The Hidden Sections of the T2 Corporation Income Tax Return

The T2 Corporation Income Tax Return is a key tax form for businesses in Canada. It helps the Canada Revenue Agency (CRA) assess corporate income tax. Many business owners know the basic sections of the T2 Tax Form, but there are parts that are often overlooked. These hidden sections can make a big difference to your tax filing accuracy and benefits.

In this guide, we will explore these hidden parts of the T2 Corporation Income Tax Return in simple words. You will learn why they matter, how to use them, and how they can impact your business taxes.

Why You Should Know the Hidden Sections

Some parts of the T2 Tax Form hold credits, write-offs, or reports that are easy to miss. These can include tax breaks for certain trades, credits on investments, or rules for loss carry-forwards.

If you skip these parts, you may pay more tax than you need to. You could also lose refunds or fail to meet CRA rules.

By knowing each part of the form, you can claim all the credits you are due. This helps you stay within the law, avoid costly errors, and lower your tax bill now and in the years ahead.

A clear grasp of these parts also helps with tax plans. You can spend time, set up deals, and make investments in ways that give the most tax gain.

Commonly Missed Schedules in the T2 Corporation Income Tax Return

Schedule 50 – Shareholder Information

- Records details of shareholders owning 10% or more of the company.

- Important for ownership tracking and CRA compliance.

- Helps with certain tax benefit claims.

Schedule 8 – Capital Cost Allowance (CCA)

- Used to claim depreciation on assets.

- Often skipped or filled incorrectly.

- Can lower taxable income when completed correctly.

Schedule 4 – Corporation Loss Continuity and Application

- Tracks unused losses from previous years.

- Let's you apply them to reduce future taxable income.

- Very useful for businesses with fluctuating profits.

Schedule 31 – Investment Tax Credit

- Helps claim credits for certain investments, such as research.

- Not all corporations know they qualify.

- It can reduce your tax bill.

Schedule 200 – Additional Information

- Holds details about certain transactions.

- May be needed for CRA audits.

- Helps avoid penalties by providing extra clarity.

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

Industry-Specific Schedules in the T2 Tax Form

Schedule 125 – Income Statement Information

- Matches accounting income with tax reporting.

- Key for industries with complex revenue streams.

Schedule 141 – Notes Checklist

- Verifies if financial statements are prepared properly.

- Often ignored but needed for compliance.

Schedule 88 – Internet Business Activities

- Needed for businesses that earn income online.

- Helps CRA track e-commerce income.

Extra Deductions Found in Hidden Sections

Charitable Donations Deduction

- Found in a less-visible section.

- Let corporations deduct donations made during the year.

SR&ED (Scientific Research and Experimental Development)

- Found in investment-related schedules.

- Gives major credit for research projects.

Apprenticeship Job Creation Tax Credit

- Available if your corporation hires apprentices.

- Found in employment-related schedules.

