What is the function of tax accounting?

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

Fulfilling the compliance

Tax accountants ensure compliance with tax laws and regulations, helping clients avoid penalties and legal issues associated with non-compliance.

Record keeping of the financial transactions

Proper record-keeping is essential for tax purposes. Tax accountants help clients maintain organized financial records to support their tax returns and defend against potential audits.

Tax return filing

Preparing accurate and timely tax returns is a fundamental function in tax accounting. Tax accountants use their knowledge of tax laws to complete and file tax returns for individuals and businesses.

Getting tax credits and incentives

Identifying and claiming applicable tax credits and incentives is a crucial aspect of tax accounting. This can help clients reduce their tax liability and improve overall financial performance.

Audit Support

In the event of a tax audit, tax accountants play a vital role in supporting clients by providing documentation. They explain the items reported on their tax returns in the proper way.

Ensure international tax compliance

For businesses operating internationally, tax accountants help navigate complex international tax laws, ensuring compliance with regulations.

Get proper advisory services

Tax accountants offer strategic advice on financial decisions to minimize tax implications. This may include guidance on choosing tax-efficient investment strategies and planning for major financial events.

These are some of the important functions of the tax accounting services. These tools aid businesses in navigating the intricate and ever-changing realm of tax regulations, reducing tax liabilities, and guaranteeing adherence to relevant laws.

If you are looking for expert tax accounting to handle all the tax-related aspects then Accounts Junction is the ultimate choice. Accounts Junction is a prominent tax accounting services providing agency.

Being an expert tax accounting services providing firm, we have qualified professionals to handle all the related aspects. Our experts have an in-depth knowledge of the taxation guidelines and can help you comply with same.

