Independent Contractor Tax Forms Every Self-Employed Worker Must File

Working as a self-employed worker gives the freedom to pick clients and jobs. It also means you must track your money and pay taxes on your own. Many do not know which independent contractor tax form to file each year. Filing the right forms keeps records clear and avoids IRS fines.

Self-employed workers track income, costs, and taxes each year in four parts. Using the right independent contractor 1099 tax form makes reporting easy. Knowing due dates, forms, and write-offs helps workers manage taxes. Good records and clear steps make filing faster and less tense.

Understanding Independent Contractor Tax Forms and Obligations

Contractor Status

- Contractors work without bosses telling them what to do each day. They set their own hours and deadlines and pick which clients to serve.

- Knowing your status shows which independent contractor tax form and taxes you must file. Mistaking your status can lead to fines or IRS notices.

Why Filing Forms Matters

- Filing the correct independent contractor tax form avoids fines, errors, and extra interest. It allows contractors to claim costs and reduce taxable income legally.

- Filing the correct independent contractor tax form on time keeps order in records and reduces audit risks. Clients may also need proof of filing for their own books.

Self-Employment Taxes

- Contractors pay both income tax and self-employment tax yearly. Self-employment tax funds social security and Medicare for future benefits.

- Paying the right amount on each independent contractor tax form avoids penalties or interest later. Knowing rates helps plan tax payments across the year safely.

Common Filing Mistakes

- Contractors may miss income or forget to file an independent contractor tax form. Wrong deductions or misreported costs often trigger IRS checks.

- Not tracking multiple 1099 forms leads to underreporting of income. Checking records regularly prevents these common mistakes before deadlines.

Keeping Records

- Keep receipts, bills, and bank notes for correct reporting. Use spreadsheets or software to track money received and spent.

- Records support claims for home office, car, and software costs. Clear records make audits easier and less stressful for workers.

