Effective Bookkeeping and Hospitality Accounting Services For The Hospitality Industry

The hospitality industry operates on unique financial principles, requiring specialized knowledge and techniques. Hospitality accounting goes beyond basic bookkeeping, encompassing revenue management, cost control, inventory management, and compliance with industry-specific regulations.

Accurate and timely financial information is vital for making informed business decisions, optimizing operations, and ensuring profitability in this competitive landscape.

Understanding the specific demands of the hospitality sector, specialized accounting practices are not just beneficial but essential for sound financial management and strategic growth.

Key Challenges in Accounting for the Hospitality Industry

Managing finances in the hospitality industry presents a unique set of challenges. The high volume of transactions and diverse revenue streams requires robust accounting systems and expertise. Effectively navigating these challenges is crucial for maintaining financial health and operational efficiency.

- High Volume of Transactions: Daily operations involve numerous transactions, from room bookings to food and beverage sales. This requires careful record-keeping.

- Diverse Revenue Streams: Hotels and restaurants generate revenue from various sources, including accommodation, dining, events, and other services, complicating revenue recognition and tracking.

- Inventory Management: Managing perishable goods and supplies in food service requires precise inventory tracking. This helps to minimize waste and optimize costs.

- Cost Control: Fluctuating occupancy rates and food costs necessitate effective cost control measures to maintain profitability.

- Compliance and Regulations: The industry is subject to specific regulations related to taxes, labor laws, and health and safety standards, so diligent compliance is required.

- Need for Real-Time Data: Quick access to financial information is crucial for making timely decisions on pricing, staffing, and inventory management.

- Integration of Different Systems: Integrating point-of-sale (POS), property management systems (PMS), and accounting software can be complex. However, this integration is essential for efficiency.

Addressing the inherent complexities of the hospitality industry, specialized accounting solutions and expertise are vital for overcoming these challenges and ensuring accurate financial reporting.

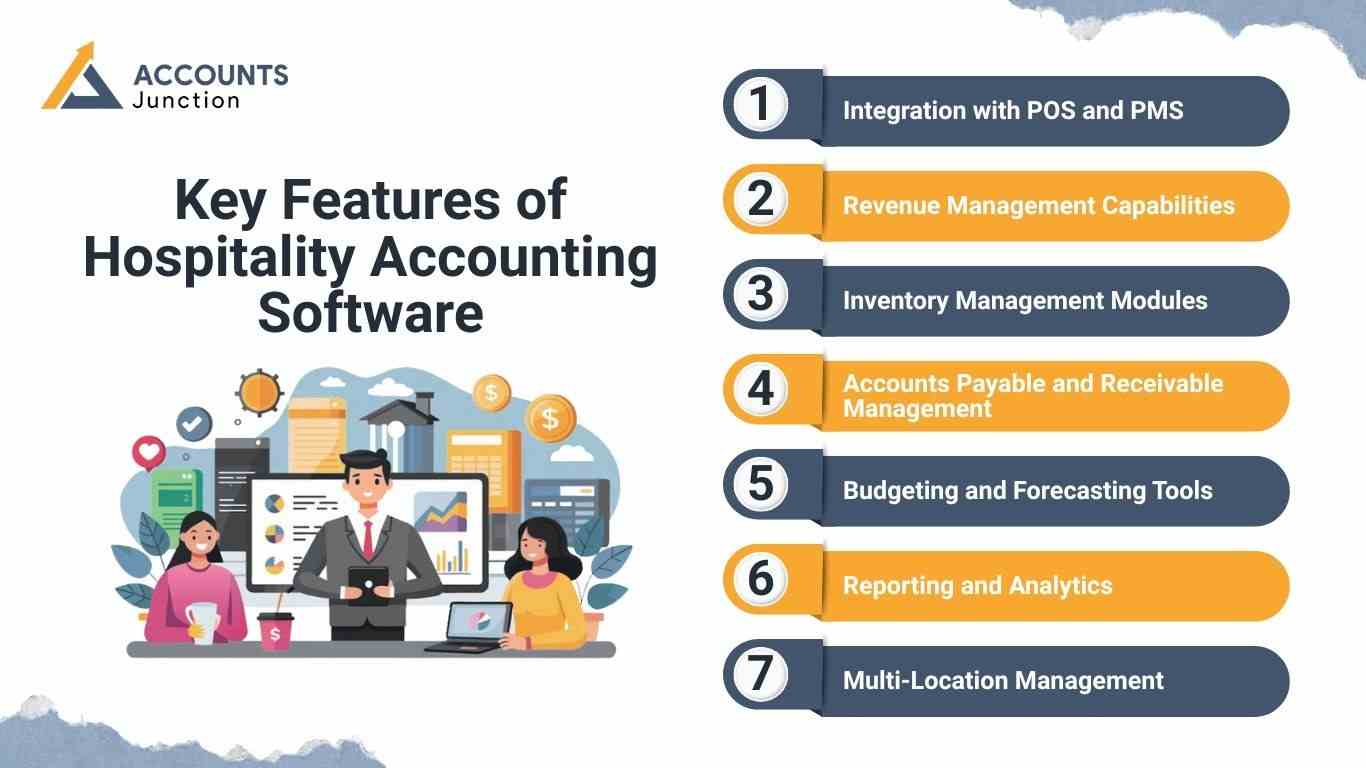

Key Features of Hospitality Accounting Software

Using technology is crucial for efficient hospitality accounting. Specialized hospitality accounting software is designed to address the unique needs of the industry. It offers features that streamline operations, improve accuracy, and provide valuable insights.

