05 Smooth Receivables Management Tips

Although your company is having a nice business with better sales, it sometimes appears that there are some financial issues. Here, the company mostly experiences cash flow issues that tend to disrupt the smooth flow of the company's workflow. This is mainly due to inefficient management of the collections your company is supposed to receive. In business terms, it is specifically known as receivable management. They come under the accounts receivable, which are the amount a company owes from its customers for the products or services provided. In this blog, we will provide you with 5 receivables management tips to help you deal with receivables efficiently.

Poor handling of receivables is a common issue that hurts cash flow. To fix this, a good Receivables Management Solution is key. So, what can you do to improve it?

If you want better results, try using a few simple Receivables Management Tips in your business.

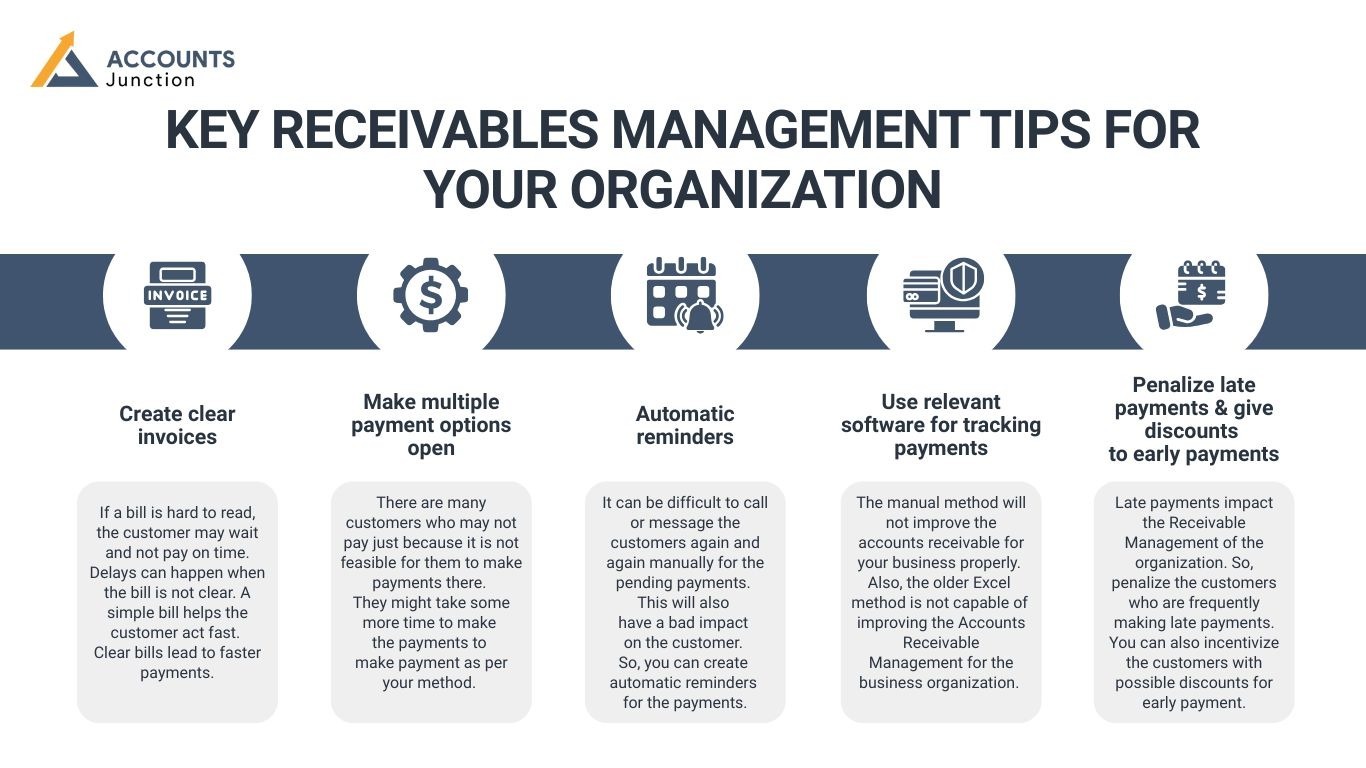

Key Receivables Management Tips for your organization

Use easy receivables management solutions to send bills, track dues, and fix errors. Merge receivables management tips with the best receivables management solutions for smooth payment handling.

1. Create clear invoices

- If a bill is hard to read, the customer may wait and not pay on time. Delays can happen when the bill is not clear. A simple bill helps the customer act fast. Clear bills lead to faster payments.

2. Make multiple payment options open

- There are many customers who may not pay just because it is not feasible for them to make payments there. They might take some more time to make the payments to make payment as per your method. So, one of the nice Receivables Management Solutions is to make multiple payment methods available to make it easier and faster. Online payments, cash, cheque, UPI, MasterCard, etc., are some of the different payment methods.

3. Automatic reminders

- It can be difficult to call or message the customers again and again manually for the pending payments. This will also have a bad impact on the customer. So, you can create automatic reminders for the payments. Accordingly, you can set automatic reminder emails, messages, etc.

4. Use relevant software for tracking payments

- The manual method will not improve the accounts receivable for your business properly. Also, the older Excel method is not capable of improving the Accounts Receivable Management for the business organization. So, using relevant software will be a great way to achieve it, and cloud-based software will be an excellent option.

5. Penalize late payments & give discounts to early payments

- Late payments impact the Receivable Management of the organization. So, penalize the customers who are frequently making late payments. You can also incentivize the customers with possible discounts for early payment. This can help improve the receivables greatly.

