Real Estate Business and Accounting

The real estate business is a dynamic and lucrative sector that offers various opportunities for investors, agents, and developers. However, to succeed in this field, understanding the intricacies of the real estate business and accounting is crucial. Proper accounting practices not only ensure compliance but also enhance profitability and sustainability.

In businesses like Real Estate, efficient accounting of the organization is one of the very important tasks. An intense focus on accounting is essential in this business due to the complex financial transactions involved. The accounting work in real estate is much different than any other business.

People are looking more positively for investment in real estate. Whether a real estate firm is small or big, a proper analysis of the accounting is of paramount importance. Apart from buying or selling, real estate businesses are making a lot of profit through real estate rental income. Many of the rental requirements have provided ample profitable opportunities for these businesses. Rather than buying a house, people are finding more advantages in staying on rent.

Understanding Real Estate Business and Accounting

Real estate business and accounting deal with money tasks in the real estate world. These include buying, selling, renting, or running properties. You also need to track money in and out, make reports, and follow tax rules.

Key Parts of Real Estate Accounting

Income Tracking

- Keep a record of all the money you earn. This can be from rent, property sales, or service fees.

Expense Tracking

- Write down all the money you spend. This includes upkeep, tax, power bills, and insurance.

Financial Reports

- Make clear reports to show how much you earn and spend. Use balance sheets, profit reports, and cash flow charts.

Tax Rules

- Follow all tax laws. These include property tax and taxes on profit when you sell.

