How to Master Law Firm Accounting: A Step-by-Step Guide for Attorneys

Law firm Accounting is the core of a thriving legal practice. Without clear records, even the most successful attorneys can face cash flow issues, missed opportunities, or legal pitfalls. Strong accounting not only keeps your money safe but also gives you a clear view of your firm’s growth and potential. Mastering accounting does not have to be hard. Start by tracking all income, managing client trust accounts carefully, and recording every expense. Review financial reports regularly to see which cases are most profitable and plan your budgets wisely.

In this blog, we will look at simple steps to track client money, check expenses, create clear reports, and make smart financial choices. These steps help your law firm stay safe, earn more, and plan for growth.

Why Law Firm Accounting is Important

Law firm accounting is more than just keeping track of money. It helps lawyers track client money, bill clients on time, track costs, and make smart money choices. Without it, even busy firms can face financial problems, fines, or lost chances to grow.

Key Benefits of Strong Accounting

1. Clear Money Records

- Clear records show how your firm is doing. They help plan budgets, spot cases that earn well, and cut extra costs.

2. Follow Rules Easily

- Lawyers must keep client money safe. Strong Law firm Accounting keeps you within the rules and avoids fines.

3. Make Smart Choices

- Clear numbers help decide on staff, ads, or new services. Numbers turn into simple steps to act on.

4. Keep Cash Flow Smooth

- Tracking bills and payments helps money move in and out without trouble.

5. Save Time

- Good habits and tools cut time on paperwork, letting you focus on clients.

6. Plan to Grow

- Records show where to spend and how to grow the firm safely.

Understanding the Basics of Law Firm Accounting

Before using advanced methods, lawyers should master the basics of Law firm Accounting. Strong basics make it easy to track money, stay within rules, and make smart choices.

Key Components:

1. Trust Accounts

- Trust accounts, or IOLTA accounts, hold client money separate from the firm’s funds. Careful tracking keeps your firm within the rules and avoids trouble.

2. Accounts Receivable and Billing

- Track who owes money and when. Clear billing helps get payments on time, cuts disputes, and keeps cash flowing.

3. Expenses and Payroll

- Write down all costs, like staff pay, rent, and software. This helps track profit. Managing payroll right keeps staff happy and avoids errors.

4. Financial Statements

- Balance sheets, income statements, and cash flow statements show how your firm is doing. They point out trends, spot problems, and help plan for growth.

5. Daily Cash Checks

- Review your cash daily or weekly. Small checks catch errors fast and keep money moving smoothly.

6. Simple Reports for Decisions

- Create short, clear reports to see which cases earn the most and where to spend. This helps make quick, smart choices for the firm.

