Does Quickbook Accounting Service good for small businesses?

Are you unsure whether QuickBooks accounting services are ideal for managing a small business or not? And whether outsourcing QuickBooks accounting services is a better option or not. If yes, then let me tell you that QuickBooks is one of the best cloud accounting software for your bookkeeping and accounting requirements.

However, as a business owner, you have to decide whether you are thorough enough to handle QuickBooks accounting or need a QuickBooks online accountant.

Having access to QuickBooks software will not serve your needs. You still need help setting up and using the QuickBooks software to its full potential. Here is where Accounts Junction’s professional QuickBooks online accountant can help you.

QuickBooks Accounting Services

QuickBooks helps small firms track each money move with great ease. It gives clear views of income, costs, and cash trends. You can check past records and plan for future needs with ease.

The tool also helps you watch unpaid bills and client dues. This keeps your cash flow smooth and helps avoid late issues. You can send quick alerts to clients when bills are due.

QuickBooks lets you set rules to speed up daily tasks. You can auto-sort deals, tag items, and match bank logs. This cuts time spent on books and improves workflow for teams.

It also helps store all key files in one safe space. You can keep bills, slips, and proof documents linked to each deal. This makes it easy to find old files when you need them.

The tool works well for firms that grow fast each year. You can add users, new apps, and fresh tools when you scale. This helps firms keep pace with new work without high cost.

QuickBooks has smart search tools that find any entry fast. You can check old logs, fix errors, and view trends in minutes. This helps teams stay sharp and avoid small mistakes.

You can also use the QuickBooks mobile app for daily tasks. It helps you scan slips, track sales, and check dues on the go. This keeps you linked to your books when you travel or work remotely. QuickBooks sends alerts when it spots odd moves in your books. This helps you act fast and keep your data safe and clean. It also gives you peace of mind with each work step.

Why small firms look for new long-term tools

Small firms often seek tools that bring more clear work steps. Many owners feel work becomes slow when stress grows each day. Some look for ways to clear tasks with calm and steady focus.

Outsourcing QuickBooks accounting services may help clear daily cash tasks. A QuickBooks online accountant may guide new users with clear, simple tips.

Small firms often want tools that keep records in one space. Some also want tools that track cash with simple, clean views.

Many firms want support that grows as the firm moves ahead. Outsourced QuickBooks accounting services may guide firms with quick daily support. A QuickBooks online accountant may help users with clear steps each day.

Role of outsourced QuickBooks accounting services

Many small firms like to use outsourced QuickBooks accounting services due to their ease. Many feel that such a service may help them keep track of money more carefully.

In many cases, they find tasks done on time, which helps them feel more ready for the next day. It may also give them a sense of space to think of growth.

Below are some parts of the service that draw the interest of many small firms.

-

Time Support

Small firms often deal with fewer staff. Time is short for many owners. When they try outsource QuickBooks accounting services, they may save time and focus on core tasks. This simple shift may build a better pace in their daily work.

-

Cost Control

Small firms try to keep costs at a fair level. Many tools add cost yet may also add value. When they use outsourced QuickBooks accounting services, they may reduce the need for a full team. It may keep their cost plan smooth.

-

Clear Work Flow

Many users report that the service may offer a clean and calm flow. Each task appears clear, and each part seems easy to check. They may use QuickBooks online accounting for added clarity in many small tasks.

-

Support in Busy Periods

Now and then, firms deal with peak work. They try hard to cope with large loads. Outsourcing QuickBooks accounting services may give them more room to breathe in such times. When they feel the load lighten, they may work with less stress.

