CIS Returns Online

If you work in construction, you may have heard of CIS Returns online. It can feel complicated at first glance. Many contractors, especially small ones, may wonder where to begin. Yet, once you understand the flow, the process may feel much simpler. Filing a CIS tax return online can save time, reduce errors, and make record keeping smoother than traditional methods.

Online submission is slowly becoming the go-to choice for many. It can allow you to manage taxes without mountains of paperwork. But what does it really mean to file CIS returns online? Let’s have a look at it with simple examples that make things clearer.

Understanding CIS Returns

CIS stands for Construction Industry Scheme. It is a system that HMRC uses to manage tax deductions from payments made to subcontractors in construction. Contractors may deduct tax from payments, and subcontractors can claim it back later if more tax was deducted than needed.

CIS returns include details such as payment amounts, deductions, and all the information about each subcontractor. Submitting them on time can save you from unwanted penalties or delays. While the system may seem formal or strict, it is designed to make taxation simpler in a sector that often involves multiple small contractors and jobs.

Even if you are a subcontractor working on a single project, knowing about CIS returns online may help you check your records and ensure that taxes deducted are correct. Sometimes small mistakes may cost money later, so online tracking can be useful.

Why CIS Returns Online May Be Better

Filing online may have more benefits than paper forms.

1. Time Saving

- Paper forms may take longer and can be misplaced easily. Online submissions may only take a few minutes if your information is ready. Some contractors may find that online filing is faster than even visiting an HMRC office.

2. Error Reduction

- Online systems can automatically check for missing fields or invalid numbers. This may prevent mistakes that could otherwise take weeks to fix.

3. Instant Confirmation

- Filing a CIS tax return online may give immediate acknowledgment from HMRC. This reassurance may help reduce anxiety about deadlines.

4. Access Anywhere

- You may submit returns from home, office, or even while traveling. No need to wait in line or deal with paper delays.

5. Better Record Keeping

- Digital submissions create an online record automatically. You may access it later for reference, audits, or just to check payments. Paper copies may get lost, but online records remain accessible.

6. Eco Friendly

- Less paper may mean a smaller environmental footprint. Even small contractors may feel good knowing they are contributing to a digital-first process.

