Importance of Bookkeeping and Accounting for E-commerce

In the modern business environment, online shops face many money and work issues. Sales may come fast from many sites at once. Without clear records, mistakes can cause loss or stress. Many shops may skip key tasks in accounting for e-commerce, which may cause loss or stress. Good records may help plan and make smart choices. They may show sales, costs, and money left each month. Accounting may also help with taxes and fines. Bookkeeping and accounting may build a strong business base. They may help owners, lenders, and partners see the truth.

What is Bookkeeping in E-commerce?

Bookkeeping is the act of writing down all money moves. For online shops, this may include sales, refunds, and fees. Each order may create more than one record to save.

Key Tasks in E-commerce Bookkeeping

1. Track Sales

- Each sale makes a record of the money coming in. Good tracking may show which products sell best.

2. Track Expenses

- Paying suppliers, delivery, and ads may need tracking. Tracking costs may help stop waste and save cash.

3. Manage Refunds and Returns

- Refunds may cut income and change reports. Recording them may stop mix-ups with taxes and checks.

4. Check Accounts

- Bank accounts and payment sites may need checks. Checking may find errors before they grow worse.

5. Track Subscriptions

- Monthly service or tool fees may need logging. Tracking may stop missed payments and errors.

6. Track Discounts

- Sales offers may lower income and need tracking. Records may also show which ads bring the best results.

Bookkeeping and accounting for e-commerce give a clear view of daily money moves. It may help shops avoid mistakes and manage cash well.

Understanding Accounting for E-commerce

Accounting is more than writing down money moves. It may check money flows, make reports, and guide choices. Accounting for e-commerce may show which items make a profit and which do not. It may also show trends to plan next steps.

Core Functions of Accounting

1. Make Reports

- Reports may show money in and money out. They may help check long-term business health.

2. Tax Help

- Good records may make filing taxes fast and right. Accounting may make sure all taxes are paid on time.

3. Cash Flow

- Tracking cash coming in and going out may help. It may stop money shortages and keep bills on time.

4. Stock Check

- Accounting may track items and the cost of goods. It may cause too much stock and high storage costs.

5. Profit Check

- Check which items or lines make money. This may guide price and ad choices.

6. Plan Ahead

- Past records may show trends for next month or the year. Planning may help set the budget and work plan.

Accounting may help shops make smart choices with facts. It may cut guesswork and give steady money growth.

