Why Accounting for Rental Business Is Important for Property Owners

Accounting for rental business helps owners track rent and costs. Many owners may miss money details without proper logs. Good records show where cash goes every month. Bookkeeping for rental properties can cut mistakes and save time. Clear accounting helps owners plan for each property easily. Proper tracking gives a calm, clear view of finances.

Many owners may not track each cost or rent clearly. Small mistakes may add up and cause big problems. Accounting for rental businesses gives a clear view of money flow. It helps owners plan for repairs, bills, and rent issues. Good bookkeeping may save time, reduce stress, and guide choices.

Understanding Accounting for Rental Business

Accounting for rental businesses means keeping track of rent and costs. It shows how money comes in and goes out. Without simple logs, mistakes may grow fast over time. Accounting becomes easier with the best software for rental property accounting, as it shows income, costs, and cash clearly.

Tracking Rental Income

- Owners must log each rent payment every month using accounting for rental properties. Bookkeeping for rental properties shows who pays on time.

- Tracking rent through accounting for rental businesses helps avoid late payments or missing cash. Using the best accounting software for rental properties makes it easy to check tenant payments anytime.

Tracking Costs

- Repairs, water, gas, and taxes must be tracked. Bookkeeping and accounting for rental businesses keep costs in one place.

- Clear logs from the best software for rental property accounting help owners plan better and control spending. Tracking costs with accounting for rental business stops surprise bills at month's end.

Handling Deposits

- Security deposits must be tracked for refunds. Accounting for rental businesses makes deposit logs clear.

- Proper tracking avoids tenant disputes over money. Bookkeeping with the best accounting software for rental properties makes deposit tracking and refunds easy.

Handling Late Fees

- Late fees can be missed without accounting for rental businesses in place. Bookkeeping and accounting for rental properties keep fee records neat.

- Owners can charge fees fairly and on time. Logs build trust between owners and tenants.

Checking Cash Flow

- Accounting for a rental business shows how money moves. Owners can see which months earn more or less.

- Cash flow reports from the best software for rental property accounting help owners plan for slow months. Bookkeeping guides money decisions for better returns.

Accounting for Rental Properties

Good accounting for rental properties makes management simple. It reduces mistakes and helps plan for the future. Organized records using the best accounting software for rental properties make reporting, taxes, and bills easy.

Keeping Tenant Records

- Tenant data includes rent, contract, and payment history. Bookkeeping and accounting for rental properties keep files neat and clear.

- Organized records ease communication with tenants. Owners can find tenant info quickly with the best software for rental property accounting.

Scheduling Maintenance and Repairs

- Regular repairs reduce high costs later. Bookkeeping for rental properties tracks service dates and bills.

- Owners can plan maintenance without surprise costs. Proper schedules keep tenants happy and property safe.

Documenting Taxes and Compliance

- Taxes may change each year or by city. Accounting for rental properties helps avoid fines.

- Accurate logs simplify tax filing and reporting. Bookkeeping keeps owners ready for any tax checks.

Tracking Utility and Service Bills

- Utilities form a major monthly expense. Bookkeeping for rental properties keeps bills in check.

- Owners notice unusual costs fast and prevent waste. Clear logs help manage property spending well.

Tracking Insurance and Legal Costs

- Insurance premiums and small legal fees must be logged. Accounting for rental business keeps payments on track.

- Bookkeeping helps during disputes or claims. Clear records reduce stress and confusion for owners.

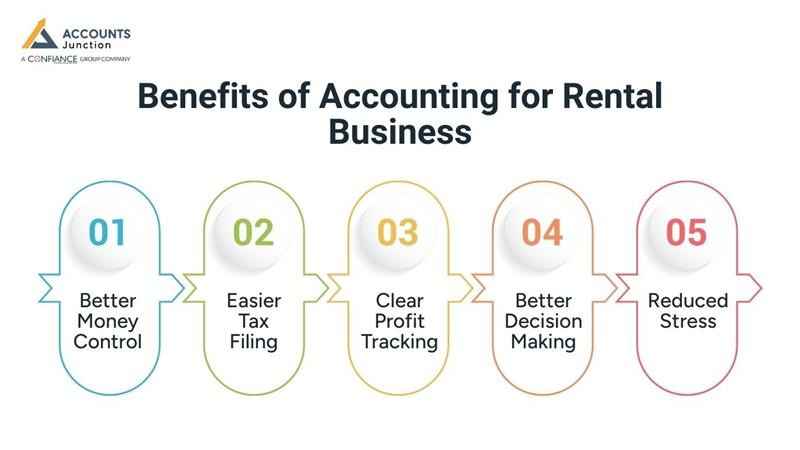

Benefits of Accounting for Rental Business

Good accounting helps owners track cash and costs.

It helps avoid loss and plan for the future.

Better Money Control

- Bookkeeping for rental properties shows cash in and out. Owners can check funds and pay bills on time.