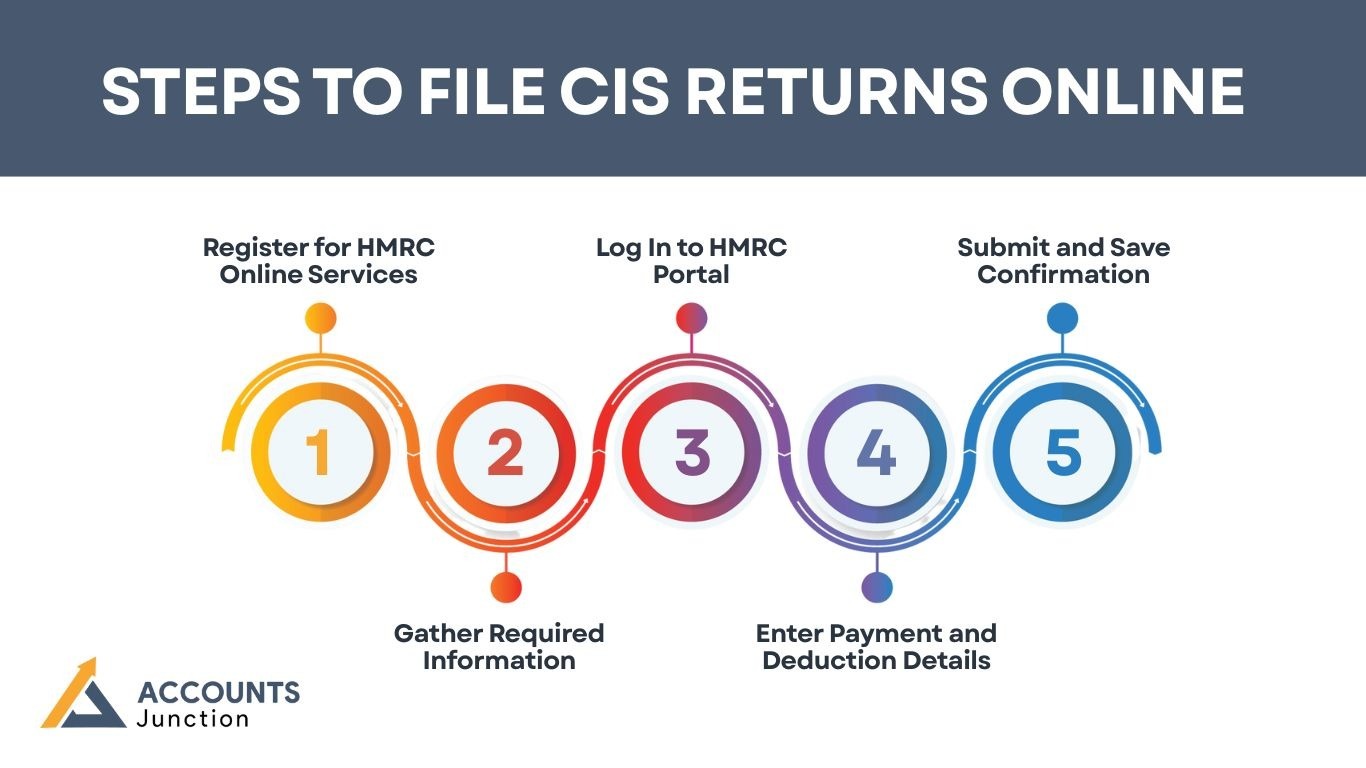

Steps to File CIS Returns Online

Filing online may seem intimidating at first. Breaking it down into clear steps may help reduce stress.

Step 1: Register for HMRC Online Services

- You may need a Government Gateway account to access online filing. Without it, submitting a CIS tax return online may not be possible. Registration may take a few minutes, and once complete, you gain access to a portal that manages all construction tax submissions digitally.

Step 2: Gather Required Information

Before logging in, gather all relevant data:

- Contractor and subcontractor names

- Payment amounts

- Deduction amounts

- UTR numbers and tax codes

Having everything ready may make the process faster. Some contractors keep spreadsheets updated monthly to avoid last-minute stress.

Step 3: Log In to HMRC Portal

- Once registered, log in to the portal. Navigate to the Construction Industry Scheme section. The interface may look technical, but HMRC provides guidance at each step.

Step 4: Enter Payment and Deduction Details

- Carefully enter each subcontractor’s payment and deduction details. Double-check figures. Mistakes may trigger HMRC queries and delay processing. Some contractors prefer entering small batches to reduce errors.

Step 5: Submit and Save Confirmation

- After submitting, save the acknowledgment receipt. It may be useful if HMRC asks for clarification. Some subcontractors also request a copy for their records to check that the right tax was deducted.

Tips to Avoid Common Mistakes

1. Double Check Numbers

- Even small number errors may cause delays or incorrect deductions.

2. Keep Documents Handy

- Receipts, invoices, and payment confirmations may help verify entries.

3. Submit Early

- Waiting until the last day may increase stress and the chance of errors.

4. Update Changes Promptly

- If a subcontractor leaves or payments change, update details before submission.

5. Follow HMRC Guidance

- Official instructions may clarify points that may otherwise seem confusing.

6. Cross Check Subcontractor Details

- Names and UTR numbers must match HMRC records exactly. Small spelling errors may trigger rejection.

7. Track Submission Dates

- Keeping a log of submission dates may help avoid repeated late filings.

Benefits of Filing CIS Tax Return Online

- Faster Processing: HMRC may handle online submissions quicker than paper forms.

- Reduced Errors: Built-in checks may prevent common mistakes.

- Convenience: Filing can be done from anywhere without mailing forms

- Eco Friendly: Less paper is required for submissions.

- Clear Records: Online submissions are stored digitally and may be easier to track.

- Peace of Mind: Knowing that a submission has been confirmed may reduce stress for contractors.

Even small contractors may benefit more than they realize by going online rather than relying on paper forms.

Challenges You May Face

1. Login Issues

- Sometimes the Government Gateway may not work immediately. Refreshing or waiting may solve it.

2. Data Mismatches

- Subcontractor information may not match HMRC records. Always double-check.

3. Late Submissions

- Deadlines may be strict. Penalties may apply, and repeated delays may affect your account.

4. Technical Errors

- Online systems may temporarily fail. Saving frequently may help prevent lost data.

5. Understanding Deductions

- Not all payments are taxed the same. Beginners may find this confusing at first.

Handling Late Filing

If a return is late, do not panic. HMRC may impose penalties. You may submit online immediately to reduce risk. Sometimes a reasonable excuse may be accepted. Filing early in the following months may help prevent repeated problems.

