Legal Bookkeepers vs. Regular Bookkeepers: What’s the Difference?

Bookkeeping is the core of every business. It keeps track of income, spending, and helps leaders make smart money choices. But not all bookkeeping works the same way. Different industries have their own needs, rules, and ways to record financial data. In the legal field, handling client funds and trust accounts calls for extra care. They handle client funds, trust accounts, and must follow strict legal standards. Legal bookkeepers understand these duties and keep the firm’s records clean, correct, and compliant. With the right support, law firms can manage money better and stay ready for growth.

In this blog, we’ll explore how legal and regular bookkeepers differ, what each role involves, and how choosing the right expert helps a firm stay clear, efficient, and prepared for success.

Understanding the Basics of Bookkeeping

Bookkeeping is the process of recording all financial transactions for a business. Every company, whether it is small or large, needs a clear record of income, expenses, and cash flow. Bookkeepers handle day-to-day tasks like:

- Recording sales and payments

- Managing invoices and bills

- Reconciling bank accounts

- Tracking expenses and payroll

But while regular bookkeeping handles general business needs, law firms deal with unique financial complexities that call for specialized accounting skills. Legal bookkeepers ensure proper trust fund management, compliance, and accurate financial tracking for every client and case.

What Makes Legal Bookkeepers Different?

1. They Understand Legal Accounting Rules

Legal accounting is not the same as regular business accounting. Law firms must manage client trust accounts ( funds held on behalf of clients). Legal bookkeepers are trained to handle these accounts with care and accuracy.

For example, they know how to:

- Keep client funds separate from firm funds

- Follow trust account rules

- Record every case-linked transaction

A regular bookkeeper may not know these legal rules, which can cause costly mistakes or even legal trouble. Hiring a bookkeeper helps avoid those risks.

2. They Manage Client Trust Accounts

One of the main jobs of Legal accountants is trust accounting. A trust account holds client money that hasn’t yet been earned by the lawyer.

For instance:

- Advance payments for legal work

- Settlement funds are waiting to be paid

- Retainers held until work is done

Each must be tracked with care. Bookkeepers ensure every dollar is handled under the law society rules. A regular bookkeeper might not have this training, making them unfit for a law firm setup.

3. They Know Legal Billing and Case-Based Accounting

Law firms bill by client, case, or hour. Law firm bookkeepers manage billing that fits these methods.

They use systems that track time, link expenses to clients, and create trust-safe invoices.

While general bookkeepers might use tools like QuickBooks, law firm bookkeepers often use:

- Clio Manage

- LEAP

- CosmoLex

- PracticePanther

These tools are built for law firms and help meet all legal standards.

4. They Maintain Compliance and Audit Readiness

Legal bookkeepers make sure every record meets compliance needs. They prepare books that are always audit-ready. This includes clear records for client trust funds, case costs, and firm expenses.

With their help, law firms stay safe from fines or penalties during audits or reviews.

5. They Improve Financial Insight for Law Firms

Beyond managing records, law firm bookkeepers give firms better financial clarity. They prepare reports that show income by case, expenses by client, and overall firm growth.

This insight helps law firms make smart choices, plan budgets, and find ways to improve profits.

Roles and Responsibilities of Legal Bookkeepers

To better understand their importance, let’s look at what legal bookkeepers do daily.

1. Maintain Accurate Trust Ledgers

Each client has a separate ledger showing how much money is held in trust. A legal accountant must record deposits, withdrawals, and fees for each client without any mix-ups.

2. Handle Compliance and Reporting

They prepare reports for trust reconciliations, showing every transaction balances with bank statements. This is vital for passing audits or reviews by legal authorities.

3. Manage Office Accounts

Apart from trust funds, law firm bookkeepers also handle the law firm’s main accounts, rent, payroll, supplies, and other business expenses.

4. Support Year-End Financials

A law firm bookkeeper prepares data that accountants use to create year-end reports or tax filings. By keeping records neat and clear, they make it easy for accountants to close the books correctly.

The Role of Regular Bookkeepers

While law firm bookkeepers focus on law firms, regular bookkeepers serve all kinds of businesses, from shops to startups.

1. General Financial Recording

They handle sales, purchases, and expense tracking for regular businesses.

2. Payroll and Tax Support

They ensure employees are paid on time and help with tax preparation for quarterly or annual filings.

3. Budget and Cash Flow

Regular bookkeepers also track how money moves in and out, helping owners stay within budget.

