Lawyer Bookkeeping 101: A Guide for Busy Attorneys

A law firm works best when money is tracked well. Lawyer Bookkeeping is more than numbers; it shows the health of your firm. By noting cash, payments, and client trust funds, lawyers can avoid mistakes and plan smart. Even small habits, like updating books each day or checking client funds each week, make a big change over time. Good bookkeeping shows where cash comes from, where it goes, and if the firm earns enough to grow. It also makes taxes, checks, and reports much easier. With a simple system, keeping books can become an easy part of the day. This guide will help busy lawyers handle cash with less stress, make reports clear, and spend more time with clients and cases, instead of chasing numbers all the time.

What is Bookkeeping 101?

Bookkeeping means noting all cash that comes in and goes out. For lawyers, it is more than bills and payments. It also means keeping client money safe, billing clients correctly, and seeing how the firm is doing with cash.

Why Lawyer Bookkeeping Is Important

Bookkeeping may seem dull, but it is very important. It helps with:

- Keep client money safe – Client cash should not mix with firm money.

- Pay taxes on time – Clear books make taxes easy.

- See what makes cash – Know which cases or work bring in money.

- Make smart choices – Plan for staff, ads, and costs.

Without accurate lawyer bookkeeping, errors can happen, cash can run low, and stress can grow. A few small habits each week make it easy to note money and keep the firm running well.

