Outside Contractor Tax Form: Which Documents Do You Need to File?

Working as a contractor gives wide control over your work, yet it also brings clear tax tasks. Many contractors are not sure which forms they must file each year. Using the correct outside contractor tax form helps track income, list costs, and claim valid tax breaks. Correct filing stops fines and keeps your records neat and well-kept.

Strong planning can make tax filing calm and smooth. An outside contractor tax form also serves as proof of income when you seek loans or lease plans. When you use the right forms, keep records in good shape, and meet all due dates, the filing process moves with ease. Good order cuts errors and helps you guide your cash with full trust.

What Is an Outside Contractor Tax Form?

An outside contractor tax form is a paper that shows yearly income. It is used to report all payments from clients to the IRS.

Purpose

- This form helps calculate taxes owed and find deductions. Filing it correctly protects contractors from fines and IRS problems.

Connection to Independent Contractor Tax Document

- The Independent contractor tax document lists income, expenses, and deductions clearly. Filing it correctly shows total profit and supports tax claims.

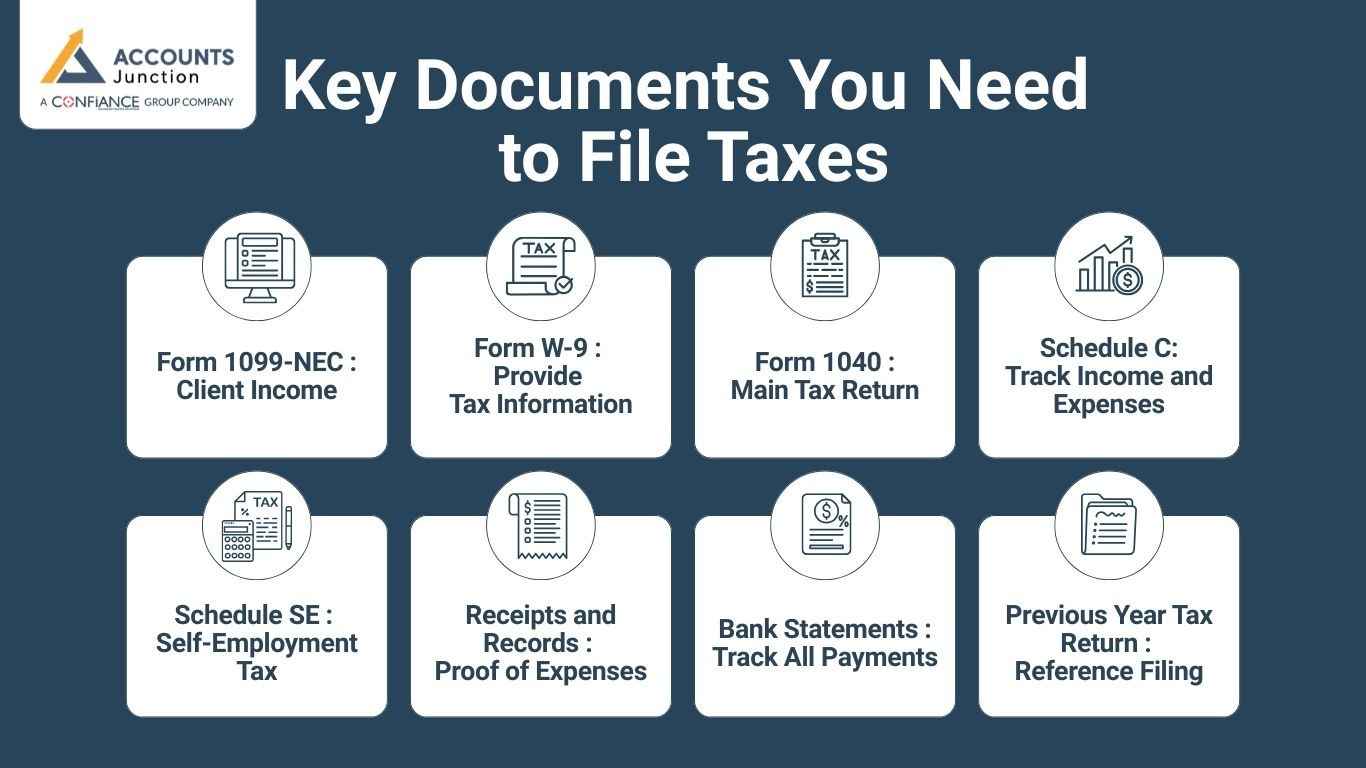

Key Documents You Need to File Taxes

1. Form 1099-NEC – Client Income

- Clients send Form 1099-NEC for payments over six hundred dollars. This form links to your outside contractor tax form for clear income reports.