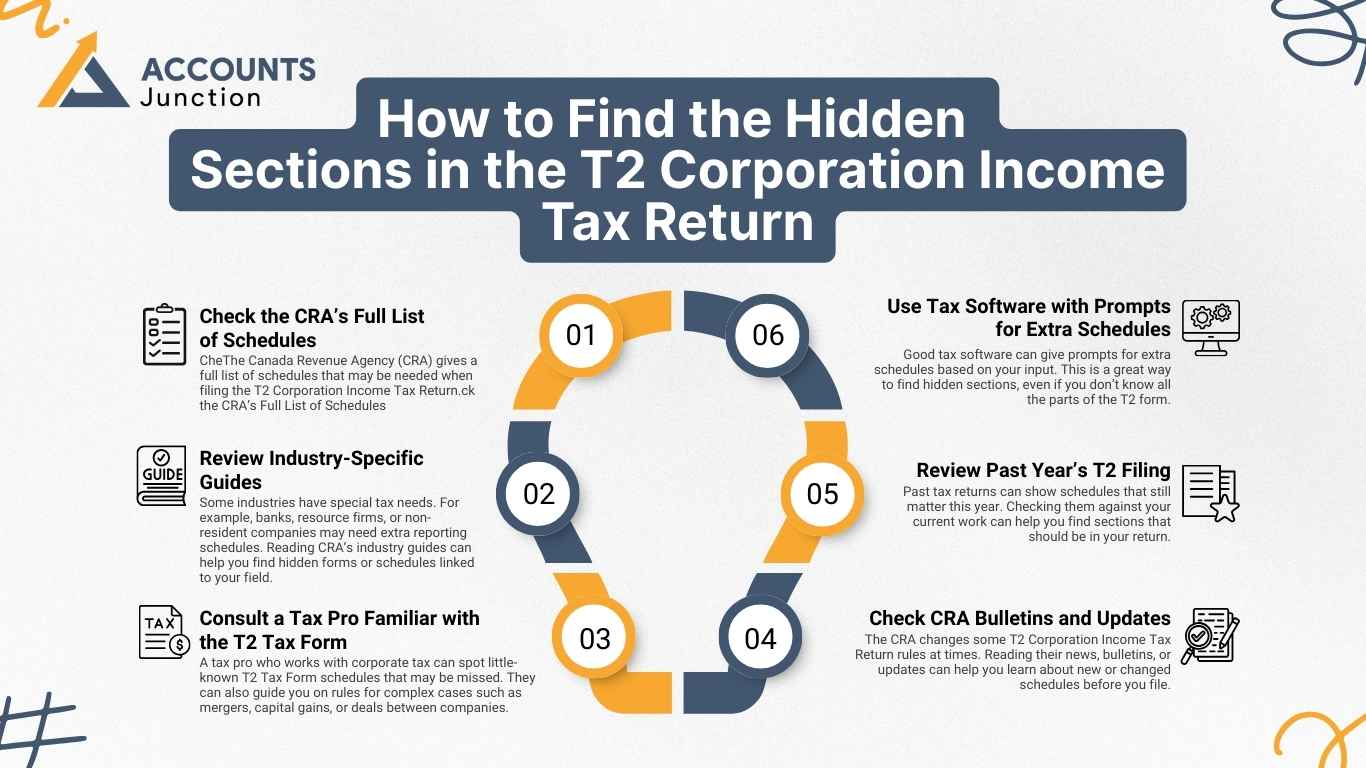

How to Find the Hidden Sections in the T2 Corporation Income Tax Return

1. Check the CRA’s Full List of Schedules

- The Canada Revenue Agency (CRA) gives a full list of schedules that may be needed when filing the T2 Corporation Income Tax Return. Many of these are not in the main form but are still key based on your company’s work. Looking at the CRA’s list helps you avoid missing a hidden section that applies to your case.

2. Review Industry-Specific Guides

- Some industries have special tax needs. For example, banks, resource firms, or non-resident companies may need extra reporting schedules. Reading CRA’s industry guides can help you find hidden forms or schedules linked to your field.

3. Consult a Tax Pro Familiar with the T2 Tax Form

- A tax pro who works with corporate tax can spot little-known T2 Tax Form schedules that may be missed. They can also guide you on rules for complex cases such as mergers, capital gains, or deals between companies.

4. Use Tax Software with Prompts for Extra Schedules

- Good tax software can give prompts for extra schedules based on your input. This is a great way to find hidden sections, even if you don’t know all the parts of the T2 form.

5. Review Past Year’s T2 Filing

- Past tax returns can show schedules that still matter this year. Checking them against your current work can help you find sections that should be in your return.

6. Check CRA Bulletins and Updates

- The CRA changes some T2 Corporation Income Tax Return rules at times. Reading their news, bulletins, or updates can help you learn about new or changed schedules before you file.

Common Mistakes to Avoid

Not Filing Required Schedules

- Even if income is zero, some schedules are still mandatory.

Ignoring Carryforward Sections

- Losses, credits, and deductions from past years can be missed.

Incorrect Asset Depreciation

- Wrong CCA class selection can lead to CRA reassessments.

Forgetting Internet Business Reporting

- Especially for e-commerce or social media income.

Tips for Completing the T2 Tax Form Correctly

1. Start Early and Gather All Financial Records

- Prepare your T2 Tax Form well before the due date. Collect income statements, balance sheets, invoices, receipts, payroll records, bank statements, and last year’s tax returns. Early prep avoids stress and missing data.

2. Use CRA’s Guide to Identify All Applicable Schedules

- The CRA guide explains which schedules apply to your business. Rules vary based on your company type, field, and activities. Check the guide to ensure you use the right forms.

