Common Mistakes in Financial Report Analysis

Financial reports are more than just numbers. They guide financial report analysis, showing how a business earns, spends, and uses money. Owners, managers, and investors use these reports to make choices. Reading them the right way is key, but many people make mistakes and reach wrong results.

Small errors in reading reports can cost money or hide problems. Some mistakes happen when people focus on one number, skip details, or do not compare with other businesses. By knowing these common errors, you can make better choices and see a company’s real state.

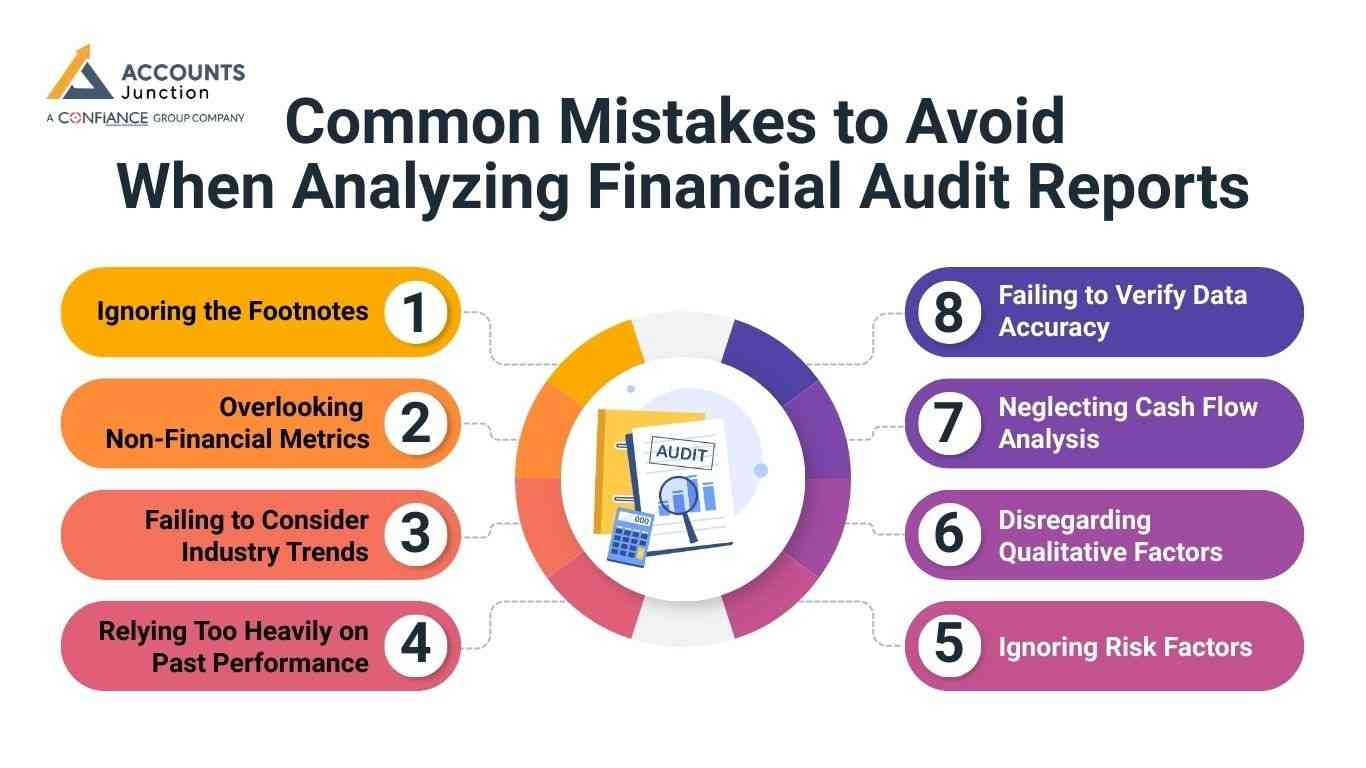

Common Mistakes to Avoid When Analyzing Financial Audit Reports

Ignoring the Footnotes

One common mistake is overlooking the footnotes in a financial audit report. These footnotes often contain crucial information that can significantly impact the interpretation of the financial statements.

Always pay attention to footnotes as they provide context and explanations for the numbers presented.