2. Form W-9 – Provide Tax Information

- Form W-9 gives your tax details to clients for reporting. A correct W-9 ensures 1099-NEC forms are accurate and complete.

3. Form 1040 – Main Tax Return

- Form 1040 reports total income, deductions, and tax owed to the IRS. Contractors attach Schedule C to show business income clearly.

4. Schedule C – Track Income and Expenses

- Schedule C lists income, business costs, and net profit for taxes. It allows claiming expenses like tools, travel, and office supplies.

5. Schedule SE – Self-Employment Tax

- Schedule SE calculates Social Security and Medicare taxes for contractors. Every net profit from Schedule C must be reported using this form.

6. Receipts and Records – Proof of Expenses

- Keep receipts for travel, software, and office items carefully. They support deduction claims and make audits easier if needed.

7. Bank Statements – Track All Payments

- Bank statements confirm deposits and income reported on tax forms. Matching statements with records ensures reporting is correct and consistent.

8. Previous Year Tax Return – Reference Filing

- Use last year’s tax return as a guide for current filing. It helps track deductions, carryovers, and income consistency.

Why Filing the Outside Contractor Tax Form Matters

-

Avoid Penalties

Filing late or wrong can lead to fines and interest. Accurate filing keeps contractors safe from IRS issues.

-

Claim Deductions

The form helps reduce taxable income by claiming costs. Good record keeping ensures no eligible deduction is missed.

-

Proof of Income

It shows your earnings to lenders, landlords, and other parties. This supports credibility and proves a reliable income for financial purposes.

-

Track Finances

Forms give clear insight into income and total business costs. Organized records help plan budgets and make smart spending choices.

Tips to Prepare Your Outside Contractor Tax Form

1. Collect All Forms Early

- Gather 1099-NEC, W-9, and bank records before filing. Having all documents ready prevents delays and last-minute mistakes.

2. Organize Receipts by Category

- Sort receipts for travel, supplies, and equipment into groups. Proper categories make deductions easier to track on your Independent contractor tax document.

3. Use Accounting Software

- Apps track income and expenses automatically without errors. They generate reports ready to use on the outside contractor tax form.

4. Estimate Quarterly Taxes

- Paying quarterly prevents big bills and interest at year-end. It keeps finances steady and reduces filing stress.

5. Double-Check Client Information

- Verify client names, addresses, and tax ID numbers carefully. Correct info prevents mistakes on 1099-NEC and other tax documents.

Common Mistakes When Filing as an Outside Contractor

-

Missing Forms

Forgetting forms like 1099-NEC or W-9 causes filing errors. Always ask clients for missing forms well before deadlines.

-

Wrong Income Reporting

Even small payments must be reported to the IRS for accuracy. Missing any income may trigger audits or fines later.

-

Incorrect Deductions

Personal costs should not be claimed as business expenses. Keep personal and business records separate to avoid mistakes.

-

Late Filing

Filing after the deadline can cause fines and interest. Plan ahead to file your outside contractor tax form on time.

Additional Independent Contractor Tax Documents You Might Need

-

Form 1095-A – Health Coverage

Reports self-employed health insurance coverage for deductions or credits. It supports claims for medical costs on your tax forms.

-

Form 8829 – Home Office Deduction

Used if a space at home is used only for work. Claiming it reduces taxable income and documents legitimate business use.

-

Receipts for Assets – Tools and Equipment

Track purchases like computers, software, or work tools carefully. These reduce taxable income when reported on your tax document.

-

Mileage Logs – Track Vehicle Use

Track miles for business travel to claim deductions. Accurate logs support claims and prevent IRS questions.

Best Practices for Filing as an Outside Contractor

-

Start Early

Organize forms and receipts before tax season to stay ready. Early preparation ensures all deductions are applied correctly.

-

Keep Digital Records

Store receipts and tax forms digitally for quick access. Digital copies reduce risk of lost paperwork and simplify audits.

-

Separate Accounts

Use a business account for income and expenses only. It prevents mixing personal and business funds and simplifies tracking.

-

Consult a Professional

Accountants help ensure accurate filings and claim all deductions. They provide guidance for 1099-NEC, Schedule C, and SE forms.

Tax Deadlines for Contractors

Contractors must pay taxes on time to avoid fines. Late payments add fees that can grow very quickly.

-

Quarterly Payments

Pay taxes four times each year: April, June, September and January. Check amounts owed before each due date to avoid issues.

-

Year-End Filing

File Form 1040 by April to stay within the law. Include all payments, receipts, and any business costs claimed.