These are 5 smooth Accounts Receivable Management tips that can be influential in improving accounts receivable. If you find it difficult to find resources or do for yourself in managing the receivables of your business, then you can outsource it to the experts.

Accounts Junction provides outsourced Receivables Management Solutions for businesses around the world. Their team has the skills to handle the receivables of businesses of different categories. They have accounting software, though they can improve accounts receivable nicely. These receivables management tips and can help your team stay on track.

Common Challenges in Receivables Management

Even with good systems, businesses still face problems. Knowing these issues helps you act fast.

- Late payments: Customers miss deadlines, hurting cash flow.

- Bad communication: Customers don’t know what they owe if you don’t stay clear.

- Disputes over bills: Customers argue about amounts, which slows payments.

- No follow-ups: Without reminders, customers forget to pay.

- Few payment choices: Not offering enough ways to pay can slow down payments.

- Not tracking overdue bills: If overdue bills are missed, cash flow drops.

- Unclear terms: If payment rules are not clear, customers may delay payments.

- Too many accounts: Small businesses can miss payments if there are too many clients.

- Slow internal processes: Delays in your business can cause issues with invoicing or payments.

To fix these issues, use clear rules and above mentioned receivables management tips. Keep communication clear, offer payment choices, and follow up often to keep payments on track.

How Receivables Management Affects Customer Experience

Good receivables management helps both your business and your customers. It keeps things clear, fast, and easy for everyone.

Positive Customer Impacts:

- Clear bills help avoid confusion.

Customers know what they owe and when it’s due, so they can pay faster. - Friendly communication builds trust.

Being polite and clear with customers shows you care and helps build a strong bond. - Different payment options make it easier.

Offering options like credit cards or payment plans lets customers pay the way that’s best for them. - Easy payment tools save time.

Simple payment options make it quicker and easier for customers to pay. - Gentle reminders help keep payments on time.

Friendly reminders help customers stay on track without feeling pressured.

With the right system, receivables management does more than get you paid. It helps keep customers happy and coming back, which leads to better cash flow and a strong business.

Why Small Businesses Must Focus on Receivables

Small businesses feel the hit of late payments more than big ones. They don’t have large cash buffers, so getting paid on time is key.

Why it matters:

- Every payment helps keep the cash flowing.

- Unpaid bills can hurt fast.

- Small teams must work smart.

- Late payments can delay growth and plans.

- Poor receivables management adds stress to daily tasks.

- Uncollected funds may mean less money for other needs.

Proper receivables management can help businesses stay on track and avoid cash shortfalls. By following the above mentioned receivables management tips, you can set clear payment rules and track bills. Small businesses can collect money faster and boost cash flow. At Accounts Junction, we help businesses keep cash flowing and support business growth with receivables management services. We have helped companies get paid faster and avoid delays for their receivables. Contact us now to take care of your payments.

FAQs

Q1: Why is receivables management important?

- Even if your business is doing okay, money may not come in on time. Managing receivables can help cash flow stay smooth and may reduce stress.

Q2: How does automation help?

- Automation can send reminders and invoices faster. It may also reduce mistakes and give your team time for other work.

Q3: What is an aging report?

- An aging report can show which bills are late and which are new. It may help you know what to collect first.

Q4: Can clear invoices make a difference?

- Yes. Clear invoices can prevent confusion. Customers may pay faster when they see exactly what they owe.

Q5: Why offer many payment options?

- Some people like cards, some cash, some online payments. Giving choices may help them pay faster and easier.

Q6: How do automatic reminders work without annoying customers?

- Reminders can be gentle. They may help customers remember to pay without feeling pressured.

Q7: Is manual tracking enough?

- It may work for a short time, but errors can happen. Software can make tracking easier and faster.

Q8: What features should I look for in receivables software?

- Cloud access can let your team work anywhere. Overdue tracking may show late bills. Automatic reminders can save time. Simple reports may help you see trends.

Q9: Should I penalize late payments?

- Small penalties can encourage faster payments. They may keep cash flow steady, but may also upset some customers if not done carefully.

Q10: Are discounts for early payments useful?

- Yes. Discounts can make customers pay sooner. It may help cash come faster, but it may not work for everyone.

Q11: How does good receivables management help customers?

- Clear bills, easy payment methods, and gentle reminders may make it simple for customers. They may feel valued and pay on time.

Q12: Can outsourcing receivables management help?

- It can. Experts may handle collections better, while you focus on other work. Results may vary by business.

Q13: What challenges do small businesses face?

- Late payments, unclear bills, too many clients, and small teams may cause problems. Knowing this may help you plan better.

Q14: How often should I follow up on unpaid bills?

- Regular follow-ups may work best. Weekly checks or reminders after due dates can help, though timing may differ by business.

Q15: Can good receivables management boost cash flow?

- Yes. Collecting money faster may keep operations smooth and reduce stress, though results can vary.

Q16: Are payment plans helpful?

- For bigger bills, they may let customers pay in parts. This can reduce delays, though not all may follow through.

Q17: What happens if invoices are unclear?

- Confusion may happen. Payments may be delayed. Clear invoices may prevent these problems.

Q18: Can software integration improve efficiency?

- Yes. Linking billing, accounts, and customer records may make tracking faster. It can also reduce duplicate work.

Q19: How do late payments affect small businesses?

- They may slow work, increase stress, and delay plans. Even small delays can ripple through the business.

Q20: Is regular reporting necessary?

- Reports may show trends and highlight overdue bills. They can help make better decisions, though skipping them may hide issues.