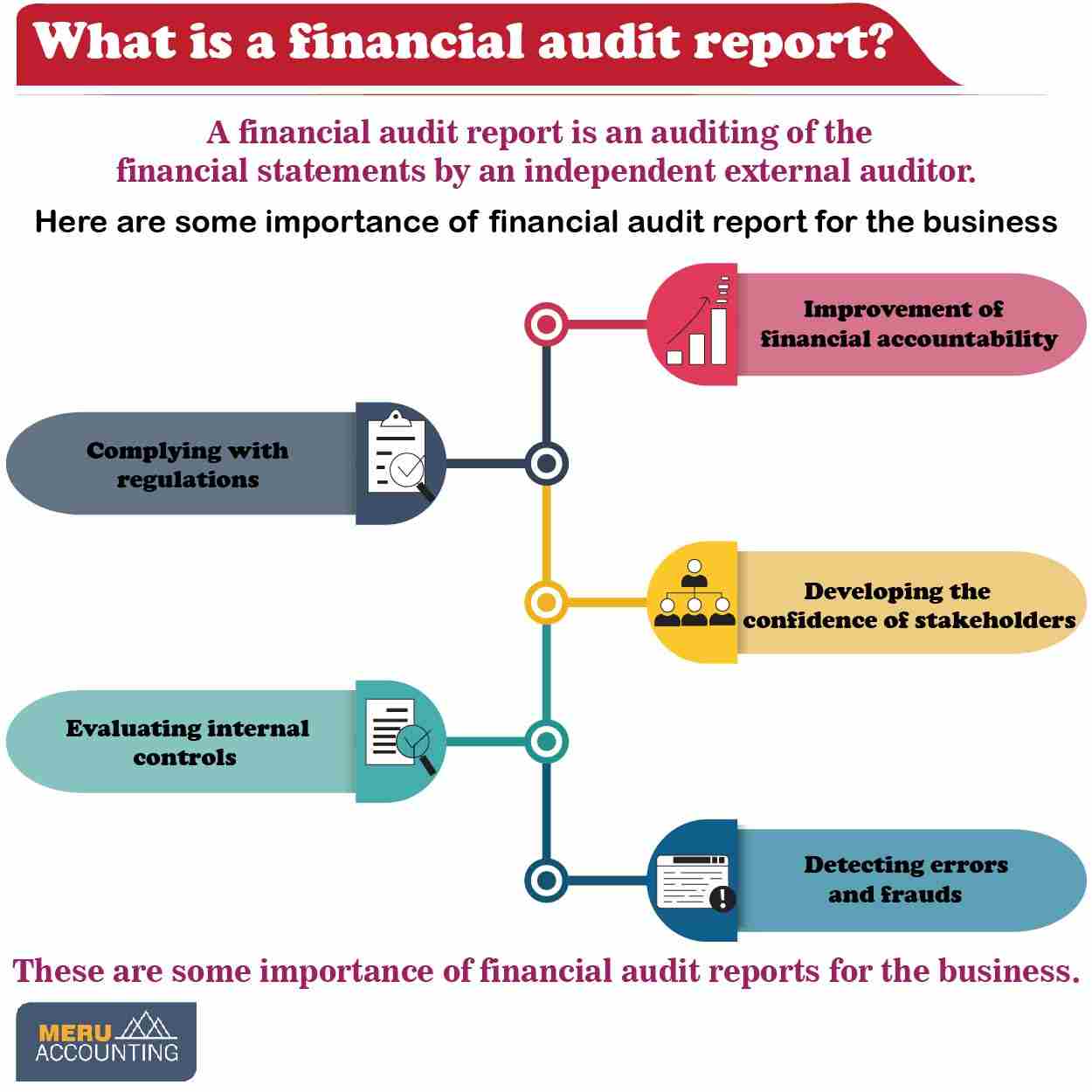

What is financial audit report?

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

Why are financial audit reports important?

Improving financial accountability

A financial audit report helps ensure that a company's financial statements accurately reflect its financial position. This enhances accountability and transparency by holding management responsible for the accuracy of the financial information presented.