-

Extensions

You can ask for more time, but still pay taxes. Late payment without filing still leads to fines and fees.

Use a calendar or set reminders to track all dates. Missed deadlines may cost money and create stress quickly.

Common Deductions for Contractors

Deductions reduce the tax you pay and save money. Keep good records to prove every cost claimed is real.

-

Home Office

Deduct rent, power, and net if used for work only. Measure the area to claim only the part used.

-

Supplies and Tools

Claim pens, paper, computers, and apps used for work. Keep receipts safe to show proof if the IRS checks.

-

Travel and Miles

Claim work trips and miles used on business travel. Write down dates, places, and cost for each trip.

-

Help from Professionals

Fees for accountants or lawyers can be claimed as costs. These services save time and reduce the chance of errors.

How to Avoid Common Tax Mistakes

Errors are common for workers who file taxes alone. Following simple steps lowers risk of fines or issues.

-

Check Forms

Verify client names, numbers, and IDs before submission. Even small mistakes can trigger IRS notices and penalties.

-

Record All Income

Track each payment, even small ones. This helps keep your outside contractor tax form correct and full.

-

Keep Accounts Separate

Use one account for work, another for personal spending. This helps track money clearly for taxes and reports.

-

Update Monthly

Update income and costs each month to avoid a rush. Monthly updates prevent mistakes and save time later.

Tools and apps can track income and costs with ease. They cut errors and make tax filing much simpler.

Using Accounting Tools for Contractors

Apps make taxes and reports faster and more accurate. These tools save time and reduce human mistakes in filing.

-

Track Income

Apps can read bank records and sort payments fast. This keeps all income clear and ready for forms.

-

Track Costs

Apps save receipts and add up costs for each item. This ensures all business costs are counted for taxes.

-

Make Reports

Generate reports for income, costs, and totals fast. These reports help fill your outside contractor tax form with ease. Reports make it easy to complete your tax forms correctly.

-

Audit Help

Good files help answer IRS questions with less stress. Digital records make audits faster and easier to handle.

Tax Benefits for Contractors

Self-employed workers have ways to lower taxes legally. Using these rules can help keep more money earned.

-

Retirement Plans

Save for the future and cut taxes by paying into plans. Self-employed plans let you save money each month steadily.

-

Health Insurance

If you pay for your plan, it may be a deduction. This can reduce the tax you owe at year-end.

-

Business Losses

Losses from work can offset other income for tax. These figures must be clear on your Independent contractor tax document. Keep records to report losses correctly and reduce total tax.

-

Work Classes

Classes or training needed for work can be deducted. Keep proof to show costs are only for work.

Record Retention Guidelines for Contractors

Good records protect you if the IRS checks your work. Well-kept files save time and reduce stress during audits.

-

Retention Period

Keep all tax papers for three to seven years. Some special cases may require longer storage of files.

-

Receipts

Save receipts for all work costs claimed on forms. These support the claims on your outside contractor tax form. These prove costs are real if the IRS asks for proof.

-

Digital Copies

Scan or take photos to store a safe backup. Digital files are easy to save and do not get lost.

-

Client Files

Keep invoices, contracts, and emails from all clients. These prove income and show that work was completed.

Understanding the outside contractor tax form is vital for self-employed workers. Collecting all documents, including the Independent contractor tax document, ensures accurate filing and fewer mistakes. Clear records make deductions easy to claim and simplify audits.

When money tasks pile up, some turn to support from skilled people. This is where a firm like Accounts Junction may play a strong role. We work with small and mid-sized firms that need steady care for their books. We handle daily records, monthly books, and year-end tasks in a neat and calm way. Our team aims to give clean books so owners can focus on growth. When you partner with Accounts Junction, your firm may gain more time, more space, and more trust in its own numbers.

Filing correctly protects earnings, builds credibility, and ensures financial peace. Organized preparation makes completing the outside contractor tax form simple and stress-free.

FAQs

1. What is an outside contractor tax form used for?

- It reports yearly income for contractors to the IRS authorities.

2. Do all clients provide a 1099-NEC?

- Only clients who pay more than six hundred dollars must provide one.

3. Can I file taxes without a W-9 form?

- Filing without it can lead to wrong reporting of income.

4. Is Schedule C mandatory for all contractors?

- Yes, it reports income, expenses, and net profit for taxes.

5 How do I track deductible expenses efficiently?

- Use spreadsheets or software to organize and categorize expenses.

6. What happens if I miss filing the outside contractor tax form?

- Missing forms can trigger fines, interest, and IRS audits.