- Integration with POS and PMS: Seamless integration with point-of-sale and property management systems for automated data flow.

- Revenue Management Capabilities: Tools for tracking and analyzing revenue streams from various sources.

- Inventory Management Modules: Features for managing food and beverage inventory, tracking costs, and reducing waste.

- Accounts Payable and Receivable Management: Efficiently managing vendor payments and customer invoices.

- Budgeting and Forecasting Tools: Functionality for creating budgets, tracking performance against targets, and forecasting future financial outcomes.

- Reporting and Analytics: You can generate customized reports on key performance indicators (KPIs). These KPIs include occupancy rates, revenue per available room (RevPAR), and food costs.

- Multi-Location Management: Features for consolidating financial data from multiple hotel or restaurant locations.

Investing in hospitality accounting software with these essential features is crucial for automating processes and improving accuracy. This investment also helps in gaining valuable insights into the financial performance of a hospitality business.

The Role of Hospitality Accounting in Cost Control and Profitability

Effective hospitality accounting is instrumental in controlling costs and maximizing profitability within the industry. It provides detailed insights into expenses and revenue streams. This enables businesses to identify areas for improvement and make data-driven decisions.

- Detailed Expense Tracking: Monitoring and categorizing all expenses, from operational overhead costs.

- Cost of Goods Sold (COGS) Analysis: It's important to specifically track the cost of food and beverage. This helps to optimize purchasing and pricing strategies.

- Labor Cost Management: Analyzing labor expenses, which are often a significant portion of costs in hospitality.

- Identifying Areas for Efficiency: Pinpointing areas where costs can be reduced without compromising quality.

- Pricing Strategies: Providing data to inform optimal pricing for rooms, menu items, and services.

- Profitability Analysis by Department: Evaluating the profitability of different departments, such as rooms, restaurants, and events.

- Budgeting and Variance Analysis: Comparing actual performance against budgets to identify and address discrepancies.

- Revenue Optimization: Analyzing revenue trends to maximize occupancy rates and sales.

- Impact of Accounting on Profit Margins: Accurate accounting directly contributes to understanding and improving profit margins.

Through careful tracking, analysis, and reporting, hospitality accounting empowers businesses to make informed decisions that directly contribute to effective cost control and enhanced profitability.

Best Practices for Efficient Accounting for the Hospitality Industry

Implementing best practices in accounting for the hospitality industry is crucial for maintaining accuracy, efficiency, and compliance. These practices help streamline financial processes, minimize errors, and provide a solid foundation for informed decision-making.

- Establish a Chart of Accounts Specific to Hospitality: Establish account classifications that correspond to the specific revenue and expenditure patterns of the industry.

- Implement Robust Internal Controls: Establishing procedures to safeguard assets and prevent fraud.

- Regularly Reconcile Bank Accounts and Credit Card Statements: Ensuring accuracy and identifying discrepancies promptly.

- Maintain Detailed Records of All Transactions: Keeping thorough documentation for all income and expenses.

- Perform Regular Inventory Counts: Accurately tracking inventory levels, especially for food and beverage.

- Utilize Technology Effectively: Using hospitality accounting software to automate tasks and improve efficiency.

- Develop and Monitor Key Performance Indicators (KPIs): Tracking metrics like RevPAR, occupancy rates, and food costs to assess performance.

Establish account classifications. These classifications should correspond to the specific revenue and expenditure patterns of the industry.

Importance of Real-Time Financial Visibility in Hospitality

Dynamic Pricing Adjustments: Real-time data helps hotels and restaurants change room rates and menu prices fast based on demand.

Improved Cost Response: Fresh numbers help teams act fast when food or drink costs rise or fall.

Early Performance Identification: Real-time reports show which areas are slow or weak before the issue grows.

Optimized Workforce Scheduling: Live data helps set the right staff count at the right time.

Proactive Decision-Making: Quick access to trends helps leaders act early and grow profit.

Role of Automation in Enhancing Hospitality Accounting Accuracy

Seamless POS Integration: Automation links POS data with accounts with no delay, which keeps all records neat and on time.

Instant Financial Reporting: Tools can make sales, tax, and room reports fast with no manual work.

Efficient Payroll Processing: Pay for staff on shifts or hours is done by the system, which cuts errors.

Reduced Administrative Workload: Automation cuts paper work and saves time on daily tasks.

Faster Period-End Closing: Month-end and year-end tasks finish faster with automated steps.

Why Outsourced Hospitality Accounting Is Becoming a Trend

Cost Reduction: Outsourcing cuts costs when compared with hiring full-time staff.

