Independent Contractor Form 1099 Explained in Simple Words

Many people hear the term independent contractor form 1099 and feel unsure about what it truly means. Some view it as a strict tax form, while others see it as a simple money record. In practice, the form may serve as a clear guide for people who do not work as regular staff. It may show what they earned, who paid them, and how these amounts may fit into their yearly tax plan. With simple words and calm pacing, this guide aims to explain the form with clarity.

Understanding the Purpose of the Independent Contractor Form 1099

The independent contractor form 1099 may exist to serve one main purpose. It may record the payment a firm made to a worker who did not serve as a staff member. Regular staff may have taxes taken out each month. Independent workers may not have that process. The form may therefore act like a neutral list of payments. It may present the total income paid by a firm during the year. This clear record may help both sides. It may help the payer meet rules. It may help the worker prepare a clean tax file.

Some workers may see the form as complex. Others may see it as a normal part of their work life. Once you break the form into smaller parts, the idea may appear far more simple. The form may only aim to note what a worker earned. It may not judge their skill, their time, or their role. It may simply report a number that reflects their work income.

How the Form 1099 Supports Self-employed contractors

1. Helps Track Multiple Tasks

- Self-employed contractors handle clients, income, costs, and time. They plan hours and accept work that matches their pace.

2. Serves as a Key Income Guide

- Since contractors do not get staff pay slips, the Form 1099 tracks income. It acts as a quiet but useful record of earnings.

3. Organizes Earnings by Client

- Workers may place each form in a single folder. At year-end, the folder shows a full picture of their income.

4. Supports Goal Setting and Planning

- The records may help set new goals or adjust rates. Workers may refine schedules or plan projects using the income view.

5. Provides a Dual Purpose

- The independent contractor form 1099 works as both a record and a planning tool. It gives clear numbers while supporting future work decisions.

When the Independent Contractor Form 1099 Is Issued

1. Typical Arrival Time

- The form usually comes near the end of January. Firms prepare it once the year closes.

2. Delivery Methods

- Forms may arrive by mail or email, depending on the payer. Some firms may send them early if books close fast.

3. Handling Delays

- Small delays may occur due to staff workload or administrative tasks. Contractors may contact the payer calmly to request a resend.

4. Importance of Timely Forms

- Most payers understand the value of sending forms on time. Timely forms help contractors stay organized during tax season.

