How to Claim Medical Insurance Tax Return Without Mistakes

Filing a tax return on medical insurance may look confusing for many people. Several taxpayers lose benefits on their medical insurance tax return only because they miss simple rules. If you understand the process step by step, you can claim deductions without stress. This guide will help you avoid common mistakes and file correctly.

Many people ask how to get the maximum deduction on health insurance premiums. The rules are simple, but they require attention to detail. With clear records and correct entries, your medical insurance tax return becomes easy. Let us explore how to file and avoid errors.

Why Medical Insurance Tax Benefits Are Important

- Medical insurance shields you from sudden hospital costs. It offers a money safety net in case of emergencies.

- The government offers tax benefits on paid premiums. These benefits reduce your tax burden each year.

- Claiming a medical insurance tax return keeps your tax bill low. It ensures you enjoy the full available deductions.

- This benefit helps people keep their insurance. It boosts health care awareness and money safety.

- Filing correctly makes sure you do not lose any claims. It also stops extra notices from tax officers.

Basic Rules to Claim Tax Return on Medical Insurance

- Premiums paid for yourself, spouse, and children count. These payments must be made through a valid bank or online mode.

- Premiums for dependent parents also qualify for a claim. Many people miss this useful benefit every year.

- Only bank or digital payments are allowed for deduction. Cash payments are not valid for tax claims.

- Senior citizens enjoy a higher deduction each year. Their health costs are often higher than others.

- Always keep receipts and policy papers safe and ready. These proofs are needed if the tax office asks later.

Documents Needed for Medical Insurance Tax Return

- Keep the original insurance policy copy ready. This document proves you hold a valid policy.

- Maintain all premium payment receipts in order. They help you cross-check deductions correctly.

- Bank statements showing premium payments are useful. They serve as additional proof of payment.

- PAN and Aadhaar details must be linked correctly. Wrong details may delay your medical insurance tax return.

- Salaried employees must collect Form 16 for records. It helps while filing income tax returns.

