The Ultimate Guide to Accounting for Law Firms in 2025

Accounting for law firms is important as it helps them in running their law practices safely and stress-free. It helps track client funds, pay bills on time, and follow tax rules. It also shows what comes in and goes out, so lawyers can plan for the future.

Law firms that use accounting software operate with greater speed and accuracy. The right solution cuts errors, saves hours, and keeps attention on clients, not records.

Clear records help a firm grow. They show money paths and spot problems fast. Even small teams can manage accounts well. This guide gives simple steps to track funds, stay safe, and run a strong law firm.

Why Accounting Matters for Law Firms

Accounting for law firms helps track money, manage client funds, and make smart choices. It shows what comes in, what goes out, and what the firm owes. Clear records keep the firm safe and in control.

-

Keeping Client Money Safe

Lawyers hold client money. They keep it separate from the firm’s funds. Mistakes can bring fines or loss of trust. Software helps track client money clearly.

-

Tracking Income and Costs

Law firms pay for rent, staff, and case costs. Accounting shows where money goes. It also shows how much profit the firm earns.

-

Managing Taxes

Law firms must pay taxes on time. Good books track income and costs. They show what can be spent and help avoid fines. This saves time and cuts stress.

-

Spotting Problems Early

Books show issues fast. Late payments, high costs, or missing bills appear in the records. Lawyers can fix problems before they get worse.

The Essential Principles of Accounting for Law Firms

A few simple rules make accounting for law firms easy and clear.

1. Cash vs. Earned Money

There are two main ways to track money:

- The cash method records money when it comes in or goes out.

- Earned method records money when it is earned or owed, even if not paid yet.

Most law firms use the earned method. It shows a clear view of money and helps plan well.

2. Trust Accounts

A trust account is for client funds only. Law firms must never mix these with business funds. Law firm accounting software can help manage trust accounts safely.

3. Organizing Expenses

Split costs into categories like salaries, rent, and case expenses. This makes reports and tax filing easier.

Choosing the Right Law Firm Accounting Software

Using software makes accounting easier and more accurate.

What to Look For

When choosing law firm accounting software, check for:

- Trust account management to protect client funds

- Billing and invoicing to track billable hours

- Expense tracking to know where money goes

- Integration with other tools, like case management

- Reports and compliance help to avoid mistakes

Cloud vs. Desktop Software

- Cloud software lets you access data anywhere and updates automatically.

- Desktop software keeps data on your computer but can be harder to manage remotely.

Both options can work for accounting for law firms, depending on firm size and need.

Benefits of Good Accounting for Law Firms

Proper accounting gives more than numbers; it helps the firm grow.

1. Better Money Visibility

Clear records show which cases are profitable. This helps in making smart decisions.

2. Manage Cash Flow

Knowing when payments come in and go out helps avoid money shortages.

3. Reduce Risk

Proper accounting reduces errors and helps follow the rules for client funds.

4. Plan for Growth

Detailed numbers help firms hire staff, invest in marketing, or expand.

Challenges in Law Firm Accounting

Accounting for law firms can be complex, even with software. Firms must track client funds, billable hours, and taxes carefully.

-

Many Clients, Many Accounts

Managing money for many clients is hard. Each client has a separate trust account and billing needs. Mistakes can happen. Software helps track every account clearly and safely.

-

Billable Hours

Lawyers must log every billable hour. Missing hours means lost money. Accurate tracking helps the firm earn what it should and keep client bills correct.

-

Taxes

Law firms pay many taxes. These include income, payroll, and profits. Errors or late filings can lead to fines. Careful accounting and fast reporting keep the firm safe.

-

Client Trust Compliance

Trust accounts must follow the law. Small mistakes can cause big trouble. Checks and good software make sure client funds stay safe and handled right.

-

Expense Management

Tracking firm expenses is key. Costs by staff or lawyers must be logged correctly. Wrong entries can make reports wrong. Proper tracking keeps finances clear.

-

Financial Reporting

Reports must be correct for decisions and clients. Mistakes can mislead partners or harm trust. Regular checks and good software keep reports right.

