Bookkeeping for Internet Marketers

Bookkeeping for Internet marketers is key to understanding your finances. It helps you see where your money comes from and where it goes. Whether you're running paid ads, selling digital products, or earning affiliate commissions, you deal with money every day. And where there’s money, there needs to be good records.

Many online marketers focus all their energy on content, traffic, and conversions. It is good. But if you don't track your income and expenses, you might miss important chances. Proper accounting for internet makers helps you in staying organized, avoiding tax trouble, and helps in growing your business.

Essential Financial Records Every Internet Marketer Should Track

When you're in the online space, it's easy to forget to track every little transaction. However, keeping the right records is key for proper accounting for Internet marketers. Here’s what to track:

1. Revenue from all sources

- This includes income from product sales, affiliate commissions, ad revenue (like from YouTube or Google Ads), and sponsored content. Tracking every stream ensures you know exactly where your money is coming from and helps with accurate tax reporting.

2. Expenses

- These are all your business-related costs. Such as subscriptions to email marketing tools, ad spending on platforms like Facebook or Google, online courses for skills, and payments to freelancers. Properly recording expenses helps you claim deductions and manage cash flow.

3. Receipts and invoices

- Always keep receipts and create invoices for your services or purchases. These are useful proofs during audits and tax filings, and they also make it easy to track spending patterns or client payments.

4. Subscriptions

- As an Internet marketer, you probably rely on multiple tools. Such as Canva, Buffer, Mailchimp, or content scheduling apps. Listing these monthly or yearly subscriptions ensures you don’t forget to account for recurring costs.

5. Bank and payment statements

-

Keeping transaction records from PayPal, Stripe, or your bank account is a core task in Bookkeeping for Internet Marketers. These statements help you balance your income and expenses. They are important for clear and organized bookkeeping for online marketers.