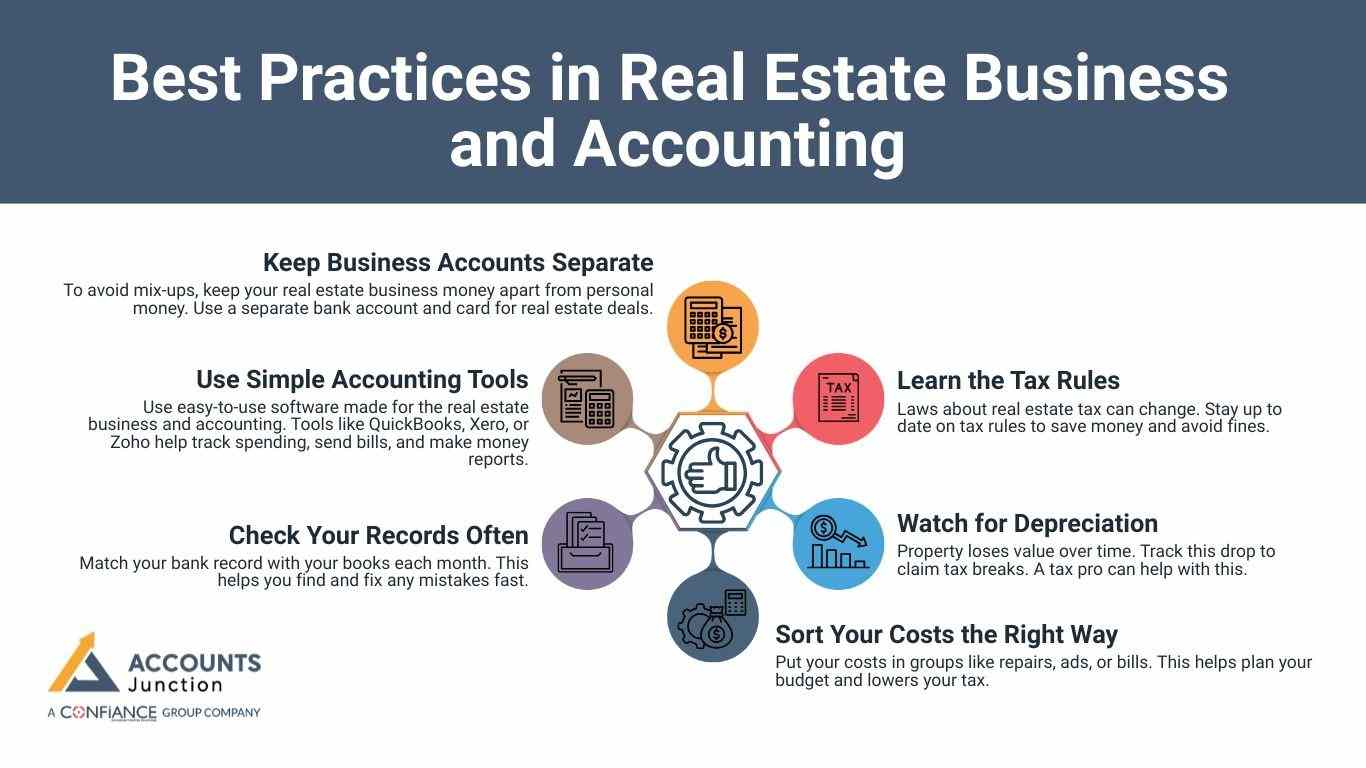

Best Practices in Real Estate Business and Accounting

1. Keep Business Accounts Separate

- To avoid mix-ups, keep your real estate business money apart from personal money. Use a separate bank account and card for real estate deals.

2. Use Simple Accounting Tools

- Use easy-to-use software made for the real estate business and accounting. Tools like QuickBooks, Xero, or Zoho help track spending, send bills, and make money reports.

3. Check Your Records Often

- Match your bank record with your books each month. This helps you find and fix any mistakes fast.

4. Sort Your Costs the Right Way

- Put your costs in groups like repairs, ads, or bills. This helps plan your budget and lowers your tax.

5. Watch for Depreciation

- Property loses value over time. Track this drop to claim tax breaks. A tax pro can help with this.

6. Learn the Tax Rules

- Laws about real estate tax can change. Stay up to date on tax rules to save money and avoid fines.

Importance of Proper Accounting in Real Estate

Good accounting in the real estate business helps in many ways:

- Financial Clarity: Shows where the business stands in terms of cash.

- Lower Taxes: Helps you find tax cuts and save on costs.

- Smart Choices: Gives you facts to buy or sell at the right time.

- Follow Rules: Keeps you safe from fines by meeting tax and legal rules.

Advantages of real estate rental

Budget-friendly

- Buying a new flat will require payment of a huge amount. Most people buy a home on an EMI basis through a loan; they have to pay some amount as a down payment. On some occasions, this amount is large, and many people find it difficult to pay this amount. Whereas the amount needed for the rental is relatively less, which can be paid in a more comfortable way.

Passive source of Income

- When you rent a property for some term, you open up a new source of passive income. You keep on getting a fixed amount of income on a monthly basis, which simply relieves you from any financial crunch.

Good return

- An investment made in Real Estate rental is one of the assured ways of getting a good return. The amount of rent paid has always increased with the passing of years, indicating a nice value appreciation. So, a high amount of return can be easily expected from the investment made in the real estate rental.

Nice way to diversify assets

- When you want to invest a huge amount, then diversification plays a vital role. You need to invest in several different markets where you can secure your assets. Real estate rental is one of the dependable ways of diversifying assets and getting a nice amount of income.

Risk Management and Compliance in Real Estate

Understanding Risks in Real Estate

The real estate sector may face many risks, such as:

- Market fluctuations: Property values can rise or fall unexpectedly.

- Delayed sales: Transactions may take longer than expected, affecting cash flow.

- Property damage: Repairs or accidents can lead to unexpected costs.

How Accounting Helps Identify Risks

Accounting can highlight potential problem areas by:

- Showing trends in profits or losses over time.

- Tracking expenses and cash flow for each property.

- Identifying properties or projects that may underperform financially.

Ensuring Compliance with Laws and Regulations

Compliance is key to avoiding fines or legal issues:

- Tax rules: Proper accounting ensures all property and income taxes are recorded.

- Local regulations: Staying up to date on zoning, safety, and reporting rules can prevent violations.

Role of Audits and Regular Checks

Regular audits and checks may help keep the business safe:

- Verify records are accurate and complete.