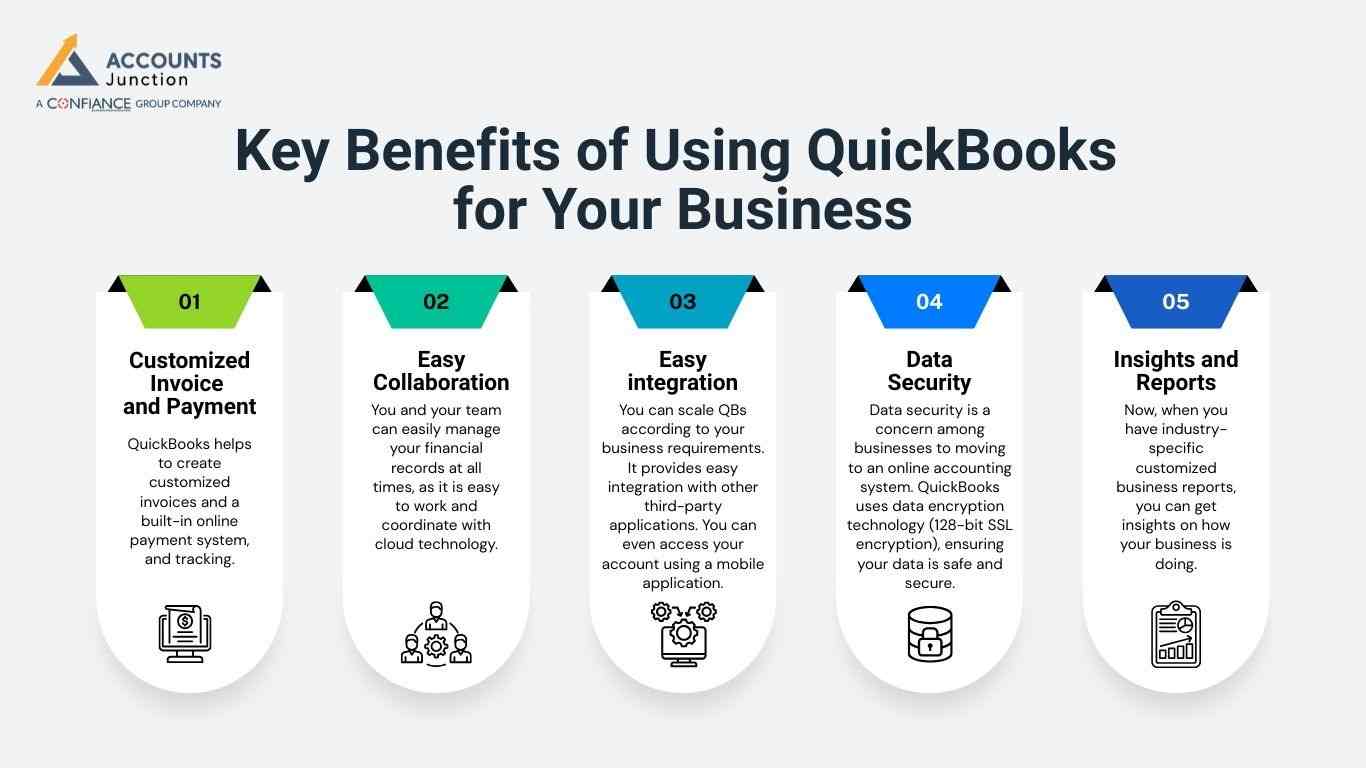

Key Benefits of Using QuickBooks for Your Business

-

Customized Invoice and Payment

QuickBooks helps to create customized invoices and a built-in online payment system, and tracking.

-

Easy Collaboration

You and your team can easily manage your financial records at all times, as it is easy to work and coordinate with cloud technology.

-

Easy integration

You can scale QBs according to your business requirements. It provides easy integration with other third-party applications. You can even access your account using a mobile application.

-

Data Security

Data security is a concern among businesses to moving to an online accounting system. QuickBooks uses data encryption technology (128-bit SSL encryption), ensuring your data is safe and secure.

-

Insights and Reports

Now, when you have industry-specific customized business reports, you can get insights on how your business is doing.

How QuickBooks Online Accountant May Support Daily Work

Many owners like tools that feel simple and safe. A QuickBooks online accountant may give them such a feeling. They can view many parts of their books in one place. They can also see reports with clear numbers.

-

Simple View

The tool seems to show numbers in a simple form. Small firms can check their bills and sales with ease. They can also track small gaps in cash flow. This may bring them a sense of calm.

