Reconciling BILL.COM in QuickBooks

BILL.COM is a leading cloud-based financial operations platform that streamlines business payments, accounts payable, and accounts receivable processes. It offers automation and efficiency, helping businesses manage their cash flow seamlessly. By using BILL.COM, companies can reduce manual entry, eliminate paperwork, and gain better visibility into their financial transactions.

For businesses using QuickBooks, BILL.COM integrations allow for smooth financial data synchronization, improving accuracy and efficiency. The integration ensures that transactions are recorded in real-time, reducing the chances of errors and missed payments. Whether handling invoices, processing vendor payments, or managing receivables, BILL.COM provides a comprehensive solution that simplifies financial management.

Benefits of Integrating BILL.COM with QuickBooks

- Automation of Transactions: BILL.COM integrations with QuickBooks automate the recording of transactions, reducing manual data entry and minimizing errors.

- Time-Saving: Double entry is time-consuming; the integration eliminates it, and businesses can focus on core operations.

- Improved Cash Flow Management: BILL.COM and QuickBooks offer real-time updates; businesses can track payments and invoices efficiently.

- Better Financial Accuracy: Accurate financial reports are vital; syncing BILL.COM and QuickBooks achieves this by correctly recording all transactions.

- Enhanced Security: BILL.COM offers multi-level approvals, fraud detection, and secure payment processing, ensuring safe and reliable financial transactions.

- Seamless Reconciliation: With BILL.COM integrations, reconciling accounts in QuickBooks becomes more streamlined, reducing discrepancies and ensuring financial accuracy.

Why Reconciling BILL.COM in QuickBooks is Important

Reconciling BILL.COM in QuickBooks is crucial for maintaining financial accuracy and ensuring that all transactions are correctly recorded. Here are some key reasons why reconciliation is essential:

1. Ensures Accuracy in Financial Records

- Businesses use BILL.COM and QuickBooks; reconciling both platforms ensures all transactions are correctly recorded. This prevents duplicate entries, missing transactions, or incorrect amounts that could lead to financial discrepancies.

2. Prevents Cash Flow Issues

- Proper reconciliation helps businesses track outstanding payments and avoid overpaying or underpaying vendors. Companies need real-time insights into cash flow; aligning BILL.COM transactions with QuickBooks ensures they have sufficient funds.

3. Simplifies Audit and Compliance Requirements

- Businesses often undergo financial audits or need to comply with tax regulations. Regular reconciliation of BILL.COM in QuickBooks provides accurate financial data, making audits easier and ensuring compliance with regulatory requirements.

4. Detects and Prevents Fraud or Errors

- Reconciling BILL.COM in QuickBooks allows businesses to catch any unauthorized transactions, duplicate payments, or errors before they impact financial stability. This proactive approach helps in fraud prevention and enhances internal financial control.

5. Reduces Manual Work and Saves Time

- By integrating BILL.COM with QuickBooks, reconciliation becomes a more automated and efficient process. Manual data entry is inefficient and error-prone; therefore, this reduces it and saves time for important business operations.

6. Improves Decision-Making

- Accurate reconciliation provides businesses with a clear financial picture. This helps business owners and financial managers make informed decisions regarding budgeting, vendor payments, and overall financial planning.

Common Challenges While Reconciling BILL.COM in QuickBooks

Sometimes, the reconciliation process may not go as smooth as planned. Some days, a few numbers may not match, and that can be confusing. Below are common hurdles businesses may face:

1. Missing or Duplicate Transactions

- It may happen that a bill is entered twice or a payment is missed during syncing. This can cause your QuickBooks balance to look off.

2. Sync Delays Between Platforms

- BILL.COM and QuickBooks exchange data, but sometimes syncing can lag due to internet issues or outdated settings.

3. Incorrect Vendor Mapping

- When vendors in BILL.COM are not linked properly to QuickBooks, transactions may appear under the wrong names or accounts.

4. Partial Payments Not Recorded

- If a vendor is paid partly, but QuickBooks records the full amount, reconciliation may seem mismatched.

5. Bank Feed Errors

- Sometimes, your bank feed in QuickBooks may not update on time, making it hard to match payments with actual bank transactions.

Tips to Avoid Reconciliation Errors

Mistakes may sneak in, but a few habits can keep your books clean and calm.

1. Keep Sync Settings Updated

- Always ensure both BILL.COM and QuickBooks are using the latest integration updates.

2. Review Transactions Regularly

- A quick weekly review may save hours during monthly reconciliation.

3. Maintain Vendor and Account Consistency

- Use the same naming structure for vendors and accounts across both tools.

4. Create a Reconciliation Checklist

- Having a list can help you stay on track. Include steps like verifying payments, checking sync logs, and confirming all invoices.

5. Backup Data Periodically

- Backing up ensures that even if errors occur, your records remain safe and recoverable.

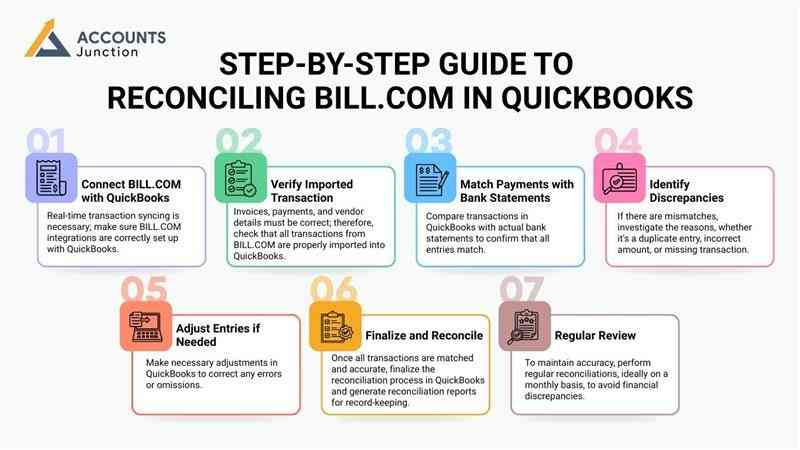

Step-by-Step Guide to Reconciling BILL.COM in QuickBooks

To maintain accurate financial records, follow these steps to reconcile BILL.COM in QuickBooks:

- Connect BILL.COM with QuickBooks: Real-time transaction syncing is necessary; make sure BILL.COM integrations are correctly set up with QuickBooks.