- Logs help avoid extra spending and missed cash. Clear records from the best software for rental property accounting help spot errors and stop waste.

Easier Tax Filing

- Taxes can be hard for owners to track. Bookkeeping and accounting for rental properties keep tax logs ready.

- Logs help file returns fast and on time. Clear records help stop fines or wrong claims.

Clear Profit Tracking

- Accounting for rental businesses shows profit for each place. Owners can see which place makes more or less.

- Logs help plan future buys or small upgrades. Clear tracking helps plan long-term money growth.

Better Decision Making

- Good logs help owners make smart choices. Owners can change rent or plan repairs with ease.

- Bookkeeping stops guesswork and shows real cash flow. Clear logs help reduce risk in money moves.

Reduced Stress

- Bookkeeping keeps all logs neat and in one place. Owners feel calm and in control of funds.

- Clear records make day-to-day work much easier. Simple tracking reduces worry about lost money.

Choosing the Best Accounting Software for Rental Properties

The best accounting software for rental properties helps track cash easily. It saves time and stops mistakes in records.

Cloud-Based Software

- Cloud tools let owners check rent anytime and anywhere. Bookkeeping for rental properties becomes simple and fast.

- Data stays safe and can be shared with help. Cloud tools make property work smooth and clear.

Automating Recurring Tasks

- Reminders reduce missed rent or payment errors. Bookkeeping and accounting for rental properties becomes quick and easy.

- Recurring bills and costs can be logged automatically. Automation makes work faster and tracking simple.

Bank and Payment Sync

- The best software for rental property accounting syncs bank and payment information automatically. Accounting for a rental business becomes simple and straightforward.

- With the best software for rental property accounting, owners can check cash flow at any time. Synchronizing stops errors from manual entry.

Quick Reports

- Reports show income, costs, and tenant trends fast. Accounting for rental properties creates reports in clicks.

- Owners see data clearly for decisions. Reports cut guesswork in money planning.

Data Safety

- Software keeps tenant and property info safe. Cloud backup stops the loss of records.

- Accounting for the rental business keeps logs secure. Owners can trust the software for long-term records.

Cost and Growth

- Software can grow as the property business grows. Owners can start small and add features later.

- Cheap tools can still give full help. Scalable software fits the rental business over time.

Common Mistakes in Rental Accounting

Many owners make mistakes when the logs are not clear. Knowing common errors helps avoid cash loss.

Missing Small Expenses

- Small bills for repair or power are often missed. Accounting for rental businesses helps log each small cost. Bookkeeping for rental properties tracks small expenses clearly. Small missed costs can grow into a big loss.

How to Avoid This Mistake

- Log each bill on the same day it is paid. Keep all bills in one folder or file. Check cost logs at least once each week. Use simple tools to track each small spend.

Ignoring Late Fees

- Late fees are missed when logs are not kept. Bookkeeping and accounting for rental properties keep fee logs clear. Accounting for rental businesses helps track fees on time. Missed fees reduce cash flow over time.

How to Avoid This Mistake

- Set a clear due date for rent each month. Check rent logs after the due date passes. Add late fees to logs right after the delay. Use simple notes to track unpaid rent.

Poor Record Order

- Messy logs cause issues during rent checks. Accounting for rental properties keeps logs neat. Bookkeeping stops the loss of bills or tenant notes. Poor order wastes time and adds stress.

How to Avoid This Mistake

- Store rent logs and bills in one place. Use clear names for files and folders. Sort logs by month and tenant name. Clean old or wrong files each month.

Proper accounting for rental businesses is key for all owners. Clear records of rent, costs, deposits, and fees help track cash. Bookkeeping for rental properties cuts errors, helps plan, and guides choices.

Using the best accounting software for rental properties can save time and reduce stress. Owners with neat records can manage more properties with ease. They stay ready for bills, repairs, or rent issues anytime.

Owners who need help can trust Accounts Junction for support. We offer services in bookkeeping for rental properties and accounting for rental businesses. Our certified experts help owners track rent, costs, and reports with care.

With Accounts Junction, owners gain clear views and more control. We use the best accounting software for rental properties to make work easy. This helps smooth rent collection, better tenant handling, and smart decisions.

FAQs

1. Why is accounting for rental properties needed?

- It shows rent and cost clearly for smart choices. It helps owners plan for bills, rent, and repairs.

2. Can bookkeeping for rental properties stop errors?

- Yes, good logs cut mistakes in rent and costs. Clear logs also make money tracking fast and simple.

3. What is the best accounting software for rental properties?

- Cloud tools with easy steps make tracking very easy. It can track rent, cost, and deposits each month.

4. How often should rental accounts be checked?

- Check logs each month or at least once per quarter. This stops small mistakes from turning into big issues.

5. Does accounting help during audits?

- Yes, good logs make audits fast and very simple. Neat logs save time and reduce stress for owners.