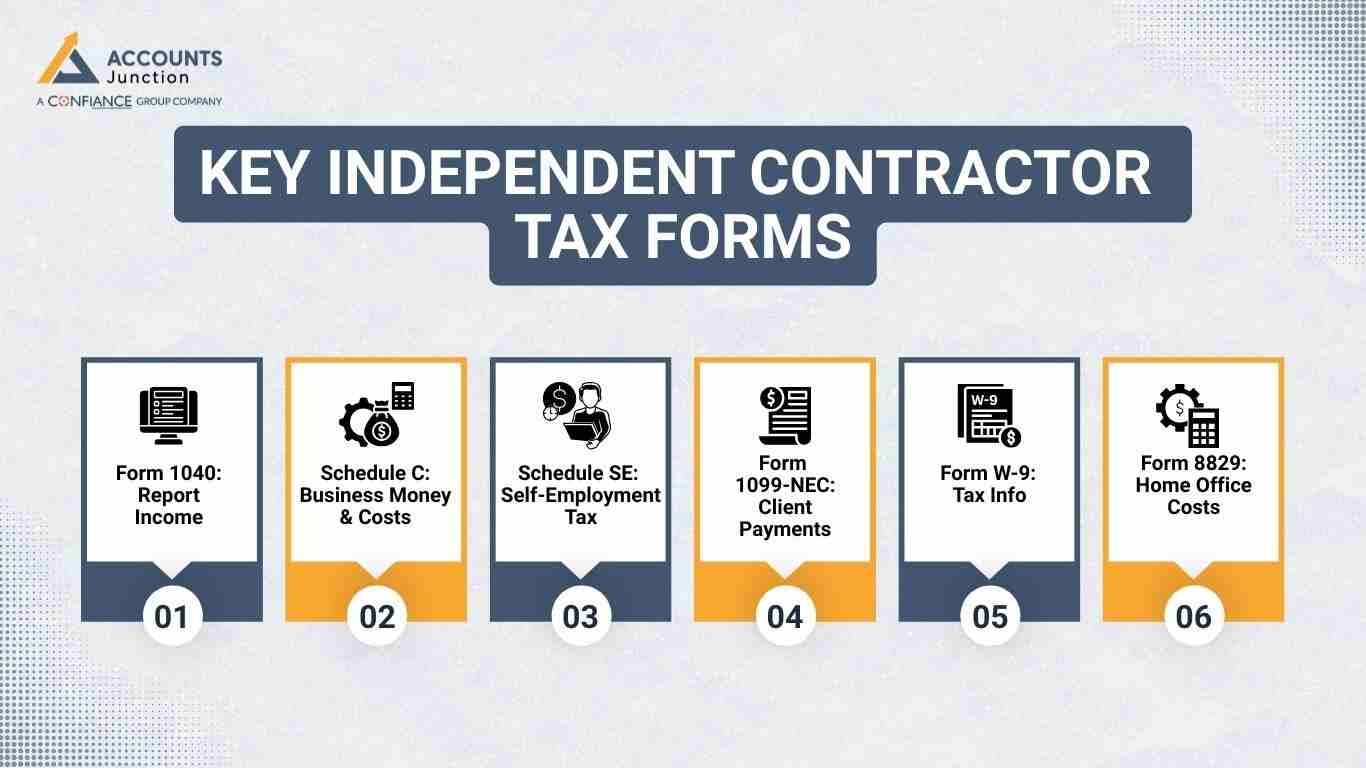

Key Independent Contractor Tax Forms

Form 1040: Report Income

- Form 1040 is the main tax form for independent workers. It shows all income and costs to the IRS.

- It also Include freelance pay, side jobs, and contract work. Reporting all money avoids fines for missed or low tax payments.

Schedule C: Business Money & Costs

- Schedule C is an important independent contractor tax form that lists money earned and work costs for deductions. Travel, office tools, and software reduce taxable income legally.

- Careful categorizing avoids errors and helps claim more deductions. Even small costs like pens or subscriptions can be included.

Schedule SE: Self-Employment Tax

- Schedule SE calculates taxes for Social Security and Medicare. It applies to net earnings from all contract work.

- Filing Schedule SE ensures correct tax payment and avoids fines. Contractors can plan quarterly payments using Schedule SE totals.

Form 1099-NEC: Client Payments

- Form 1099-NEC is the main independent contractor 1099 tax form showing payments over $600 from each client yearly. Clients must send copies to both contractors and the IRS.

- Having many clients may mean receiving multiple 1099 forms each year. Accurate reporting avoids mistakes in total income calculations.

Form W-9: Tax Info

- Form W-9 is a simple independent contractor tax form that gives contractor information to clients for correct reporting. It helps clients prepare accurate 1099 forms for IRS filing.

- Keeping a W-9 ready avoids delays in payments from clients. Updating info yearly reduces errors in tax reporting and forms.

Form 8829: Home Office Costs

- Form 8829 claims deductions for a home office used for work. Costs include rent, internet, utilities, and repairs used for business.

- Only the work-use part can be claimed to avoid IRS questions. Measure space and keep records to support home office claims.

Form 1099 Filing Tips for Contractors

Track Income Often

- Write down payments as soon as they come in to avoid errors. Use spreadsheets or software to track money from each client.

- Tracking income makes filling Schedule C and Form 1040 easier. Regular checks also help plan quarterly tax payments correctly.

Keep Accounts Separate

- Use separate accounts for personal and work money to avoid mistakes. This makes audits simple and shows a clear separation of funds.

- Business accounts make tracking and reporting simpler and safer. Mixing money may raise questions from the IRS or clients.

Pay Taxes Quarterly

- Pay taxes four times a year to avoid big year-end bills. Form 1040-ES helps calculate income and self-employment tax payments.

- Paying correctly reduces penalties and interest on unpaid taxes. Check income trends to adjust quarterly payments as needed.

Keep Proof of Costs

- Save receipts, invoices, and statements for all business purchases. Digital copies make records safe and easy to find when needed.

- Proof helps claim costs for home office, car, and work tools. Good order reduces issues in case of IRS checks or audits.

Follow IRS Changes

- Rules for taxes and deductions change every year. Following updates on independent contractor tax forms ensures claims are correct and reduces mistakes.

- IRS newsletters or professionals help keep info up to date. Being aware avoids fines or late filing penalties.

Understanding the Independent Contractor 1099 Tax Form

Purpose of 1099-NEC

- Form 1099-NEC is the main independent contractor 1099 tax form that shows payments above $600 to the IRS. It helps clients and contractors check reported income is correct.

- All payments above $600 must be reported to avoid issues. The form ensures income is clear and reported properly.

Who Gets 1099 Forms

- Contractors get 1099 forms from clients paying over $600. Multiple clients may send several forms in the same year.

- Tracking all independent contractor 1099 tax forms ensures total income is reported on Form 1040. Missing forms may lead to IRS fines or checks.

Deadlines

- Clients must send the independent contractor 1099 tax form by January 31 each year. Contractors include this income on their yearly tax returns.

- Meeting deadlines avoids late fees and ensures smooth filing. Getting forms early reduces stress during tax preparation time.

Common Errors

- Common mistakes include missing an independent contractor 1099 tax form, entering wrong amounts, or using wrong IDs.

- Check all forms carefully to avoid IRS notices or audits. Keep a list of forms you get to make sure all income is counted.

Electronic Filing

- Filing online is faster, safe, and lowers mistakes. Paper filing is slow and can have errors.

