Chart Of Accounts

A Chart of Accounts is basically a customized list of names of accounts that an organisation uses in order to track the amounts of expenses spent for individual categories. In a nutshell, it's just the classification of list of accounts which are used to record transactions.

Since mentioned in the above lines, it is always customizable and can be tailored according to the needs & aims of the organization. They are often designed from your reporting requirements. It is entirely your wish to tailor the Chart of Accounts depended on how precise your requirements are and one could even add up more accounts if required.

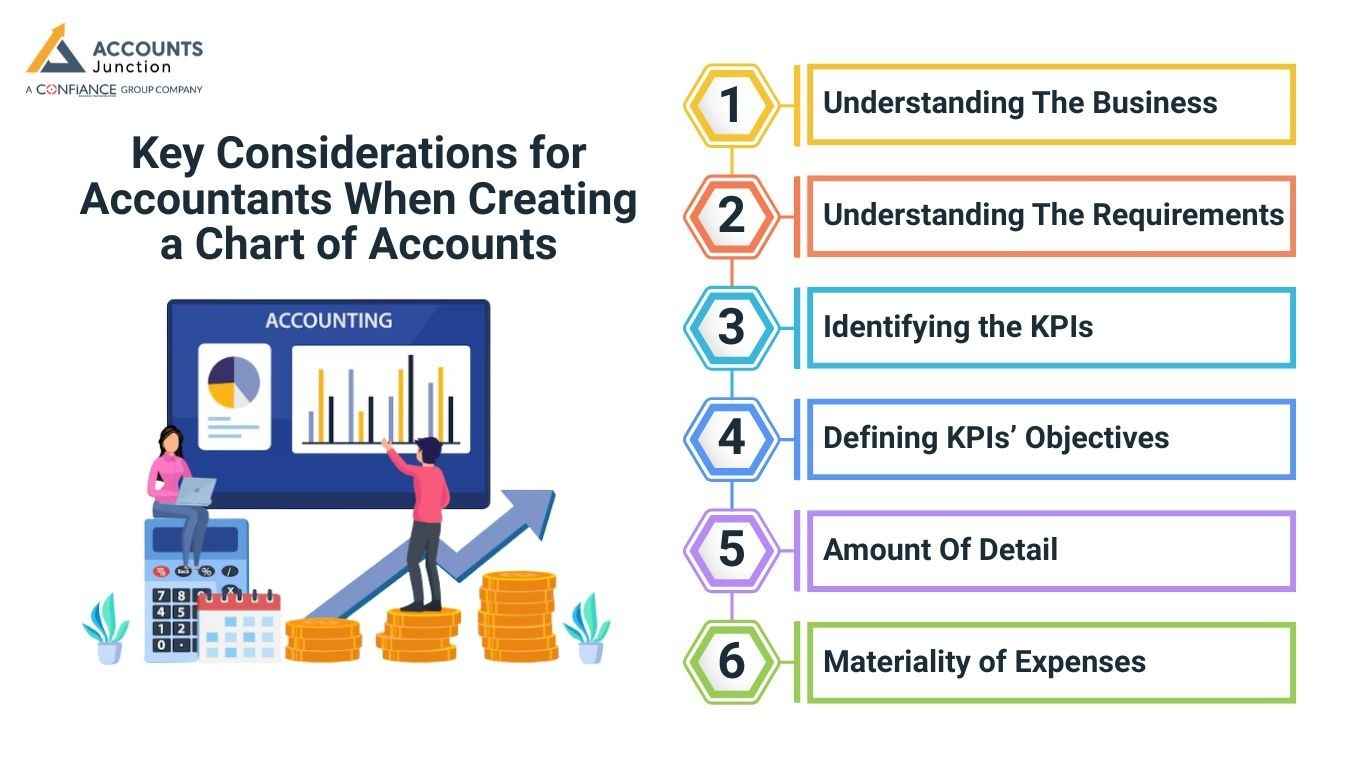

Key Considerations for Accountants When Creating a Chart of Accounts

Now for an accountant or a bookkeeper, in order to create a Chart of Accounts for your organisation, there are a certain points to take into consideration beforehand one begins the work. Those requirements of the accountants are :

Understanding The Business

The first and the foremost cornerstone for an accountant in order to do Chart of Accounts is to have an in depth knowledge and a meticulous understanding regarding the organisation from tip to toe including its functions.