- Ensure all income, expenses, and taxes are properly tracked.

- Detect mistakes before they become costly problems.

Tracking Insurance and Legal Costs

Accounting can also monitor essential protective costs:

- Insurance premiums: Track payments for property, liability, or business coverage.

- Legal fees: Record costs for contracts, disputes, or compliance advice.

Taking a Proactive Approach

A proactive accounting system can help your business stay resilient by:

- Preparing for unexpected losses or delays.

- Supporting informed decisions on investments and property management.

- Reducing the risk of fines, financial loss, or operational disruptions.

What things should to remembered while accounting for real estate rentals?

1. Bookkeeping

- Proper bookkeeping is the foremost thing in real estate accounting. A proper debit and credit entry is made in the bookkeeping to ensure that the proper financial records are made.

2. Accurate tax filings

- The real estate businesses have a little different tax structure that requires they need to follow a proper order. A well-experienced accounting expert can make the proper arrangement of taxes wherever applicable and make all possible tax savings.

3. Payroll Management

- Managing the payroll system of the staff is very time-consuming; payroll management has to be made properly in accounting. Accounting software has a nice capability for payroll management.

4. Proper evaluation of assets in profitability

- The profitability of the assets has to be calculated accurately to know the profits earned in the business. The accounting method has to ensure the proper profitability of the assets.

In the real estate business, good accounting is key to doing well. Keep clear records, use the right tools, and learn about money matters. This helps real estate pros make more profit and grow over time.

Accounts Junction has a very nice experience in real estate accounting across the world. Our diligence towards providing better accounting services to the real estate business has gained them a lot of trust among their clients.

FAQs

1. Why is accounting important in the real estate business?

- It may help track property income, expenses, and taxes while supporting better investment decisions.

2. What expenses should be tracked in real estate accounting?

- Maintenance, property tax, insurance, advertising, utilities, and loan interest should be recorded.

3. Can I manage real estate accounting myself?

- Small businesses may handle it, but professional accountants reduce mistakes and ensure compliance.

4. How often should I reconcile real estate accounts?

- Monthly reconciliation may ensure accurate records and correct financial statements.

5. What is property depreciation in real estate accounting?

- It is the decrease in property value over time that may reduce taxable income.

6. How can accounting software help in the real estate business?

- It can track rent, expenses, payroll, and generate profit and loss reports automatically.

7. Should I separate personal and business finances in real estate?

- Yes, it keeps records clear, simplifies taxes, and protects your business assets.

8. Why is cash flow management crucial in real estate accounting?

- It may ensure rent, maintenance, and loan payments are covered without financial stress.

9. How should rental income be recorded in accounting?

- Track each property separately to measure profitability and simplify tax filings.

10. Which taxes are unique to real estate businesses?

- Property tax, capital gains tax on sales, and rental income tax rules may apply.

11. What is project-based accounting in real estate?

- It may calculate costs and profits for each property or development project.

12. Why is accurate bookkeeping important for real estate rentals?

- It may prevent tax mistakes, track expenses, and support profit analysis.

13. What financial reports are needed in real estate accounting?

- Profit and loss statements, balance sheets, and cash flow reports help track performance.

14. How should loans and mortgages be tracked in accounting?

- Record principal and interest separately to manage payments and tax deductions.

15. How often should property profitability be evaluated?

- Quarterly or yearly checks may show if each property meets income expectations.

16. What is passive income in real estate accounting?

- It is regular income from rentals that can be tracked for taxes and investment planning.

17. How does risk management relate to real estate accounting?

- It may reveal potential losses and prepare for market fluctuations or unexpected costs.

18. Can accounting help in deciding which property to buy or sell?

- Yes, financial records may show which properties are profitable or need improvement.

19. Why are audits important in real estate accounting?

- They may verify property records, detect errors, and ensure compliance with laws.

20. How can real estate accounting improve business growth?

- It may highlight profitable properties, reduce costs, and guide better investment decisions.