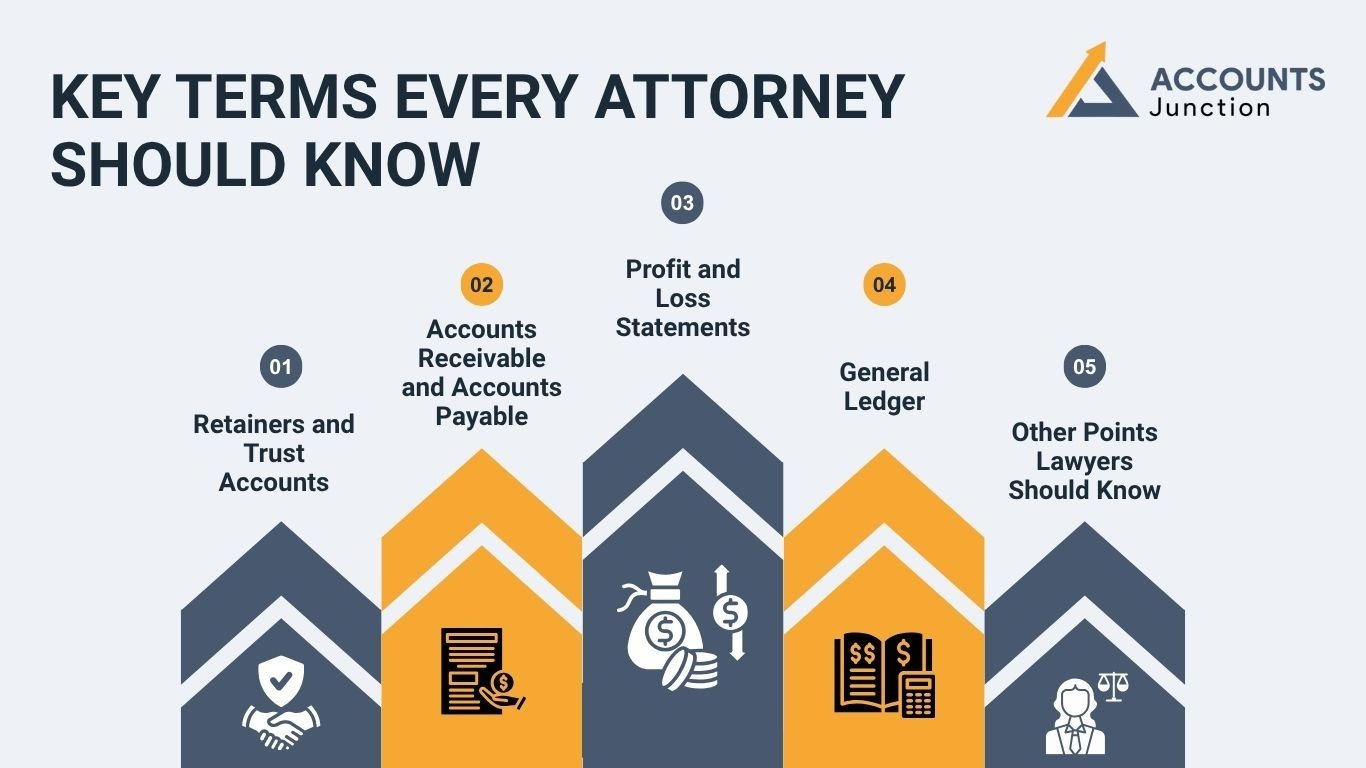

Key Terms Every Attorney Should Know

Knowing a few terms makes lawyer bookkeeping much easier. Here are some terms every lawyer should know:

1. Retainers and Trust Accounts

A retainer is money a client pays before work starts. It is kept in a trust account. Lawyers must keep this money separate from their own cash to follow the law and protect clients.

2. Accounts Receivable and Accounts Payable

- Accounts Receivable (AR): Money clients owe the firm

- Accounts Payable (AP): Money the firm owes to others

Keeping track of AR and AP helps the firm have enough cash, pay bills on time, and avoid extra costs or stress.

3. Profit and Loss Statements

A profit and loss statement shows how much cash came in and went out. It helps lawyers see which cases or services bring in the most money and which costs need to be cut.

4. General Ledger

The general ledger is the main record of all payments and expenses. Every item should be logged here so the books stay correct.

5. Other Points Lawyers Should Know

- Bank Checks: Compare the books to the bank each month to catch errors.

- Track Costs: Note small costs like supplies. They add up fast.

- Clear Billing: Send invoices on time so payments come in fast.

- Use Tools: Software can save time and cut mistakes.

Good bookkeeping keeps clients’ money safe, avoids stress, and helps the firm run well.

Common Lawyer Bookkeeping Challenges

Lawyer bookkeeping can be hard for busy attorneys. Even small errors can cause stress or loss of cash. Here are some common issues and ways to handle them:

Hard to Track Bills

- Law firms charge in many ways: hourly, flat fee, or retainer. Mixing these can lead to wrong bills or late payments. Track each bill as it comes in to avoid trouble.

Tax Worries

- Taxes can be hard if books are messy. Bad records can lead to stress, late fees, or wrong reports. Keep books neat and add each payment or cost as it happens.

Lost Small Costs

- Small costs like travel, meals, or office items add up fast. If you don’t track them, profits drop and cash runs low. Note each cost to see the real profit.

Old or Messy Records

- Old or messy books make it hard to see where the cash goes. Keep notes fresh and clear. Even short weekly checks save time and stop stress from growing.

Essential Bookkeeping Practices for Busy Attorneys

Effective lawyer bookkeeping starts with simple, steady habits. Even a busy lawyer can keep cash clear and books correct with these practices:

Keep Money Apart

- Do not mix firm and personal cash. Put client money in its own account. This keeps books clean and builds trust.

Check Cash Often

- Look at your books each week or month. Write down every bill, fee, and cost. This helps you spot mistakes fast.

Use Simple Tools

- Tools like Clio, QuickBooks, or Xero can track bills, costs, and payments. They save time and make reports easy to read.

Save All Papers

- Keep receipts, bills, and signed deals. Use folders or online storage. These papers help at tax time and protect you if checks happen.

Look at Reports

- Check profit and loss each month. See what brings in cash and what costs too much. This helps plan for growth.

Stay Consistent

- Spend 10–15 minutes each week on books. Even this small time keeps things neat and cuts stress later.

Tips for Streamlining Lawyer Bookkeeping

Good lawyer bookkeeping can save time and stress. Here are key tips:

Automate Payments

- Set up automatic invoices and reminders. This reduces mistakes and late payments.