Understanding The Requirements

Now comes the first part in actually making out a Chart of Accounts. Here, the accountants should understand the exact details regarding the reporting requirements of the management of an organisation. In simple terms the accountant gets to know the requirements from the organisation regarding how they'd like to receive a report.

Identifying the KPIs

In this step, the accountant gets to research, analyze & understand what exactly are the key performance indicators that the management would like to focus on improving.

Defining KPIs’ Objectives

After talking to the management regarding what performance indicators they'd like to focus, it is now time for an accountant to identify & define the key objectives for a performance indicator. By having a clear objectives of the KPIs, the accountant moves on to the next step.

Amount Of Detail

Over here, it now comes for the accountant to decide how detailed or precise a particular account should be deduced. As said above, the management might even add as many accounts as possible & required if at all management is interested in details, then the accountant might add up to as many deductions as the organisation wants. For eg : Utilities Expenses are broken down to Electricity, Water & Internet etc., as far as required .

Materiality of Expenses

Basically Materiality is the importance of transactions, balances or even errors in the financial statements. It is actually a cut-off and after that reaches the financial information becomes relevant to the needs of users. Generally it is suggested that the expenses which are actually more than 1% of the sales revenue are only allowed to put into a separate expense bucket.

Based on the requirements of the managements & accountants Chart of Accounts are designed and are often helpful in tracking & reporting the expenses & returns of a particular category of items and it aligns with the financial structure of an organisation & lets you choose the level of precision in the Chart of Accounts.

Types of Accounts in a Chart of Accounts

A Chart of Accounts lists Assets, Liabilities, Income, Expenses. It shows all business money clearly and in order. It helps managers track funds and avoid simple mistakes.

Sub-Accounts for Detailed Tracking

Each account type can have sub-accounts for more tracking. Sub-accounts help track money in different business areas. They also show growth or loss in each section.

Assets

Assets are things the business owns and uses daily. They show what the company has for its work. Common sub-account types include Current Assets and Fixed Assets.

Current Assets

Current Assets include cash, receivables, and short-term items. These are used within one year for company work.

Fixed Assets

Fixed Assets include land, equipment, and long-term items. They are used for work or business every year.

Examples of Asset Accounts

Cash, Accounts Receivable, and Equipment track money clearly. Each account keeps records correct for reports and planning. They also help plan spending for future company needs.

Liabilities

Liabilities include short-term and long-term money the business owes. They track loans, bills, and payments owed to others. Keeping them in order avoids missed payments or extra fees.

Income

Income accounts track sales, fees, and other money earned. Organized accounts help see trends in business money clearly. They also show which products or services earn the most.

Expenses

Expense accounts track costs like rent, wages, and bills. They show where business money is spent each month. Proper tracking helps reduce costs and raise company profits.

How a Chart of Accounts Can Evolve

- A Chart of Accounts can change as the business grows. New operations or services may need new accounts added.

- Old accounts may become less needed and can be removed. Removing unused accounts keeps reports clean and easy to read.

- Regular checks ensure accounts serve reporting and management needs. Audits stop outdated accounts from causing mistakes or confusion.

- Updated structures keep financial statements clean and clear. Managers can trust reports for faster and better decisions.

- Growth may need to split or merge some accounts carefully. This keeps details correct without making reports too complex.

- Accounts may need to match industry rules and standards. This ensures reports are right for audits and checks.

- Changes in accounts reflect business changes quickly and clearly. Updated accounts give a true view of all finances.

Common Mistakes to Avoid

- Adding too many accounts can make reports hard to read. Use only accounts that are needed for tracking purposes.

- Inconsistent names can cause mistakes in the accounts. Standard names make tracking and reporting easier for staff.

- Accounts not linked to reports reduce analysis usefulness. Every account should have a clear purpose in reporting.

- Duplicate accounts may cause errors and waste time. Regular checks help remove repeated or extra accounts.

- Mixing personal and business costs can create big errors. Keep all entries strictly for business only.

- Not reviewing accounts often may hide money problems. Regular checks ensure records are correct and up to date.

- Vague account names make reports hard to understand. Clear names make it easy to find each transaction.

Benefits of a Well-Structured Chart of Accounts

- Clear accounts make bookkeeping simple for all staff. Staff can enter data faster and with fewer errors.

- Tracking income, expenses, and assets is faster and correct. Managers can see money trends clearly and plan well.

- Organized accounts give decision-makers a full performance view. It shows where costs are high or profits are low.

- Good accounts save time during audits and reduce mistakes. Auditors can check records fast with proper accounts.

