Finance & Accounting Services - Lower Costs & Improve Quality

Proper control of finances is very important for any business organization. This is prominent for any finance and accounting department of the organization. A proper streamlined finance can help businesses to achieve efficiency in the accounting department. Many businesses are struggling to maintain proper finance and accounting in their organization. So, finance and accounting outsourcing can be very beneficial for businesses. This can help to relive the businesses from the complexities in finance and accounting. Financial accounting outsourcing can lower the cost and improve the quality of the service. There are several benefits of outsourcing the financial accounting task.

Why Businesses Choose Finance and Accounting Outsourcing

Many firms find it hard to do all money work in-house. Hiring a full team can cost more and slow key work.

With finance and accounting outsourcing, firms can focus on main tasks. Outsourced teams can handle pay, taxes, and reports well.

-

Lower Costs

Pay, perks, and software spend go down. Outsourcing can cut hidden costs that slow growth.

-

Skilled Team

Experts do work with care and few errors. They bring skill that small teams may not have.

-

Flexible Work

Teams can grow or shrink as needs change. This lets firms match help to the work load.

-

Save Time

Leaders can spend time on plans and growth. Time saved helps focus on new projects and goals.

Tight budgets and few staff make financial accounting outsourcing a smart choice. Small firms get expert work without big spend.

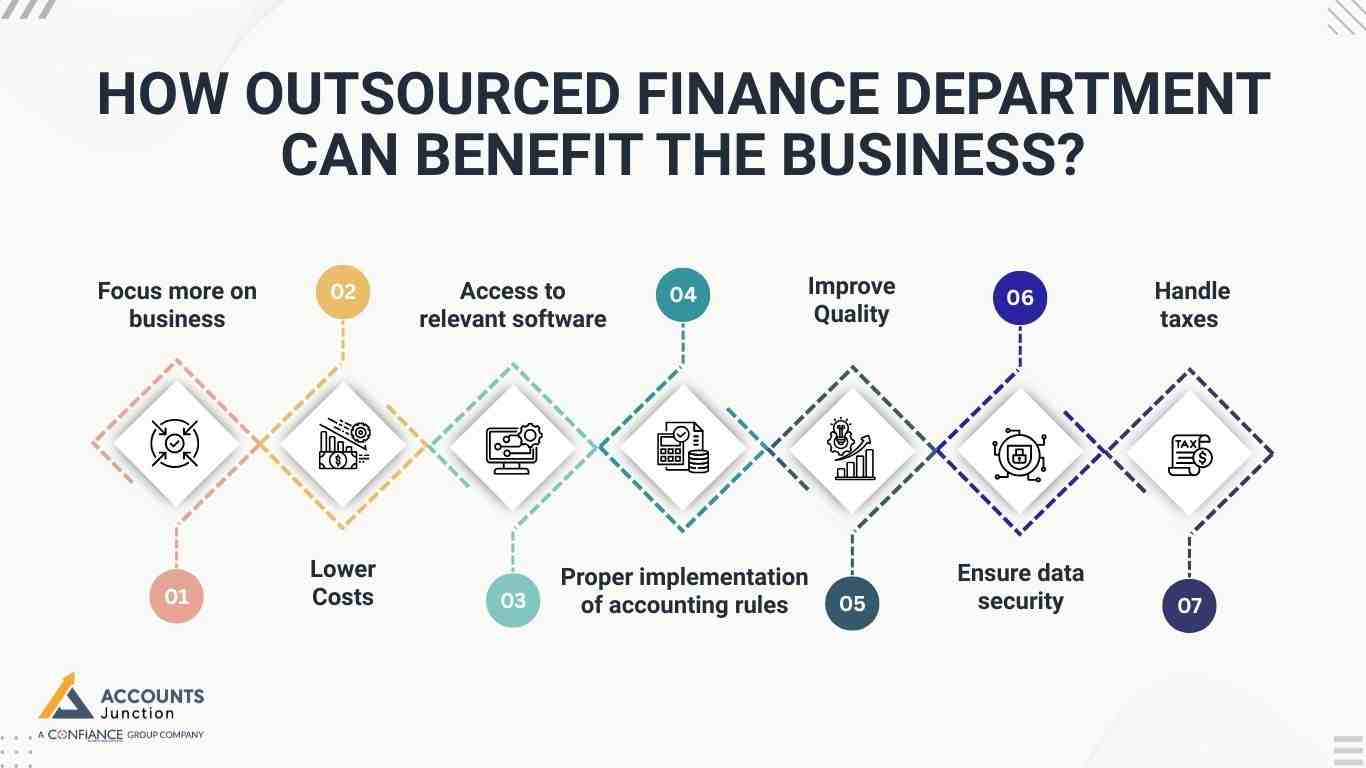

How outsourced finance department benefit the business?