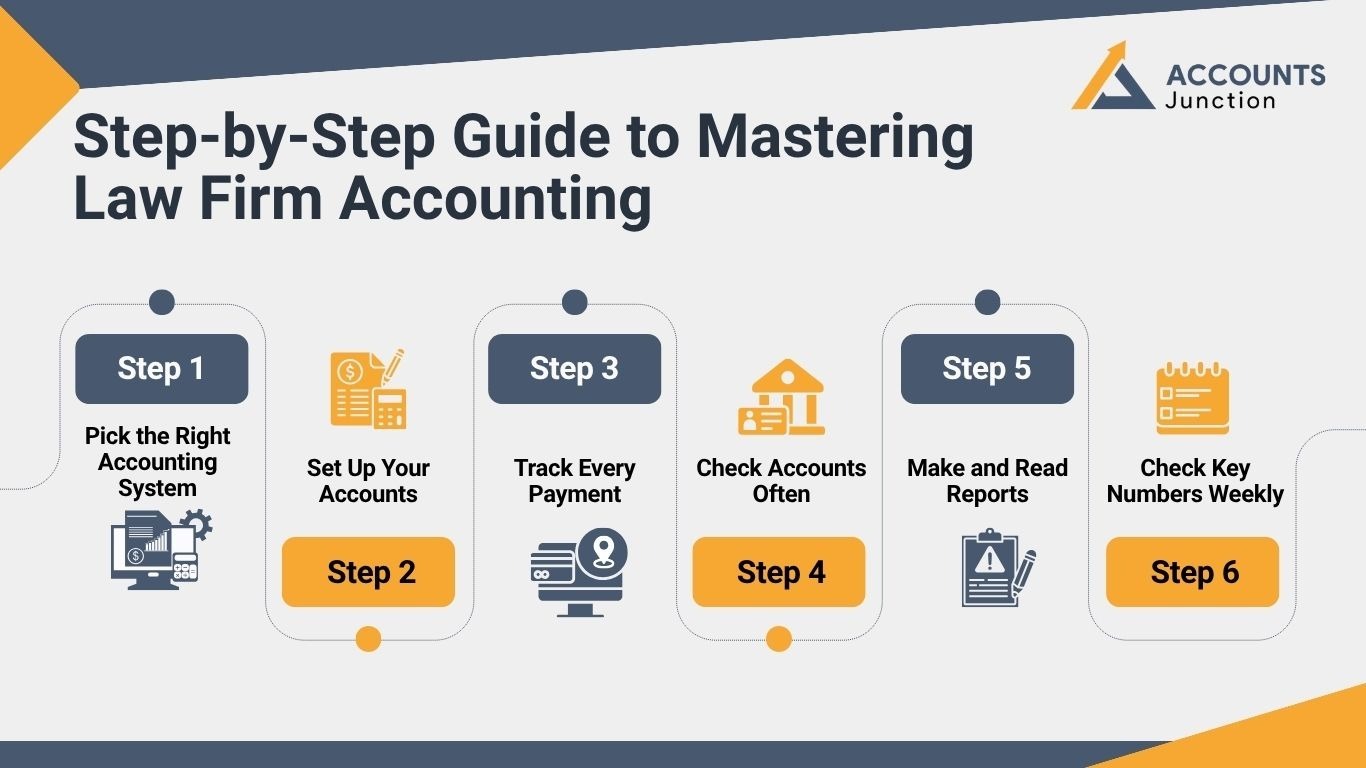

Step-by-Step Guide to Mastering Law Firm Accounting

To master Law firm Accounting, lawyers can follow clear steps. This keeps money safe, records right, and helps make smart choices.

Step 1: Pick the Right Accounting System

Choose software made for law firms. Look for features like:

- Track client trust accounts

- Send bills automatically

- Track expenses like staff pay and rent

- Make clear money reports

Step 2: Set Up Your Accounts

Group money into clear sections:

- Client fees and payments

- Office and staff costs

- Payroll

- Taxes and dues

This setup keeps reports easy and makes sure all money entries are correct.

Step 3: Track Every Payment

Write down all the money in and out. Track bills, payments, and transfers. Small mistakes can grow if not caught.

Step 4: Check Accounts Often

Compare your records with bank statements. Doing this each month stops errors, fraud, and rule breaches.

Step 5: Make and Read Reports

Look at reports each month. Check profit, cash flow, and trends. Compare the money planned with the money spent. Reports help find ways to save and plan smart moves.

Step 6: Check Key Numbers Weekly

Look at payments due, client fees, and cash flow each week. Small checks keep money on track and prevent surprises.

Tips to Improve Law Firm Accounting Efficiency

Automate Routine Tasks

Automation cuts mistakes and saves time. Software can do:

- Make and send invoices

- Send payment reminders

- Run payroll

- Sort and track expenses

Hire a Skilled Accountant

Even with software, a trained accountant keeps records correct, files taxes, and gives smart advice.

Watch Key Numbers

Track numbers like:

- Average billing per lawyer

- How fast clients pay

- Profit margins

These numbers help spot problems, improve work, and boost profit.

Check Reports Often

Look at short reports weekly. They help see trends, spot slow payments, and make quick choices to keep money flowing.

💡 Need help managing your law firm’s finances?

👉 Talk to a Legal Accounting Expert Today

Common Challenges in Law Firm Accounting

Even skilled lawyers face problems in Law firm Accounting. Knowing these challenges helps fix them quickly.

1. Managing Trust Accounts

- Trust account mistakes are common. Keep client money separate and write down every entry to avoid trouble.

2. Late Client Payments

- Late payments hurt cash flow. Set clear billing rules and follow up on unpaid bills.

3. Tracking Expenses

- Law firms have many costs, from research tools to office supplies. Sort and track all costs carefully.

4. Tax Rules

- Taxes can be tricky. Work with a tax pro to file on time and avoid mistakes.

