Major difference between Accounts payable and accounts receivables

Every business deals with bills and payments, yet not many know the two sides of finance. Some days, cash goes out to pay for things the company needs. On others, money flows in from people who owe for what they bought. There’s a major difference between accounts payable and accounts receivable.

At first glance, both may sound almost alike. After all, both sit around numbers and due dates. But looking a little closer, you may notice the difference. One shows what the business owes to others. The other, about what others owe to the business.

The balance between them shows how healthy business cash flow feels. Too much on one side, and the business might struggle to breathe. A smooth balance, though, can make things run with ease. In this blog, we’ll see how Accounts Payable differs from Accounts Receivable, how both shape business flow, and why knowing their difference can make day-to-day work far more simple.

Understanding Accounts Payable and Accounts Receivable

Accounts Payable — The Outgoing Side

When a business buys goods or services but does not pay right away, that unpaid amount may become accounts payable. It is like a short-term promise. The business can owe that money to vendors or suppliers.

A company may receive an invoice, store it for later payment, and mark it as pending. The payable list grows each time the company buys something on credit. Paying those bills on time may help the business keep trust with suppliers and maintain its good name.

Accounts Receivable — The Incoming Side

Now picture the other side. When your business sells something to a client and agrees to collect the payment later, that amount may turn into accounts receivable.

It is money that others may owe you. A promise of income that has yet to arrive. Your sales team may send invoices, wait for responses, and remind clients politely.

The receivable list may rise each time you sell more on credit.

The main difference between accounts payable and accounts receivable

At first, both may seem like simple terms in your ledger. But the difference between accounts payable and accounts receivable lies in the direction of cash.

- Accounts payable may represent what you owe to others.

- Accounts receivable may represent what others owe to you.

One deals with outgoing money. The other handles incoming money. One reduces your balance, the other may increase it. Together, they may paint a full picture of how cash moves inside your business.

How Each One Works

The Path of Accounts Payable

The process may begin when a supplier sends you a bill.

Steps may include:

- The invoice arrives and gets recorded.

- The product or service is verified.

- The payable team checks the details and sets a due date.

- The manager may approve the payment.

- Finally, the company pays the supplier before or on the due date.

Each step may look simple, yet missing one may cause confusion or delay.

The Path of Accounts Receivable

This one may begin when you send a bill to your client.

Steps may include:

- You record the sale and prepare the invoice.

- You deliver goods or provide services.

- You send the invoice to the client.

- The receivable team may follow up near the due date.

- Once the client pays, the entry is cleared.

Both sides mirror each other — one records what leaves, the other what enters.

From Balance Sheet Point of View

When you open a balance sheet, accounts payable may appear under liabilities, because it shows what you owe. Accounts receivable may sit under assets, since it reflects future income.

This placement may help you read your company’s financial story. Payables may tell what you still have to settle. Receivables may tell what you are waiting to receive.

If receivables rise too much, cash may get locked in unpaid bills. If payables stay too high, it may mean the business is delaying payments too often.

Cash Flow Connection

Cash flow may be the bridge between both.

When receivables come in slowly, cash may dry up even when sales look good. When payables pile up too fast, your available balance may fall short.

A company can have high revenue on paper but still face a cash shortage if customers delay their payments. On the other side, a business that pays too early may run out of working cash.

Balancing both sides may help the business breathe smoothly.

The Role of Timing

Timing may change everything.

If receivables arrive before payables are due, your business may stay safe. If they come after, you may face a tight gap.

That is why many firms try to match due dates — collecting from clients before paying suppliers. This rhythm may not always be perfect, but it can make your operations steady.

Challenges Businesses Often Face

1. Late Payments from Clients

- Sometimes, customers take longer than expected to pay. Cash may freeze, and plans may wait.

2. Forgetting Due Dates

- Missed vendor payments may hurt your reputation.

3. Unclear Records

- Invoices misplaced or wrongly entered may confuse financial reports.

4. Weak Follow-Ups

- A lack of gentle reminders may lead to more unpaid invoices.

5. Cash Flow Gaps

- When money in and out does not align, even a strong business may stumble.

Best Practices for Managing Accounts Payable and Accounts Receivable

Managing Accounts Payable

- Keep all invoices stored safely.

- Confirm every bill before recording.

- Use clear approval steps.