-

Shared Access

Some owners want to let staff view some parts of the books. A QuickBooks online accountant may let them share access with care. It is done in a way that feels safe and easy. This may save time in the long run.

-

Clear Records

Many owners like neat records. This tool may help them keep things neat. It may also help them check old files with ease. Simple steps may reduce confusion.

-

Quick Reports

Quick reports may help owners make fast choices. Many small firms want fast reports. A QuickBooks online accountant may help them check trends at the right time.

Common Tasks That Firms May Manage with These Tools

Many small firms use outsourced QuickBooks accounting services to handle many tasks. Below is a list of tasks that may be part of their daily work.

-

Billing

Firms need quick and clear bills. The service may help them send them on time.

-

Cash Flow View

Small firms track cash each day. A clear view may help them plan.

-

Payroll

Many firms manage staff pay with simple tools. Some use QuickBooks online for basic checks.

-

Sales Records

Small firms want to track sales in a simple way. These tools may help them track trends.

-

Expense Checks

They want to track each small and large cost. These tools may show costs in a neat way.

Integration with Other Business Tools

Many small firms use several apps to manage daily work. QuickBooks can link with other tools to make work easier and reduce repeated tasks. These links may save time, lower errors, and help owners focus on the main business work.

Key Benefits of Integration:

- Connects with Banks:

QuickBooks can link directly with bank accounts. Firms may import transactions automatically. Manual mistakes may be dropped, and time may be saved. Owners can reconcile accounts without checking each record one by one. - Supports Payment Apps:

Apps like PayPal, Stripe, and Square can connect to QuickBooks. This may track payments automatically and show pending or received money. Small firms may watch cash flow easily and reduce confusion. - Simplifies Invoicing:

QuickBooks can link with invoicing tools to send bills on time. Firms may track unpaid invoices and reduce late payments. Integration helps invoices go out faster, and cash flow stays steady. - Automates Receipts Management:

Expense receipts can be imported and sorted automatically. This may lower manual work and keep records neat. A QuickBooks online accountant may show all receipts in one clear view. - Improves Reporting and Insights:

Linked tools let QuickBooks gather data from many sources. Owners may make reports quickly and see trends easily. Income, costs, and payments may be checked without extra work. - Reduces Manual Workload:

Linked apps lower the need for repeated tasks. Fewer mistakes may happen, and teams may focus on growth work. Automation may improve staff work and reduce stress. - Enhances Collaboration:

Integration may let multiple staff see synced data. A QuickBooks Online accountant may show updates to all authorized users. Teams may work together without using email or files manually. - Supports Strategy and Planning:

When data flows well, owners may focus on planning growth. Integration reduces the need to match many systems. Firms may see chances for cost savings or expansion easily.

Extended Example:

For example, a small shop may link QuickBooks with its bank, payment apps, and stock system. Each sale, payment, or cost may update in QuickBooks automatically. Owners may see profits, track stock, and create invoices without extra steps. A QuickBooks online accountant may provide a dashboard with all linked data clearly, giving owners real-time insights for better choices.

Accounts Junction is one of the leading QuickBooks accounting service providers for a comprehensive range of QuickBooks services, along with consulting services. We can help with anything and everything related to QuickBooks. We have a professionally qualified and certified QuickBooks Online accountant to get you started with QuickBooks accounting.

FAQs

1. What does outsourcing QuickBooks accounting services really mean?

- It may mean a team handles your cash tasks. It may also mean you save time with clear steps.

2. Is QuickBooks Online Accountant safe for small firms?

- It may feel safe for most small firm needs. It may guide users through clear, simple daily moves.

3. Are outsourced QuickBooks accounting services costly today?

- The cost may feel fair for most small teams. Users may find value in the steady support.

4. Can a QuickBooks Online accountant track daily cash moves?

- It may track cash through clean, simple views. Users may check cash data at any time.

5. Are outsourced QuickBooks accounting services good for new teams?

- New teams may gain help from ready-skilled support. This may guide them during early firm days.

6. Can QuickBooks Online accountants suit wide task lists?

- It may suit small and mid-sized task lists. It may guide users through each short task.