However, they don’t usually deal with trust funds, retainers, or court-related payments, which are things that everyday work for Legal Bookkeepers.

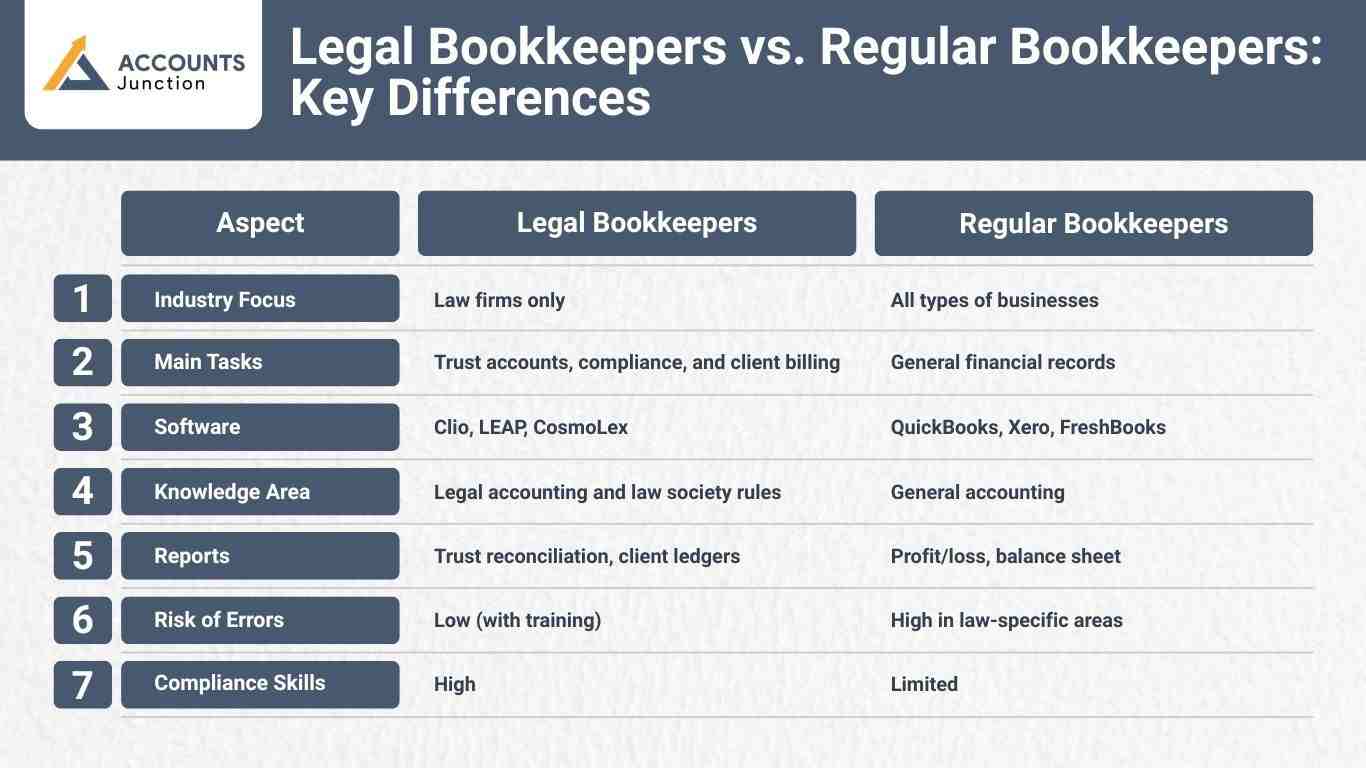

Legal Bookkeepers vs. Regular Bookkeepers: Key Differences

|

Aspect |

Legal Bookkeepers |

Regular Bookkeepers |

|

Industry Focus |

Law firms only |

All types of businesses |

|

Main Tasks |

Trust accounts, compliance, and client billing |

General financial records |

|

Software |

Clio, LEAP, CosmoLex |

QuickBooks, Xero, FreshBooks |

|

Knowledge Area |

Legal accounting and law society rules |

General accounting |

|

Reports |

Trust reconciliation, client ledgers |

Profit/loss, balance sheet |

|

Risk of Errors |

Low (with training) |

High in law-specific areas |

|

Compliance Skills |

High |

Limited |

This table makes it clear that law firms need someone who understands their special financial world. So, legal bookkeepers are not just bookkeepers, but compliance partners.

