What Are Virtual Bookkeeping Solutions and How Do They Work?

In the modern business environment, Virtual bookkeeping solutions are highly useful. Many firms want to know how these tools work. They prefer systems that cut work but stay correct. Cloud platforms now give fast access to records anywhere. Firms can track money moves, check cash, and make reports. Virtual bookkeeping solutions let firms manage finances without offices or in-house staff. Outsourced bookkeeping solutions make work easier and save time. The rise of Virtual accounting services shows a clear shift to remote handling.

These tools pair software with trained staff for strong results. Firms save time, cut errors, and get fast insights. Real-time access, safe storage, and automation speed work. Companies using these tools face lower costs and more control.

Understanding Virtual Bookkeeping Solutions

Virtual bookkeeping solutions let firms manage records from anywhere. They use cloud software to store money data safely. Teams can view ledgers, bills, and payroll anytime online. Unlike old methods, these services do not need offices. Software links with bank accounts, payment systems, and business apps.

Key features include:

- Users can review all financial accounts from any device. This helps teams work fast and make quick choices.

- Secure document storage keeps all accounting records safe. It helps guard files and keep records clean.

- System links with accounting and payment tools move data well. This cuts manual work and saves team time.

- Real-time tracking helps track cash flow each day. It helps spot issues early and keep control.

- Auto reports give clear data for smart choices. They help teams check results without extra work.

Firms often pair Virtual bookkeeping solutions with Outsourced bookkeeping solutions. Skilled staff manage records without on-site work. Companies get expert help and lower costs.

How Virtual Bookkeeping Solutions Work

These tools work easily but still get results. Companies pick a provider that gives cloud access. Accountants use a safe login to see records. Data entry, checks, and reports are done online. Firms track work with dashboards, alerts, and notes.

-

Onboarding and Setup

Connecting bank accounts and software tools. Accounts connect fast to support a smooth daily workflow. Bank accounts and tools link during basic setup.

-

Transaction Processing

Recording purchases, sales, and expenses. Each purchase sale expense record logs correctly. Entries grouped by type for clear tracking.

-

Reconciliation

Matching bank statements and invoices. Bank statements match invoices to keep balances right. Teams find errors early and fix them fast.

-

Reporting

Generating financial statements and insights. Financial statements are generated quickly for a clear business view. Profit, cash flow balance sheets become ready fast.

-

Ongoing Support

Handling queries and audit preparation. Support teams handle queries and help audit work. Staff answer questions and help auditors during checks.

The mix of software and skilled staff defines Virtual Accounting Services. Work is faster, accurate, and transparent than old methods.

