Best Accounts Payable Management Procedures

Proper money management is key for any business. Following accounts payable management procedures helps ensure bills are paid on time and cash flow stays smooth. They also cut errors and keep costs low. Companies that follow managing accounts payable best practices run smoothly and keep strong ties with suppliers.

Managing AP is more than paying bills. It includes checking invoices, planning payments, keeping records, and approvals. Businesses that follow accounts payable management procedures save money, cut mistakes, and stay transparent. Clear processes boost work speed and reduce financial risks.

Understanding Accounts Payable Management

Accounts payable management procedures involve tracking and paying supplier bills on time to maintain financial accuracy. It ensures all bills are correct and paid promptly. Good AP management keeps accounts accurate and supports smooth work.

Importance: Following AP steps stops late fees and disputes. Good management and managing accounts payable best practices improve cash flow, helping plan and make smart financial choices.

Why Accounts Payable Procedures Are Essential

- Ensure Timely Payments: Paying bills on time avoids fines and builds trust with suppliers.

- Improve Cash Flow: Watching cash outflow helps keep enough money for business needs. Good planning stops shortages.

- Reduce Errors: Avoid paying the same bill twice or paying the wrong amounts. Fewer errors save money and prevent disputes.

- Enhance Supplier Relationships: Timely payments build trust. Good supplier ties help businesses grow.

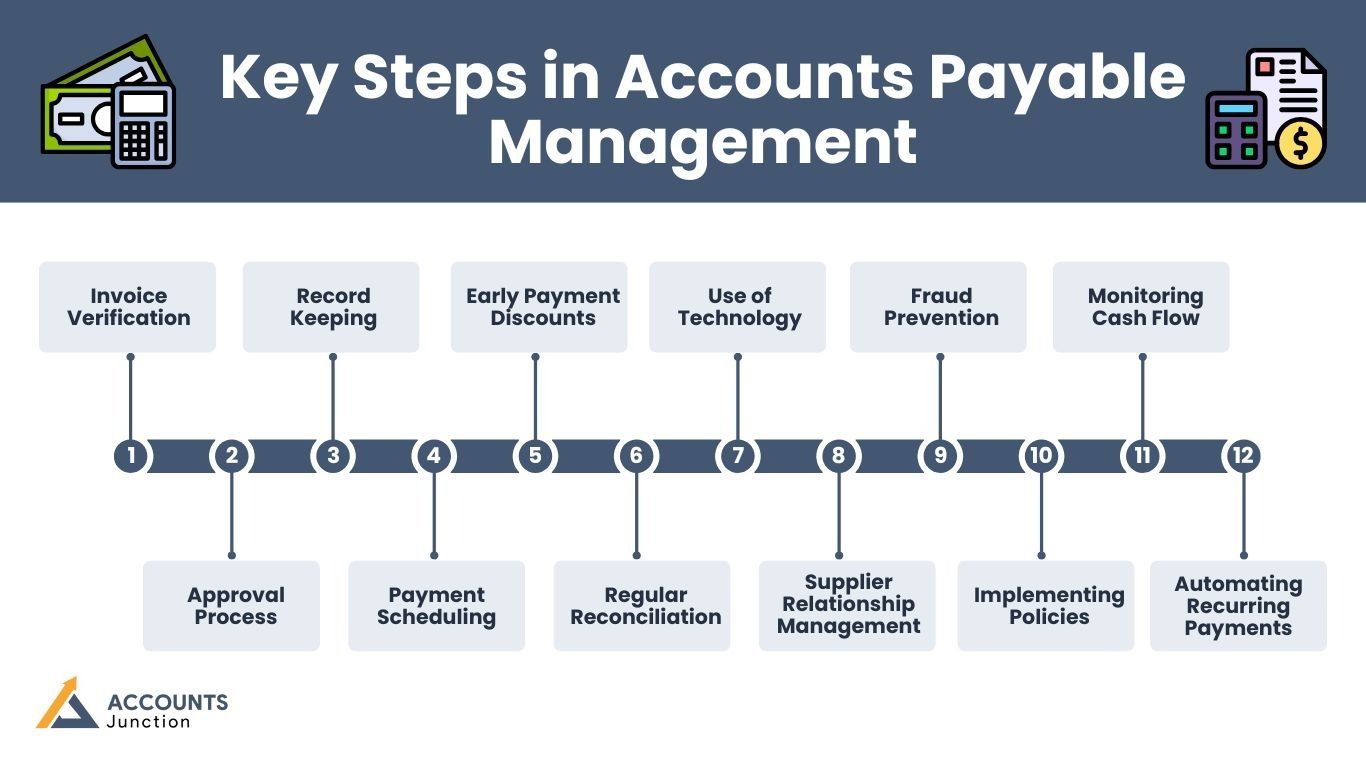

Key Steps in Accounts Payable Management

1. Invoice Verification

- Check All Details: Make sure amounts, dates, and purchase orders match.

- Prevent Fraud: Verify bills are real before payment.

2. Approval Process

- Structured Approvals: Have multiple checks for large payments.

- Assign Responsibilities: Clear roles keep staff accountable.