Even if you miss a deadline, prompt online submission may minimize additional charges.

Using Software for CIS Returns Online

Many accounting software options may make filing easier. They may:

- Pre-fill subcontractor details automatically

- Calculate deductions accurately

- Submit returns directly to HMRC

- Keep digital records for future reference

Even with software, manual checking may help prevent mistakes. Some contractors prefer reviewing numbers line by line before final submission.

Record Keeping After Filing

After you file CIS tax return online, keeping proper records may be essential. You may retain:

- Payment and deduction records

- Confirmation receipts from HMRC

- Any communication regarding submissions

These may be useful if HMRC requests clarification, or if subcontractors question deductions. Digital storage may reduce clutter and simplify access later.

CIS Returns Online for Subcontractors

Subcontractors may benefit from understanding online filing as well. Filing may help:

- Claim overpaid tax

- Track received payments

- Prevent disputes with contractors

Even if your contractor submits the return, checking your own records may help prevent mistakes or missing deductions.

Best Practices for Smooth Filing

- Start early every month

- Keep login information safe

- Update subcontractor info promptly

- Double-check numbers before submission

- Save receipts for reference

- Verify any system updates from HMRC

- Use secure devices for submission

Being prepared may prevent errors and save valuable time.

Why CIS Returns Online Can Be Important

Online filing may not just be convenient. It may:

- Reduce errors

- Save time for contractors and subcontractors

- Provide digital proof

- Improve accounting clarity

- Avoid fines for late submission

In today’s digital world, filing online may be the most practical path for construction professionals of all sizes.

Common Mistakes to Avoid

- Entering wrong subcontractor details

- Forgetting to update deductions

- Submitting after the deadline

- Ignoring HMRC messages

- Not keeping records

Avoiding these may make the filing process much smoother.

How Software May Help

Accounting software may allow:

- Batch submissions

- Auto-calculation of deductions

- Saving of digital records

- Faster online filing

Using software may reduce errors and save time, though careful review is still recommended.

Extra Tips

- Always verify HMRC portal updates

- Use secure devices for online submission

- Back up digital records regularly

- Track monthly submissions carefully

- Ask for help if unsure

Being prepared may prevent errors, save time, and avoid unnecessary stress.

Online filing of CIS tax returns online may save time, reduce errors, improve record keeping, and protect from penalties. For contractors and subcontractors, the digital path is simpler once the steps are understood. With preparation, guidance, and a careful approach, online filing may even feel easier than paper forms. If you need help with filing CIS tax returns online, Accounts Junction is here to help. Our tax preparation services cover everything you need regarding the HMRC portal. Contact us now and leave CIS tax filing on us.

FAQs

1. What is CIS returns online?

- It is a way to submit construction tax details digitally to HMRC.

2. Can I file CIS tax return online myself?

- Yes, with an HMRC account, you may file directly.

3. Is online filing safe?

- Yes, HMRC uses secure systems to protect information.

4. How often should CIS returns be filed?

- Usually monthly, showing payments and deductions.

5. Can software help with CIS returns online?

- Yes, it may auto-calculate and submit details.

6. What if I submit late?

- Penalties may apply, but filing promptly may reduce them.

7. Can subcontractors check their online return?

- Yes, they may verify payment and deduction records.

8. Do I need a Government Gateway account?

- Yes, it may be required to access online filing.

9. Can errors be corrected online?

- Yes, you may submit updates if mistakes are found.

10. Is paper filing still allowed?

- Yes, but online filing may be faster and safer.

11. What information is needed for filing?

- Contractor and subcontractor names, payments, deductions, UTR numbers.

12. Does online filing save money?

- Indirectly, by reducing errors and avoiding penalties.

13. Can multiple subcontractors be submitted together?

- Yes, batch entries may be allowed online.

14. Are receipts needed after filing?

- Yes, they may help if HMRC requests proof.

15. Can mobile devices be used for filing?

- Yes, if HMRC portal is accessible.

16. Can subcontractors claim overpaid tax online?

- Yes, they may request adjustments digitally.

17. Is filing complicated?

- It may seem tricky, but step-by-step guidance can help.

18. Can contractors submit online without software?

- Yes, direct HMRC submission is possible.

19. How to avoid common mistakes?

- Double-check names, numbers, and deductions before submitting.

20. Does online submission confirm receipt?

- Yes, instant confirmation may be received after submission.