Why the Importance of Retail Bookkeeping Matters in Business Operations

Understanding the importance of retail bookkeeping helps business owners track money and plan well. It records sales, costs, and stock clearly every single day. Without proper bookkeeping, mistakes happen, and money can be wasted. Good bookkeeping helps with taxes, cash flow, and smart choices.

Accurate records show profits and losses for every month. It supports growth, keeps suppliers happy, and helps smooth operations. Recognizing the importance of retail bookkeeping is key to running the business successfully.

What is Retail Bookkeeping?

Bookkeeping for retail businesses records all money coming in and out daily. It includes sales, purchases, payments, and business-related expenses every day.

Why It is Important

- The importance of retail bookkeeping lies in keeping records clear, accurate, and easy to read.

- It allows owners to make smarter choices about business money.

Difference from Regular Bookkeeping

- Retail bookkeeping focuses on stock, sales, and supplier payments.

- It handles returns, seasonal sales, and retail-specific business issues.

Main Parts of Retail Bookkeeping

Sales Tracking

- Record all daily sales, including cash and online orders.

- It shows which products sell best and earn the most.

Expense Tracking

- Track all costs, including rent, wages, and utility bills.

- It helps owners spend money wisely and avoid unnecessary expenses.

Stock Control

- Keep product counts accurate for all items in stock.

- It prevents running out of popular items or overstocking inventory.

Money Owed

- Record what customers owe and what is owed by suppliers.

- Pay suppliers on time to avoid penalties and late fees.

Taxes

- Keep records needed for all taxes and local rules.

- This helps calculate taxes correctly and avoid fines or penalties.

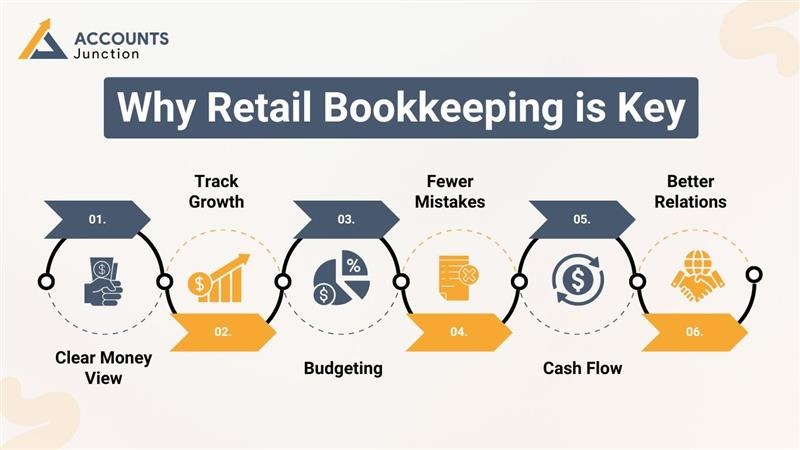

Why Retail Bookkeeping is Key

Clear Money View

- Proper bookkeeping for retail businesses shows income, expenses, and profits for each month clearly.

- Helps owners make quick, smart, and informed business decisions daily.

Track Growth

- Shows which products bring the most profits every single month.

- Helps plan growth and add new products carefully, showing the importance of retail bookkeeping in strategic decisions.

Budgeting

- Helps plan spending on staff, stock, and marketing smartly, which highlights the importance of retail bookkeeping in budgeting.

- Keeps costs under control and money available for business needs.

Fewer Mistakes

- With proper bookkeeping for a retail business, records remain correct and organized every single day.

- Reduces errors and protects business from fraud or financial loss.

Cash Flow

- Tracks money coming in and going out each day.

- Ensures enough cash is available for daily operations and emergencies.

Better Relations

- Pay suppliers on time and refund customers quickly every time.

- Builds trust and keeps business operations smooth without any delays.

How to Keep Good Records

- Daily Records

Write down all sales, purchases, and payments each day. This helps track money and avoid mistakes.

- Use Software

Use tools like QuickBooks or Tally for bookkeeping. They save time and make records easy to read.

- Check Stock Often

Count stock after each sale or new delivery. This stops shortages or extra stock from piling up.

- Check Bank Records

Match bank statements with your books each month. This finds errors or fraud early.

- Review Reports

Look at profit, loss, and cash flow reports each month. It helps plan growth and make smart choices.

- Hire Experts

Accountants keep records right and follow rules. They can also give tips to save money.

Challenges in Retail Bookkeeping

Many Transactions

- Retail stores have many small sales each single day.

- Recording all manually can lead to mistakes or missing data.

Stock Issues

- Losing track of stock can cause big financial losses fast.

- Regular checks are needed to maintain correct and updated records.

Human Error

- Manual bookkeeping can cause mistakes or miss some transactions.

- Software helps reduce errors and saves time for business owners.

Hard Reports

- Financial reports can be hard to read and understand.

- Accountant support or training helps owners review data and trends.

Tax Rules

- Tax laws change often, making proper filing complex and tricky.

- Good bookkeeping ensures taxes are correct and filed on time.

Benefits of Bookkeeping

Correct Records

- All income and expenses are tracked clearly and systematically daily.

- It provides data for smart business decisions without any guesswork.

Smart Decisions

- Helps owners set prices and plan business growth efficiently.

- Improves overall profits and ensures smooth business operations daily.

Plan Ahead

- Supports budgeting and forecasting, emphasizing the importance of retail bookkeeping for smooth operations during high and low sales.

- Prepares the business to handle slow months without financial trouble.

Less Stress

- Organized bookkeeping for retail business reduces worries about mistakes and missing money.

- Helps manage operations easily during audits, taxes, or business reviews.