Access to Industry Experts: Firms gain help from experts who know hotel and food service rules.

Advanced Reporting Capabilities: Outsource teams use strong tools to make clear reports without extra cost.

Scalability for All Seasons: Support can rise in peak times and drop when it is slow.

Improved Compliance: Expert teams help meet tax and rule needs with ease.

How Accounting Improves Operational Efficiency in Hospitality

Better Menu and Inventory Decisions: Clear numbers show slow menu items and help cut waste.

Profitable Room Package Analysis: Data shows which room deals bring the best gain.

Labor Cost Evaluation: Reports show shifts that cost too much but bring low sales.

Vendor Performance Tracking: Numbers help track vendors and guide better price deals.

Stable Cash Flow Management: Good records help keep cash flow steady for daily needs.

The Impact of Bookkeeping on Guest Experience

Smoother Guest Processes: Linked systems help guests check in and out fast.

Improved Staff Allocation: Clear data sets the right staff count at busy hours.

Availability of Quality Supplies: Good records help buy goods on time so stock stays full.

On-Time Maintenance: Clean books help plan repair work and keep the place in good shape.

Enhanced Loyalty Programs: Good accounts help run reward plans in a smooth and fair way.

Effective bookkeeping and accounting are indispensable for navigating the unique financial landscape of the hospitality industry. From managing high transaction volumes and diverse revenue streams to controlling costs and ensuring compliance, the challenges are significant. At Accounts Junction, we recognize the critical role that specialized accounting plays in the success of hospitality businesses. We provide comprehensive hospitality accounting services tailored to meet the specific needs of hotels, restaurants, and other establishments.

FAQs

1. What is hospitality accounting in hotels and restaurants?

- It deals with room sales, food sales, and cost checks each day. It helps hotels and food sites track spend, sales, stock, and profit.

2. Why is hospitality accounting key for the hospitality industry?

- It keeps all money data clear and on time. It also helps plan price, staff, and cost steps.

3. How do accounting services for the hospitality industry help profit?

- They give clean cost and sales info for each unit. This helps cut waste and lift profit.

4. What makes hospitality accounting different from normal accounting?

- Hotels and food sites run high sales and stock flow. This needs fast checks, real-time data, and tight cost control.

5. Why do hotels need real-time data in accounting?

- Live data helps change room rates, menu rates, and staff levels. It also flags cash or cost issues at once.

6. How does hospitality accounting software help daily tasks?

- It links with POS and PMS to pull sales and room data. It cuts errors and saves time on books.

7. What key tools should hospitality accounting software have?

- It must sync POS and PMS, track food stock, and make fast reports. It should also help with cost and budget plans.

8. How does good bookkeeping help hotel guests?

- Clean books help fast check-in, quick bills, and full stock. This boosts the guest stay.

9. Why is POS sync vital in hospitality accounting?

- It pulls food and room sales with no manual work. This keeps books up-to-date and error-free.

10. How does accounting help set room rates?

- It shows real costs, demand trends, and past sales. This helps set smart and fair rates.

11. How does hospitality accounting cut food and drink waste?

- It tracks use, spoil, and vendor rates. This helps buy right and stop loss.

12. Why is stock control hard in hotels and food sites?

- Food stock moves fast and can spoil quick. Good books help track levels in real time.

13. What KPIs are key for hospitality accounting?

- RevPAR, ADR, food cost %, and labor cost %. These show how well each unit runs.

14. How often should hotels check their key reports?

- Daily for sales, staff, and stock. Monthly for full cost and profit checks.

15. How do accounting services help with tax rules for hospitality?

- They track GST, TDS, and labor rules with care. This cuts risk of fines or gaps.

16. How does hospitality accounting help with labor cost?

- It shows peak hours, high-cost shifts, and staff use. This helps plan the right staff mix.

17. Why do hotels need a custom chart of accounts?

- Each hotel has room, food, bar, event, and spa sales. A custom chart helps track each line with ease.

18. How does accounting help menu and food cost plans?

- It shows plate cost and top or slow items. This helps pick the right price and cut loss.

19. Why is cash flow control vital in hotels?

- Many costs hit daily, like food, staff, and stock. Good flow helps meet each need on time.

20. How does hospitality accounting support multi-site hotels?

- It joins all units in one file for a clear view. This helps track sales, cost, and profit by site.

21. How do accounting services track vendor performance?

- They check the rate, supply time, and bill errors. This helps pick the best vendors for cost and quality.

22. What errors affect hospitality accounting the most?

- Wrong stock counts, missed sales posts, and weak checks. These can hurt cash and profit.

23. How does hospitality accounting help with peak and low seasons?

- It uses past trends to plan costs, stock, and staff. This helps stay stable in each season.

24. Why is revenue management linked to hospitality accounting?

- It needs clean sales and cost data to set rates. This lifts yield and boosts room and food sales.

25. Why do many hotels use outsourced hospitality accounting?

- It cuts cost and gives skill from hotel-based teams. It also adds pro tools and fast reports.