- Plan payments to avoid late fees.

- Stay friendly with suppliers.

Managing Accounts Receivable

- Send invoices right after each sale.

- Remind clients politely near due dates.

- Keep a regular check on overdue accounts.

- Offer small discounts for early payment.

- Record every transaction cleanly.

When both are handled with care, cash may move smoothly.

While accounts payable may point outward, and accounts receivable may point inward, they both form two halves of one story.

Think of them as a pair of open doors. Cash flows out from one and returns through the other. Without either, your business may not move.

A strong manager may not only track both but also read the patterns — when money comes in, when it goes out, and how those times may align.

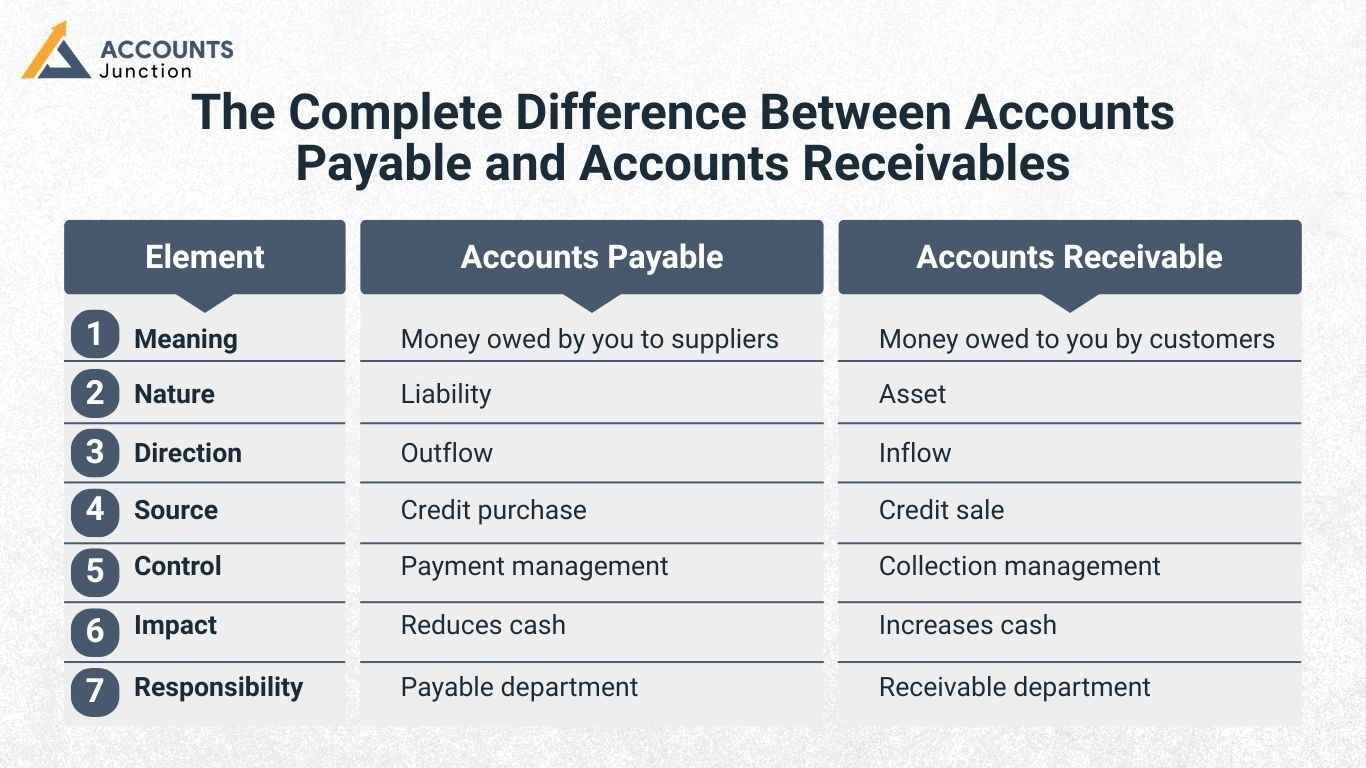

The Complete Difference Between Accounts Payable and Accounts Receivables

To see them clearly side by side:

|

Element |

Accounts Payable |

Accounts Receivable |

|

Meaning |

Money owed by you to suppliers |

Money owed to you by customers |

|

Nature |

Liability |

Asset |

|

Direction |

Outflow |

Inflow |

|

Source |

Credit purchase |

Credit sale |

|

Control |

Payment management |

Collection management |

|

Impact |

Reduces cash |

Increases cash |

|

Responsibility |

Payable department |

Receivable department |

The two may seem to reflect each other like a mirror, yet the reflection holds the secret to liquidity, timing, and balance.

