Does outsourcing accounting services solve a business scalability problem?

Businesses always need to make proper plans if they want to expand their market. Scalability is a very important factor that helps expand the business and increase its revenue.

Many businesses lack the ability to get proper scalability of their operations, and they cannot plan the other aspects accordingly. If the accounting team of the organization is less qualified or inexperienced, then it may not provide proper scalability for the business.

It is not possible for all small and medium-scale businesses to hire a high-paying accounting team. So, outsourcing accounting services can be a better choice for these business organizations.

They can help achieve better scalability for businesses. There are accounting outsourcing companies where you can outsource the accounting activities. Outsourcing accounting activities can be very beneficial for business scalability.

Understanding Business Scalability Problems

Scaling a business means growing sales, clients, or products without adding costs. Many firms face problems because financial work becomes hard to handle quickly. Manual books, payroll mistakes, and late reports often slow down growth. Hiring extra staff may help, but it adds cost and takes time to train. Here, outsourcing accounting services can give firms a simple way to scale.

Many firms may also see stress when rules change fast. Teams may not track new tax needs in real time. This can slow plans and hurt steady growth in key markets. With outsourcing accounting services, firms gain clear help that keeps work smooth.

Common Signs of Scalability Challenges

- Late reports cause poor choices and missed business chances. Slow data can also hurt planning and day-to-day decisions.

- Payroll errors rise as staff or locations grow too fast. Mistakes can upset employees and lower trust within teams.

- High costs cut profit even when sales keep going up. Extra spending can stop growth and reduce funds for new work.

- Internal staff may lack skills for hard accounting tasks. Tasks like taxes or audits may overwhelm the current team.

- Weak tech slows the review of data and delays decisions. Old systems often stop fast reporting and reduce insight.

When these signs appear, firms often turn to accounting outsourcing companies.