Audit Ready

- Accurate bookkeeping keeps a business prepared for audits anytime, quickly.

- Allows verification of all transactions without wasting time or effort.

Business Trust

- Shows professionalism to banks, suppliers, and investors clearly always.

- Builds trust and opens opportunities for growth and partnerships easily.

Tips for Good Bookkeeping

- Record all sales and payments daily to keep accurate books.

- Use separate accounts for personal and business money management.

- Review reports weekly or monthly to spot errors quickly.

- Use software to save time and reduce mistakes efficiently.

- Train staff to record transactions correctly every single time.

- Hire accountants for taxes or complex transactions whenever needed.

Common Mistakes in Retail Bookkeeping

Mixing Personal and Business Funds

- Using personal accounts for business money causes mix-ups.

- Makes it hard to track income and costs.

Ignoring Small Transactions

- Skipping small cash sales or petty costs leaves gaps.

- Record all transactions to keep the books correct.

Delayed Record Updates

- Waiting days or weeks to update books causes errors.

- Update daily to keep information correct.

Relying Only on Manual Methods

- Writing in books or spreadsheets leads to mistakes.

- Software can cut errors and save time.

Role of Technology in Retail Bookkeeping

Point of Sale (POS) Systems

- POS helps automate bookkeeping for retail businesses by tracking sales, returns, and payments quickly.

- Cuts errors and gives reports quickly.

Cloud Accounting Tools

- Why Use Cloud Tools

- Cloud tools store data online so owners can access it anytime.

- Multiple users can work together at the same time.

- It helps teams share information fast and avoid mistakes.

Auto Work for Repeated Tasks

- Auto calculations for taxes, invoices, and reports save time.

- It reduces errors and speeds up daily bookkeeping work.

- Owners can focus more on sales and business growth.

How Retail Bookkeeping Helps in Decision Making

Stock Planning

- Shows which items sell fast and slow, highlighting the importance of retail bookkeeping in stock planning.

- Helps decide what to restock or remove.

Pricing Strategies

- Tracks profit on each product.

- Helps set prices to stay competitive.

Marketing Investments

- Shows how much to spend on ads.

- Helps pick campaigns that work best, showing how bookkeeping for retail business informs marketing decisions.

Outsourcing Bookkeeping for Retail

Why Outsource

- Outsourcing saves owners time so they can grow sales fast.

- It reduces errors and keeps all records correct and clear.

- Owners can plan well and make smart business choices.

What to Expect from Professionals

- Pros give reports, help with taxes, and check for mistakes.

- They guide choices based on simple and clear numbers.

- Advice helps boost profits, keep cash steady, and grow business.

Cost-Effectiveness

- Hiring professionals for bookkeeping for retail businesses can be more cost-effective than hiring a full staff.

- Cuts the risk of fines and bookkeeping mistakes.

Key Performance Indicators (KPIs) for Retail Bookkeeping

Key Performance Indicators (KPIs) for Retail Bookkeeping

- Daily Sales Reports

- Shows total sales, returns, and cash.

- Helps track store performance fast.

- Gives a clear view of daily trends and shifts.

- Inventory Turnover

- Shows how fast items sell each month.

- Helps plan restock and avoid extra stock.

- High turnover means products move quickly.

- Expense Ratio

- Compares costs to revenue.

- Helps control spending and boost profit.

- Lower ratios show costs are well managed.

- Outstanding Payments

- Tracks money owed by clients or to vendors.

- Ensures timely collection and payments.

- Reduces risk of late fees or bad debt.

Bookkeeping for retail businesses is key to running a business well. It shows money, stock, and profits clearly every month. Clear records help owners make smart choices and grow their business.

Accounts Junction provides professional bookkeeping for retail businesses, serving small and large businesses efficiently. Our certified team tracks accounts, checks money, and keeps records exactly. Our work saves time, lowers errors, and makes business smooth. Partner with us to keep your business clear, organized, and ready to grow.

FAQs

1. What is retail bookkeeping?

- It tracks all money coming in and going out.

2. Why is retail bookkeeping important?

- It helps track money, stock, and costs each day.

3. Can I do retail bookkeeping myself?

- Yes, software can help you keep books correct.

4. How often should I update records?

- Update records each day to keep books correct.

5. Does bookkeeping help with tax filing?

- Yes, it makes paying taxes simple and correct.

6. What software helps with retail bookkeeping?

- QuickBooks, Tally, and Zoho Books help track money.

7. Can bookkeeping improve business growth?

- Yes, it shows profits and guides smart choices.

8. What records should I keep daily?

- Track sales, purchases, payments, costs, and stock daily.

9. How can bookkeeping reduce mistakes?

- Daily records stop errors, missing money, or lost cash.

10. How does bookkeeping help cash flow?

- It shows money coming in and going out.

11. Can bookkeeping improve supplier relations?

- Yes, paying suppliers on time always builds trust.

12. Is training staff important for bookkeeping?

- Yes, staff must learn to keep records correct.

13. How do I track inventory accurately?

- Check stock after each sale or new purchase.

14. Can bookkeeping help during audits?

- Yes, clear books make audits simple and fast.

15. What is accounts receivable in retail bookkeeping?

- It shows the money that customers still owe your business.

16. What are accounts payable in retail bookkeeping?

- It shows the money your business owes to suppliers.

17. How do software tools help bookkeeping?

- They help track sales and show reports fast.

18. Can bookkeeping prevent tax errors?

- Yes, clear books make tax filing correct each time.

19. Can bookkeeping prevent fraud in business?

- Yes, daily records stop mistakes and wrong money use.