-

Technology Integration

Many software tools can cause errors if not linked. Accounting, billing, and case systems must work together to save time and avoid mistakes.

Law firm accounting is hard, but it can be done. With care, checks, and good tools, firms can keep finances safe, correct, and simple.

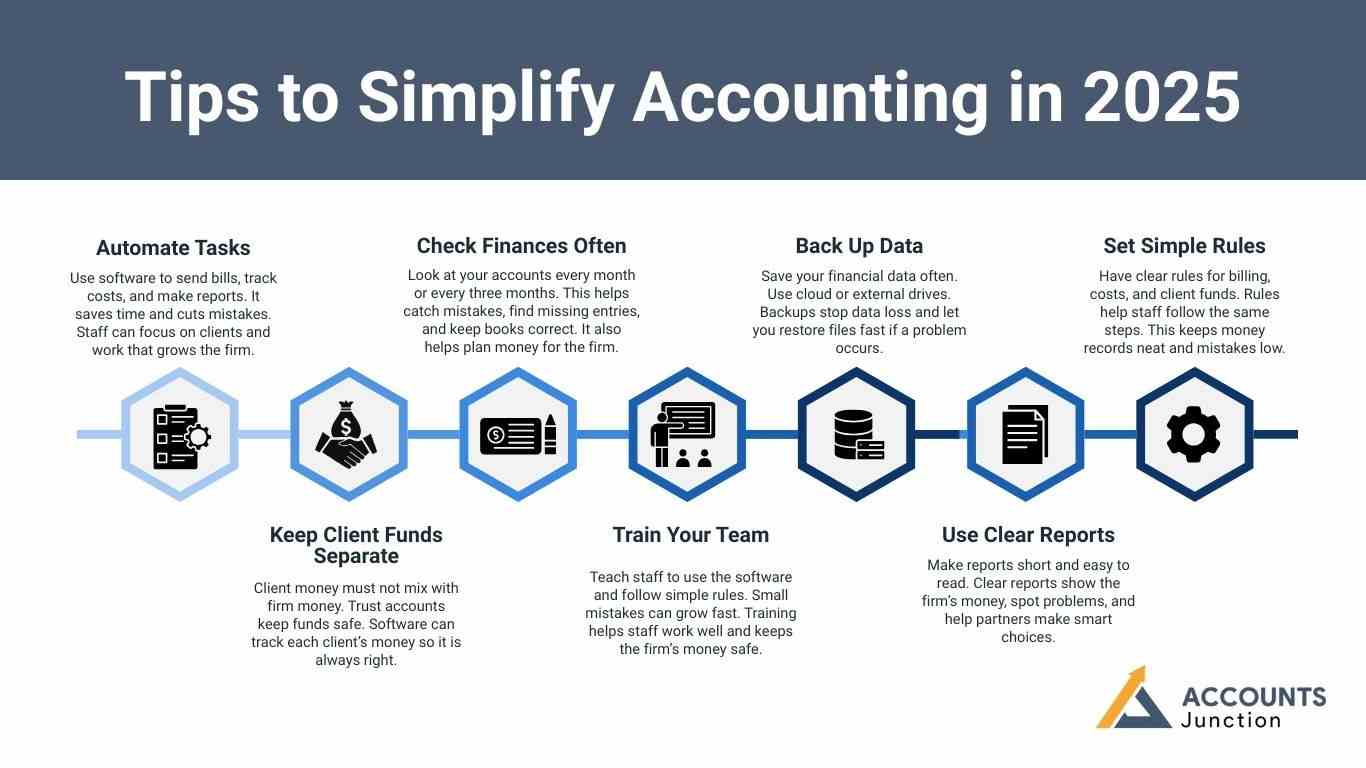

Tips to Simplify Accounting in 2025

Accounting can be hard. Simple steps can make it smooth. Law firms can save time, cut errors, and stay on top of money by using the right tools.

-

Automate Tasks

Use software to send bills, track costs, and make reports. It saves time and cuts mistakes. Staff can focus on clients and work that grows the firm.

-

Keep Client Funds Separate

Client money must not mix with firm money. Trust accounts keep funds safe. Software can track each client’s money so it is always right.