- Verify Imported Transactions: Invoices, payments, and vendor details must be correct; therefore, check that all transactions from BILL.COM are properly imported into QuickBooks.

- Match Payments with Bank Statements: Compare transactions in QuickBooks with actual bank statements to confirm that all entries match.

- Identify Discrepancies: If there are mismatches, investigate the reasons, whether it's a duplicate entry, incorrect amount, or missing transaction.

- Adjust Entries if Needed: Make necessary adjustments in QuickBooks to correct any errors or omissions.

- Finalize and Reconcile: Once all transactions are matched and accurate, finalize the reconciliation process in QuickBooks and generate reconciliation reports for record-keeping.

- Regular Review: To maintain accuracy, perform regular reconciliations, ideally on a monthly basis, to avoid financial discrepancies.

Why Choose Accounts Junction for BILL.COM and QuickBooks Reconciliation?

At Accounts Junction, we understand the complexities of financial management and the importance of accurate bookkeeping. Our expert team ensures seamless BILL.COM integrations with QuickBooks, providing businesses with a hassle-free reconciliation process. Here’s why you should choose us:

- Experienced Professionals: BILL.COM integrations and reconciliation require expertise; our team includes certified accountants and QuickBooks specialists.

- Accurate and Timely Reconciliation: We ensure that all transactions are accurately recorded, eliminating errors and maintaining financial transparency.

- Customized Solutions: We tailor our services to fit your business needs, ensuring smooth financial operations.

- Cost-Effective Services: You can save time and resources; therefore, outsource your reconciliation process to Accounts Junction, and then focus on business growth.

- Secure and Compliant Processes: Data security and compliance are our priorities; we ensure your financial records are protected and audit-ready.

BILL.COM is a powerful tool that enhances financial management through automation and efficiency. Integrating BILL.COM with QuickBooks provides businesses with accurate, real-time transaction tracking, reducing manual workload and improving financial transparency. Regular reconciliation of BILL.COM transactions in QuickBooks is essential to detect errors, prevent fraud, and maintain compliance.

Choosing Accounts Junction for BILL.COM integrations and reconciliation ensures expert financial management tailored to your business needs. Our dedicated professionals streamline your accounting processes, allowing you to focus on growth while maintaining financial accuracy. By leveraging BILL.COM effectively, businesses can optimize cash flow, reduce operational complexities, and achieve long-term financial success.

FAQs

1. Why is reconciliation needed when BILL.COM syncs with QuickBooks automatically?

- Even with automation, small sync mismatches or missing data can occur, which reconciliation may help fix.

2. How long does a BILL.COM reconciliation usually take?

- It may take from a few minutes to a few hours, depending on the number of transactions and sync status.

3. What should I do if my QuickBooks balance doesn’t match BILL.COM?

- You can review each transaction, check for duplicate or missing entries, and then adjust as needed.

4. Can BILL.COM automatically post payments to QuickBooks?

- Yes, once integration is active, most payments post automatically, but it’s good to verify.

5. Is it safe to connect BILL.COM with QuickBooks?

- Yes, both platforms use secure encryption and multi-layered authentication for data safety.

6. What kind of reports can I generate after reconciliation?

- You can generate reconciliation summaries, payment records, and vendor-specific reports in QuickBooks.

7. Can reconciliation detect fraudulent activity?

- It may help identify unusual or unauthorized payments early before they grow into bigger issues.

8. Should small businesses also reconcile monthly?

- Yes, even small businesses may benefit, as it ensures accuracy and helps manage cash flow.

9. Does reconciliation affect my tax filing?

- Accurate reconciliation ensures that your tax reports reflect real transactions, which can simplify filings.

10. What happens if reconciliation is skipped for a few months?

- Unreconciled months can pile up, making it harder to locate mismatched entries later.

11. How can I prevent duplicate entries in QuickBooks?

- Avoid manual entry for bills or payments already synced from BILL.COM.

12. Is there a way to automate reconciliation completely?

- While automation can reduce work, full automation may still need human review for accuracy.

13. Can reconciliation errors affect cash flow?

- Yes, if wrong balances appear, you may overpay vendors or delay payments without realizing it.

14. Why does BILL.COM sometimes not sync all invoices?

- It may happen due to integration settings or internet interruptions during sync.

15. What is the best time to perform reconciliation?

- Usually, after month-end when all bills, invoices, and bank statements are available.

16. Can Accounts Junction customize reconciliation reports?

- Yes, they may tailor reports to show only the data your business needs.

17. Will reconciling affect previously closed periods in QuickBooks?

- If done correctly, it won’t. But changes in older periods should be reviewed carefully.

18. What information should I have before starting reconciliation?

- You may need your bank statements, BILL.COM transaction list, and QuickBooks register.

19. How often should integrations be refreshed?

- It’s best to refresh or test connections every few weeks to ensure smooth syncing.

20. Can reconciliation improve decision-making?

- Yes, when your books are accurate, you can plan budgets and track payments more clearly.

21. Can Accounts Junction help with setting up BILL.COM integrations?

- Yes, our experts can assist in setting up and optimizing BILL.COM integrations with QuickBooks to streamline your financial processes.