Businesses can achieve better efficiency by outsourcing accounting work.

Here are some benefits of finance and accounting outsourcing for businesses:

1. Focus more on business

In-house handling of the finance and accounting get involvement of the business owners and the management to a large extent. This can distract attention from the important business functions. So, financial accounting outsourcing can help tremendously in achieving better productivity.

2. Lower Costs

In-house handling of the finance and accounting can incur a higher cost comparatively. However, the outsourced finance department will avoid all the unnecessary costs for the finance and accounting departments.

3. Access to relevant software

As most accounting activities are now done using the relevant software, you do not have to buy the software separately. Here, you can get access to better accounting software that can help to do all the relevant financial and accounting activities properly.

4. Proper implementation of accounting rules

When you outsource finance and accounting, you get access to a highly knowledgeable team. They will have all the proper knowledge regarding the accounting rules and other entities related to it. So, you do not have to worry about accounting implementation with proper rules. The service provider would have already done the task for you.

5. Improve Quality

The outsourced finance department can improve the quality of the finance and accounting departments. They will streamline all the finance and accounting departments of the business. There will be a reduction in the errors and high level of accuracy in accounting. This will avoid the different hassles later, improving the finance and accounting quality.

6. Ensure data security

Finance and accounting outsourcing to a reputable agency can help to avoid data insecurity. Data security, like data manipulation, data access, or loss of data, can be very problematic to the company. So, a reputable agency will more likely have the mechanism to avoid data security problems and ensure safe data.

7. Handle taxes

The tax aspects of a company will vary from one region to another. Also, the tax aspects are generally very complicated and tedious. Inability to handle the tax aspects can be problematic. So, outsourcing can help experts to work on the tax-related aspects to handle it efficiently.

These are some benefits of financial accounting outsourcing to an expert agency. They can streamline all the activities properly to achieve efficiency in the accounting activities.

How an Outsourced Finance Department Works

An outsourced finance department works like an in-house team but costs less. It gives firms fast and safe help through financial accounting outsourcing.

Firms share their financial files securely and get correct reports on time. Teams follow rules while using finance and accounting outsourcing for smooth work.

Step 1: Data Collection and Checks

The team collects bills, bank slips, and payroll files. They check every item before adding it to the outsourced finance department.

Step 2: Processing and Analysis

Reports, reconciliations, and expense lists are done step by step. Financial accounting outsourcing ensures all totals are correct and clear.

Step 3: Reporting and Feedback

Reports are shared, showing main numbers and key points. Teams use finance and accounting outsourcing to give clear updates on time.

Step 4: Advice and Strategy

The team may suggest cost-saving tips, but the firm chooses final steps. Ideas come from data seen in the outsourced finance department.

Using financial accounting outsourcing, firms see work done faster and fewer mistakes. Tasks run smooth and give higher output with less stress.

Key Services Provided by Finance and Accounting Outsourcing

Finance and accounting outsourcing covers many key financial tasks. Teams keep work right and in line with rules.

-

Bookkeeping

Log daily records on time and correct. Teams keep full data using finance and accounting outsourcing.

-

Accounts Payable and Receivable

Track bills, payments, and cash flow. Money stays on track using financial accounting outsourcing.

-

Payroll

Pay wages, taxes, and follow all rules. Outsourced teams make payroll smooth.

-

Financial Reports

Make balance sheets, profit-loss lists, and cash flow charts. Reports are clear and correct.

-

Tax Work

File taxes on time and follow rules. Experts watch changes carefully.

-

Budgeting and Forecasting

Give plans for money use ahead. Forecasts use real data from the outsourced finance department.

-

Audit Support

Preparing files for inside or outside checks. Teams ensure all steps match rules.