3. Record Keeping

- Maintain Accurate Records: Keep all invoice and payment details.

- Organize Digitally: Use software to store and retrieve records easily.

4. Payment Scheduling

- Plan Payment Dates: Schedule payments to manage cash flow.

- Avoid Overpayments: Pay only what is due.

5. Early Payment Discounts

- Take Advantage: Pay early if discounts are offered.

- Plan Strategically: Make sure funds are enough before paying early.

6. Regular Reconciliation

- Compare Records: Match company records with supplier statements.

- Correct Mistakes: Fix errors quickly.

7. Use of Technology

- Automate Tasks: Use software to manage AP steps.

- Track Payments: Digital tools alert for due payments.

8. Supplier Relationship Management

- Build Trust: Communicate clearly and agree on fair terms.

- Resolve Issues: Solve disputes fast to keep trust.

9. Fraud Prevention

- Segregate Duties: No single person should approve and pay.

- Monitor Transactions: Check for unusual activity often.

10. Implementing Policies

- Set Clear Guidelines: Define approvals, payments, and record rules.

- Communicate Policies: Make sure all staff understand rules.

11. Monitoring Cash Flow

- Track Outgoing Payments: Watch cash flow to keep money steady.

- Plan Major Payments: Schedule large bills carefully.

12. Automating Recurring Payments

- Set Automated Payments: Let software pay regular bills.

- Monitor Automation: Check auto-payments for accuracy.

Benefits of Effective Accounts Payable Management

- Improved Cash Flow: Know when money goes out of the business. Plan spending well to avoid running short of cash.

- Cost Savings: Avoid late fees and get early payment deals. This keeps more cash in the business each month.

- Enhanced Efficiency: Simple steps save time and cut extra work. Teams finish tasks fast and focus on main work.

- Accurate Financial Records: Managing accounts payable best practices ensures error-free accounts for audits and financial reports.

- Stronger Supplier Relationships: Paying on time helps build trust with suppliers.

Challenges in Accounts Payable Management

- High Invoice Volume: Many bills can tire staff fast. Use tools to manage work better.

- Human Errors: Mistakes happen in daily work. Train staff well to avoid them.

- Late Approvals: Delays lead to fines. Clear accounts payable management procedures prevent these delays.

- Supplier Disputes: Wrong bills can cause vendor issues. Fix them fast to keep the peace.

- Lack of Automation: Manual work takes more time. Use software to speed up AP.

Tools for Accounts Payable Management

- Accounting Software: QuickBooks, Xero, and Zoho Books save time. They help track money and keep accounts correct daily.

- Invoice Management Tools: Bill.com and FreshBooks make bills easy to handle. These tools help staff check invoices fast and clearly.

- Payment Automation Tools: Tipalti and Stampli pay bills with less work. They reduce errors and make payment tasks much faster.

- ERP Systems: SAP, Oracle, and Microsoft Dynamics link all processes. These systems help teams manage accounts and work together.

Understanding Accounts Payable Metrics

What Are AP Metrics?

AP metrics are numbers that show how well AP works. They help managers find problems and improve processes.

Key Metrics:

- Days Payable Outstanding (DPO): Shows how long it takes to pay vendors. Helps plan cash. Also shows payment trends.

- Invoice Error Rate: Percent of invoices with mistakes. Lower rates save time. Fewer errors build trust.

- Payment Accuracy Rate: Percent of payments done correctly. High accuracy keeps vendors happy. Reduces disputes.

- Cost per Invoice: Shows the cost to process one invoice. Lower cost saves money. Helps efficiency.

Benefit: Tracking these numbers improves planning and saves money. It also helps spot weak spots.

Accounts Payable Workflow Optimization

Step-by-Step Process: Use clear steps and managing accounts payable best practices to handle invoices, avoid delays, and simplify training.

Automation

- Speed Up Tasks: Machines do routine work and save staff time. Staff can focus on key work without any long delays.

- Increase Accuracy: Alerts and checks help cut common human errors. This keeps the work correct and makes the results more reliable.

Benefits

- Fewer mistakes happen when work is done by machines.

- Tasks get done fast, helping projects move without delays.

- Teams see all work clearly and stay well organized.

Outcome: Smooth work saves time and lowers team stress levels. Teams finish tasks faster, and work becomes more efficient.

Integrating Accounts Payable with Cash Management

Plan Cash Flow: Use accounts payable management procedures to track funds, pay vendors on time, and avoid shortages.

Payment Timing:

Plan payments to match cash and avoid late fees always. Pay on time to keep vendors happy and trust strong. Set payment dates carefully to stop mistakes and extra charges.

Benefits:

- Avoid money shortages by planning payments ahead of each month clearly.

- Good timing helps investments and makes businesses grow more steadily.

- Keep cash flow smooth and plan future payments without stress.

Compliance and Regulatory Considerations

- Follow Laws: Managing accounts payable best practices ensures compliance with tax and legal rules, avoiding fines and protecting reputation.