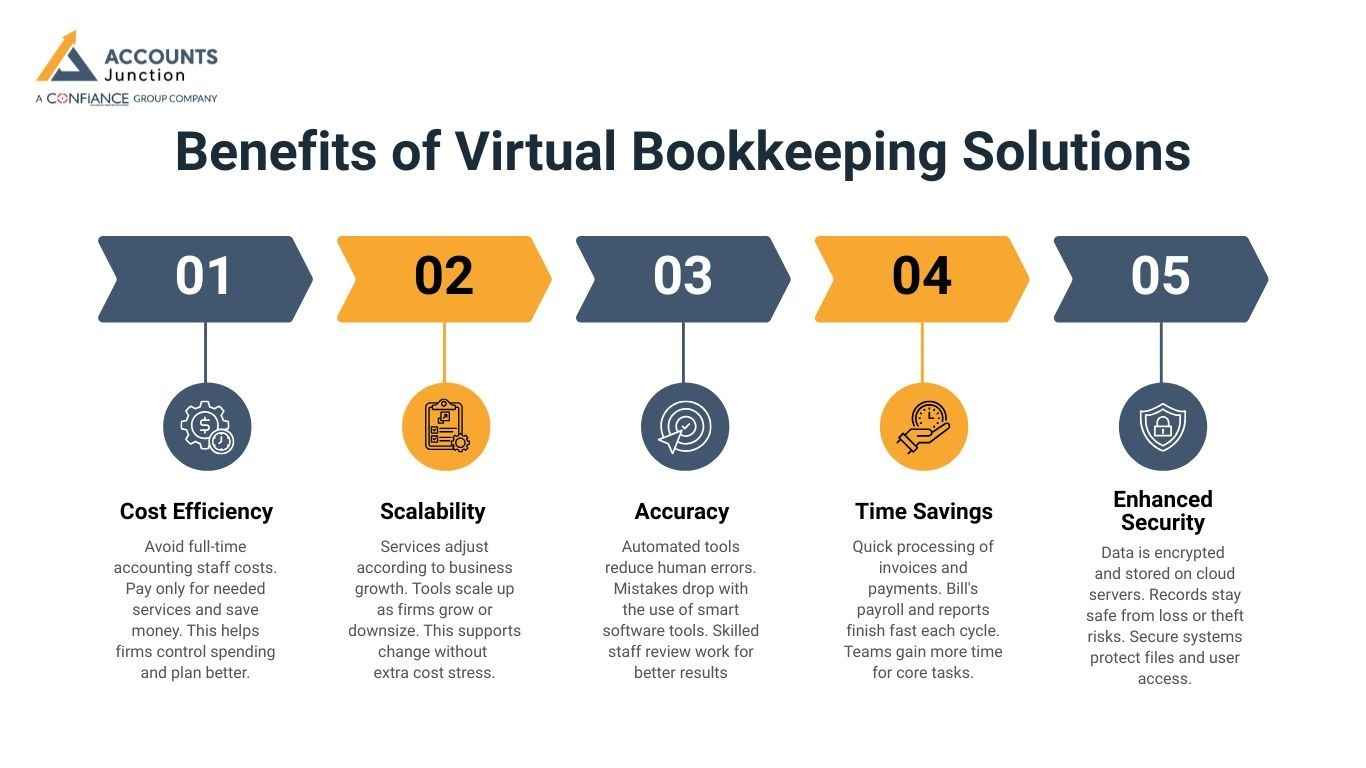

Benefits of Virtual Bookkeeping Solutions

Firms explore Virtual bookkeeping solutions for cost and practical reasons. Remote access lowers the need for files and office space. Work continues without delay even during crises or peak periods.

-

Cost Efficiency

Avoid full-time accounting staff costs. Pay only for needed services and save money. This helps firms control spending and plan better.

-

Scalability

Services adjust according to business growth. Tools scale up as firms grow or downsize. This supports change without extra cost stress.

-

Accuracy

Automated tools reduce human errors. Mistakes drop with the use of smart software tools. Skilled staff review work for better results.

-

Time Savings

Quick processing of invoices and payments. Bill's payroll and reports finish fast each cycle. Teams gain more time for core tasks.

-

Enhanced Security

Data is encrypted and stored on cloud servers. Records stay safe from loss or theft risks. Secure systems protect files and user access.

Firms using Outsourced bookkeeping solutions get expert guidance on tax, reports, and reconciliation. Virtual accounting services provide timely insight for better decisions.

Virtual vs Traditional Bookkeeping

Choosing between virtual bookkeeping solutions and traditional methods requires careful thought. Traditional bookkeeping needs offices, paper ledgers, and slower work. Virtual bookkeeping solutions use software and cloud storage instead.

-

Location

Traditional work needs an office, but virtual work does not. Remote tools cut the need for a real office space. Teams can work from any place using online tools.

-

Speed

Virtual updates records instantly. Auto tools cut repeat tasks and show data fast.

Updates appear quick for daily business needs.

-

Cost

Virtual is more affordable than full-time staff. Pay only for the help you use and save money. This lowers spending and keeps costs in control.

-

Flexibility

Virtual adapts to changing business needs. Tools adjust for the size of projects or busy work times. Firms scale support without hiring new staff.

-

Accessibility

Virtual allows 24/7 access to data. Managers check records any time and act fast. This supports quick reviews and smart business moves.

Some firms use both methods for transition. Still, Virtual accounting services are the standard for modern companies.

How Outsourced Bookkeeping Solutions Enhance Virtual Systems

Adding Outsourced bookkeeping solutions to online tools ensures skilled handling. Experts manage payroll, tax, and reconciliation without constant supervision.

-

Expert Oversight

Certified accountants keep records correct every day. Errors fall, and reports stay right each month. Work follows rules and builds trust in business.