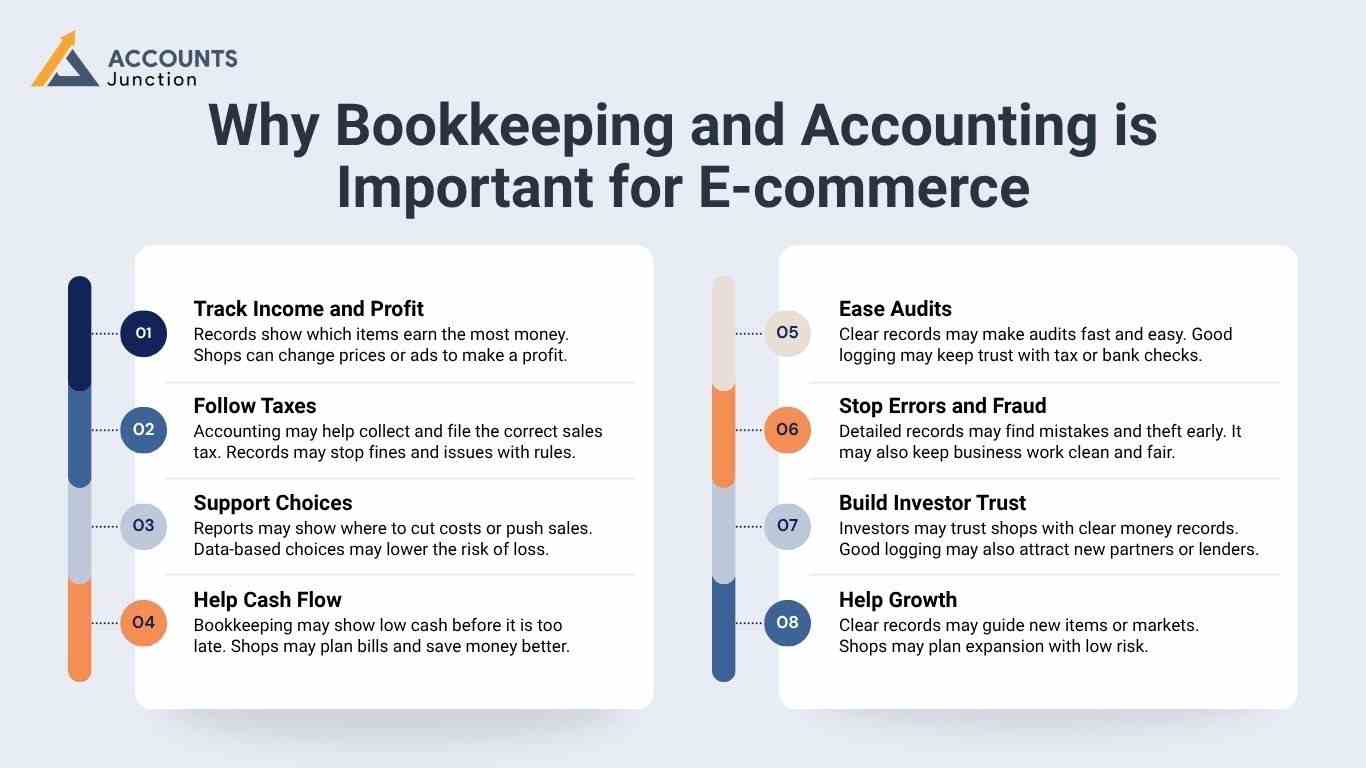

Why Bookkeeping and Accounting is Important for E-commerce

Online shops may face high money risk without strong accounting for e-commerce systems. Many sites, foreign sales, and changing costs may cause trouble. Bookkeeping may stop mistakes, aid in rule following, and give clear numbers.

1. Track Income and Profit

- Records show which items earn the most money. Shops can change prices or ads to make a profit.

2. Follow Taxes

- Accounting may help collect and file the correct sales tax. Records may stop fines and issues with rules.

3. Support Choices

- Reports may show where to cut costs or push sales. Data-based choices may lower the risk of loss.

4. Help Cash Flow

- Bookkeeping may show low cash before it is too late. Shops may plan bills and save money better.

5. Ease Audits

- Clear records may make audits fast and easy. Good logging may keep trust with tax or bank checks.

6. Stop Errors and Fraud

- Detailed records may find mistakes and theft early. It may also keep business work clean and fair.

7. Build Investor Trust

- Investors may trust shops with clear money records. Good logging may also attract new partners or lenders.

8. Help Growth

- Clear records may guide new items or markets. Shops may plan expansion with low risk.

Common Bookkeeping Problems in E-commerce

Online shops may face problems that normal shops rarely see. Knowing them may stop mistakes and losses.

1. Many Sales Channels

- Orders from Amazon, Shopify, or social sites may mix, so accounting for e-commerce must track all in one place. Combining them may be needed for clear reporting.

2. Large Volume

- Daily sales may make hundreds of records to track. Automation may cut mistakes and save staff time.

3. Refunds and Chargebacks

- Many returns may change income reports and cash flow. Logging may manage refunds without account errors.

4. Stock Management

- Items in multiple warehouses may need close checks. Errors may slow delivery and upset customers.

5. Tax Differences

- States or countries may have many tax rules. Accounting may ensure proper collection and reports.

6. Currency Changes

- Foreign sales may change with exchange rates. Tracking rates may keep reports correct.

7. Late Payments

- Unpaid bills may hurt cash flow plans. Tracking may avoid delays in paying suppliers or staff.

Best Accounting Practices for E-commerce

Good systems may save time and cut mistakes.

1. Use Software

- Apps built for accounting for e-commerce may log sales and costs in one place. They may also make reports fast for choices.

2. Separate Accounts

- Keep business and personal money apart. Separation may also help with audits and taxes.

3. Record Every Sale

- Every sale, refund, or cost may change totals. Logging may prevent mistakes and keep accounts clean.

4. Check Accounts Often

- Weekly or monthly checks may match bank and sales records. It may find errors before they grow.

5. Keep Digital Records

- Digital logs may make audits fast and clear. They also give access from anywhere at any time.

6. Link Stock and Accounts

- Track items and money in one system. It may stop overstock and keep customers happy.

7. Watch Expenses

- Small costs may add up and cut profit. Tracking may stop waste and save money.

8. Track Ads

- Logging ad cost may show which ads work. It may improve profit from campaigns.

9. Automate Bills

- Set up subscription payments to avoid late fees. Automation may also save staff time.

10. Train Staff

- Staff may log sales right away with clear rules. Training may stop mistakes and keep books clean.

Cost Benefits of Good Accounting

1. Avoid Penalties

- The right tax filing may stop fines. On-time filing may build trust with authorities.

2. Cut Errors

- Good logging and smooth accounting for e-commerce may stop costly mistakes. Fewer errors may save time and money.

3. Better Stock Use

- Tracking items may cut storage costs. It may also improve delivery and satisfaction.

4. Improve Cash Flow

- Forecasting may stop overdrafts or late fees. Good plans may keep work smooth.

5. Better Profit

- Check items with low profit to save costs. Small changes may raise the total money earned.

