Tax return in Australia

If you're running a business in Australia or planning to start one, it's essential to understand how the Tax Return in Australia works. Managing taxes might seem complex, but when approached systematically, online income tax filing makes it far more manageable. Before getting the notices from the ATO (Australian Tax Office), you must make all the tax-related calculations with a proper tax consultant. It will ease your lodging tax return to a large extent.

As per the nature of the work, the ATO expects that every business file its tax returns as per the guidelines. The government is extremely encouraging online income tax filing as the preferred method. A third-party agency can handle these taxes perfectly for your business.

A tax return in Australia is a yearly form you send to the ATO. It shows what you earn, what you spend, and any tax breaks you can get.

The ATO uses this information to figure out how much tax you need to pay or if you’ll get a refund. Both individuals and businesses must follow the rules for filing taxes online. If you don’t file your tax return on time or make errors, you could face fines or audits. You can lower your taxable income by using legal tax deductions offered in Australia.

How can online lodging of tax returns in Australia benefit Taxpayers?

Online income tax filing offers several advantages for individuals and businesses alike:

Easy to Use

- Online filing is simple. The platform helps you step-by-step, making it easier to file your tax return.

Clear Information

- Digital platforms provide clear summaries of your income, expenses, and possible tax deductions in Australia. You’re better equipped to understand your financial situation and maximize your refund.

Saves Time and Effort

- Filing online means no long waits, no delays, and less paper. It speeds up the process and helps you get your refund quicker.

Secure and Convenient

- You can file your tax return from home or work. There’s no need to visit any offices, making it more secure and easier.

Instant Updates

- You get real-time updates on your filing. This helps you track your submission and make sure everything is on track. If there are any issues, you can resolve them quickly, without waiting for long periods.

Fewer Mistakes

- Online filing has checks to reduce errors, helping you file a more accurate tax return. These checks can catch common mistakes, making it less likely that your return will be flagged for review. This saves you time and stress in the long run.

Enhanced Accuracy

- Online income tax filing systems include built-in checks and auto-fill options. This lowers the chances of common mistakes and makes your tax return in Australia more accurate.

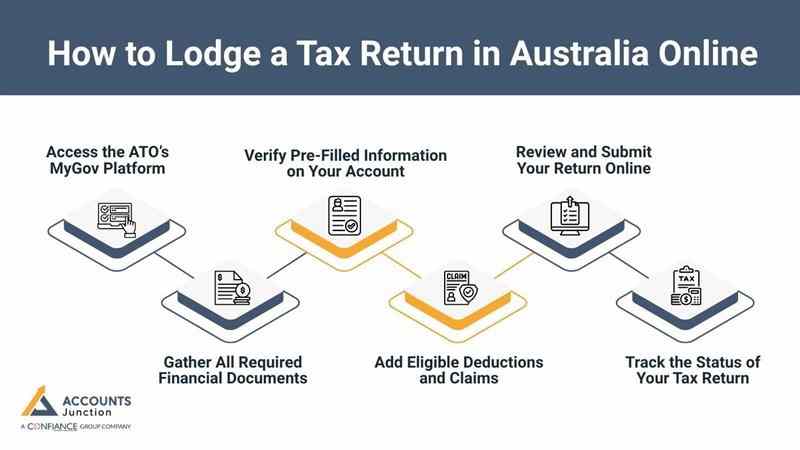

How to Lodge a Tax Return in Australia Online

Filing your tax return in Australia online can be fast and simple. The ATO’s digital platform makes the process easier for every taxpayer. It ensures that your details stay accurate, secure, and up to date. Following the right steps may help you receive refunds much faster.

1. Access the ATO’s MyGov Platform

- Log in or create your MyGov account to start online lodgment.

- It connects directly with the Australian Taxation Office for submission.

2. Gather All Required Financial Documents

- Collect payslips, expense receipts, income statements, and investment details carefully.

- Having documents ready ensures a smooth and error-free tax submission.

3. Verify Pre-Filled Information on Your Account

- The ATO may pre-fill details such as salary, interest, or benefits.

- You must cross-check this data before submitting your final tax return.

4. Add Eligible Deductions and Claims

- Include deductions for work gear, home office, or travel costs.

- Proper claims can reduce your taxable income and increase possible refunds.

5. Review and Submit Your Return Online

- Recheck every section to confirm all numbers are entered correctly.

- Once verified, click submit and wait for acknowledgment from the ATO.

6. Track the Status of Your Tax Return

- After lodgment, you can track updates directly through your MyGov dashboard.

- Most refunds are processed within two weeks of successful filing.

Common Mistakes When Filing Tax Returns

Even experienced taxpayers sometimes make small yet costly mistakes.

Avoiding these errors can protect your refund and peace of mind.

1. Forgetting to Include Small Income Sources

- Side jobs or freelance payments often get overlooked by many. The ATO may still detect them through financial data matching.

2. Claiming Unverified or Excessive Deductions

- Claiming non-work expenses can trigger ATO reviews or penalties. Always claim only genuine and well-documented business costs carefully.