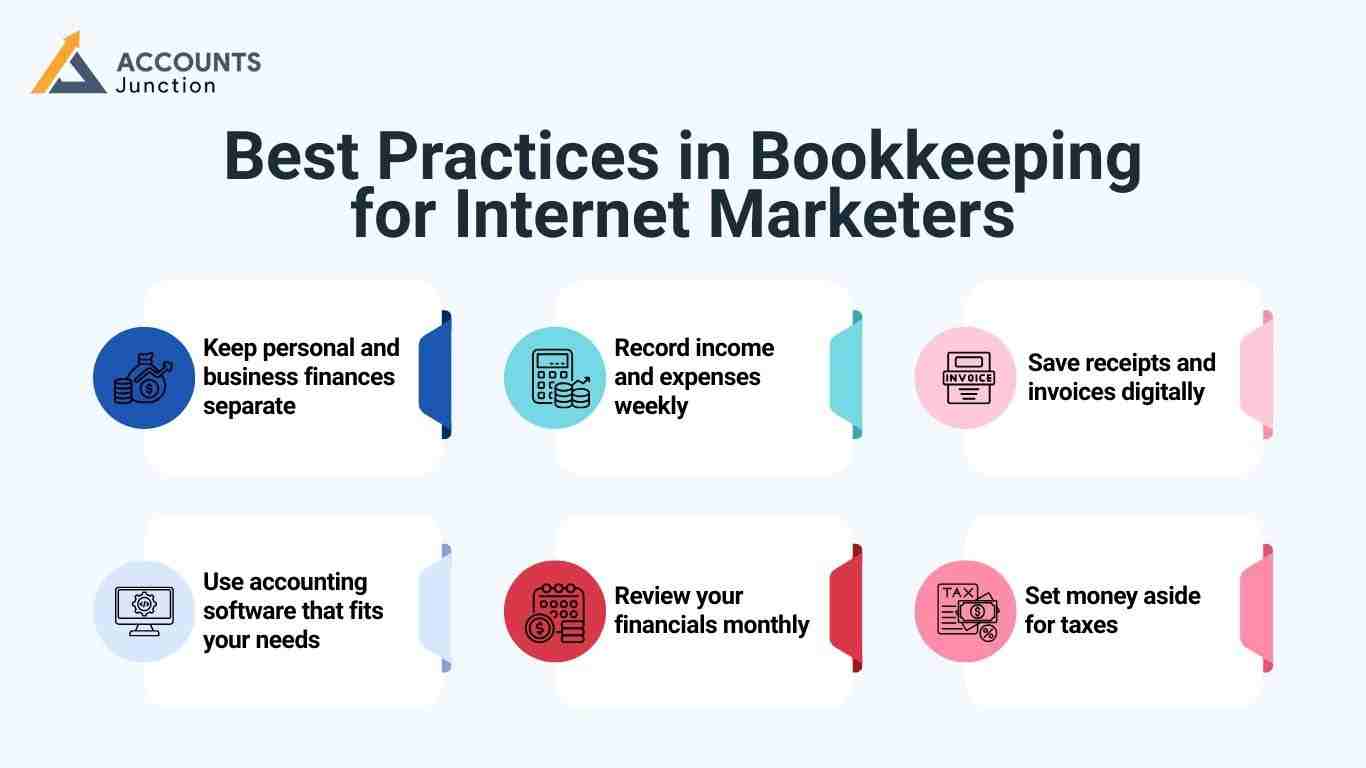

Best Practices in Bookkeeping for Internet Marketers

Effective Bookkeeping for Internet Marketers gets much easier when you follow the right habits. These simple practices can save you from stress, surprise tax bills, or missed growth opportunities.

1. Keep personal and business finances separate

- Open a separate bank account for your business. Mixing your spending with your work income makes it hard to track profits and expenses. A dedicated account keeps things clean and professional.

2. Record income and expenses weekly

- Take out 10–15 minutes each week to log your income and expenses. This small habit makes bookkeeping feel effortless and helps you stay in control.

3. Save receipts and invoices digitally

- Paper receipts fade, get lost. Instead, use apps like Google Drive, Dropbox, or expense-tracking tools to store everything in the cloud. It keeps your records safe and easy to find during tax season.

4. Use accounting software that fits your needs

- Tools like QuickBooks, Wave, or FreshBooks are perfect for accounting for Internet marketers. They track your money, send invoices, and generate reports automatically!

5. Review your financials monthly

- Once a month, look at your income, expenses, and profit. It helps you see where your money is going and where you can improve. These monthly check-ins are like financial health checkups.

6. Set money aside for taxes

- Saving for taxes is a crucial part of Bookkeeping for Internet Marketers. Set aside a portion of each payment. So you’re ready when tax season comes. It’s better to be prepared than stressed later.

Common Bookkeeping Mistakes Internet Marketers Make

Bookkeeping for Internet Marketers can feel overwhelming at times, but simple steps make it manageable. Even the most experienced marketers slip up. Let’s look at the most common mistakes and how to avoid them:

1. Not saving receipts, especially for online expenses

- Many marketers forget to save digital receipts—especially when buying tools, ads, or software online. These small receipts matter during tax time. Use cloud folders or apps to snap and store them instantly.

2. Forgetting small expenses like domains or stock photos

- It’s easy to ignore little purchases like stock images, plugins, or monthly website fees. But these small amounts add up over time and can be claimed as business expenses. Tracking them can save you money.

3. Mixing personal and business funds

- If you use the same bank account for everything, it becomes messy fast. You won’t know what money came from your business and what was spent personally. Keeping things separate keeps your books clear and organized.

4. Not setting money aside for taxes

- Many online marketers spend their earnings without realizing they’ll owe taxes later. Not saving can lead to surprise tax bills. Always put aside a chunk of your income—so tax season doesn’t bring stress.

5. Only reviewing numbers once a year

- Waiting until year-end to look at your finances is a bad habit. You miss out on insights that help you grow. Checking in monthly lets you fix problems early and make smarter business moves.