5. Keeping Records Simple

- Many errors come from messy records. Keep entries clear and organized to save time and reduce mistakes.

Advanced Strategies for Legal Firm Accounting

Once the basics are in place, lawyers can use advanced steps to make Law firm Accounting smoother and efficient. These strategies help save time, cut mistakes, and give a clear view of the firm’s finances.

1. Use Data for Decisions

- Look at the money records to see which cases and clients earn the most. Use simple dashboards or reports to spot trends and plan moves.

2. Plan with a Budget

- A clear budget shows where to spend on ads, staff, or tools. It keeps costs in check and helps the firm grow.

3. Outsource Special Tasks

- Outsource pay, bookkeeping, or taxes. This saves time and keeps records right and within rules.

4. Set Up Internal Checks

- Use controls to stop mistakes or fraud. Require two approvals for big payments or limit access to sensitive accounts.

5. Automate Routine Work

- Use software to send bills, track payments, and sort expenses. This cuts errors and saves hours each week.

6. Monitor Key Numbers

- Check weekly numbers like client payments, cash flow, and profit. Small checks help spot issues early and guide smart moves.

7. Train Staff Regularly

- Teach staff how to handle accounts, track expenses, and use software. Skilled staff reduce errors and boost efficiency.

By being proactive, attorneys can maintain smooth financial operations and focus on serving clients.

Conclusion

Mastering Law firm Accounting is key for a firm that wants to be safe, earn well, and run right. Track client money, watch expenses, and check reports often. This helps lawyers make smart choices and plan for growth. Using simple steps like budgeting, reviewing data, and outsourcing some tasks also saves time, cuts errors, and keeps the firm running well.

At Accounts Junction, our team of skilled and experienced accounting experts helps law firms handle every aspect of accounting, from trust account management to payroll and detailed financial reporting. With our support, attorneys can save time, stay compliant, and focus on serving clients.

Simplify your law firm’s accounting today with Accounts Junction, where our expert team ensures accuracy, saves you time, and helps your practice grow.

📈 Simplify Your Law Firm Accounting with Experts You Can Trust

At Accounts Junction, we help attorneys manage trust accounts, payroll, taxes, and reports—accurately and stress-free.

✉️ Schedule a Free Consultation to streamline your law firm’s accounting and focus on what matters most—your clients.

FAQs

1. What is law firm accounting?

- It is the process of keeping track of client money, bills, and payments in a law firm.

2. Why is law firm accounting needed?

- It keeps money safe, records clear, rules followed, and helps the firm grow.

3. What are trust accounts?

- Trust accounts hold client money separate from the firm’s money. Track each entry carefully.

4. How do I track client payments?

- Send invoices on time, note payments, and follow up on unpaid bills.

5. What is a chart of accounts?

- It is a list of income, costs, staff pay, and taxes to keep records clear.

6. How often should I check accounts?

- Check accounts weekly or monthly to catch errors or missing payments.

7. What reports should I make?

- Make balance sheets, cash flow sheets, and income sheets to see firm's health.

8. How can I improve cash flow?

- Track bills, send invoices fast, and follow up on late payments.

9. Should I use software?

- Yes, software can send bills, track pay, record costs, and make reports fast.

10. Can I do accounting alone?

- Yes, but an expert keeps records right, files taxes, and gives advice.

11. How do I track expenses?

- Sort every cost, such as rent, staff pay, tools, and update records daily.

12. What are common mistakes?

- Mixing personal and firm money, ignoring trust rules, late account checks, and poor records.

13. How can I save time?

- Automate bills, payroll, and reports. Keep records neat. Check numbers weekly.

14. What is reconciliation?

- It is matching records with bank statements to catch errors or fraud.

15. How do I plan for growth?

- Use reports to see which cases earn the most, track costs, and make a simple budget.

16. What key metrics should I watch?

- Client payment speed, average billing per lawyer, profit, and cash flow.

17. Should I outsource some tasks?

- Yes, outsourcing pay, bookkeeping, or taxes saves time and keeps records right.

18. How can data checks help my firm?

- Analytics show which clients and cases earn the most, helping you make smart moves.

19. How do internal controls help?

- Controls stop mistakes or fraud. For example, two approvals for large payments.