5 Tips for Avoiding Production Accounting Disasters

Though production accounting may seem easy at first glance, it can quietly become complicated. A small mistake may slowly grow into delays, confusion, or unexpected costs. With careful attention, many of these issues may often be prevented before they escalate.

In this post, we explore five tips that can help teams reduce risks in production accounting. They do not promise perfection, yet they may guide projects toward smoother results and fewer surprises. Along the way, mini real-life examples will show how these tips may play out in practice.

Understanding Production Accounting

When projects involve money, labor, equipment, and materials, production accounting may already influence daily work. Essentially, it can be the process of tracking all financial inflows and outflows in a project.

If records are sloppy, mistakes may appear without warning. Overpayments, missed invoices, and incorrect budgets may slowly creep in. By keeping attention on details, teams may reduce these risks and maintain clarity.

For instance, a small film crew may start by recording only major equipment costs. Later, forgotten minor expenses may make the budget seem off. Tracking all costs from the start may prevent such surprises.

Key Tips for Avoiding Production Accounting Disasters

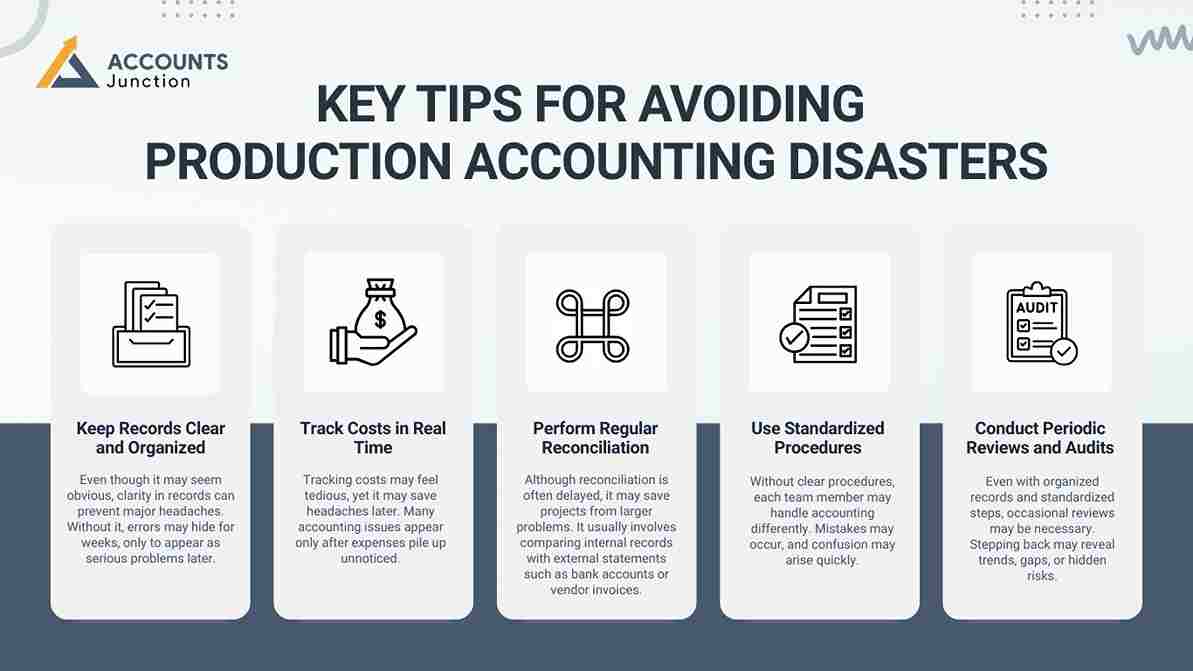

Tip 1: Keep Records Clear and Organized

Even though it may seem obvious, clarity in records can prevent major headaches. Without it, errors may hide for weeks, only to appear as serious problems later.

Why it may help:

- Mistakes may be noticed faster with clear records.

- Reporting may become easier and less stressful.

- Teams can understand the current financial state at a glance.

Steps to improve organization:

- Record each transaction consistently, avoiding skipped details.

- Keep all receipts, invoices, and reports in one place.

- Review entries often, instead of waiting until the end of the month.

Mini Scenario:

Imagine a small office where receipts lie in drawers. When the team makes a report, many small payments are lost. By labeling and filing each receipt right away, this confusion can be stopped.