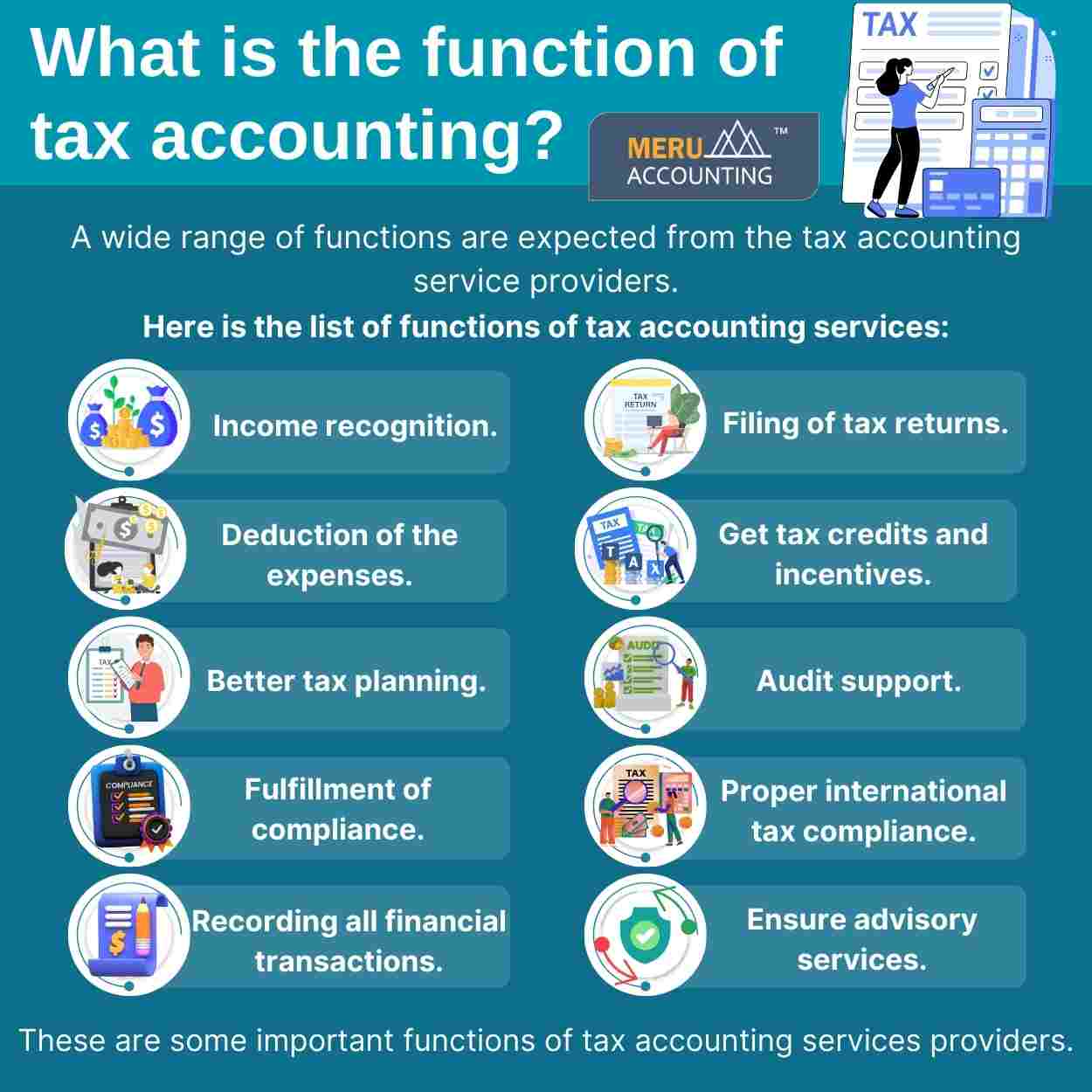

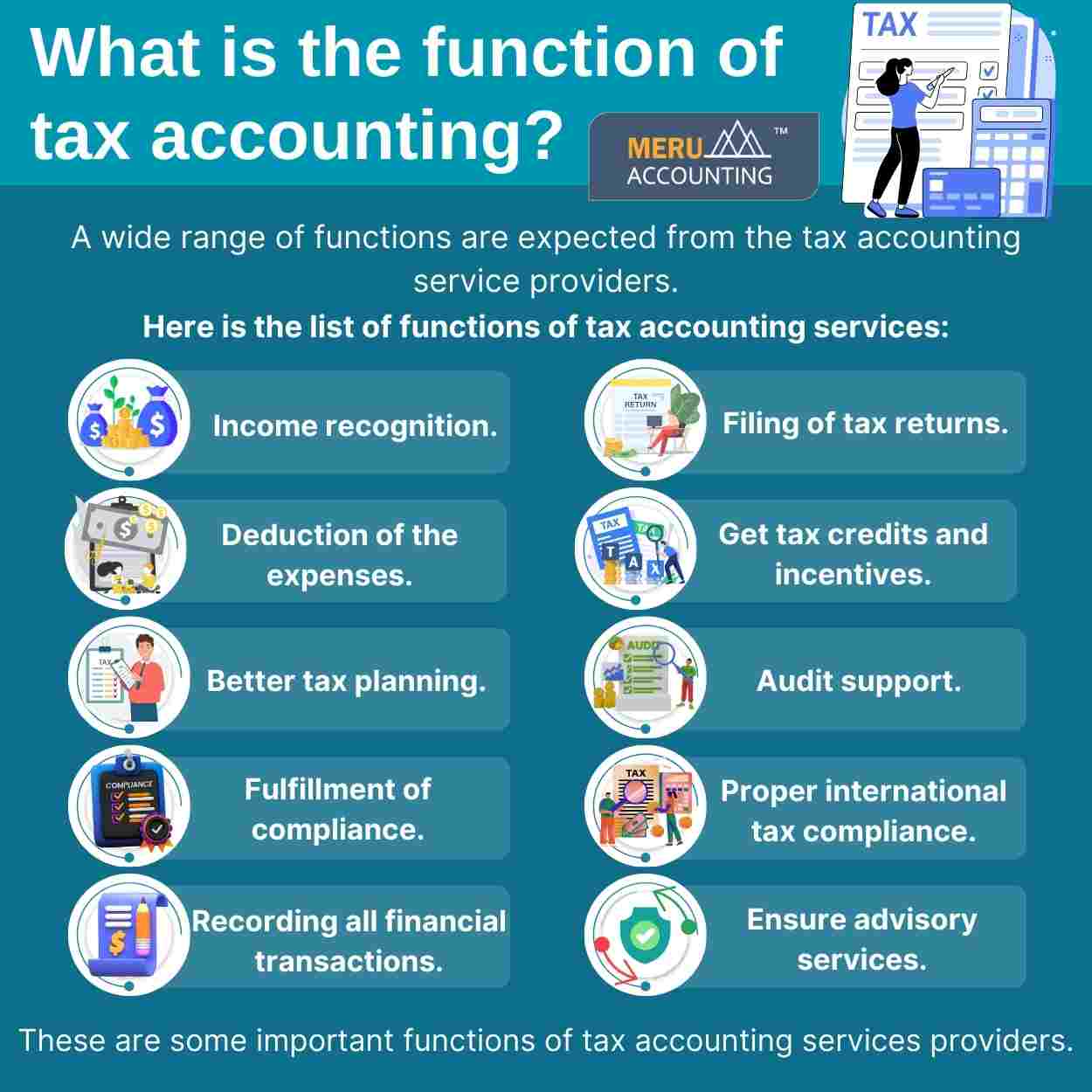

A proper filing of taxes is one of the primary aspects of every business. This has given a lot of prominence to tax accounting in the business world. It helps to relieve the business organizations from all the hassles related to taxation. The primary aspects of tax accounting services are to do proper tax filing, follow tax guidelines, and maximize possible tax returns. There are a lot of guidelines related to taxation which can be understood only by experts in their respective fields. If you experience hassles while tax filing and want experts to work on it, you must know the functions included in tax accounting. It will help you to get the right resources for it.

What are the main functions of tax accounting services?

While filing taxes there is a need to consider different aspects related to the taxes as per the guidelines.

Here are some of the important functions included in tax accounting:

Income recognition

Tax accountants ensure accurate recognition of income in accordance with tax laws. They help individuals and businesses to report their earnings correctly.

Deductions of the expenses

Identifying and maximizing allowable deductions is a key function. Tax accountants help clients identify and claim legitimate business expenses to reduce taxable income.

Proper tax planning

Tax accountants engage in proactive tax planning to help individuals and businesses minimize their tax liabilities legally. This may involve strategic decisions on investments, expenses, and timing of transactions.

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

Fulfilling the compliance

Tax accountants ensure compliance with tax laws and regulations, helping clients avoid penalties and legal issues associated with non-compliance.

Record keeping of the financial transactions