-

Resource Optimization

Internal staff focus on strategic tasks. Teams work on growth and client care daily. This use of time lifts value and results.

-

Cost Savings

Avoid hiring multiple full-time accountants. Pay only for used help and save money. Costs stay low while service quality stays high.

-

Risk Reduction

Experts prevent compliance errors each cycle. Tax filings and audits stay accurate each year. This lowers fines and stress for leaders often.

-

Flexibility

Services scale according to business needs quickly. Extra help is ready for the busy months ahead. Firms add or cut support without hiring delays.

Pairing Virtual bookkeeping solutions with Outsourced bookkeeping solutions gives firms fast, accurate reporting. Management sees data faster, and errors are minimized.

Tools and Technologies Used in Virtual Bookkeeping

Modern systems use software for speed and accuracy. Tools reduce manual work and improve tracking.

- Cloud tools keep ledgers and invoices in order. Data stays online and changes each day safely. Teams view books anytime with no local tools.

- Payroll management software for automated salary tasks today. Staff are paid right on time and monthly. Pay runs process fast with less manual work.

- Expense tracking apps for real-time monitoring today. Money moves are tracked live during work hours. Teams spot spend issues early and fix fast.

- Bank integration for smooth reconciliation tasks across accounts. Statements match bills with less manual effort needed. This cuts errors and saves close time monthly.

- Reporting dashboards for financial insight and clarity needs. Graphs and tables show results clearly in daily views. Leaders read data fast and plan next steps.

Using these tools with Outsourced bookkeeping solutions ensures a smooth workflow. Virtual accounting services rely on software plus staff checks.

Common Challenges and How to Overcome Them

Even with good tools, challenges exist. Firms may face security issues or software adaptation.

-

Data Security

Risk of cyber threats if not encrypted. Use strong passwords and cloud backup to protect files. This keeps sensitive financial data safe from loss.

-

Connectivity Issues

Remote work requires a strong internet connection each day. Keep backups ready to carry on work fast. Teams stay productive even if networks go down.

-

Software Learning Curve

Staff may need training for new tools. Provide guides, demos, and hands-on support for learning. This helps staff use tools quickly and correctly.

-

Communication Gaps

Coordination with remote accountants can lag. Schedule calls and weekly reports to stay aligned. Regular updates keep teams informed and reduce errors.

Handling these ensures smooth use of Virtual accounting services.

Who Should Consider Virtual Bookkeeping Solutions?

Virtual bookkeeping solutions fit small to medium-sized firms best. Startups, online stores, and multi-location offices benefit most.

- Businesses that need cheap accounting pay only for services used. This method helps firms save money and control costs.

- Companies that want 24/7 access can check records online. Managers view accounts fast and make quick business choices.

- Firms that plan to grow can let tools expand easily. Support rises as work and transactions increase each day.

- Organizations that use new accounting software link it with banks. Systems work together to move data fast and clearly.

- Those who need outsourced bookkeeping get skilled help on demand. Teams get expert aid while keeping costs low and fixed.

Firms using Outsourced bookkeeping solutions see better reporting and faster decisions. Virtual accounting services help with audits and taxes.

Virtual bookkeeping solutions are changing how firms handle finances. Using Outsourced bookkeeping solutions with software gives speed and accuracy. Companies save time, lower mistakes, and gain better insights. Real-time access and skilled handling help decision-making.

At Accounts Junction, we provide full Virtual accounting services for firms. Staff keep records correct and reports on time. Clients save costs, get expert help, and stay secure. We mix tools with staff skills for the best results. Partnering with Accounts Junction lets firms focus on growth while we handle accounts efficiently.

FAQs

1. What are virtual bookkeeping solutions?

- They are online tools to manage business books. These tools help teams track cash and records fast.

2. How do virtual accounting services work?

- They use cloud tools and staff to manage work. Teams can check reports and entries anytime, fast.

3. Are outsourced bookkeeping solutions cost-effective?

- Yes, they save cash compared to full-time staff. Firms pay only for work they truly need.

4. Can small businesses use virtual bookkeeping solutions?

- Yes, small teams get expert help with books. Even new firms can access skilled accounting help.

5. How fast can virtual bookkeeping solutions generate reports?

- Reports are ready fast with the software and staff. Teams get info instantly for smart decisions.