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

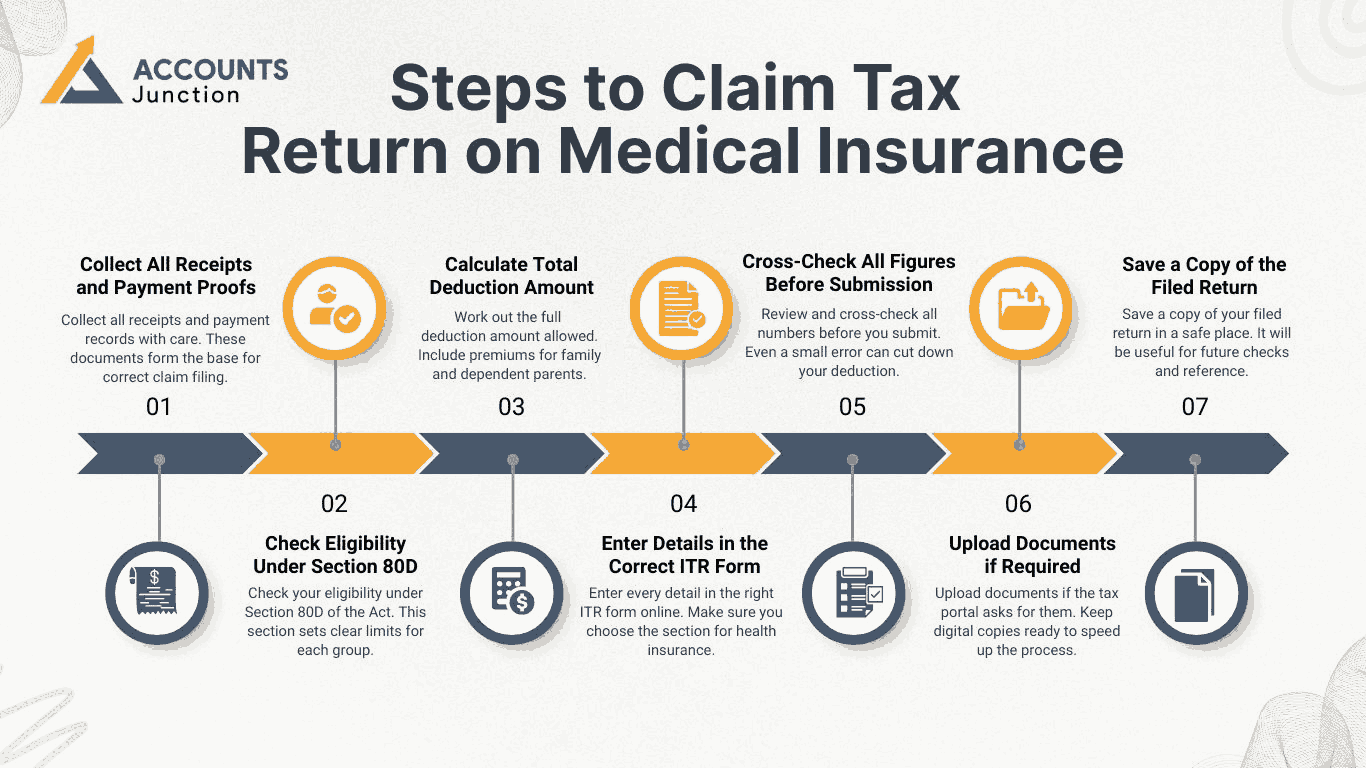

Steps to Claim Tax Return on Medical Insurance

1. Collect All Receipts and Payment Proofs

- Collect all receipts and payment records with care. These documents form the base for correct claim filing.

2. Check Eligibility Under Section 80D

- Check your eligibility under Section 80D of the Act. This section sets clear limits for each group.

3. Calculate Total Deduction Amount

- Work out the full deduction amount allowed. Include premiums for family and dependent parents.

4. Enter Details in the Correct ITR Form

- Enter every detail in the right ITR form online. Make sure you choose the section for health insurance.

5. Cross-Check All Figures Before Submission

- Review and cross-check all numbers before you submit. Even a small error can cut down your deduction.

6. Upload Documents if Required

- Upload documents if the tax portal asks for them. Keep digital copies ready to speed up the process.

7. Save a Copy of the Filed Return

- Save a copy of your filed return in a safe place. It will be useful for future checks and reference.

Common Mistakes While Claiming Medical Insurance Tax Return

- Entering the wrong premium amount in the return form is a common mistake while filing a tax return on medical insurance. This mistake results in false or reduced deductions.

- Forgetting to add premiums paid for dependent parents. This lowers your total eligible claim unfairly.

- Claiming deductions for premiums paid in cash. Cash payments are not valid under Section 80D.

- Mixing health insurance with life insurance premiums. Only health policy payments qualify for tax relief.

- Not updating the senior citizen status of parents. This mistake cuts down the higher deduction allowed.

- Losing receipts or proofs at the time of filing. Missing records make your claim weak and risky.

How to Avoid Errors in Tax Return on Medical Insurance

- Always make payments through bank or digital methods. This ensures deduction claims are valid and accepted.

- Keep receipts and policy documents in one folder. It saves time during filing and checks.

- Double-check the names of policyholders before filing. Wrong names can create issues later on.

- Verify PAN and Aadhaar details before return filing. Unlinked details may stop your refund processing.

- Use trusted tax filing software or professionals when handling your medical insurance tax return. Expert help reduces mistakes and saves valuable time.

- Stay updated with new tax law notifications. Rules may change every financial year, unexpectedly.

Who Can Claim Medical Insurance Tax Return?

- Salaried employees pay their own premiums each year. Their payment proof is required during tax filing.

- Self-employed professionals who purchase medical insurance policies can also file a tax return on medical insurance under Section 80D. They can also claim Section 80D benefits.

- Individuals paying for spouse and dependent children. These payments also qualify for a tax deduction.

- People are paying health premiums for their parents. The deduction is higher for senior citizen parents.

- Senior citizens themselves with health insurance policies. They enjoy the highest deduction limits.

Section 80D Limits for Medical Insurance Tax Return

- Up to ₹25,000 deduction for self and family. This applies if no member is a senior citizen.

- Up to ₹50,000 deduction for parents above 60 years. This gives better support for their health costs.

- Preventive health check-ups allow up to ₹5,000 claim. This is included within the main deduction limit.

- Both self and parent premiums can be combined. This allows a maximum claim up to ₹1,00,000.

- Always calculate limits before filing to avoid errors. Exceeding limits leads to reduced refund amounts.

Filing Process for Tax Return on Medical Insurance

- Visit the income tax e-filing portal online. Log in with your PAN and a secure password.

- Choose the correct ITR form as per your income. A wrong choice can delay approval of your return.

- Enter Section 80D details for insurance deductions carefully while filing your medical insurance tax return. Fill in the premium amounts with full accuracy.

- Upload the needed details and submit the return. Always keep a draft copy before final submission.

- Complete e-verification for quick processing of returns. Refunds are released only after verification.

Tips to File Medical Insurance Tax Return Smoothly

- Start filing your tax return on medical insurance well before the deadline to avoid last-minute errors. A last-minute rush often raises the chance of errors.