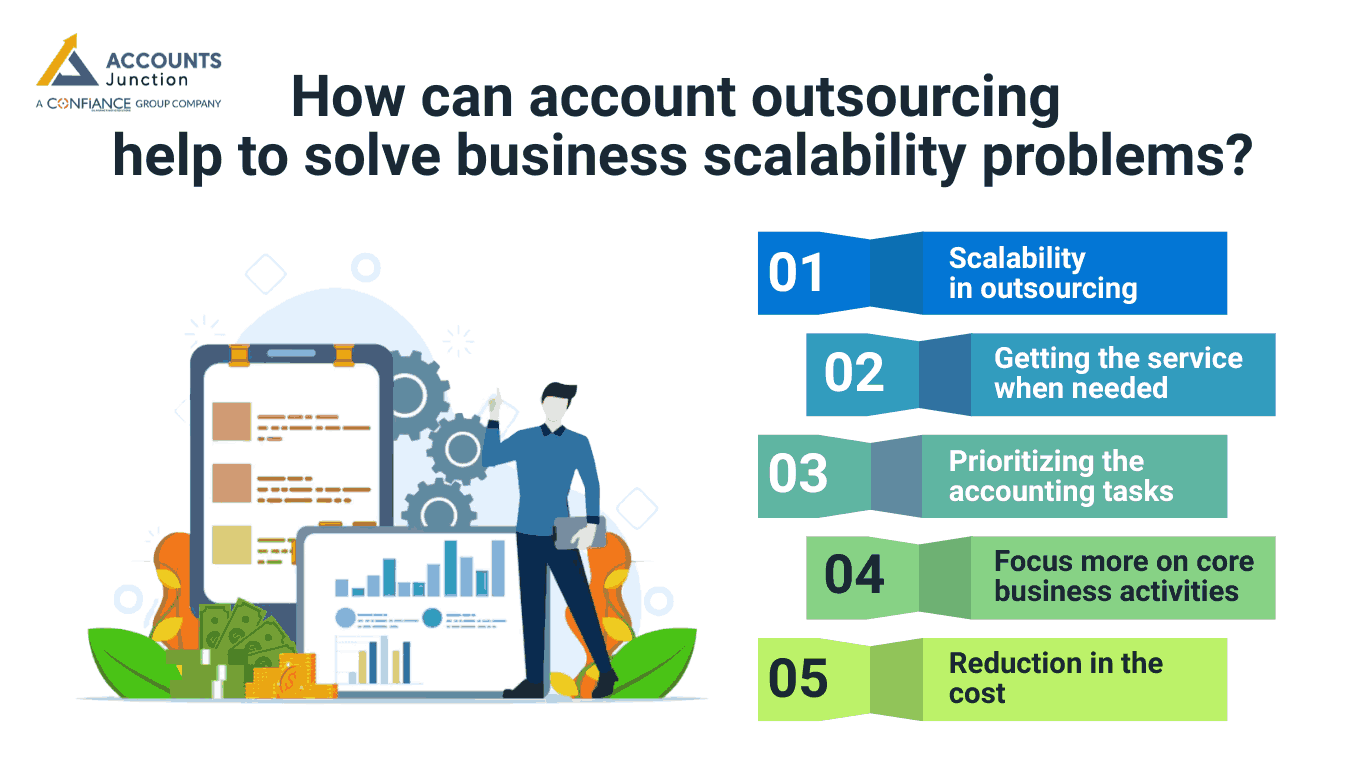

How can account outsourcing help to solve business scalability problems?

Outsourcing of the accounting task can be very influential in solving the business scalability to a great extent.

Here are some ways through which outsourcing accounting services can solve problems relating to business scalability:

1. Scalability in outsourcing

Businesses can achieve scalability through outsourcing in an efficient manner. Investment in the infrastructure, training, and other related aspects can be easily checked.

2. Getting the service when needed

If you have a small or medium-sized business, it is not affordable to hire high-paying accounting staff. It can also impact the needed accounting service for the organization. Account outsourcing can reduce the cost, and you can get the accounting services whenever needed.

3. Prioritizing the accounting tasks

The accounting task is usually done in a traditional pattern in proper steps by the accounting department. However, if the business needs some activities to be done in a certain pattern where they want to prioritize some tasks, then you can do it accordingly. You can communicate the priority to the outsourced agency as needed by the business organization.

4. Focus more on core business activities

In many businesses, the business owners and other management staff get involved in the accounting activities. This distorts the focus from the important business activities. Outsourcing the accounting activities can help the business owners and other staff to focus more on the core business activities.

5. Reduction in the cost

If you have an in-house accounting team, then it will involve some unavoidable processes like hiring, training, buying accounting software, and allocating other needed resources. All of them will involve some amount of cost, increasing the organizational expenses. By outsourcing accounting services, you can reduce the cost of the business. This can help to get better scalability in the business.

These are some ways through which account outsourcing can solve the business scalability. To get a better solution for the scalability problem, it is important that the outsourcing task is given to a proficient agency.

Challenges of Outsourcing Accounting Services

Outsourcing gives help, but some problems may appear often.

1. Communication Gaps

Working across distance and time zones can slow updates. Regular checks and clear steps help avoid mistakes fast. Trusted accounting outsourcing companies fix most communication problems. Teamwork ensures messages reach all sides fast and clear.

2. Data Security Concerns

Sharing financial data needs strict rules at all times. Rules and codes protect data from loss or theft. Trusted accounting outsourcing companies follow strict safety rules. Contracts must keep all company data safe always.

3. Lack of Control

Outsourcing gives some control to teams outside the company. Clear rules and checks help keep work right always.

Account outsourcing works best with set goals and tasks. Regular reviews make sure tasks match the company's needs.

Choosing the Right Accounting Outsourcing Company

Picking the right partner is key to smooth work. Choose a team that fits your plans and work needs.

Experience and expertise

Make sure accountants know your business well. They should show real skill with their daily finance tasks.

Technology adoption

Check that the company uses safe, modern tools. The tools must help you track your numbers fast.

Scalability support

Ensure they handle growth or work spikes. They should add support when your workload grows.