-

Check Finances Often

Look at your accounts every month or every three months. This helps catch mistakes, find missing entries, and keep books correct. It also helps plan money for the firm.

-

Train Your Team

Teach staff to use the software and follow simple rules. Small mistakes can grow fast. Training helps staff work well and keeps the firm’s money safe.

-

Back Up Data

Save your financial data often. Use cloud or external drives. Backups stop data loss and let you restore files fast if a problem occurs.

-

Use Clear Reports

Make reports short and easy to read. Clear reports show the firm’s money, spot problems, and help partners make smart choices.

-

Set Simple Rules

Have clear rules for billing, costs, and client funds. Rules help staff follow the same steps. This keeps money records neat and mistakes low.

The above Simple steps help law firms keep accounts right, save time, and avoid errors. Good tools and trained staff make work smooth.

Future of Accounting for Law Firms

2025 brings new tools and smarter ways to manage finances.

-

AI Assistance

AI can analyze spending, predict cash flow problems, and suggest savings.

-

All-in-One Platforms

Some software combines accounting, case management, and document storage in one place. This reduces work and keeps information in one spot.

-

Security

Protecting client data is key. Modern software uses encryption to keep information safe.

-

Real-Time Reports

Dashboards now show live financial health, so decisions are faster and more accurate.

Accounting is more than just keeping numbers. It helps law firms plan better, save money, and make smarter decisions. Using law firm accounting software makes tasks like billing, expense tracking, and trust account management easier. When law firms use reliable accounting software for law firms, they gain a clear view of their finances and make smarter choices for growth.

For law firms Accounts Junction offers professional accounting services. We provide bookkeeping, billing, trust accounts, and reports. So, lawyers can focus on clients. With us, law firms save time, reduce errors, and maintain clear, accurate financial records. With the right tools and support, your law firm can save time, reduce errors, and grow steadily. Partner with us to simplify your accounting and keep your law firm’s finances under control.

FAQs

1: What is accounting for law firms?

- It is the process of tracking a law firm’s income, expenses, and client funds. It helps the firm stay organized and grow.

2: Why do law firms need trust accounts?

- Trust accounts keep client money separate from firm money. This stops mistakes and follows the law.

3: How can law firm accounting software help?

- It tracks hours, costs, and client funds. It also makes bills and reports fast.

4: Should law firms use cloud or desktop software?

- Cloud software works anywhere and updates on its own. Desktop keeps data on your computer. Cloud is easier to use.

5: How often should law firms check their finances?

- Check accounts each month or every three months. This helps catch mistakes and plan money well.

6: Can AI improve law firm accounting?

- Yes. AI can find trends, spot money problems, and make fast reports.

7: What services does Account Junction offer law firms?

- They handle books, trust accounts, billing, and reports. This saves time and cuts errors.

8: What is the main benefit of good accounting for law firms?

- Good accounting helps the firm make smart choices. It also manages cash well and helps profits grow.

9: How does expense tracking help law firms?

- Tracking costs shows where money goes. It helps save and keep taxes simple.

10: Can small law firms benefit from accounting software?

- Yes. Small firms can save time, avoid mistakes, and stay organized with the right software.

11: How does legal firm accounting help with taxes?

- Accurate books keep income and costs correct. This makes taxes easy and stops fines.

12: What is the difference between cash and accrual accounting?

- Cash accounting records money when it moves. Accrual records money when earned or owed. Accrual gives a clearer view of funds.

13. How does accounting for law firms track client money?

- It logs each payment and keeps client funds apart.

14. Can law firm accounting software save time?

- Yes. It tracks costs and hours fast with less work.

15. How does accounting for law firms stop mistakes?

- It checks each payment, cost, and record.

16. Can small law firms use accounting software?

- Yes. It helps track money and client funds with ease.

17. How does law firm accounting software help with bills?

- It keeps hours and payments right and sends bills fast.

18. Can accounting for law firms improve cash flow?

- Yes. It shows money in and out, so firms plan well.

19. How does accounting for law firms help follow rules?

- It keeps client funds safe and tracks each step.