- Use Form 16 or Form 26AS to check details. These forms help cross-check all tax entries with ease.

- Match your payment proofs with insurance documents. This ensures the data is correct and free of mismatches.

- Keep both digital and paper copies for records. Extra sets are helpful during audits or reviews.

- Review your full return before you submit online. Fixing errors later is harder and takes more time.

Why the Correct Filing of Medical Insurance Tax Return is Important

- Correct filing helps get refunds released much faster. Errors in returns often lead to long delays.

- It prevents notices or warnings from tax officials. Wrong details can trigger strict review or checks.

- Filing with care ensures no loss of tax benefits. Mistakes can reduce the deductions you deserve.

- It also builds trust and credibility with insurers. Proper compliance supports future claim approval.

- Correct filing reduces stress in the tax season. Peace of mind comes with error-free returns.

Benefits of Claiming Tax Return on Medical Insurance

- You can save more money on yearly taxes. Savings grow when you claim deductions in the right way.

- Health costs are easier to manage with insurance. Coverage reduces heavy out-of-pocket expenses.

- It helps build discipline in both finance and tax planning. Filing your medical insurance tax return each year increases awareness and builds disciplined tax habits.

- Your family stays protected with active health cover. This protection also brings valid tax benefits.

- It spreads health awareness across all age groups. Preventive health checks can be claimed as deductions.

Expert Help for Medical Insurance Tax Return

- Experts ensure correct filing with maximum deductions. They check every entry with care before submission.

- They confirm if you qualify for all tax benefits. This helps raise the value of your refund amount.

- Professionals deal with queries from tax officers. You remain stress-free during a notice or audit.

- Expert support reduces the risk of common filing errors. Accurate filing will save both time and money.

- Busy people can outsource their tax return on medical insurance to experts for faster and safer filing. This gives peace of mind during tax season.

Key Do’s for Medical Insurance Tax Return

- Pay health premiums before due dates each year. Late payment can cause lapse of your policy.

- Keep all receipts and proofs of payment safe. These are needed for tax claim checks later.

- Check and verify the names of insured persons. Names must match with Aadhaar and PAN records.

- File tax returns within the set deadline each year. Delays can bring both stress and penalties.

- Review Section 80D before you send the return. Make sure all details are true and updated.

Key Don’ts for Tax Return on Medical Insurance

- Do not claim deductions for expired or lapsed policies. Only active health policies are valid for claims.

- Do not file returns without insurance payment proofs. Missing documents will make your claim weaker.

- Do not wait till the last day to file returns. Late filing raises error risks and invites penalties.

- Do not choose the wrong ITR form when filing. A wrong choice may cancel your claim deductions.

- Do not ignore notices sent by tax officials. Always reply fast to prevent bigger future issues.

Future of Medical Insurance Tax Return Rules

- Filing will be simpler with better digital tools. Online portals will guide users with easy steps.

- AI systems may detect common errors at an early stage. This will help reduce notices from the tax office.

- Awareness of Section 80D will grow more in the coming years. Many taxpayers will benefit from health care deductions.

- Deduction limits may rise with steady price inflation. This will support families facing higher health costs.

- Online claim tracking will be faster and smoother. New tech will enhance the overall user experience.

Filing a tax return on medical insurance is not complicated if you follow the rules. By avoiding errors and preparing documents, you can maximize your benefits. Each premium paid for yourself or your family can reduce tax liability. Filing on time ensures peace of mind and better savings.

In the context of Accounts Junction, you can rely on expert guidance for stress-free filing. Accounts Junction provides professional tax services that reduce mistakes. Their team helps clients get the maximum medical insurance tax return benefits. They ensure compliance with tax laws and handle all paperwork smoothly. By trusting Accounts Junction, you save time, avoid errors, and secure your tax savings.

FAQs

1. Can I claim tax benefits for my parents’ insurance?

- Yes, parents’ premiums are allowed, and limits are higher for seniors.

2. Can I claim for cash premium payments?

- No, only digital or banking payments are accepted.

3. Can both husband and wife claim a deduction?

- Yes, if both pay premiums separately under valid policies.

4. What is the limit for a preventive health check-up?

- You can claim up to ₹5,000 within Section 80D limits.

5. Is the medical insurance tax return available for NRIs?

- Yes, NRIs can also claim if policies are valid.

6. Can I claim tax benefits on employer group insurance?

- No, employer-paid premiums for group policies are not eligible.

7. Do I need to upload receipts while filing?

- Not during filing, but you must keep them for checks.