Developing stakeholder confidence

Shareholders, investors, lenders, and other stakeholders rely on financial audit reports to make informed decisions. The report provides an independent and expert assessment of the financial health of the company, which can boost confidence in its operations.

Detecting errors and fraud

Auditors are trained to identify errors and irregularities in financial statements, including fraud. The audit process can uncover financial misstatements or fraudulent activities, helping to prevent financial losses.

Compliance with Regulations

Financial audits ensure that a company complies with relevant laws and regulations, including accounting standards and tax laws. Noncompliance can lead to complications and other penalties.

Evaluating Internal Controls

Auditors assess a company's internal control systems. This evaluation identifies weaknesses in the control environment of the organization. It also provides recommendations for improvement, which can prevent financial risks.

These are some of the benefits of the financial audit report for businesses. It motivates business owners and other stakeholders to grow their businesses.

If you want to get a quality financial audit report, then you can outsource this task to the experts. Accounts Junction provides outsourced services for financial report analysis and delivers quality reports. The expert team here has worked on making audit reports for many businesses. Accounts Junction is an expert audit report-making company across the globe.

Businesses need to maintain a fair and true view of their financial statements. To achieve this, the company makes a financial audit report. Here, the financial statements are audited by an independent external auditor. A proper financial report analysis can help business owners, creditors, banks, and regulators. A clean audit report is an indication of maintaining proper accounting standards in the accounting activities. A financial audit report is crucial in ensuring the transparency, accuracy, and integrity of a company's financial statements. These reports are essential for business owners to make proper, informed decisions.

What are the important elements of the financial audit report?

Some important elements of these audit reports contain the following aspects:

Auditor's Analysis

It contains the auditor's professional judgment on whether the financial statements are free from material misstatements and conform to generally accepted accounting principles (GAAP).

Scope of the Audit

The report should outline the scope of the audit, including the period covered, the procedures performed, and the audit methodology used.

Management's Responsibility

The report often includes a section that outlines the responsibility of the organization's management for preparing the financial statements and maintaining internal controls.

Basis for Opinion

This section explains the basis for the auditor's opinion, including the audit evidence gathered and the audit procedures performed. It may also include information about any limitations or significant findings.

Auditor's Opinion

This is where the auditor expresses their opinion on whether the financial report analysis is presented fairly and according to the relevant accounting standards or framework. The most common types of opinions are unqualified (clean opinion), qualified, adverse, or a disclaimer of opinion, depending on the findings and issues identified during the audit.

Supplementary Information

The report may address supplementary information accompanying the financial statements, such as a management discussion and analysis (MD&A), if applicable.

Other Reporting Requirements

Sometimes, the auditor may be required to address other matters, such as compliance with laws and regulations or internal control deficiencies.