Why Finance and Accounting Outsourcing Reduces Costs

-

Lower Staff Costs

No need to hire or train full teams. Firms save using finance and accounting outsourcing.

-

Reduced Tool Costs

Outsourced teams bring the needed tools. Extra software costs fall with financial accounting outsourcing.

-

Scalable Services

Pay only for the tasks you need. The outsourced finance department grows or shrinks to fit firm needs.

-

Faster Work

Teams finish tasks quickly, saving time. Accuracy rises with finance and accounting outsourcing steps.

-

Lower Risk

Outsourced teams cut mistakes and avoid fines. Firms gain trust from financial accounting outsourcing.

Firms report cost savings of 30 to 50 percent using financial accounting outsourcing. Savings rise further when the outsourced finance department handles daily work.

Improving Quality Through Outsourced Finance Services

Quality comes from skill, tools, and steady steps. Finance and accounting outsourcing gives correct results across all tasks.

-

Skilled Teams

Accountants with skill manage each task. Teams keep high standards using financial accounting outsourcing methods.

-

Technology Use

Tools and automation lower errors. Teams use modern tools in finance and accounting outsourcing.

-

Smooth Workflow

Steps follow a clear path for correct work. The outsourced finance department keeps work neat and right.

-

On-Time Delivery

Teams meet deadlines with no delay. Financial accounting outsourcing ensures reports reach managers on time.

-

Follow Rules

Teams know rules and act by them. Using finance and accounting outsourcing cuts the risk of fines.

An outsourced finance department leads to fewer mistakes and right results. Firms make better choices using financial accounting outsourcing.

Challenges to Consider in Financial Accounting Outsourcing

Even with gains, some problems may appear. Careful plans lower risk in finance and accounting outsourcing.

- Data Safety

Sending files needs strong rules. Teams use safe steps in the outsourced finance department.

- Talk Gaps

Time zones or remote work can slow replies. Frequent updates help in financial accounting outsourcing.

- Provider Dependence

Relying on one firm may bring risk. Contracts limit issues in finance and accounting outsourcing.

- Special Needs

Some tasks need unique steps. Outsourced teams adjust tasks in financial accounting outsourcing.

With right choice and clear rules, finance and accounting outsourcing works well. Firms run smooth with an outsourced finance department.

How to Choose the Right Outsourced Finance Partner

- Check Skill

Pick certified accountants for best work. Teams give safe results using financial accounting outsourcing.

- Check Tools

Ensure teams use safe and fast tools. New systems make finance and accounting outsourcing smooth and correct.

- Check Steps

Ask about task steps, reports, and checks. Clear paths are key for an outsourced finance department to work well.

- Check Flexibility

See if services can grow with the firm. Flexible financial accounting outsourcing lets firms adapt fast.

- Check References

Talk to past clients about trust and results. Success shows a strong finance and accounting outsourcing partner.

A strong partner makes an outsourced finance department smooth and cost-efficient. Good teamwork boosts results of financial accounting outsourcing over time.

Accounts Junction is a popular finance and accounting outsourcing agency that can handle accounting activities. We have certified experts to handle the accounting and related activities properly. We use the latest accounting software to handle the finance and accounting activities. Accounts Junction is a proficient accounting service providing agency around the world.

FAQs

1. What is finance and accounting outsourcing?

- It is hiring skilled staff to handle tasks well. Outsourcing makes account work fast and with few errors.

2. How does financial accounting outsourcing save costs?

- It cuts staff, office, and software spending fast. It also changes fixed costs into small, easy payments.

3. Can an outsourced finance department handle payroll?

- Yes, payroll and taxes are done by trained teams. They check salaries, taxes, and deductions with care.

4. Is finance and accounting outsourcing secure?

- Yes, firms use strong steps to keep data safe. Encrypted tools and rules keep all financial data secure.

5. Can small businesses use financial accounting outsourcing?

- Yes, small firms get skill while cutting their costs. It lets them focus on growth and core business work.

6. How does outsourcing improve decision-making?

- Clear data from experts helps make fast, smart choices. Reports show costs, budgets, and money plans with ease.

7. Are outsourced finance departments scalable?

- Yes, services can grow or shrink as needs change. Flexible plans fit busy seasons or smaller workloads easily.

8. Can outsourced teams assist during audits?

- Yes, they get records ready for all audits fast. They check files and keep work correct for reviews.