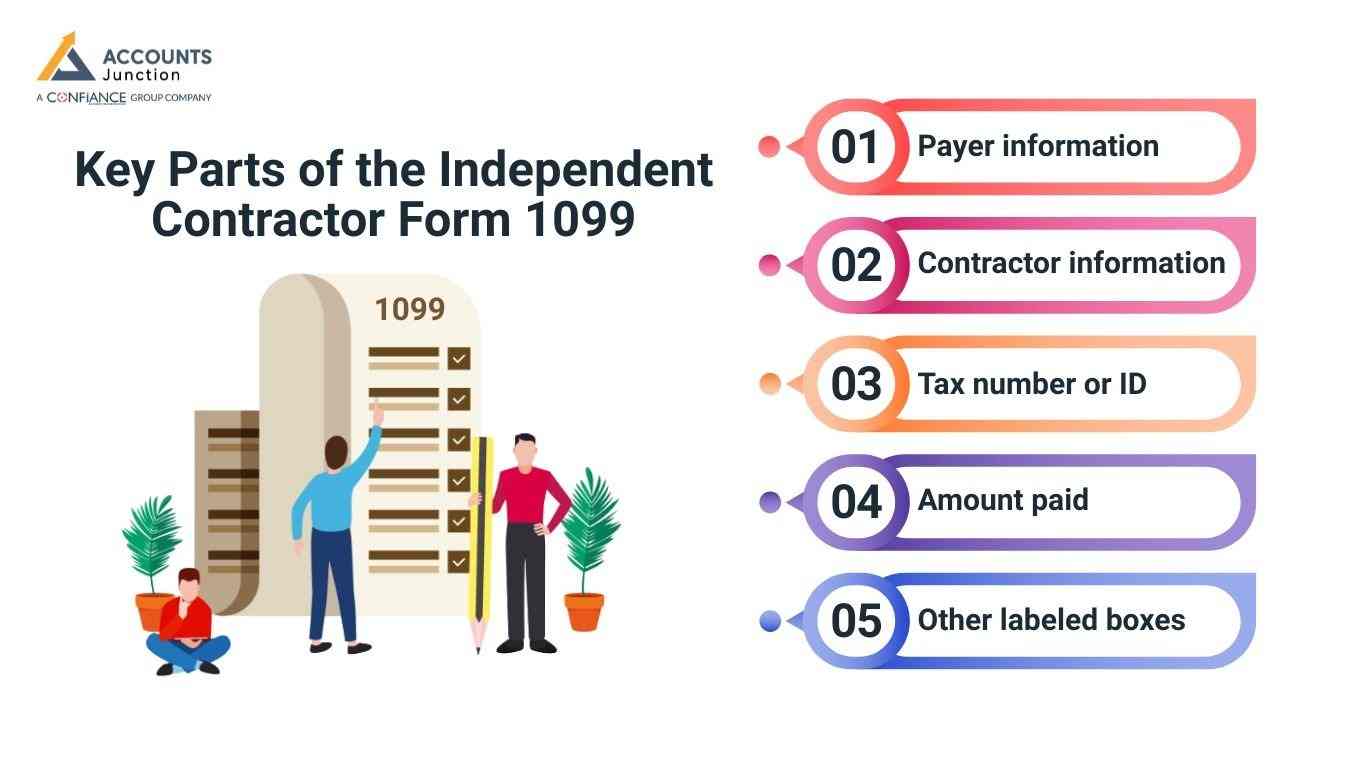

Key Parts of the Independent Contractor Form 1099

Though the independent contractor form 1099 may look formal, it carries clear and direct parts. These parts may appear in small boxes on the form. Each box may reflect a needed detail.

-

Payer information

This may show the name and address of the firm that paid you.

-

Contractor information

This may reflect your own name and address.

-

Tax number or ID

This may link the form with your tax file.

-

Amount paid

This may list the total income you earned from that payer.

-

Other labeled boxes

Some boxes may reflect special notes. They may not apply to most workers. Still, they remain part of the form layout.

Each part may work together to create a clean record. When the worker reads it slowly, the form may feel clearer than it first thought.

Why This Form Matters in Tax Time

1. Tracks Income for Independent Workers

- Independent workers may not have tax withheld from their earnings. The independent contractor form 1099 helps track total income from each payer.

2. Supports Accurate Tax Filing

- Workers can gather all forms and organize them into their tax file. This ensures reported income matches what they actually earned.

3. Prevents Mistakes and Errors

- Without the form, workers may guess amounts or rely on notes. The form provides clear proof of earnings to reduce errors.

4. Does Not Set Tax, Only Shows Income

- The form lists income but does not specify the tax rate. It shows totals only, helping workers calculate taxes themselves.

5. Reduces Stress During Tax Season

- Using the form may bring clarity and order to financial records. It supports a calm, structured approach to filing taxes.

The Difference Between a Form 1099 and a Staff Pay Slip

1. Tax Withholding

- Regular staff pay slips usually show tax deducted each month. The self-employed contractor from 1099 does not show any tax withheld.

2. Hours and Work Details

- Pay slips often display hours worked and pay breakdowns. Form 1099 only shows the total amount paid, without detailed work hours.

3. Net vs. Gross Income

- Staff pay slips may list net pay after deductions. Form 1099 lists gross income, reflecting full earnings before taxes.

4. Record Keeping for Contractors

- The form acts primarily as a record of income earned. Contractors can use it to track payments and organize financial records.

5. Flexibility and Control

- Independent workers may enjoy more control over their work schedule. The form supports clean personal tracking and planning for future work.

Common Myths About the Independent Contractor Form 1099

Some myths may cause confusion. Many workers may worry about the form without reason.

1. Myth: The Form Means You Owe More Tax

- Some workers may think the form increases their tax liability. The form only shows what you earned, not tax owed.