3. Missing Submission Deadlines or Extensions

- Late lodgment invites penalties, interest, and compliance issues easily. Always mark tax deadlines and file before the final date arrives.

4. Ignoring Superannuation Contribution Records

- Many taxpayers forget the super contribution benefits for deductions. Tracking these details may reduce your taxable income significantly.

5. Using Wrong Bank or Contact Details

- Incorrect banking data can delay refunds or misdirect payments easily. Always confirm your account details before lodging the final form.

Top Tax Deductions Many People Often Miss

Tax deductions may reduce your total payable tax if used correctly. Here are some commonly missed deductions Australian taxpayers overlook.

- Home office expenses, such as phone and electricity bills.

- Job-related training courses or certification program costs.

- Donations to approved and registered charitable organizations only.

- Depreciation on tools, furniture, or electronic office devices.

- Union membership or professional association annual fee payments.

- Vehicle fuel or travel expenses linked directly to work.

- Insurance premiums that protect your income from loss.

Maintaining receipts for every deduction ensures smoother verification later.

It helps maximize your total refund while staying within compliance.

Filing a tax return in Australia is a key task for both people and businesses. The government supports online tax payments to make things faster and easier. It’s important to keep clear records of your income, costs, and claims. Being aware of available tax deductions in Australia can make a major difference in your tax outcome.

If your business needs tax work done in Australia, Accounts Junction provides complete tax services for businesses of all sizes. Our certified experts manage tax filings with precision and ensure full compliance with ATO regulations. We focus on making the entire process fast, accurate, and stress-free. Partner with us to handle your taxes the right way and keep your business compliant year-round.

FAQs

1. Who must lodge a tax return in Australia?

- Any Australian resident earning taxable income must lodge a yearly return with the ATO.

- This includes employees, freelancers, and registered business owners nationwide.

2. When is the ATO tax return deadline in Australia?

- The official tax return deadline is usually October 31st every year.

- Registered tax agents may get extended lodgment dates from the ATO.

3. How can I lodge my Australian tax return online easily?

- You can file through the ATO’s MyGov online portal quickly and securely.

- It guides you step-by-step through each required lodgment section.

4. What details are required for filing a tax return in Australia?

- You’ll need income statements, payslips, bank interest, and deduction receipts.

- Accurate details help the ATO process your return without any delay.

5. Can I file a tax return in Australia without an agent?

- Yes, you can self-lodge directly online through the ATO MyGov website.

- However, tax agents may assist in claiming eligible deductions correctly.

6. What happens if I miss the ATO tax return deadline?

- Missing deadlines may cause late penalties or ATO compliance reminders.

- It’s best to file early or contact a registered tax agent.

7. Are online Australian tax return lodgments completely safe?

- Yes, ATO systems use encryption and identity verification for protection.

- Your personal and financial data remains fully secure during the process.

8. How long does an Australian tax refund usually take?

- Most refunds arrive within two weeks after successful online lodgment.

- Delays may occur if details are missing or claims need verification.

9. What income sources must be declared in Australian tax returns?

- You must declare salary, freelance income, dividends, and overseas earnings.

- ATO cross-checks all reported data using employer and bank records.

10. Which expenses are deductible in an Australian tax return?

- Work-related costs like travel, training, and home office bills are deductible.

- Always keep receipts or digital proof for every expense you claim.

11. Can I claim home office expenses on my Australian tax return?

- Yes, home-based workers can claim part of the electricity, internet, and supplies.

- The ATO provides specific calculation methods for accurate expense claims.

12. How does superannuation affect my tax return in Australia?

- Voluntary super contributions may lower your taxable income each year.

- They also support long-term savings for your retirement plan.

13. What are common mistakes when lodging tax returns in Australia?

- People often miss side incomes or overclaim deductions without evidence.

- Reviewing your data before submission can prevent these common errors.

14. How can small businesses file their Australian tax returns?

- Small businesses must report all income, GST, and deductible expenses accurately.

- ATO online services or registered tax agents can simplify the process.

15. Do sole traders in Australia need to file a tax return?

- Yes, sole traders must lodge individual tax returns for their earnings.

- They should include business income, expenses, and ATO-approved deductions.

16. What should I do before lodging my Australian tax return?

- Gather all financial records, receipts, and employer income summaries.

- Verify details carefully to avoid delays or ATO correction notices.

17. Can I amend my Australian tax return after submission?

- Yes, corrections can be made through your MyGov account anytime.

- The ATO allows updates for missed income or incorrect claims.

18. What are ATO audit triggers in tax return filings?

- Unusual deductions, underreported income, or mismatched data raise ATO flags.

- Submitting honest and supported claims can help avoid an audit.

19. Can foreign residents file Australian tax returns online?

- Yes, non-residents earning income in Australia must file annually.

- They can use the ATO portal or authorized tax professionals online.

20. Why should businesses use certified experts for Australian tax returns?

- Certified experts ensure compliance, accuracy, and correct tax deductions always.

- They also help avoid errors and maximize your business's refund potential.