Impact on Customer Experience

1. Faster Refunds

- Accurate records with strong accounting for e-commerce may speed up refund work. It may make customers trust the shop more.

2. Better Delivery

- Stock tracking may stop items from running out. On-time delivery may make repeat sales more likely.

3. Clear Pricing

- The right bills may stop mistakes in discounts. It may increase trust in the shop.

4. Steady Shipping

- Cash flow checks may pay delivery partners on time. Customers may get goods without delay.

Managing International Transactions

1. Track Rates

- Foreign money may change and affect reports, so accounting for e-commerce must track rate shifts. Tracking may keep totals correct.

2. Tax per Country

- Each country may have its own tax. Records may keep shops safe from fines.

3. Payment Fees

- Cross-border payments may cost extra. Tracking may stop profit from dropping.

4. Track Returns

- Refunds may affect foreign cash flow. Logging may keep accounts right.

5. Auto Convert

- Software may update currency rates quickly. It may stop mistakes and save staff work.

Avoidable Bookkeeping Mistakes

1. Miss Fees

- Shipping, platform, and payment fees may be missed. It may lower profit.

2. Mix Accounts

- Mixing personal and business funds may cause errors. Separate accounts may keep money clear.

3. Delay Checks

- Unseen errors may grow over time. Check often to prevent big problems.

4. Ignore Taxes

- Failing to pay tax may cause fines. Keep records to stay safe.

5. Skip Refunds

- Refunds may inflate income if missed. Logging may keep totals correct.

6. Forget Foreign Sales

- Foreign sales may add untracked taxes or errors. Record them for safe accounting.

Benefits of Professional Accounting Services

1. Expert Advice

- Experts in accounting for e-commerce may suggest ways to save money. They may guide on growth and cost.

2. Stop Errors

- Professional checks may prevent mistakes. Records stay right and clean.

3. Save Time

- Owners may focus on selling, not accounts. Outsourcing frees time for growth.

4. Show Insights

- Data may show trends and guide plans. Decisions may rely on facts, not guesses.

Bookkeeping and accounting may shape e-commerce success. Good records may help make decisions, rules, and growth. Shops may avoid loss using clear accounting. Records may boost trust with lenders and partners.

Accounts Junction gives full accounting for e-commerce services for online shops. Our experts may track money, taxes, and audits. We handle daily books, stock, and reports fully. Shops may rely on our team to grow profits. Partner with Accounts Junction and build business safely.

FAQs

1. What does accounting for e-commerce include?

- It may include revenue tracking, cost analysis, tax work, and platform reconciliation.

2. Why is bookkeeping important for e-commerce stores?

- It may maintain clear records and support correct reports for online sales.

3. How does accounting for e-commerce differ from normal accounting?

- It may involve tracking online fees, multi-channel sales, and dynamic inventory.

4. Can accounting for e-commerce improve sales decisions?

- It may show product trends and guide pricing or stock planning.

5. How do online platforms impact bookkeeping work?

- They may create many small records that require constant tracking.

6. Why should e-commerce firms reconcile payment gateways?

- Reconciliation may prevent revenue gaps caused by delays or missing payouts.

7. Do e-commerce businesses need to track marketplace fees?

- Yes, fees from platforms like Amazon or Shopify may change profit margins.

8. Can bookkeeping support better inventory control?

- Clear records may reveal stock flow and reduce extra holding costs.

9. Does accounting for e-commerce manage return and refund entries?

- Yes, refund entries may adjust revenue and prevent wrong profit numbers.

10. How can proper accounting support tax compliance for e-commerce?

- Correct records may show exact taxable amounts across regions.

11. Why do e-commerce firms need digital record systems?

- Digital systems may store large data sets and support fast audits.

12. Can accounting tools integrate with e-commerce platforms?

- Most tools may connect with online stores and automate transaction flow.

13. How do shipping costs influence accounting for e-commerce?

- Shipping charges may affect cost calculation and require clear tracking.

14. Can bookkeeping reveal slow-moving e-commerce products?

- Data records may highlight items with low turnover or weak demand.

15. Why should e-commerce owners separate business and personal funds?

- Separate accounts may create clear books and avoid mixed transactions.

16. Can accounting show the real profit of an e-commerce business?

- It may reveal net income after fees, returns, ads, and supplies.

17. Why do high-order volumes require strong bookkeeping?

- Large volumes may create errors if records are not updated on time.

18. How can accounting for e-commerce support long-term planning?

- Accurate data may show growth patterns and guide future steps.

19. Can outsourced accounting improve e-commerce performance?

- Professional teams may track complex data and reduce costly mistakes.

20. Why is financial analysis important for e-commerce brands?

- Analysis may detect spending issues and improve budget control.