How Accounting for Rental Property Helps with Tax Compliance

Managing money for rental homes can feel hard. Many landlords do not see how good accounting for rental property helps with taxes. Clear records make tax filing easier, reduce errors, and avoid penalties. Whether you own one home or many, keeping accounts clear is very important. Using tools like rental property accounting software makes it easy to track rent, costs, and deductions. For a property management business, having proper accounts saves time and stress while helping make better decisions.

In this blog, we will look at how accounting for rental property can help with tax duties, the use of accounting software for rental properties, and ways to manage your rental property in a simple and clear way.

Why Accounting for Rental Property Is Crucial

Proper accounting for rental property helps landlords see all the money details. It keeps track of both income and costs. Many property owners miss deductions due to poor records. By keeping accounts right, landlords track rent, repairs, and loan interest easily.

- Helps avoid mistakes when filing taxes each year

- Keeps record of all rent and fees collected

- Supports claiming costs for repairs and utilities

- Gives a clear view of your rental property income and spending

For people running a property management business, keeping accurate accounts is key. A business with many clients must show income and spending clearly. Using clear accounting makes taxes easier while giving clients trust.

Benefits of Rental Property Accounting Software

Using rental property accounting software helps landlords handle money fast. Manual accounting takes more time and can cause small mistakes.

Software made for rentals supports accounting for rental property by tracking rent and costs.. Landlords and property managers can use it to stay clear.

1. Efficient Rent Tracking

A main use of rental property accounting software is rent tracking. It logs rent payments safely and on the set date.

The software can send notes for any late payments. This helps accounting for rental property to stay clear for every unit. With proper tracking, landlords can grow their rental property fast.

2. Easy Expense Management

Accounting software for rentals helps landlords track all costs well. It logs repairs, bills, and utility costs for each home. It keeps insurance and other costs for the rental house.

This sorts all costs for each unit clearly and fast. Tracking costs helps owners and property management businesses claim deductions.

3. Tax-Ready Reports

Another key use of rental property accounting software is tax work. It makes reports ready for use at tax time. It makes accounting for rental property easier by summarizing all income.

Proper accounting for rental property helps avoid filing errors and missed claims. This makes tax time simple and less stressful for owners.

4. Smooth Integration with Other Tools

Most accounting software for rental properties can link with tools. It links to bank accounts for live updates and checks. This works with payment apps and property tools with ease.

This keeps accounting for rental property accurate across all linked accounts. Integration saves time and helps manage your rental property well.

5. Separation of Personal and Property Finances

Effective accounting for rental property keeps personal and rental money separate.. It stops mix-ups between personal and rental costs or funds. It makes bookkeeping simple, right, and easy to manage daily.

This helps property management business owners make smart money choices.

Keeping money apart gives clear records and smooth tax work.