Skills That Make a Law Firm Bookkeeper Special

1. Deep Knowledge of Legal Accounting

They understand terms like retainers, disbursements, and trust transfers. This knowledge helps them manage law firm books the right way.

2. Attention to Detail

Every cent in a trust account must be tracked. A law firm bookkeeper works with precision to avoid even the smallest mistake.

3. Strong Tech Skills

Most Legal Bookkeepers use cloud software for automation, real-time tracking, and data backup. This ensures accuracy and speed.

4. Clear Communication

They must explain financial matters in simple words to lawyers who may not be finance experts.

Common Mistakes When Hiring Regular Bookkeepers for Law Firms

Even small firms sometimes hire regular bookkeepers to save money. But this can backfire. Common issues include:

- Mixing trust and office funds

- Missing key compliance deadlines

- Incorrect client billing

- Poor trust reconciliations

Each of these errors can lead to legal trouble. That’s why hiring Legal bookkeepers is a smarter and safer choice.

How to Choose the Right Legal Bookkeeper

1. Check Their Experience with Law Firms

- Ask how many legal clients they’ve worked with and what systems they use.

2. Verify Their Knowledge of Trust Accounting

- They must know how to handle trust accounts under your state or country’s legal rules.

3. Look for Software Skills

- Choose someone who knows tools like Clio or LEAP, as these programs are built for law firms.

4. Ask for References

- Other firms can share how well the bookkeeper managed their accounts and audits.

Benefits of Outsourcing Legal Bookkeeping

Many firms now choose to outsource their bookkeeping needs. Hiring a specialized service gives you access to expert Legal bookkeepers without hiring in-house.

Key Benefits:

- Lower costs compared to full-time staff

- Access to experts in legal finance

- 24/7 cloud access to records

- Regular compliance updates

Outsourcing helps firms of all sizes stay efficient and compliant without the high cost of local hiring.

Legal bookkeeping is more than routine recordkeeping, but it ensures accuracy, compliance, and transparency in how a law firm handles client funds and trust accounts. A skilled legal bookkeeper helps prevent costly errors, maintains audit-ready records, and supports smooth financial operations. With proper bookkeeping, firms can focus more on clients and less on financial stress.

At Accounts Junction, we offer specialized legal bookkeeping services tailored for law firms of all sizes. Our experts handle everything from client fund management to audit preparation, giving your firm reliable financial control and freedom to focus on clients. Partner with us to simplify your bookkeeping, ensure compliance, and help your law firm grow with confidence.

FAQs

1. What does a Legal Bookkeeper do?

- A legal bookkeeper records money for law firms and keeps all trust and client funds in line with the rules.

2. How is a Legal Bookkeeper different from a regular bookkeeper?

- A Legal bookkeeper works for law firms, while a regular bookkeeper works for any type of business.

3. Why do law firms need Legal accountants?

- Law firms need them to keep client money safe, follow trust laws, and avoid costly errors.

4. Can a regular bookkeeper do legal work?

- No. Regular bookkeepers don’t know the trust rules or how to track client retainers.

5. What is trust accounting?

- It means holding client money for future work and keeping clear, separate records for each one.

6. What tools do Legal Bookkeepers use?

- They use law-based tools like Clio, LEAP, or CosmoLex to track billing and trust funds.

7. How often should a firm check trust accounts?

- Each month. It helps find and fix any small errors before they become big ones.

8. Do law firm bookkeepers file taxes?

- No. They record daily data. Accountants use that data to file taxes.

9. Is it cheaper to outsource Legal Bookkeeping?

- Yes. You can hire pros at a lower cost instead of keeping a full-time staff member.

10. Can small firms afford a Legal Bookkeeper?

- Yes. Many small law firms hire one part-time or use online help to save money.

11. What happens if the client and firm's money mix?

- It breaks trust rules and can lead to big fines or audits.

12. How do Legal Bookkeepers help in audits?

- They keep books clear so audits go fast and smoothly with no stress.

13. Do law firm bookkeepers get special training?

- Yes. They study law firm rules and how to handle client trust money.

14. What reports do they make?

- They prepare client ledgers, trust balance sheets, and monthly reports.

15. Can law firm bookkeeper work online?

- Yes. Many work from home and share records through safe cloud tools.

16. What should I check before hiring one?

- Check their law firm's work, trust skills, and the tools they use.

17. Why is trust compliance key for law firms?

- It keeps client money safe and protects the firm’s name and license.