Check Accounts Regularly

- Look at bank accounts every month to make sure everything matches.

Get Help When Needed

- Hire a bookkeeper or outsource your bookkeeping. This frees up time to focus on clients and cases.

Connect Your Tools

- Use software that works with your case management system. This gives up-to-date info on hours, payments, and expenses.

Bookkeeping Mistakes Lawyers Should Avoid

Even small mistakes can cost cash and stress. Avoid these to keep lawyer bookkeeping smooth:

Mixing Money

- Never use client funds for personal or firm expenses. Keep all accounts separate.

Ignoring Small Expenses

- Small costs add up. Track every expense to know true profit.

Skipping Account Checks

- Check accounts each month. This stops errors and fraud.

Waiting Too Long

- Do not put off updates. Late records make bookkeeping harder and more stressful.

Benefits of Outsourcing Lawyer Bookkeeping

Hiring outside help can make finances much easier.

Save Time and Stress

- Professionals handle your books while you focus on clients and cases.

Keep Records Correct

- Bookkeepers know the rules for law firms and trust accounts. This reduces mistakes.

Get Useful Reports

- Outsourced bookkeeping often includes easy-to-read reports. These show what is profitable and where changes are needed.

Save Money

- Outsourcing can cost less than hiring a full-time accountant and gives expert help.

Even if you outsource, good lawyer bookkeeping habits help you understand your firm’s cash flow.

Accounts Junction offers bookkeeping services designed for law firms. We understand the challenges lawyers face and provide simple solutions to keep finances correct. We track income, expenses, and trust accounts. We prepare monthly profit and loss statements and balance sheets. We provide ready-to-use records for taxes. With Account Junction, busy attorneys can focus on clients while we keep their books accurate and up-to-date.

FAQs

1. What is bookkeeping for a law firm?

- Lawyer bookkeeping means tracking all cash in and out. It helps show which work earns money and keeps client funds safe.

2. Why should I keep books well?

- Good books help you see cash, pay taxes on time, and plan for staff, ads, and costs. They also cut stress and stop small mistakes from growing.

3. How do trust accounts work?

- Clients pay retainers before work starts. You keep this money in a trust account, apart from firm cash. This protects clients and follows the law.

4. How often should I check my books?

- Look at all bills, fees, and costs each week or month. Small checks keep your cash clear and avoid big surprises later.

5. What tools help with bookkeeping?

- Use tools like Clio, QuickBooks, or Xero. They track cash, bills, and client fees fast and cut errors, so you can focus on work.

6. Can small costs hurt my profits?

- Yes. Travel, meals, and office supplies add up fast. Keep a note of each cost to see the real profit and avoid low cash.

7. Should I hire help for books?

- A bookkeeper can save time and keep the cash right. This lets you spend more time with clients, not on numbers.

8. What mistakes should lawyers avoid?

- Don’t mix client and firm cash. Track all small costs and check accounts each month. Don’t wait to update books, or errors and stress grow fast.

9. How do I keep client cash safe?

- Put client money in a trust account. Do not use it for firm bills. Check it often to stay safe.

10. How do I see if my firm makes money?

- Look at your profit and loss each month. See which cases bring cash and which cost too much.

11. How do I track unpaid bills?

- Make a list of the money clients owe. Check it each week and remind clients of late payments.

12. How do I track bills I must pay?

- List all bills for rent, staff, or services. Pay on time to keep cash clear.

13. Can software help with taxes?

- Yes. Tools can sum money in and out. They make reports fast and easy to read.

14. How do I stop errors?

- Check your books each week or month. Compare totals to bank cash. Small checks stop big mistakes.

15. How do I track small costs?

- Write down travel, meals, and office bills as they happen. This keeps cash clear and shows real profit.

16. Can I do bookkeeping in a short time?

- Yes. Spend 10–15 minutes each week on bills and cash. Small, steady work keeps books neat and stress low.

17. How can I avoid errors in my books?

- Check bills, fees, and payments each week or month. Compare totals to bank cash. Small, steady checks make lawyers' bookkeeping safe and clear.