- They allow consistent reporting across months and departments. Comparing periods becomes easy, and errors are reduced.

- Accurate accounts improve budgets and money planning for growth. Plans are more correct and based on real numbers.

- Proper accounts reduce stress when preparing year-end statements. Staff can work with confidence knowing all is correct.

Best Practices for Maintaining a Chart of Accounts

- Check accounts often to keep records correct and clear. Updates prevent mistakes and make reports consistent.

- Update accounts when the business adds new services or departments. This ensures all new work is tracked properly.

- Avoid duplicate accounts to reduce mistakes and confusion. Always check before creating new accounts in the system.

- Use the same naming style for all accounts. Standard names make staff training faster and simpler.

- Archive accounts that are no longer needed or used. This keeps the Chart of Accounts neat and clear.

- Keep sub-accounts grouped under main account categories. Related accounts together make reports easier to read.

- Train staff to follow the Chart of Accounts rules. Proper use keeps records correct and reduces bookkeeping errors.

A clear Chart of Accounts is the base of all business finance. It keeps records simple and correct, so reports are easy to read. Using best practices helps firms avoid mistakes, track performance well, and make good financial choices. Regular checks and careful updates keep accounts right and match business goals.

Keeping accounts neat also makes audits and budgets much easier. Clear accounts show trends, control costs, and help plan growth. Avoid duplicates, use the same names, and train staff to use accounts right. A clean Chart of Accounts keeps reports simple, clear, and correct.

Accounts Junction offers accounting and bookkeeping services with certified staff. We set up and keep a clear Chart of Accounts for all firms. Partner with us for safe, correct, and smooth financial work.

FAQs

1. What is a Chart of Accounts in accounting?

- It is a clear list of all business accounts. It tracks income, expenses, and assets for reporting.

2. Why do businesses use a Chart of Accounts?

- It organizes transactions for reports and easy review. Managers can check finances and make better decisions.

3. Who is responsible for creating a Chart of Accounts?

- Accountants or bookkeepers usually create the account structure. They make sure accounts match reports and business needs.

4. How can a Chart of Accounts be customized for a business?

- Accounts can be added or removed as needed. The setup depends on reports and company goals.

5. What are main types of accounts in a Chart of Accounts?

- Assets, Liabilities, Income, and Expenses are main groups. Each group can have sub-accounts for more detail.

6. What are sub-accounts in a Chart of Accounts?

- Sub-accounts divide main accounts into smaller categories. For example, Utilities can include Water, Electricity, Internet.

7. How detailed should a Chart of Accounts be?

- The level of detail depends on reporting needs. More detail helps produce accurate and clear financial reports.

8. How does account materiality affect reporting?

- Materiality shows which transactions are important for reports. Only significant items may need separate account tracking.

9. Can financial reports improve using a Chart of Accounts?

- Yes, structured accounts make reporting easier and faster. Managers can track trends and results by each category.

10. When should businesses review their accounts structure?

- Review accounts annually or when business undergoes changes. Updates keep reports correct, clear, and relevant for use.

11. How can a Chart of Accounts evolve over time?

- Add new accounts and remove old accounts as needed. Growth or changes may require adjusting the account structure.

12. What common mistakes occur in account setup?

- Too many accounts, mixed names, and wrong categorization occur. Good planning helps avoid errors and confusion in reports.

13. How can accountants maintain account accuracy?

- Accountants check accounts regularly and make adjustments as needed. This keeps reports correct, reliable, and ready for use.

14. How does account organization help during audits?

- Clear accounts speed audits and reduce errors significantly. Auditors can follow transactions and verify data easily.

15. Can small businesses benefit from detailed accounts?

- Yes, even small businesses track income and costs clearly. Clear accounts improve understanding and support smarter business decisions.

16. What role do key performance indicators play in accounts?

- KPIs show areas that require more attention or focus. Accounts can be structured to track results effectively.

17. Can software integrate with account structures?

- Yes, software uses structured accounts to produce fast reports. Proper setup ensures reports are accurate and easy to read.

18. How can expense tracking improve with proper accounts?

- Categorized accounts give clear insight into company spending. Managers can see which areas spend more or less.

19. Why is consistent naming important for accounts?

- Consistent names prevent confusion in reports and during audits. Teams can read and understand account data with ease.

20. How can a well-organized account structure support growth?

- It makes tracking, reporting, and analysis easier for management. Businesses can make better choices with clear financial data.