How Bookkeeping for Lawyers Supports Tax Preparation and Compliance

Accounting begins with keeping money in order. It tracks income and expenses and shows how cash flows in a business. For law firms, bookkeeping for lawyers goes further. It records client funds, bills, and office costs with care. This makes tax work easier and keeps the firm within the law. Clear records also help lawyers make good decisions, plan budgets, and find ways to save. Keeping books up to date helps a firm stay secure, avoid mistakes, and be ready for any review. Proper bookkeeping is more than paperwork. It is a tool that keeps the firm strong and prepared.

In this blog, we will look at how bookkeeping for lawyers helps with tax preparation, compliance, and smart financial decisions for law firms.

Why Lawyers’ Bookkeeping Matters to Law Firms

Lawyers handle many client accounts, fees, and funds. Without clear records, tax errors can happen, leading to fines or problems. Bookkeeping keeps every payment and expense tracked. This makes it easy to report taxes and stay within the law.

Legal Trust Accounts

Law firms often manage client money in trust accounts. These funds are separate from the firm’s money. Bookkeeping for lawyers ensures:

- Client funds are safe and separate

- Every payment is logged correctly

- Reports are ready for audits

Keeping clear records of trust accounts avoids mistakes and legal trouble.

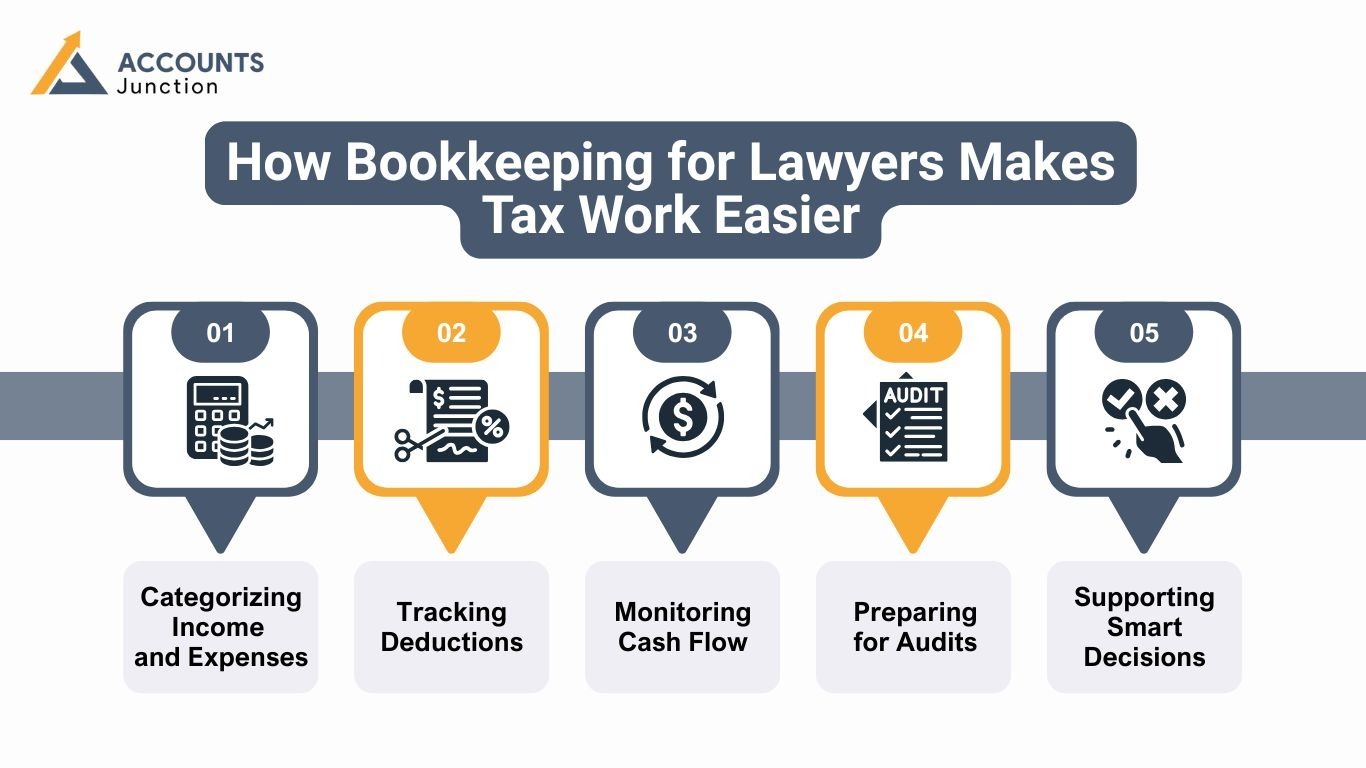

How Bookkeeping for Lawyers Makes Tax Work Easier

Bookkeeping for lawyers simplifies taxes. Law firms face many tax types, including income, payroll, and sometimes sales tax. When records are accurate, tax filing is faster and less stressful.

1. Categorizing Income and Expenses

Bookkeeping for lawyers sorts money into clear groups:

- Client payments

- Court fees

- Rent and utilities

- Staff salaries

- Office supplies

When expenses and income are organized, forms like Schedule C or Form 1120 can be filled out quickly and correctly.

2. Tracking Deductions

Law firms have many expenses they can deduct. Good bookkeeping ensures nothing is missed. Deductible costs include:

- Education and training

- Office supplies and software

- Travel for clients

- Advertising

With full records, firms pay less tax legally.

3. Monitoring Cash Flow

Bookkeeping tracks money coming in and going out. It helps firms see when bills are due and when payments arrive. Key items to track include:

- Client payments

- Court fees

- Rent and utilities

- Staff pay

- Office supplies

When cash flow is tracked, firms can pay bills on time and avoid shortfalls.

4. Preparing for Audits

