5 Advantages and Benefits of Receivable Management

Irrespective of the size of the business, one of the important aspects for any business is proper management of accounts receivable. When we consider accounts receivable, it is simply the amount of payments the company is supposed to receive for the sale of goods or services. A proper accounts receivable process will ensure a steady cash flow in the business. Inappropriate accounts receivable processes can have several negative impacts on business finances. So, there are several Benefits Of Receivable Management for every business. Every organization must focus on bringing efficiency in the accounts receivable process to achieve financial stability.

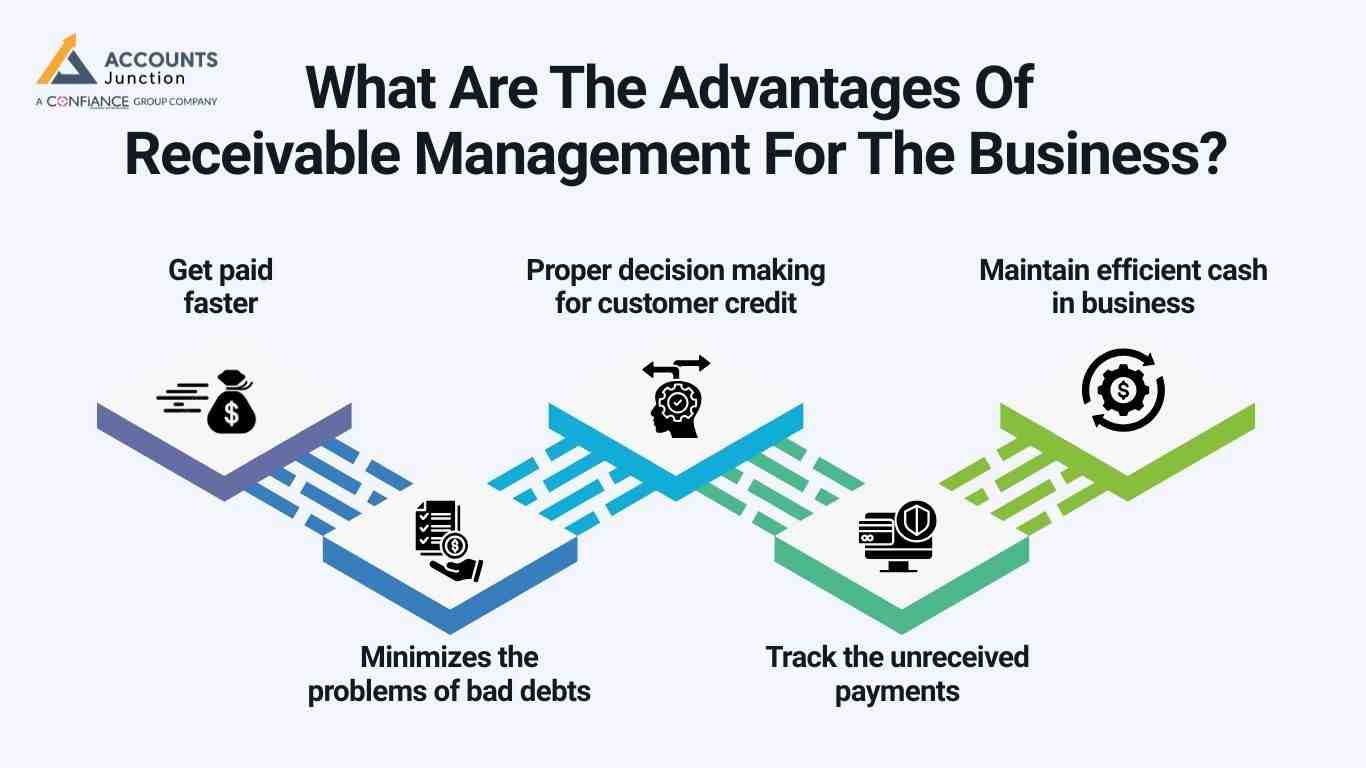

What Are The Advantages Of Receivable Management For The Business?