- Audit Ready:

Keep clear records for audits. Show all payments correctly and clearly. Organized files help auditors check data fast and without errors. Correct records save time and reduce mistakes during all reviews. - Internal Controls:

Use checks and approvals to stop fraud and errors daily. Limit access to accounts to protect the company's money safely and well. Update rules often so that all staff follow proper steps always. - Regular Review:

Check accounts payable often to keep the process safe and clear. Find mistakes early to prevent delays and keep work smooth. Regular review builds trust and duty in the finance team. - Benefit:

Follow rules to reduce risk and keep finances safe and sound. It ensures the law is met and avoids costly mistakes later. Clear steps improve trust and keep all financial work steady.

Vendor Communication Strategies

- Clear Updates: Share payment plans with vendors early. Avoid mix-ups and build strong trust.

- Negotiate Terms: As part of accounts payable management procedures, ask for early discounts or longer payment days to improve cash flow for both sides.

- Supplier Portals: Track bills online with fewer errors. Let vendors see updates anytime, fast.

- Outcome: Clear talk keeps vendors happy always. Builds strong and trusted business ties.

Utilizing Technology for Advanced Accounts Payable

- AI Tools: Spot duplicate bills and forecast cash needs. Save time and boost payment accuracy.

- Cloud Solutions: Work anywhere with fast, safe access. Support teams and improve daily work.

- Data Analytics: Track trends and plan smart payments. Save money and guide better choices.

- Benefit: Tech makes AP quick and smart. Cut errors and improve results easily.

Accounts Payable Outsourcing

What It Is: Hire a third party for AP tasks. This supports managing accounts payable best practices and reduces staff workload.

Advantages:

- Save labor costs with smart process use.

- Get expert tools for faster, cleaner work.

- Cut errors and lower fraud risk easily.

- Works well during busy business times.

Outcome: Keep AP smooth and stress-free daily. Ensure better control and full compliance.

Advanced Payment Strategies

- Dynamic Discounts: Pay bills early to earn small savings. Increase profit and build vendor trust.

- Payment Consolidation: Group vendor payments to cut extra work. Fewer deals mean simple tracking tasks.

- Electronic Payments: Use online transfers for quick, safe pay. Avoid errors and speed up the process.

- Outcome: Save money and improve cash flow. Make payment tracking clear and easy.

Risk Management in Accounts Payable

- Spot Risks: Look for fraud, delays, and vendor issues early. Fix problems fast to stop loss and damage.

- Mitigate Risks: Use clear checks and simple tools for safety. Cut errors and keep your money secure.

- Continuity: Keep backup systems ready for any issue. Make sure payments run smooth in all times.

- Outcome: Save business money and keep work steady. Good risk control builds trust and stability.

Green Accounts Payable Practices

- Paperless Invoicing: Use online bills to cut paper and costs. Digital invoicing speeds work and saves time.

- Energy-Efficient Tools: Choose cloud systems that use less power. These tools lower bills and reduce waste.

- Eco-Friendly Vendors: Partner with green suppliers for clean work. It helps nature and builds a good image.

- Outcome: Saves money and supports a green future. Boosts brand trust and long-term success.

Good accounts payable keeps payments correct, cash flow steady, and suppliers happy. Clear steps, proper tools, and trained staff cut errors and risk.

Accounts Junction provides accounts payable services, such as checking invoices, planning payments, reconciling accounts, and making reports. We have certified experts who follow accounts payable management procedures and apply managing accounts payable best practices to keep records accurate and operations smooth. Partner with us to build trust with suppliers, strengthen your finances, and grow your business.

FAQs

1. What are accounts payable procedures?

- Steps to manage invoices, approvals, and payments correctly.

2. Why manage accounts payable?

- It ensures on-time payments, saves money, and builds trust.

3. How does automation help?

- It lowers mistakes and keeps payments on time.

4. What is invoice verification?

- Checks amounts, dates, and purchase orders carefully.

5. How often should AP be reconciled?

- Monthly checks keep records right and up-to-date.

6. Do small businesses benefit from AP management?

- Yes, AP steps improve cash flow and avoid errors.

7. Best way to prevent fraud in AP?

- Split duties, verify bills, and monitor all payments.

8. What is a payment schedule?

- A plan that sets dates to pay bills on time.

9. How can AP reduce costs?

- Avoid late fees and get early payment discounts.

10. Why keep digital records?

- Easy access, fewer mistakes, and faster reporting.

11. What is the role of the approval process?

- Checks large payments and keeps staff accountable.

12. How does early payment help the business?

- It saves money with supplier discounts and builds trust.

13. What are recurring payments?

- Bills that repeat regularly, like rent or subscriptions.

14. How can technology improve AP?

- It automates steps and alerts for due payments.

15. What is cash flow monitoring?

- Watching money in and out to keep funds ready.

16. Why manage supplier relationships in AP?

- Good ties ensure smooth business and timely supplies.

17. How can reconciliation prevent errors?

- It finds mistakes and fixes them before problems grow.

18. What is fraud prevention in AP?

- Checks and balances to stop fake or wrong payments.

19. What tools help manage AP?

- Accounting software, invoice tools, payment automation, and ERP systems.

20. Why is AP important for business growth?

- It keeps money steady, saves costs, and builds trust.