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

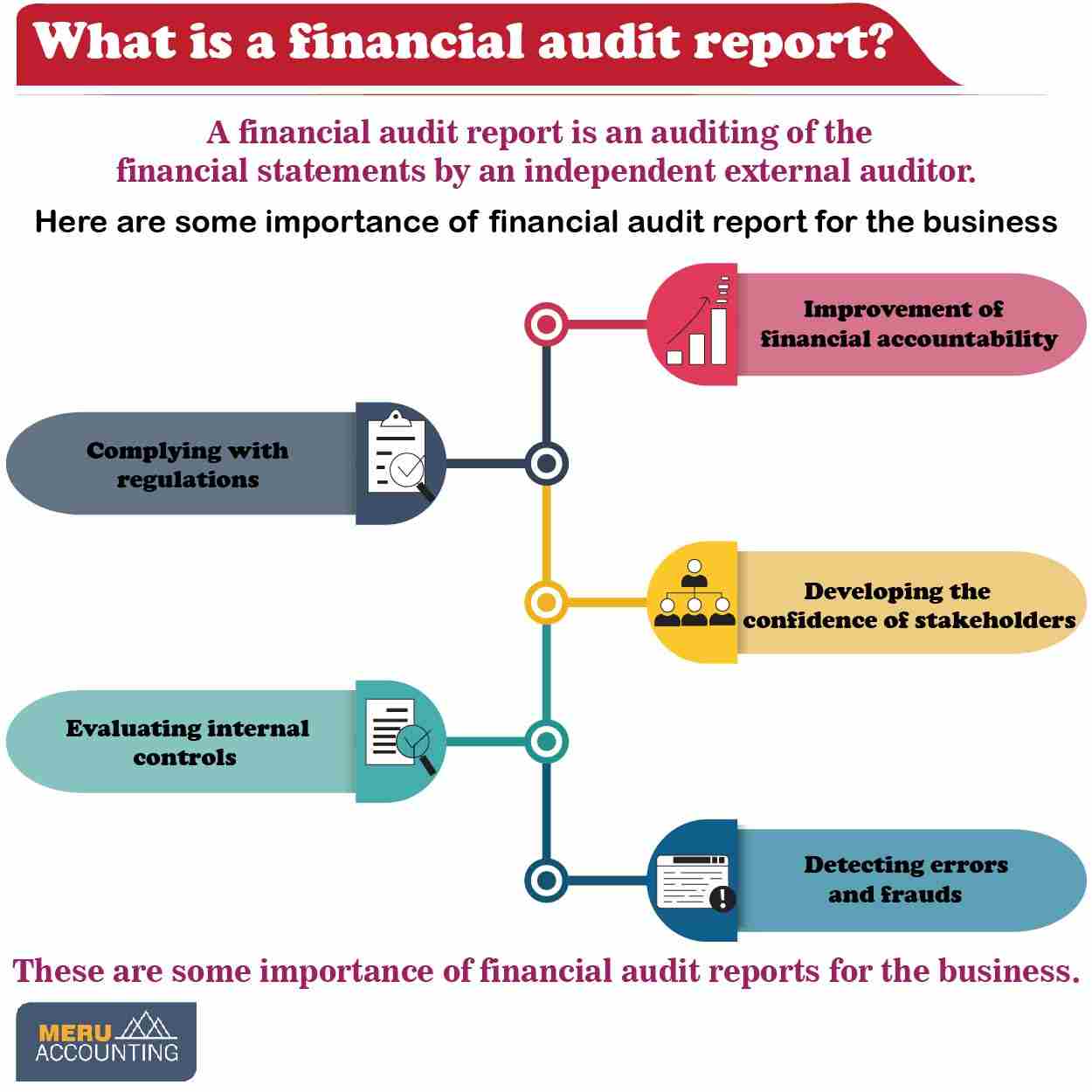

Why are financial audit reports important?

Improving financial accountability

A financial audit report helps ensure that a company's financial statements accurately reflect its financial position. This enhances accountability and transparency by holding management responsible for the accuracy of the financial information presented.

Developing stakeholder confidence

Shareholders, investors, lenders, and other stakeholders rely on financial audit reports to make informed decisions. The report provides an independent and expert assessment of the financial health of the company, which can boost confidence in its operations.

Detecting errors and fraud

Auditors are trained to identify errors and irregularities in financial statements, including fraud. The audit process can uncover financial misstatements or fraudulent activities, helping to prevent financial losses.

Compliance with Regulations

Financial audits ensure that a company complies with relevant laws and regulations, including accounting standards and tax laws. Noncompliance can lead to complications and other penalties.

Evaluating Internal Controls

Auditors assess a company's internal control systems. This evaluation identifies weaknesses in the control environment of the organization. It also provides recommendations for improvement, which can prevent financial risks.

These are some of the benefits of the financial audit report for businesses. It motivates business owners and other stakeholders to grow their businesses.

If you want to get a quality financial audit report, then you can outsource this task to the experts. Accounts Junction provides outsourced services for financial report analysis and delivers quality reports. The expert team here has worked on making audit reports for many businesses. Accounts Junction is an expert audit report-making company across the globe.