A proper receivable management can help the businesses to achieve better stability in their organization.

Here are some of the important Benefits Of Receivable Management:

1. Get paid faster

- One of the primary Advantages Of Receivable Management is getting the payments faster. Invoicing is one of the primary aspects for getting paid from clients or any vendors. If the invoice is created wrongly then it will be again sent back for the correction which can further delay the payments. So, make appropriate invoices for proper payments.

2. Minimizes the problems of bad debts

- Bad debts are problematic for any business that further ruins the finances of the organization. When the accounts receivables are not managed properly, it causes unnecessary burden on the finances of business, leading to bad debts. A proper processing of the accounts receivables can minimize the bad debts issues considerably.

3. Proper decision making for customer credit

- A proper accounts receivables helps the businesses to track the customers who have good history of repayments. This helps the organization to sort the customers as per the history of their repayments. It makes it easier for the businesses to make the decision of extending the customer credit accordingly.

4. Track the unreceived payments

- The most important aspect of receivable management is tracking the unreceived payments. All the unreceived payments from the clients can be tracked easily and it can be easier to initiate the collection procedure. It will ensure that the records of all the unreceived payments are done and a proper payment of the payments is done. The key information provided here is the effective way to track the expected payments from the clients.

5. Maintain efficient cash in business

- Every business desires to have an efficient cash which can help them to allocate proper resources to the further projects. It can also help to use these funds during uneven circumstances properly. An efficient cash can be very effective in analyzing the capabilities of the business to improve their performance nicely.

Why Timely Invoicing and Payment Terms Are Important

A key part of receivable management is sending invoices on time and setting clear payment rules. Quick invoicing helps get money fast. It also shows clients that your business is organized and professional. Let clients know from the start when invoices go out, how they can pay, and the due date. Clear rules help avoid confusion and delays.

Tips for Good Invoicing:

- Add all details such as due date, late fees, and early payment discounts. This keeps clients aware of all terms.

- Show any penalties for late payment to get the money on time. Penalties also encourage faster responses.

- Use online invoicing tools to send reminders and track payments. These tools make follow-ups easy and reduce missed payments.

Use Automation in Receivable Management

Automation is a key part of receivable management, as it saves time and cuts errors. It can send invoices, remind clients, and make reports fast. Automation helps businesses track payments without extra effort. This lets you focus on running your business while the money owed is tracked correctly. Automated systems also reduce stress for staff handling accounts.

Benefits of Automation

-

Faster Invoices

One of the main benefits of receivable management is sending invoices as soon as work is done. Quick sending means quicker payments.

-

Fewer Errors

Another benefit of receivable management is fewer mistakes. Machines do the work right, reducing errors. This keeps clients clear and satisfied.

-

Better Cash Flow

Automated reminders help clients pay on time. This keeps cash flowing and bills paid.

Tools like QuickBooks, Xero, or Zoho Books can handle these tasks for small and large businesses. They make invoicing simple and keep records neat.

The Role of Collection Procedures

Check if clients can pay before giving credit. This is part of smart receivable management and lowers the chance of unpaid bills. Credit checks also help set fair payment terms for each client.

Steps to Reduce Risk

-

Set Credit Rules

Decide who can get credit and the payment time (e.g., 30 or 60 days). Rules help prevent losses.

-

Check Credit Scores

Use agencies to see if clients can pay. This shows if a client is safe to trust.

-

Watch Clients

Check clients’ finances, especially big accounts. Ongoing checks reduce the risk of surprise defaults.

Strong credit rules protect your business from losses. They give confidence that the money owed will be collected.

The Role of Collection Procedures

Have a plan if clients do not pay. A clear process keeps payments coming without harming relationships. Following a set plan also saves time and avoids repeated confusion.

Steps for Collections

-

First Reminder

Send a friendly note after the due date. Keep the tone polite and professional.