- Many accounting tools let you file 1099 forms online. Electronic copies give proof of filing right away.

Other Important Tax Forms

Form 4562: Depreciation

- Form 4562 allows a deduction for equipment and business tools. Computers, desks, or other work tools qualify for a deduction.

- Tracking depreciation cuts taxable income over the life of tools. Clear records ensure totals are right each tax year.

Form 1040-ES: Estimated Taxes

- Form 1040-ES helps calculate quarterly tax payments to avoid fines. It covers income tax and self-employment tax for contractors.

- Paying regularly stops large year-end tax bills and extra charges. Accurate estimates reduce stress and make filing easier.

Form 941: Payroll Taxes

- Needed if contractors hire staff or temporary help. Reports income tax, social security, and Medicare to the IRS.

- Quarterly filing keeps payroll legal and avoids fines. Good records make reporting accurate and simple.

State Tax Forms

- Some states require additional independent contractor tax forms for income or work taxes. Check state rules to avoid missed deadlines and penalties.

- Forms differ by state and business type. Filing properly keeps you safe from fines and audits.

Common Tax Deductions for Contractors

Home Office Costs

- Claim deductions for a home office on your independent contractor tax form. Costs like utilities, internet, and repairs qualify partially.

- Measuring space ensures correct deduction for each year. Good records prevent IRS issues during checks or audits.

Vehicle Costs

- Business trips or car costs are deductible. Track miles, fuel, and repairs for proof purposes.

- Local and long trips for work can count as deductions. Proper logs ensure maximum deduction without IRS issues.

Supplies and Software

- Office items, computers, and software used for work are deductible. Keep receipts for all items to claim on Schedule C.

- Subscriptions for business can also be included. Good order ensures deductions survive IRS checks.

Health Insurance

- Premiums for health plans can reduce taxable income. Coverage can include contractor, spouse, and children.

- Plans must be eligible to get deductions. Keep records to support claims during filing and audits.

Professional Services

- Accountants, consultants, or legal help for business are deductible. These costs reduce taxable income and support business operations.

- Keep invoices to prove claims if IRS questions arise. Hiring experts can save more than it costs in taxes.

Tips for Smooth Filing

Use Accounting Software

- Software tracks income, costs, and forms easily. Reports make tax filing simple and faster each year.

- Automation reduces errors and saves time during busy seasons. Tools can link with 1099 and 1040 forms for ease.

Hire Professionals

- Tax experts ensure forms are correct and deductions claimed. They cut mistakes, prevent penalties, and save time.

- Professional help is useful for complex deductions or multiple forms. Experts keep contractors safe from IRS issues.

Start Early

- Preparing taxes early reduces stress and mistakes. Collect receipts and forms before deadlines for accuracy.

- Starting early gives time to fix missing or wrong information. It ensures all deductions are claimed properly.

Check Numbers Carefully

- Totals must match invoices, bank statements, and forms. Errors may trigger audits or delay refunds unnecessarily.

- Double-check numbers to prevent underpayment or reporting mistakes. Verification improves confidence before filing with the IRS.

Stay Updated

- Tax rules change every year, affecting forms and deductions. Following updates helps contractors stay compliant and avoid fines.

- Newsletters or experts keep information current. Being aware reduces mistakes and maximizes deductions.

Filing the correct independent contractor tax form is key to staying compliant and following IRS rules. Schedule C, SE, 1099, and W-9 help report income correctly. Filing on time and keeping clear records reduces mistakes and IRS stress.

Accounts Junction provides accounting and bookkeeping services for self-employed workers. We track income, costs, and tax forms through the year. Using Accounts Junction helps claim all deductions and file easily.

Contractors can focus on work while rules are done right. Experts help saves time, cuts mistakes, and keeps taxes clear.

Understanding the independent contractor 1099 tax form gives peace of mind. It keeps contractors compliant while managing income and business costs correct.

FAQs

1. What is an independent contractor tax form?

- It shows the money earned by self-employed workers to IRS. It also helps track taxes and claim work costs.

2. How do I file an independent contractor 1099 tax form?

- Report money from clients using Form 1099-NEC each year. Filing right keeps you safe from IRS fines.

3. When do independent contractors get Form 1099-NEC?

- Clients send it by January 31st every year. It lists all the money paid in the past year.

4. Which forms do independent contractors need to file?

- Main forms are 1040, Schedule C, SE, and 1099. Other forms may apply for work costs or claims.

5. Can missing a 1099 form cause tax issues?

- Yes, it can lead to IRS fines or extra tax. It can also delay your tax return or refund.

6. Are independent contractor tax forms required for all money?

- Yes, all earned money must be shown to the IRS. Not reporting may cause audits or IRS fines.