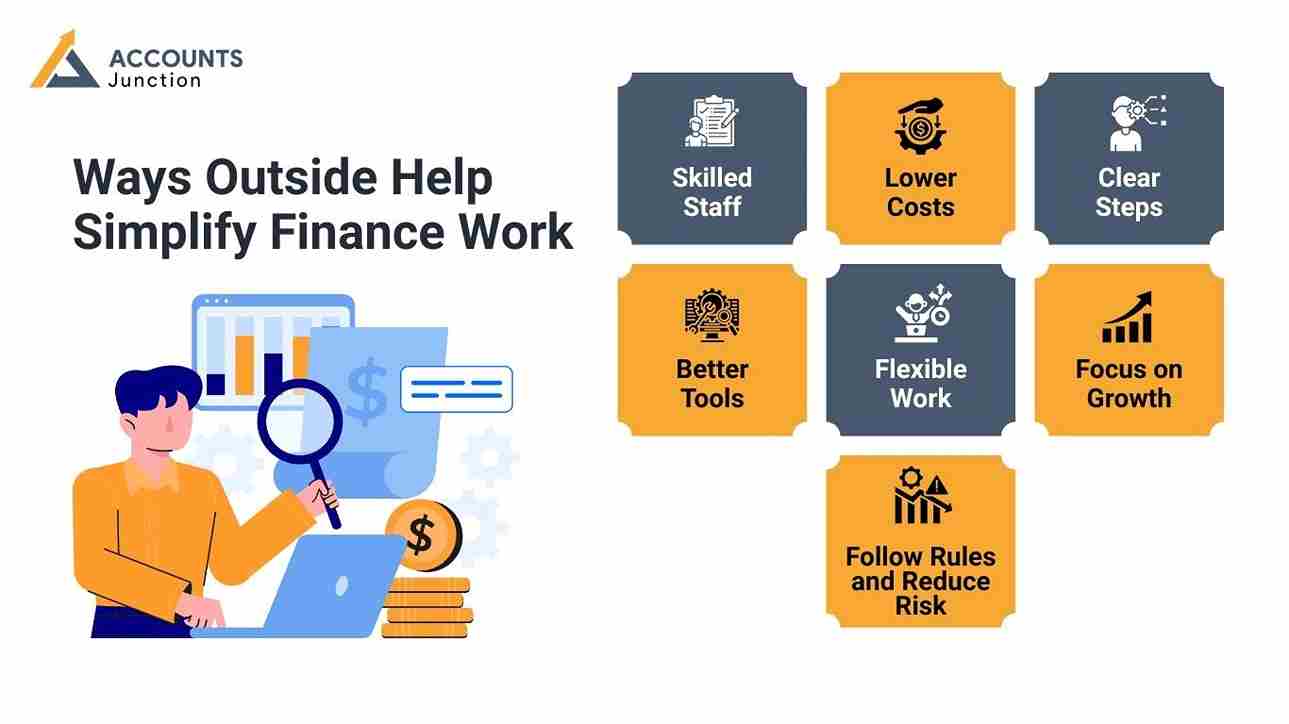

Ways Outside Help Simplify Finance Work

1. Skilled Staff

- Outside help brings trained staff to handle the financial accounting process efficiently. They can manage payroll, bills, and monthly reports reliably.

- Experts spot mistakes early and keep records clear. Internal teams may focus on strategy and planning tasks.

2. Lower Costs

- Paying for outside help may cost less than hiring staff. Companies avoid paying salaries, benefits, or training for new staff.

- Software and tools are often included in services. Money saved can be used to grow the business faster.

3. Clear Steps

- Outside teams use clear steps for all tasks in the financial accounting process, ensuring consistency and fewer errors. Bills, payments, and reports are done the same way every time.

- This reduces mistakes and speeds up monthly reporting. Audits and reviews become easier and less stressful.

4. Better Tools

- Outside help often comes with tools that streamline the financial accounting process and provide real-time insights. Automation reduces manual work and speeds up payroll and bills.

- Teams can track all payments and invoices in real time. Internal staff focus on reviewing results, not entering data.