Even small habits, like naming files or keeping the same format, can stop bigger problems later. Often, trouble starts with missed details.

Tip 2: Track Costs in Real Time

Tracking costs may feel tedious, yet it may save headaches later. Many accounting issues appear only after expenses pile up unnoticed.

Benefits of real-time tracking may include:

- Unusual spending may be spotted immediately.

- Project plans may be adjusted before budgets are exceeded.

- Reports may more accurately reflect the current situation.

Ways to track effectively:

- Log costs as they happen using simple spreadsheets or digital tools.

- Assign team members to monitor labor, materials, or equipment costs.

- Reconcile records weekly, instead of waiting for month-end.

Mini Scenario:

A small marketing shoot can spend too much on props without noticing. By writing down costs each day, the team can spot overspending early and cut back on extra items.

Keeping track of spending as it happens helps fix problems faster. Choices become clearer, and sudden surprises are less likely.

Tip 3: Perform Regular Reconciliation

Although reconciliation is often delayed, it may save projects from larger problems. It usually involves comparing internal records with external statements such as bank accounts or vendor invoices.

Why it may help:

- Small errors may be detected before they grow.

- Potential mismanagement or fraud may be noticed early.

- The financial picture may become more accurate and reliable.

Practical approaches:

- Reconcile records weekly or bi-weekly, depending on project size.

- Compare each expense with receipts or invoices promptly.

- Investigate and document discrepancies immediately.

Mini Scenario:

A production team may see a supplier charge the same item twice. Checking accounts each week lets the team fix this error before it grows into a bigger budget problem.

Even small mismatches may show larger issues. Staying consistent can stop small mistakes from turning into big ones.

Tip 4: Use Standardized Procedures

Without clear procedures, each team member may handle accounting differently. Mistakes may occur, and confusion may arise quickly.

Why it may matter:

- Promotes uniform handling of transactions across the project.

- Reduces ambiguity in reporting.

- Makes training new staff easier and quicker.

How to implement standards:

- Create step-by-step checklists for every accounting task.

- Share procedures with all staff involved in production accounting.

- Review and revise procedures periodically.

Mini Scenario:

A small studio may have two assistants enter costs in different ways. One logs labor each week, the other each day. Using the same method can stop mismatched totals and disputes.

Even if it feels strict, following clear steps can prevent mistakes. Teams may see smoother work and fewer arguments over numbers.

Tip 5: Conduct Periodic Reviews and Audits

Even with organized records and standardized steps, occasional reviews may be necessary. Stepping back may reveal trends, gaps, or hidden risks.

Why it may help:

- Possible problems may be identified early.

- Compliance with policies or rules may be ensured.

- Insights may be gained for future budgeting or planning.

How to implement:

- Schedule quarterly or semi-annual audits.

- Consider external reviews for added perspective.

- Invite team feedback about current procedures and reporting.

Mini Scenario:

A documentary team may find that some travel costs are missing from their reports. Checking accounts every three months lets the team fix these gaps before the next project.

Regular reviews act as a safety net, catching problems that daily checks might miss.

Extra Practices That May Help

Beyond the five core tips, some practices may strengthen production accounting further:

- Clear communication: Everyone should know their job. Teams should talk often to avoid mistakes. Sharing updates helps all stay on track.

- Training: Staff may need brief refreshers on tools and steps. Short guides or practice sessions can help staff stay sharp.

- Adaptability: Projects can change, so accounting may shift. Being ready to adjust plans keeps work smooth. Flexibility helps avoid delays.

- Documentation: Odd entries should be noted for later. Keeping clear notes makes it easier to check numbers. Records can help spot trends or errors.

- Technology: Automation can cut errors, but humans still check. Tools speed up work, but review keeps things safe. New software may help, but training is key.

By combining these practices with the main tips, production accounting may become smoother and more reliable.

Common Mistakes to Avoid

Even with careful planning, mistakes may occur. Some frequent pitfalls may include:

- Relying on Memory

Counting only on memory instead of writing things down. This can cause missed or wrong entries. - Ignoring Small Errors

Letting small mistakes grow without fixing them. Minor gaps can turn into bigger problems. - Overcomplicating Tasks

Making simple steps more complex than needed. This slows work and can cause confusion. - Delaying Reconciliation

Waiting until the month-end to check records. Frequent checks help catch errors early. - Neglecting Training

Not giving clear guidance or instructions. Team members may make avoidable mistakes without help.