-

Second Reminder

Send a formal note if still unpaid, noting late fees. This shows seriousness while keeping relations intact.

-

Final Notice

Send a last warning about consequences, like legal action. Clear communication may encourage payment.

-

Use Agencies

If needed, hire a collection agency. This can recover funds that are hard to get internally.

These are some of the important Benefits Of Receivable Management for the businesses. An efficient system is very essential to ensure that it is done more effectively. Although there are many Advantages Of Receivable Management and you do not have expert in-house staff to handle it, then you can outsource it. This can help you get a quality level of service.

Accounts Junction provides outsourced receivable management services for the businesses. They have a team of experts who have proper mechanisms to manage the accounts receivable efficiently. They have proper accounting software that can automate many accounts receivable tasks. Accounts Junction is a well-known accounting services providing agency across the globe.

FAQs

1. What is receivable management in business?

- It is how a business keeps track of money that clients owe. Good handling of payments keeps cash moving. It also helps the business plan spending and reach money goals.

2. Why is managing client payments important?

- It helps a business get money on time, avoid losses, and keep cash ready for daily use. It also builds trust with clients and stops mix-ups over unpaid bills.

3. How can proper payment tracking reduce bad debts?

- By keeping simple records and checking unpaid bills, a business can stop debts from growing. It also shows which clients need more attention.

4. What are the main benefits of receivable management?

- It brings faster payments, fewer mistakes, better credit checks, and clear money records. These benefits help the business grow and plan new work.

5. How does payment tracking help in giving credit to clients?

- It shows which clients pay on time, helping a business know who can get credit safely. It also lowers the risk of lending to clients who may pay late.

6. Why is timely invoicing important for a business?

- Sending invoices fast brings quicker payments and shows the business is well-organized. It also stops delays that can break cash flow and daily work.

7. What payment terms should businesses set for clients?

- Terms should include due dates, late fees, and early payment discounts to guide clients. Clear rules also help fix disputes over money easily.

8. How can automation improve invoice work?

- Automation sends invoices and reminders fast, cuts mistakes, and saves staff time. It also lets staff focus on more important tasks.

9. Which tools can help track client payments?

- Tools like QuickBooks, Xero, or Zoho Books track payments and keep records neat. They also make reports to show trends and unpaid bills.

10. Why are collection steps important?

- They make sure late bills are handled on time without hurting client ties. A clear plan also cuts stress for staff who handle money.

11. How can businesses track unpaid invoices well?

- Keep simple records and use reminders so no payment is missed. Regular checks also show clients who pay late often.

12. What are the steps for handling late payments?

- Send a friendly note first, a firm note next, a last warning, and hire agencies if needed. Following steps keeps the process fair and clear.

13. How do credit checks lower the risk of lost money?

- They show if clients can pay on time, cutting the chance of lost money. Checks also help set safe limits for each client.

14. How does checking payments affect cash flow?

- It keeps money coming in, helping the business run and pay bills. It also helps plan for growth or sudden needs.

15. Can automation cut errors in invoicing?

- Yes, it cuts mistakes, keeps invoices correct, and keeps clients happy. It also speeds up tracking and reporting for the business.

16. Why should businesses set credit rules for clients?

- Rules say who can get credit and how long to pay, cutting losses. Clear rules also make disputes easier to handle.

17. How often should businesses check client payments?

- Regular checks, especially for big clients, help spot delays fast. Frequent checks also stop small problems from getting worse.

18. Can tracking invoices improve business work?

- Yes, it keeps money moving, lowers debt risks, and helps make smart choices. It also gives data to plan for growth and new work.

19. What penalties make clients pay on time?

- Late fees or small charges push clients to pay on time and stop overdue bills. They also remind clients to follow payment rules.

20. How do tools make payment tracking easier?

- They send reminders, keep records, and cut manual work and mistakes. Tools also make it easy to see past payments for planning.