5. Flexible Work

- Outsourcing the financial accounting process allows teams to scale up or down during busy periods. Costs are lower when work is slow, making it flexible for companies.

- This helps companies handle growth or seasonal peaks smoothly. Finance work becomes predictable and easier to manage overall.

6. Focus on Growth

- Internal teams can focus on strategy while outsourcing ensures the financial accounting process runs smoothly. Leaders get clear and timely reports for faster decisions.

- Staff spend time on analysis while outsourcing manages the daily financial accounting process. Companies can become more agile and responsive to market needs.

7. Follow Rules and Reduce Risk

- Finance rules may often change and cause confusion. Outside teams stay updated with rules and reports to keep the financial accounting process compliant and risk-free.

- Automation helps prevent mistakes in payroll, taxes, or bills. Companies reduce the risk of penalties or legal issues.

Things to Consider

-

What to Outsource

Choose tasks such as bookkeeping, payroll, or reporting. A clear scope prevents confusion and keeps staff accountable.

-

Protect Data

Finance work involves sensitive company data and client information. Choose providers with secure systems and strong data policies.

-

Communication

Teams must share updates and instructions with outside help. Clear communication prevents delays and keeps work accurate.

-

Track Costs and Work Quality

Use KPIs to track speed, errors, and cost effectiveness. Regular review ensures service meets company needs.

-

Plan the Move

Handover should happen step by step to avoid mistakes. Train staff to work with outside teams clearly and effectively.

How Processes Change

-

Before Sending Work Out

Staff handling the financial accounting process manually often spend hours on routine tasks. Monthly reports take extra time and may have mistakes.

Busy months may cause overtime and delays in payments. Updating software or processes is often costly and slow.

-

After Sending the Work Out

Outside help manages invoices, payroll, and reconciliations quickly. Reports and dashboards arrive on time with fewer errors.

Staff spend time on planning, analysis, and growth activities. Automation reduces routine work and errors in daily finance tasks.

Who Benefits Most

-

Small and Medium Businesses

SMEs may not afford a full in-house team. Outside help provides trained staff and tools at a low cost.

-

Companies with Busy Periods

Seasonal or monthly peaks may overload small teams. Outside help provides extra hands and keeps the work on time.

-

Growing Companies

Expansion increases transactions and reports quickly. Outside help keeps processes smooth without extra internal staff.

-

Companies Focused on Core Work

Internal staff focus on products, marketing, and service. Outside help handles daily finance work reliably.

-

Companies Lacking Tools

Outside help often includes dashboards and cloud software. No need to buy expensive software or hire IT staff.

Role of Technology

-

Automation

Automation handles invoices, payroll, and reconciliations easily. Errors are reduced, and staff focus on important tasks.

-

Cloud Systems

Teams can access updates instantly and work together easily. Reports and dashboards are always current and accurate.

-

Dashboards

Visual dashboards help leaders understand finances quickly. Decisions are faster without checking raw data manually.

-

Templates

Reports follow a clear, simple format every month. Audits, checks, and reviews are easier and faster.

-

Data Safety

Secure servers and backups keep financial data safe. Information stays private and reduces the risk of leaks.

Steps to Start

- Review Tasks

List tasks that take too much time or cause errors.

- Choose Scope

Decide what tasks to send outside for help.

- Set Goals

Define targets like lower errors, faster reports, and cost savings.

- Pick a Provider

Choose a firm with experience, tools, and good reviews.

- Plan Transition

Move work step by step to avoid mistakes or delays.

- Monitor Performance

Use KPIs for speed, accuracy, and cost control.

- Use Time Saved

Internal staff focus on planning, strategy, and growth activities.

Why Work Gets Simpler

-

Less Routine Tasks

Outside teams handle repeated tasks efficiently. Internal teams focus on planning and decision-making.

-

Fewer Errors

Standard processes reduce mistakes in financial work. Automation further cuts human errors in reporting.

-

Clear Reporting

Dashboards and templates provide instant key information. Managers can make better decisions faster and easier.