Good bookkeeping keeps all records in order. Law firms can show exactly how money moves. Important records include:

- Invoices and receipts

- Bank statements

- Payroll records

- Tax forms

- Expense reports

With organized records, firms can respond to audits quickly and reduce the risk of fines.

5. Supporting Smart Decisions

Bookkeeping shows where money comes from and where it goes. Firms can use this data to plan and grow. Key areas to review include:

- Client income

- Office costs

- Staff expenses

- Marketing spend

- Equipment purchases

With clear numbers, firms can plan budgets and make choices that help the business grow safely.

Compliance Through Accurate Bookkeeping

Staying compliant is key for every law firm. Tax offices and regulators ask for clear, correct records. Bookkeeping keeps full proof of all money moves. This lowers the risk of fines and helps meet legal rules.

1. Regular Financial Reports

Bookkeeping for lawyers allows monthly or quarterly reports. Such as:

- Income statements

- Balance sheets

- Cash flow statements

These reports help with tax prep and show the true health of the firm. They also guide smart money plans and growth goals.

2. Being Audit-Ready

Audits go smoother with clean, detailed books. Full records of trust funds, bills, and spend make the audit quick and stress-free. Good books mean fewer errors and more trust from clients and tax agents.

3. Better Decision-Making

Accurate books give real-time money insight. Firm leaders can spot trends, plan budgets, and act fast when issues arise. Clear data means smarter choices and steady growth.

Benefits of Outsourcing Bookkeeping for Lawyers

Some firms do books in-house, while others hire outside help. Using experts has clear gains:

1. Save Time and Money

- Experts handle the books so lawyers can focus on cases. It also costs less than hiring full-time staff.

2. Use Expert Skills

- Bookkeepers know the rules for law firms. They track client funds, pay bills, and make reports right.

3. Reduce Mistakes

- Skilled staff keep records correct. Fewer errors mean smoother taxes and audits.

4. Fast Tax Filing

- Records stay up to date, so filing taxes is quick and stress-free.

5. Clear Money View

- Experts make reports that show income and spending. Firms can plan budgets, cut waste, and grow safely.

Using Technology for Bookkeeping

Tech tools make bookkeeping for lawyers faster. Apps like QuickBooks, Xero, and Clio help track money and records.

-

Automate Tasks

Apps can sort costs, track pay, and make reports on their own. This cuts errors and saves time.

-

Cloud Access

Cloud tools let teams view books anywhere. Data stays safe and easy to share when stored online.