Communication

Look for fast updates and clear reports always. Good teams share facts at the right time.

Cost efficiency

Compare fees and avoid extra costs. Pick a plan that fits your budget well.

Investing in trusted accounting outsourcing companies helps growth go smoothly. Good partners cut mistakes, save money, and support goals.

When Account Outsourcing Is Most Effective

- For startups with low budgets for full accounting teams. Outsourcing lets them get experts without hiring many staff members inside.

- Growing businesses with work that changes by season. Flexible teams cover busy times and keep accounts correct all year.

- Companies moving to new markets or expanding areas. Outsourced accountants handle taxes and rules in these new places.

- Businesses need smart tax help and rule compliance. Experts help avoid fines and keep reports clear and on time.

- Firms wanting to use cloud or automated accounting tools. Outsourcing sets up and manages these systems for smooth use.

Tips for Successful Accounting Outsourcing

- Set clear goals and key performance targets first. Track results to see if outsourcing meets your expected needs.

- Keep open and steady talks with outsourced teams. Regular updates stop errors and boost team understanding quickly.

- Blend outsourced work with in-house tasks smoothly. Good workflows avoid overlap and make daily tasks more efficient.

- Check legal and tax rules in all areas. Follow rules carefully to avoid issues with local authorities.

- Review results often and make needed changes fast. Quick changes keep finance work correct and ready for growth.

Does Outsourcing Truly Solve Scalability Problems?

Outsourcing accounting services can help a business grow fast. It gives teams skill and time to focus on core work.

Still, it does not fully replace internal finance plans. Internal plans stay key to guide growth and smart choices.

It cuts costs, boosts work speed, and gives expert help. Firms can handle more tasks without adding big internal teams. Clear rules, talks, and checks are key to success. Oversight keeps outsourced work correct and matches business goals.

In the end, accounting outsourcing companies are tools, not magic fixes. Used right, account outsourcing helps businesses grow in a steady way.

Industry Specific Advantages of Account Outsourcing

1. Retail Businesses

Retail stores deal with stock and sales data each day. Outsourcing accounting services helps track stock and sales with clear results.

Retail-based accounting outsourcing companies can handle busy times with ease. This setup cuts errors and lifts profit in peak sales times.

2. Service-Based Companies

Service firms deal with bills, tasks, and staff pay each day. Account outsourcing keeps bills right and tax work on the right time. This lets service firms give more time to clients and work.

3. Manufacturing Firms

Plant units track cost, staff pay, and goods flow each day. Outsourcing accounting services makes the cost and report work faster and cleaner. Skilled accounting outsourcing companies can guide plant accounts with great care.

Accounts Junction is one of the proficient accounting outsourcing companies where you can expect better business scalability. Outsourcing accounting services here can help you get experts working on your accounting tasks. We can streamline the accounting activities to solve problems related to scalability. Accounts Junction is a popular accounting services providing agency around the world.

FAQs

1. Can outsourcing reduce my business costs significantly?

- Yes, outsourcing avoids hiring more staff and cuts many costs. It also lowers rent, tools, and office supply spending.

2. Is outsourcing accounting services safe for sensitive data?

- Most firms use strict rules to keep data fully safe. They lock files and give access only to the needed staff.

3. Can account outsourcing help with tax compliance?

- Yes, skilled firms handle taxes right to avoid fines or fees. They meet deadlines and keep all reports up to date.

4. Will outsourcing slow down decision-making in my company?

- No, regular updates give data fast for smart decisions. Reports arrive on time, and help leaders act without stress.

5. Can small businesses benefit from outsourcing accounting services?

- Yes, small firms save cash and gain expert support quickly. It lets owners focus more on work that grows the business.

6. How do I choose the right accounting outsourcing company?

- Check skill, tools, growth help, cost, and clear updates. Also see reviews to know if past clients were happy.

7. Does outsourcing replace my in-house accounting team entirely?

- Not always, it adds help and improves teamwork and speed. It takes care of tasks while staff handle key plans.