How the Difference Affects Business Decisions

When planning budgets, knowing what you owe and what you will receive may change your approach. You may delay some payments to protect cash. Or you may speed up collections to fund upcoming bills.

Credit policies may grow from this understanding. Businesses often adjust payment terms with clients and suppliers to keep the flow healthy.

Without clarity, even profitable companies may run short of usable money.

Key Points to Remember

- Accounts payable shows what you owe.

- Accounts receivable shows what others owe you.

- Payables live under liabilities, receivables under assets.

- Both affect cash flow in opposite ways.

- Managing both may help avoid liquidity issues.

- Balanced timing may lead to financial peace.

So when we talk about the difference between accounts payable and accounts receivables, we may not just compare two terms. We may see two movements of one cycle. One releases, and one returns. Business, in its pure form, may depend on how well these movements balance together. Hence, management of both is essential.

At Accounts Junction, we handle management of both for many companies and businesses. Do you want to outsource your accounts payable and accounts receivable management to experts? Contact us now to know how we can change your business with our AP and AR management services.

FAQs

1. Why might the difference between Accounts Payable and Accounts Receivable matter for a business?

- The difference may show how money flows in and out, helping the business sense its cash strength and plan next moves.

2. When may Accounts Payable rise faster than Accounts Receivable in a company?

- That may happen when a firm buys more goods or services on credit than it sells to customers.

3. How can Accounts Receivable give a sign of how well a company earns from credit sales?

- A rising Accounts Receivable balance may suggest that more customers are trusting the firm to pay later.

4. What may cause a delay in clearing Accounts Payable with suppliers?

- A tight cash cycle or slow sales may push the company to wait longer before paying its dues.

5. How might Accounts Payable and Accounts Receivable together reflect business health?

- A steady balance between what is owed and what is earned may show that the company runs on a smooth track.

6. Why can Accounts Receivable be seen as an asset in business books?

- It represents money that customers may soon bring in, which can add to the company’s value.

7. Why may Accounts Payable appear under liabilities in accounting records?

- It shows the amount that the company still owes to suppliers and needs to pay soon.

8. How can a company improve the management of Accounts Receivable?

- By sending friendly reminders, setting due dates, and offering small rewards for early payments.

9. What role may Accounts Payable play in maintaining vendor trust?

- Timely payments may build strong ties, and vendors can feel safe in offering better deals.

10. Why could the difference between Accounts Payable and Accounts Receivable change each month?

- Changes in sales, purchases, or payment terms may shift the numbers from one side to the other.

11. How might a growing Accounts Receivable balance affect cash on hand?

- The cash may tighten for a while since the money is still with customers until they pay.

12. When can Accounts Payable give a short-term benefit to a business?

- When a company uses goods first and pays later, it may keep more cash free for daily needs.

13. How can mismatched records of Accounts Payable and Accounts Receivable cause confusion?

- Unclear data may hide what is truly owed or earned, leading to wrong plans or late payments.

14. Why may an accountant often compare Accounts Payable and Accounts Receivable?

- Comparing both may help check if the business has enough funds to clear dues on time.

15. How can automation tools change the handling of Accounts Payable and Accounts Receivable?

- Such tools can record, track, and alert users about due dates, which may reduce manual errors.

16. What may happen if Accounts Receivable stays unpaid for a long period?

- The money may turn into bad debt, lowering the actual income of the business.

17. Why might Accounts Payable be seen as a sign of business scale?

- A higher payable balance may hint that the firm is buying more to meet bigger customer demand.

18. How can Accounts Receivable influence company planning for future expenses?

- Expected receipts may guide when and how the company can spend on new ideas or goods.

19. What risk may come when Accounts Payable is ignored for too long?

- Suppliers may lose trust and can stop services or goods until old dues are cleared.

20. How could comparing Accounts Payable and Accounts Receivable help in judging profit cycles?

- The balance between both may reveal whether income flows faster than expenses over time.