-

Trust Account Integration

Some software connects to client trust accounts. This keeps funds separate and ensures compliance, making reporting easier.

Common Bookkeeping Mistakes

Even careful firms can make errors. Common mistakes include:

Mixing Accounts

- Combining personal and firm accounts can cause confusion, wrong tax filings, and audits.

Not Updating Records

- Bookkeeping must be done regularly. Ignoring it leads to missing payments, wrong categories, and wrong reports.

Poor Trust Account Tracking

- Client funds must be tracked carefully. Errors can break the law and lead to penalties.

Best Practices for Bookkeeping

To get the most from bookkeeping for lawyers, firms should follow these steps:

-

Keep Accounts Separate

Keep client money and firm funds apart. This keeps records clear and meets rules.

-

Reconcile Often

Match your books with bank records often. This helps catch errors fast.

-

Keep Proof

Save all bills, slips, and payment proof. These help with tax and audit checks.

-

Check Reports Monthly

Review income, balance, and cash flow each month. This helps plan and spot issues early.

-

Set a Bookkeeping Schedule

Plan specific days each week or month to update records. Regular work keeps books accurate and tasks manageable.

-

Review Errors Promptly

Check for mistakes in invoices, payments, or reports as soon as they appear. Early fixes prevent bigger problems later.

How Bookkeeping Guides Decisions

Bookkeeping is more than taxes; it guides choices for growth.

-

Forecast Money

Records help predict income and cash flow. This allows better planning.

-

Control Costs

Bookkeeping shows where money is spent. Firms can cut waste and save.

-

Know Profitability

Accurate records show which services or clients earn the most, helping firms focus on growth.

Bookkeeping for lawyers keeps money clear, client funds safe, and taxes easier. For law firms, it tracks money, keeps client funds safe, and makes taxes easier. Clear books reduce mistakes, help follow the law, and make audits smoother. They also give leaders insight into income,

costs, and cash flow, which helps plan budgets, manage expenses, and make smart decisions.

At Accounts Junction, we help law firms handle all bookkeeping and accounting tasks. Our team tracks every payment, expense, and trust account with care. We simplify tax preparation, ensure compliance, and provide reports ready for audits. Using our services saves time, cuts errors, and gives peace of mind, knowing your firm’s finances are accurate and secure.

Partner with us to keep your firm compliant, prepared, and confident for every tax and audit need.

FAQs

1. What is bookkeeping for lawyers?

- It tracks law firm money such as income, costs, and client funds in an organized way.

2. Why do law firms need bookkeeping?

- It keeps money clear, helps file taxes, and meets rules.

3. How does bookkeeping support tax preparation?

- It sorts income and costs so tax forms are fast and correct.

4. What are trust accounts in bookkeeping for lawyers?

- They hold client money separate from the firm’s funds.

5. Why must trust accounts stay separate?

- Mixing funds can break rules and bring legal trouble.

6. How often should firms update books?

- Each week or month, so the records stay right and fresh.

7. What records should lawyers keep?

- Bills, bank slips, tax forms, and proofs of payment.

8. How does bookkeeping help audits?

- Clean books make audits fast and stress-free.

9. What reports do firms need most?

- Income, cash flow, and balance sheet reports.

10. How does bookkeeping help cash flow?

- It shows when bills are due and when pay comes in.

11. What mistakes do law firms make?

- Mixing accounts, late updates, and poor trust checks.

12. Can firms use apps for bookkeeping?

- Yes. Tools like QuickBooks or Xero track all money.

13. Why use cloud apps?

- They keep data safe and let teams see it from any place.

14. Why let apps handle tasks?

- They save time and cut errors.

15. Is it good to hire experts for books?

- Yes. They save money and keep records right.

16. How do outsourced bookkeepers help compliance?

- They know tax and trust rules, keeping records legal.

17. How does bookkeeping help in decisions?

- It shows where money goes and which areas earn profit.

18. Can bookkeeping help a firm grow?

- Yes. Clear books guide smart plans and safe growth.

19. What happens if a firm skips bookkeeping?

- It may face fines, tax issues, or lose client trust.

20. How can firms stay audit-ready?

- Save proofs, check reports, and update books often.