2. Myth: The Form Judges Your Work

- Some may feel the form evaluates their performance or skill. It does not judge work. It only records income.

3. Myth: The Form Makes Tax Time Harder

- Workers may worry the form adds stress during tax season. The form may reduce stress with clear income records.

How to View These Myths Calmly

Once reviewed, these myths may seem less concerning. The form’s main purpose is to provide accurate income tracking.

How the Form Helps Workers Track Growth

1. Builds a Yearly Income Record

- Independent workers may keep each independent contractor form 1099 in a folder. This helps create a full record of yearly pay.

2. Shows Regular Clients and Income Trends

- The forms may show which clients give steady work. They may also show which months have more or less income.

3. Helps Plan Goals

- Workers may use the forms to set new projects or money goals. They may also change rates based on past work with clients.

4. Encourages Simple Money Tracking

- Some workers use notebooks or apps to track sums from each form. These small habits help plan money and keep things clear.

5. Supports Long-Term Work Stability

- Tracking income may help workers make better choices for future projects. Over time, these habits may lead to a steadier work path.

How Firms Use the Independent Contractor Form 1099

1. Follows Rules and Compliance

- Firms may use the independent contractor form 1099 to meet tax rules. They may record all payments made to contractors for proper reporting.

2. Sends Clear Income Records

- The form may be sent to the worker and the tax office. This helps keep records clear and the system organized.

3. Builds Trust with Contractors

- Providing the form may help workers trust the firm. It acts as a clear link showing income and payment details.

4. Tracks Contractor Costs

- Firms may use the form to see total payments made to each contractor. This helps them monitor spending and manage yearly costs.

5. Supports Budget Planning

- The recorded amounts may help plan budgets for the next year. It may guide firms in setting spending limits and hiring plans.

How to Handle the Form with Ease

Workers may follow simple steps to keep the form safe.

-

Store each form in one folder

Place all forms in one secure place for later use.

-

Check your name and income

Make sure the details match your own records.

-

Reach out if you see errors

A simple request may fix a small issue fast.

-

Match each form with your notes

This may help build a complete income picture.

-

Keep a copy for tax time

This may support smooth filing and reduce stress.

These steps may help any worker feel calmer and more in control.

Why the Form May Feel Less Complex Over Time

The first time a worker sees the independent contractor form 1099, it may feel formal. With each year, the form may feel easier to read. The worker may become familiar with each part. They may handle it with confidence and ease. The form may become a simple part of their yearly routine.

Workers who track their income may feel more prepared. They may set aside notes each week. They may record income often. With these habits, the form may fit smoothly into their file.

The form may look serious, yet its purpose remains simple. It may serve as a record. It may help the worker prepare taxes. It may keep the system clean. It may guide future plans. It may reflect the work done. With this view, the form may feel less stressful and more useful.

Independent contractor Form 1099 filing becomes easier when you keep clear records, track each payment, and follow IRS rules with care. Small errors lead to delays, but strong systems keep your books clean and your filings accurate. Accounts Junction provides full 1099 preparation and filing services for small firms and growing businesses. Our team of certified experts handles data checks, form creation, deadline tracking, and error reviews so you stay compliant and avoid stress during tax season.

FAQs

1. What is the purpose of Form 1099 for contract workers?

- It records the total income paid to a worker during the year. This helps with taxes and keeps financial records organized.

2. When should I receive the independent contractor form 1099?

- Most workers receive it by late January every year. Early delivery may occur if the payer closes books quickly.

3. How do I verify the details on my Form 1099?

- Check your name, address, and the total income listed. Also confirm that the payer’s information matches your records exactly.

4. What should I do if Form 1099 has incorrect information?

- Contact the payer immediately to request a corrected form. Most payers fix minor errors promptly after reviewing the details.

5. Can a self-employed contractor receive multiple Form 1099 documents?

- Yes, each payer may send a separate form for their payments. This helps contractors track income from multiple clients accurately.

6. Do I need Form 1099 for filing taxes?

- It is not always required, but it helps confirm yearly income. It ensures that your tax return aligns with official payer records.