How Professional Accounting for Internet Marketers Can Drive Growth

Partnering with someone who truly understands accounting for Internet marketers can be a game-changer. Here's why bringing in a professional is worth it:

1. Tax planning and filing

- A professional accountant keeps your records ready for tax time. They help you plan, claim the right deductions, and avoid mistakes.

2. Financial forecasting for smarter choices

- Accountants don’t just track numbers but also help you plan for the future. With their help, you can understand future income, spot trends, and make better decisions about where to invest or cut back.

3. Staying legally compliant

- Online businesses have tax rules too. A certified accountant knows the laws, sales tax rules for digital products, and what records to keep. So, you stay on the right side of the law.

4. Saving you time

- Instead of trying to figure out your finances on weekends or late nights, let a pro handle it. That way, you can focus on building your brand, serving clients, or creating new content.

5. Peace of mind

- Knowing your books are in order brings relief. No more second-guessing or late-night Google searches. You can run your business with confidence.

Proper bookkeeping sets the foundation for long-term growth in your online business. Accounts Junction provides professional bookkeeping and accounting services specifically for Internet Marketers. With our team of certified experts, you can trust that your financial records are accurate and up to date. Partner with us to streamline your finances and grow your business confidently.

FAQ

1. What is bookkeeping for Internet marketers?

- It is the process of tracking income, ad spend, subscriptions, and other financial transactions for online marketing businesses.

2. Why is bookkeeping important for online marketers?

- Proper bookkeeping may help track ad spend, manage revenue streams, and prepare for taxes efficiently.

3. Which financial records should Internet marketers track?

- Records may include ad campaign costs, affiliate revenue, digital product sales, subscriptions, invoices, and bank statements.

4. How can bookkeeping help track online ad spend?

- Recording each ad expense may show which campaigns are profitable and which are draining budgets.

5. What are common bookkeeping mistakes Internet marketers make?

- Mistakes may include ignoring small digital expenses, mixing personal funds, or missing recurring subscriptions.

6. How do I track income from multiple online marketing channels?

- Track affiliate earnings, ad revenue, sponsored content, and product sales separately in accounting software.

7. Which tools are best for bookkeeping for online marketers?

- Software like QuickBooks, FreshBooks, Wave, or Zoho may help track ad spend, subscriptions, and client payments.

8. Should recurring marketing subscriptions be tracked in bookkeeping?

- Yes, tools like Canva, Mailchimp, and scheduling apps should be recorded to know true business expenses.

9. How often should an Internet marketer update financial records?

- Weekly or monthly updates may help spot errors and keep ad spending and revenue organized.

10. Can bookkeeping help optimize online marketing campaigns?

- Yes, reviewing financial records may identify which campaigns bring the best ROI and guide future spending.

11. How does bookkeeping support tax preparation for online marketers?

- It may organize invoices, receipts, and ad costs, making tax filing accurate and less stressful.

12. What expenses are often overlooked by Internet marketers?

- Costs like stock photos, plugins, domain renewals, and minor software subscriptions may be forgotten.

13. How can I track payments from platforms like PayPal or Stripe?

- Record each transaction and reconcile with your accounting software to ensure accurate revenue reporting.

14. Can bookkeeping help forecast online business growth?

- Yes, tracking income and expenses may help predict future cash flow and guide investment decisions.

15. How does separating personal and business finances benefit online marketers?

- It may prevent errors, simplify bookkeeping, and make tax reporting easier.

16. How do invoices fit into bookkeeping for Internet marketers?

- Invoices track payments due or received from clients, affiliates, or sponsors, and keep cash flow organized.

17. Can professional bookkeeping improve profitability for Internet marketers?

- Yes, accountants may help track ad spend, identify profitable campaigns, and optimize revenue streams.

18. How can bookkeeping help manage recurring ad campaigns?

- By tracking ad spend and performance monthly, marketers may make better budget decisions.

19. Why should online marketers store receipts digitally?

- Digital storage ensures quick access, reduces loss risk, and may simplify audits or tax filing.

20. Can bookkeeping help scale an Internet marketing business?

- Accurate records may guide investment in tools, ads, freelancers, or product launches for growth.