-

Flexible Work

Resources adjust according to workload and growth. Finance work becomes predictable and easier to manage.

Benefits for Growth

- Faster Decisions: Timely reports help leaders act quickly.

- Better Resource Use: Staff focus on high-value work, not routine tasks.

- Lower Risks: Updated processes reduce penalties and mistakes.

- Cost Savings: Fixed fees reduce overhead and avoid surprises.

- Investor Confidence: Reliable finance work improves credibility.

Sending finance and accounting tasks outside may simplify work. Expert staff, modern tools, and clear steps simplify the financial accounting process and cut errors. Internal teams can focus on growth rather than daily finance work.

At Accounts Junction, we help companies manage finance tasks efficiently. We provide bookkeeping, payroll, and reporting using modern tools. Our team helps reduce errors, save costs, and let companies focus on growth. With Accounts Junction, finance work becomes simple, clear, and reliable for all businesses.

FAQs

1. What is outsourced accounting?

- Hiring outside experts to do books, payroll, and reports.

- They handle daily finance tasks so your team can grow the business.

2. How can CPA outsourcing help my business?

- Certified accountants manage taxes, audits, and rules to cut mistakes.

- They keep your accounts correct and follow all laws.

3. Which accounting tasks can be outsourced?

- Bookkeeping, payroll, tax filing, invoices, and reports are common.

- Other tasks include reconciliations and cash flow tracking.

4. How does outsourcing improve accuracy?

- Experts and simple tools reduce mistakes in records.

- Routine checks make reports correct each month.

5. Can outsourcing lower accounting costs?

- Yes, it saves on salaries, software, and training.

- You pay only for what you need, no extra costs.

6. How does outsourcing help with compliance?

- Experts follow tax laws and rules to avoid fines.

- They make sure reports meet all local and national rules.

7. Can outsourced accounting handle payroll?

- Yes, they run pay, deductions, and taxes on time.

- They also give clear pay slips to employees.

8. How does outsourcing help small businesses?

- Small firms get expert help without a full staff.

- It saves time, cuts errors, and frees the team to grow.

9. Is cloud accounting used in outsourcing?

- Yes, cloud tools track invoices, payroll, and reports safely.

- Staff can see data anytime, from anywhere.

10. Can outsourcing speed up reporting?

- Yes, dashboards and simple tools give fast reports.

- Managers see finances quickly and make faster choices.

11. Can outsourced accounting handle audits?

- Yes, experts make clear records for audits.

- They make checks easy and avoid last-minute stress.

12. How does outsourcing support growing companies?

- It grows with more transactions and reports.

- Teams adjust to meet busy months or more work.

13. Can outsourcing reduce the risk of mistakes?

- Yes, experts follow rules and checks to avoid errors.

- Tools and reviews lower mistakes even more.

14. How fast can outsourcing start?

- Work can start in a few weeks, step by step.

- Planning ensures a smooth handover without delays.

15. Can outsourcing improve decisions?

- Yes, quick reports and dashboards help leaders act fast.

- Correct data allows better budget and growth plans.

16. Is outsourcing only for big companies?

- No, small and mid-sized firms can use it too.

- Even startups save money and get correct accounts.

17. Can outsourcing help with tax planning?

- Yes, accountants give tips to lower taxes.

- They also help pick deductions and credits.

18. How do I track outsourcing performance?

- Check KPIs like report speed, accuracy, and cost.

- Reviews ensure service meets business needs.

19. Why is outsourcing better than hiring in-house?

- Lower costs, expert staff, tools, and flexible help.

- No need to hire, train, or buy software.

20. Can outsourcing handle peak workloads?

- Yes, teams scale up in busy months.

- This keeps finance work on time even in spikes.

21. Do outsourced accountants do reconciliations?

- Yes, they check accounts and bank balances often.

- They spot mistakes early and keep records correct.

22. How does outsourcing make accounting easier?

- Clear steps, simple tools, and experts reduce work.

- Dashboards and templates make finances easy to see.

23. Can outsourcing improve investor trust?

- Yes, timely and correct reports build confidence.

- Transparent records show strong financial control.