Overlooking Non-Financial Metrics

While financial metrics are essential, focusing solely on them can lead to a skewed analysis.

Non-financial metrics like customer satisfaction, employee turnover, and market share can provide valuable insights into a company's overall performance and prospects.

Incorporating these metrics into financial audit report analysis provides a more comprehensive view.

Failing to Consider Industry Trends

Another mistake is neglecting to consider industry-specific trends and benchmarks. What might be considered a positive financial indicator in one industry could be concerning in another.

Always benchmark financial performance against industry standards to gain a clearer understanding of a company's position relative to its peers.

Relying Too Heavily on Past Performance

While past performance can provide valuable insights, relying solely on historical data can be risky. Market conditions, regulations, and competitive landscapes change over time, impacting future performance.

It's essential to supplement historical data with forward-looking analysis, considering factors like market trends, technological advancements, and strategic initiatives.

Ignoring Risk Factors

Every investment carries inherent risks, and failing to assess and mitigate these risks can lead to costly mistakes. When analyzing financial reports, pay close attention to risk factors disclosed by the company.

Evaluate how these risks may impact future performance and consider strategies to manage or mitigate them.

Disregarding Qualitative Factors

Financial audit reports often focus on quantitative data, such as revenue, expenses, and profits. However, qualitative factors, such as management competence, brand reputation, and corporate culture, also play a crucial role in a company's success.

Incorporating qualitative analysis alongside quantitative metrics provides a more holistic view of the business.

Neglecting Cash Flow Analysis

Profitability is important, but so is cash flow. Neglecting cash flow analysis can lead to misunderstandings about a company's liquidity and financial stability.

Analyze cash flow statements to assess how effectively a company generates and manages cash, ensuring it can meet its short-term and long-term obligations.

Failing to Verify Data Accuracy

Lastly, failing to verify the accuracy of the data in financial reports can lead to faulty conclusions.

Always cross-reference financial statements with other sources, such as regulatory filings or industry databases, to ensure data integrity. Scrutinize inconsistencies or irregularities and seek clarification from the company if necessary.

Valuable Insights for Smarter Analysis

Avoiding mistakes is only the first step. Financial report analysis combines numbers, context, and forward thinking.

1. Look Beyond Numbers

Numbers alone do not tell the full story. Read management notes, market news, and reports from competitors. These show why numbers change and what risks or chances exist.

2. Check Cash Flow

Cash flow shows how money moves in the business. Look at cash from operations, investments, and loans. Profit alone cannot ensure bills are paid on time.

3. Compare with Competitors

Compare key numbers with other companies in the market. This shows if the company performs better or worse. It highlights areas that work well and need improvement.

4. Watch for Red Flags

Notice sudden drops in sales, rising debt, or costs. Such changes may indicate risk, mistakes, or poor decisions. Early detection helps prevent serious problems or financial loss.

5. Study Business Segments

Big companies run many parts. Check each segment to see which parts grow and which do not. This helps make smart choices.

6. Adjust for Inflation and Currency

For firms that work in other countries, inflation and exchange rates affect money in and out. Adjusting for these gives a clear view of real performance.

7. Account for Seasonality

Some businesses earn more in certain months. Comparing periods without this in mind can give a wrong view. Compare similar periods to see real trends.

8. Check Historical Trends

Look at three to five years of data. Trends show growth, profit cycles, and how well operations run. Avoid decisions based on one year only.

9. Separate Core and One-Time Items

Know what earnings repeat and what are one-off gains or losses. This helps predict steady profits.

10. Ask Experts

Reports can be hard to read. Accountants and analysts give advice and help avoid mistakes.

Advanced Strategies for Better Financial Report Analysis

Going beyond basic tips, these strategies add depth to your financial analysis:

1. Track Ratio Trends

Look at key ratios like gross margin, current ratio, and return on assets over time. Trends show if the company is stable, improving, or weakening.

2. Test Financials for Risks

Check how changes affect the company. For example, what happens if revenue drops 10%? Testing this way shows weak points.

3. Check Working Capital

Watch inventory, receivables, and payables. Good control here shows strong operations and cash flow.

4. Assess Debt Levels

Look at total debt, interest coverage, and repayment plans. High debt or short-term loans can be risky, even if profits are high.