Common Challenges in Production Accounting

- Hidden Fees

Equipment rentals, labor, or outside services may have extra charges. - Shared Resources

Using tools or materials for many projects can make costs hard to track. - Travel & Shipping

Last-minute trips, shipping delays, or fuel changes can raise expenses. - Emergency Costs

Repairs, replacements, or urgent orders can add sudden costs. - Price Changes

Material or service costs can shift fast, needing budget updates.

How Technology Affects Production Accounting

1. Automation Benefits

- Faster Calculations

Software adds costs and keeps records in order.

It can handle large data fast, saving time. - Collaboration

Cloud tools let many users update records at once.

Teams can work from any location without delays. - Integration

Linking project and accounting software cuts repeated entries.

It also keeps data the same across all reports.

2. Need for Human Oversight

- Error Checking

Software can put costs in the wrong place.

Regular checks catch mistakes before they affect budgets. - Critical Review

Humans can spot odd transactions that software misses.

They can also check that costs match project goals.

3. Analytics and Insights

- Spending Trends

Software shows unusual cost patterns.

This helps managers see where money may be wasted. - Forecasting

Tools suggest future trends, but humans decide.

Managers can plan budgets more accurately with this view. - Visuals

Charts make financial trends easy to see.

Graphs show key data, making reports clear and simple.

Understanding Cost Types

1. Direct vs Indirect Costs

- Direct Costs: Labor, materials, or tools used for the project.

These costs can be directly traced to a specific task. - Indirect Costs: Utilities, admin support, insurance, and overhead.

They support the project but are not tied to one task. - Hidden Costs: Small fees can add up and affect the budget.

They often appear in minor services or extra charges.

2. Fixed vs Variable Costs

- Fixed Costs: Salaries, rent, or regular payments.

They stay the same, no matter the project size. - Variable Costs: Overtime, material use, or supplies.

These rise or fall with the level of work. - Unexpected Changes: Price or labor shifts may require budget updates.

Always monitor for sudden spikes to avoid overspending.

3. Misclassification Risks

- Wrong Allocation: Shared tools or equipment labeled as project-only can raise costs.

This can make some projects look more expensive than they are. - Check History: Reviewing past records helps stop repeat errors.

Proper tracking prevents mistakes from becoming patterns.

Being aware of these pitfalls may help teams prevent them proactively.

Production accounting may seem slow, but it shapes project results. At Accounts Junction, we offer services that keep records clear, track costs in real time, check accounts often, follow set steps, and review work regularly to cut many risks. Mistakes can still happen, but our certified experts make sure all processes are correct and finances are clear. This approach leads to smooth work, clear budgets, and more confidence in financial choices. Partner with us for reliable production accounting.

FAQs

1. What is production accounting?

- It is the process of tracking all costs, income, and resources in a project.

2. Why is it important?

- It helps teams avoid overspending and know project finances.

3. Can mistakes be costly?

- Yes, even small errors can grow into bigger money problems.

4. How often should records be updated?

- Updating daily or weekly keeps records clear and correct.

5. Should costs be tracked in real time?

- Yes, tracking in real time shows problems early.

6. What is reconciliation?

- It is checking your records against outside statements for accuracy.

7. How often should reconciliation happen?

- Checking weekly or every two weeks can stop big mistakes.

8. Are standardized procedures necessary?

- Yes, they cut errors and keep reporting consistently.

9. Should audits be internal or external?

- Both help; outside audits give extra confidence.

10. Can technology replace human checks?

- Automation helps, but humans are still needed to check details.

11. What happens if records are messy?

- Messy records cause errors, confusion, and missed costs.

12. How can small teams manage accounting?

- Use clear steps, simple tools, and check records often.

13. Can training improve accuracy?

- Yes, training helps staff follow the correct steps.

14. How to handle discrepancies?

- Check and write down differences quickly to avoid bigger issues.

15. Is communication important?

- Clear talk reduces mistakes and confusion.

16. Can real-time tracking save money?

- Yes, it shows problems early and stops overspending.

17. How to simplify complex accounting?

- Use standard steps, clear records, and easy tools.

18. Are quarterly reviews enough?

- It depends; some projects need more or fewer checks.

19. How to prevent fraud?

- Check often, do audits, and follow clear rules.

20. What is the biggest risk in production accounting?

- Inconsistent records and poor checks can cause big problems.