3. Keep a Record of Unused Credits and Losses

- Track carry-forward items like non-capital losses, capital losses, and investment tax credits. These can lower taxes in future years. Keep a simple record for an easy claim.

4. Review Your T2 Corporation Income Tax Return Before Filing

- Check that all figures, deductions, and credits are correct. Confirm shareholder and ownership details. Fixing errors now saves time and cost later.

5. Maintain Proper Documentation for All Deductions

- If you claim home office, travel, or meal costs, keep proof. Store receipts, logs, and records. CRA may ask for these during a check.

6. Use Certified T2 Filing Software

- CRA-approved software helps reduce errors. It also allows e-filing, which is faster and more secure.

Benefits of Understanding the Hidden Sections

1. Lower Tax Payable Through Proper Deductions and Credits

- You may qualify for credits like SR&ED or manufacturing tax relief. These can cut your tax bill in a big way.

2. Better Compliance and Lower Audit Risk

- Filing all sections the right way lowers the chance of CRA audits or penalties.

3. Improved Financial Tracking for Long-Term Planning

- T2 forms give a full view of your business’s health. This helps plan for growth and control costs.

4. Maximized Use of Industry-Specific Benefits

- Some fields, like media, farming, or energy, have special tax breaks. Know which schedules to file to claim them.

Step-by-Step Approach to Check Hidden Sections

1. Download the Latest T2 Tax Form from CRA

- Always use the newest form to meet current CRA rules.

2. Identify All Mandatory Schedules for Your Business Type

- Examples include Schedule 7 for investment income or Schedule 125 for income statements.

3. Review Prior Years’ Returns for Unused Amounts

- Look for unused ITCs, donations, or loss carry-forwards.

4. Double-Check Ownership and Shareholder Information

- Make sure ownership details are up to date and match your records.

5. Submit the Return with All Required Supporting Documents

- Attach all forms and proof needed. Missing info can delay CRA processing.

Role of a Tax Professional in T2 Filing

1. Identifying Missed Credits

- Experts know where to find savings, such as foreign tax relief or local credits.

2. Ensuring Full CRA Compliance

- They ensure all forms and numbers meet CRA rules.

3. Reducing Risk of Costly Errors

- A pro review cuts the chance of penalties or audits.

4. Offering Strategic Tax Planning Advice

- They help you plan for lower taxes in future years, not just now.

CRA Tools for T2 Corporation Income Tax Return

1. CRA Online Services

- Use “My Business Account” to see filing status, payments, and balances.

2. Certified T2 Tax Software

- These tools help prepare and file returns fast and with fewer mistakes.

3. CRA Help Lines for Business Taxpayers

- Call CRA for help with forms, rules, and due dates.

4. CRA’s Web Forms

- For simple cases, use CRA Web Forms to file online without software.

5. Guide T4012 – T2 Corporation Income Tax Guide

- This CRA guide explains each part of the T2 Tax Form in plain terms.

The T2 Corporation Income Tax Return is more than a basic filing need. Hidden parts in the T2 Tax Form can give useful credits, deductions, and details that lower tax and reduce risk. Many owners miss them because they do not know they exist. By checking all parts of the T2, keeping full records, and looking at industry-based schedules, a business can make the most of its tax return and stay in line with CRA rules.

At Accounts Junction, we help businesses file the T2 Corporation Income Tax Return right and on time. We find the hidden parts and make sure you claim each credit and deduction you can. With our skills, you can cut errors, save more tax, and stay fully compliant with CRA needs.

FAQs

1: What is the T2 Corporation Income Tax Return?

- It is a form used by Canadian corporations to report income and taxes to the CRA.

2: Is the T2 Tax Form mandatory for all corporations?

- Yes, all resident corporations must file it, even with no income.

3: Can I file the T2 Tax Form online?

- Yes, most corporations must file electronically.

4: What happens if I miss a hidden schedule?

- You may lose deductions or face CRA penalties.

5: How often is the T2 Corporation Income Tax Return filed?

- It is filed every tax year by the corporation.

6: Do I need a tax expert to complete the T2 Tax Form?

- Not always, but it can help you find all the benefits.

7: Are there industry-specific sections in the T2?

- Yes, some schedules apply only to certain industries.