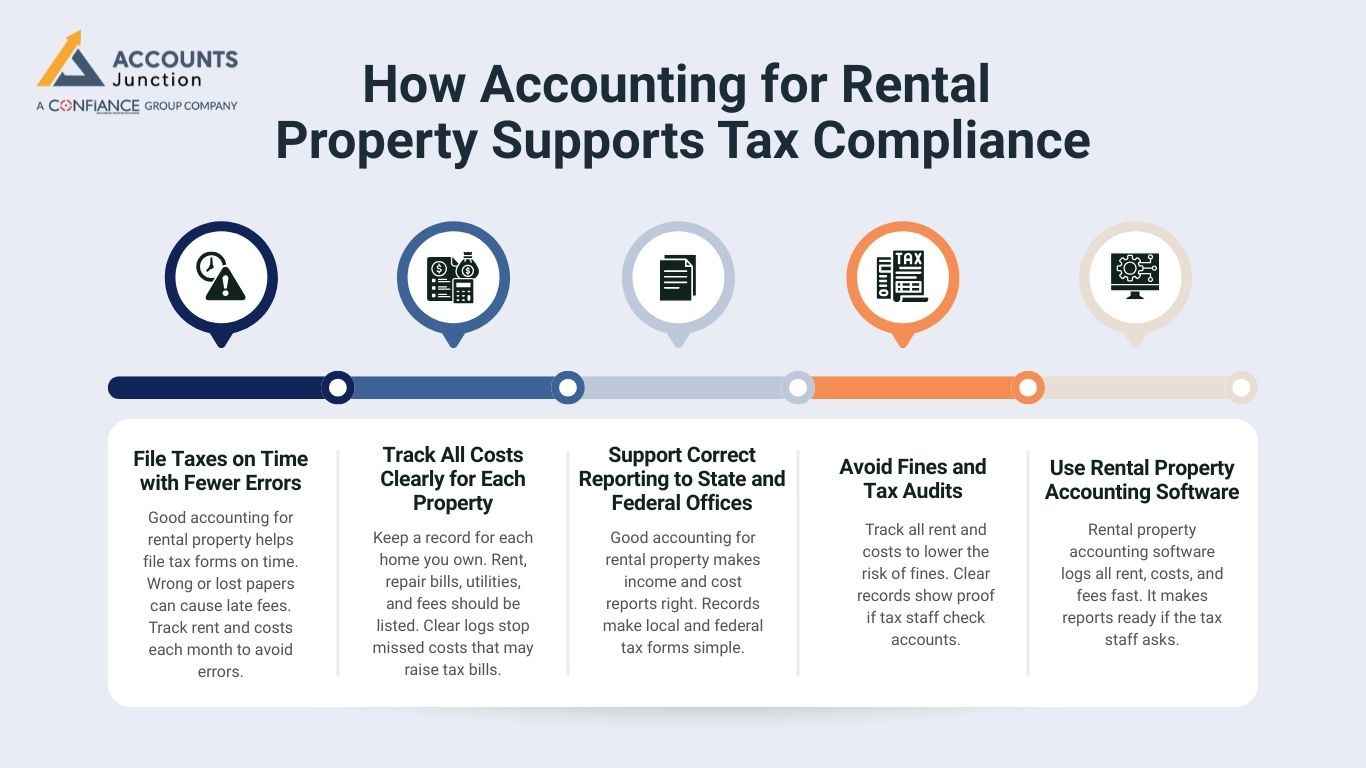

How Accounting for Rental Property Supports Tax Compliance

Good accounting for rental property helps keep track of all rent and costs. Clear records make tax work easy and safe. Tracking all payments lets landlords claim tax cuts. Costs like repairs, loan fees, and insurance lower tax bills.

-

File Taxes on Time with Fewer Errors

Good accounting for rental property helps file tax forms on time. Wrong or lost papers can cause late fees. Track rent and costs each month to avoid errors. On-time filing keeps tax work smooth and stress-free.

-

Track All Costs Clearly for Each Property

Keep a record for each home you own. Rent, repair bills, utilities, and fees should be listed. Clear logs stop missed costs that may raise tax bills. Rental property accounting software helps note each cost every day.

-

Support Correct Reporting to State and Federal Offices

Good accounting for rental property makes income and cost reports right. Records make local and federal tax forms simple. Track each payment to show the tax offices proof. This keeps landlords and your rental property safe from fines.

-

Avoid Fines and Tax Audits

Track all rent and costs to lower the risk of fines. Clear records show proof if tax staff check accounts. Accounting software for rental properties can make this task quick.

-

Use Rental Property Accounting Software

Rental property accounting software logs all rent, costs, and fees fast. It makes reports ready if the tax staff asks. For a property management business or many homes, software keeps work smooth and tracks all details for your rental property.

Top Features to Look for in Accounting Software for Rental Properties

Picking the right accounting software for rental properties helps with taxes and running homes well. Not all software has the same tools, so owners must choose smartly.

-

Income Tracking

Logs rent and fees fast and in one place. Records each payment automatically for each rental property. Helps landlords see all the money coming from each unit.

-

Expense Management

Tracks repairs, bills, and all other costs easily. Keeps a record of insurance, utilities, and home fixes. Sorts all costs for each rental unit clearly and fast.

-

Tax Reports

Makes forms ready for the IRS with no stress. Shows all income and expenses for each rental property. Helps landlords avoid mistakes and missing deductions during filing.

-

Dashboard Insights

Shows the money health of all rentals at a glance. Summarizes income, costs, and balance for each property clearly. Gives landlords a quick view to make better decisions fast.

-

Integration

Works with banks, payment apps, and other property tools. Keeps all data synced across software for smooth updates. Helps landlords manage their rental property with less work.

A property management business gains much from software that handles many units. Owners of your rental property get a clear view of cash flow, taxes, and money health.

Tips for Efficient Accounting for Your Rental Property

Efficiency comes from habits and the right tools. Even with software, landlords need a routine to stay accurate.

- Record rent and costs right after each transaction

- Keep personal money separate from property money

- Check bank statements each month to avoid errors

- Use cloud tools for live account updates

- Save digital copies of all bills and receipts

Following these steps makes handling your rental property less stressful. A property management business gains from software alerts and report functions. Keeping habits ensures taxes are done right and on time.

Common Challenges in Rental Property Accounting

Even with tools, landlords face some problems. Knowing these helps improve work and tax filing.

- Mixing personal and rental money leads to mistakes

- Lost receipts or incomplete info reduces deductions

- Manual math increases the chances of tax errors

- Many properties make tracking money harder

Rental property accounting software solves many of these issues. It makes reporting simpler for landlords and property management business owners. For your rental property, clear accounts cut errors, stress, and audit risks.

Good accounting for rental property is key to tax compliance. It helps report money clearly, claim deductions, and cut audit risks. Using rental property accounting software or accounting software for rental properties makes tracking money and filing taxes easy. Landlords and managers with clear records save time, reduce stress, and see their money clearly. For anyone running your rental property, proper accounting helps make better choices and follow tax rules correctly.

At Accounts Junction, we provide accounting and bookkeeping services for landlords. Our team keeps all the financial records for your rental property correct. Using easy rental property accounting software, we track rent, costs, and make reports for tax use. Whether you have one home or a full property management business, our services keep records clear and smooth. Working with us helps landlords save time, cut stress, and stay within tax rules.

FAQs

1. Why is accounting for rental property important for taxes?

- It keeps all records clear and helps claim tax breaks. Good accounts stop mistakes and avoid extra tax fines.

2. Can rental property accounting software simplify tax filings?

- Yes, it tracks rent income and all costs for taxes. It also makes ready reports for faster tax work.

3. How often should I update my rental property accounts?

- Update accounts each week to keep all records correct. Weekly updates make sure all costs and rent are right.

4. Is accounting software for rental properties suitable for landlords?

- Yes, it helps track money and stay within tax rules. It also keeps records neat for review at any time.

5. How does accounting support a property management business?

- It makes reports simple and cuts the chance of errors. Clear accounts help show trust and build client confidence.