5. Use Future Estimates

Combine past data with budgets, forecasts, and market trends. Predicting results makes your analysis more useful.

6. Link Numbers to Strategy

Compare results with company goals. Are profits from growth areas? Are cost cuts real and lasting? Connecting numbers to strategy gives better insights.

7. Read Auditor Notes

Auditor opinions show risks or issues. Qualified opinions or special notes mean you need to look closer.

8. Use Visual Tools

Charts, graphs, and dashboards make trends clear. Visuals help spot changes and compare numbers fast.

9. Check Related Party Deals

Deals with related parties may not be fair. Look in footnotes to see if these transactions affect results.

10. Follow Key Metrics

KPIs like EBITDA, net margin, and ROI give clear insights. Use them with financial reports to guide decisions.

Practical Takeaways

- Read the financial audit report fully, including notes, MD&A, and auditor comments

- Combine numbers with context, check trends and rivals closely.

- Focus on cash flow, not just profit, for growth.

- Look at many periods and segments to avoid errors.

- Use ratios and KPIs wisely, watch trends over time.

- Adjust numbers for outside factors like prices and money.

- Ask experts, such as accountants or analysts, if needed.

To avoid common mistakes in financial report analysis, it's important to be diligent, pay attention to detail, and take a comprehensive approach. By looking at both numbers and other relevant factors, staying updated on industry trends, and making sure the data is accurate, investors and analysts can make better decisions and reduce the risk of errors. For expert help with financial audits and analysis, you can rely on the professionals at Accounts Junction to ensure that your financial reports are accurate and useful. Accounts Junction provides outsourcing bookkeeping solutions globally.

FAQs

1. What are common mistakes in financial report analysis?

- Ignoring footnotes, skipping cash flow, or focusing on past data are mistakes in financial report analysis.

2. Why is ignoring footnotes in financial reports a risk?

- Footnotes explain key details and special events. Ignoring them can give a wrong view of results.

3. How does neglecting cash flow affect analysis?

- Looking only at profit can hide money problems. Cash flow shows if bills and debts can be paid.

4. Why should non-financial metrics be included?

- Metrics like staff turnover, customer feedback, and market share show health beyond money numbers.

5. How does relying only on past performance mislead analysts?

- Past data does not show current changes. Trends and plans help predict future results.

6. What mistakes happen when industry trends are ignored?

- Numbers may look good but lag behind peers. Comparing to the industry shows the true position.

7. How does ignoring risk factors affect decisions?

- Missing risks like debts or market shifts can cause losses. Checking risks helps reduce surprises.

8. Why is qualitative analysis often skipped?

- Focusing only on numbers ignores factors like management skill and brand value, giving a weak view.

9. What errors occur if one-time events are not separated?

- One-off gains or losses can inflate profit. Tracking regular income shows real performance.

10. Why is checking data accuracy crucial in financial report analysis?

- Wrong or mixed-up data leads to bad decisions. Always confirm numbers with reliable sources.

11. How can misreading segment-level data cause mistakes?

- Total results can hide weak units. Looking at each segment shows which areas grow or lag.

12. What is the risk of ignoring seasonality?

- Seasonal trends can mislead short-term comparisons. Adjusting for the season gives a true picture.

13. How do single ratios mislead analysis?

- Relying on one ratio hides overall trends. Tracking ratios over time shows stability and risk.

14. Why include forward-looking metrics?

- Budgets, forecasts, and trends show what may happen next. They reduce surprises in planning.

15. How can related-party deals distort reports?

- Deals with affiliates may not reflect real prices. Ignoring them can overstate profit or hide risk.

16. What mistakes occur by skipping notes in a financial audit report?

- Auditor notes highlight risks and issues. Ignoring them can lead to critical problems.

17. Why is working capital analysis missed?

- Skipping inventory, receivable, or payable checks hides cash flow issues. Good working capital shows strength.

18. How does skipping peer benchmarking mislead?

- Without comparing rivals, the strengths and weaknesses are unclear. Benchmarking shows real standing.

19. What happens if inflation and currency changes are ignored?

- Revenue and costs may look wrong. Adjusting for price and currency changes gives real results.

20. Why is focusing only on profit a mistake?

- Profit alone hides cash flow and risk. Using cash flow, KPIs, and other factors gives a full view.