Proper record-keeping is essential for tax purposes. Tax accountants help clients maintain organized financial records to support their tax returns and defend against potential audits.

Tax return filing

Preparing accurate and timely tax returns is a fundamental function in tax accounting. Tax accountants use their knowledge of tax laws to complete and file tax returns for individuals and businesses.

Getting tax credits and incentives

Identifying and claiming applicable tax credits and incentives is a crucial aspect of tax accounting. This can help clients reduce their tax liability and improve overall financial performance.

Audit Support

In the event of a tax audit, tax accountants play a vital role in supporting clients by providing documentation. They explain the items reported on their tax returns in the proper way.

Ensure international tax compliance

For businesses operating internationally, tax accountants help navigate complex international tax laws, ensuring compliance with regulations.

Get proper advisory services

Tax accountants offer strategic advice on financial decisions to minimize tax implications. This may include guidance on choosing tax-efficient investment strategies and planning for major financial events.

These are some of the important functions of the tax accounting services. These tools aid businesses in navigating the intricate and ever-changing realm of tax regulations, reducing tax liabilities, and guaranteeing adherence to relevant laws.

If you are looking for expert tax accounting to handle all the tax-related aspects then Accounts Junction is the ultimate choice. Accounts Junction is a prominent tax accounting services providing agency.

Being an expert tax accounting services providing firm, we have qualified professionals to handle all the related aspects. Our experts have an in-depth knowledge of the taxation guidelines and can help you comply with same.