Why outsource accounting is the growth engine for CPA firms?

Many CPA firms struggle with one common challenge: ensuring their financials are handled and managed in the same way as their clients. As a CPA firm, they know accurate and efficient accounting is essential for sound financial health. But often, while meeting their clients' expectations and requirements, they end up in the following two situations.

- Firstly, they lose track of their firm’s accounting and bookkeeping.

- Second, they don’t get enough time to focus on the growth of the business.

Further, these situations lead to missing business development opportunities, which ultimately affect the business. Negligence in accounting harms the financial health of the business.

If you are a CPA firm stuck in the above-mentioned situation, there are two ways to handle these challenges:

- Hire an in-house accounting team to manage your accounting and bookkeeping.

- Outsource bookkeeping services to reliable and reputable accounting service providers.

CPA outsourcing services are the new norm for getting your accounts done. As a CPA firm, you must be aware of the various benefits of outsourced bookkeeping services for CPAs.

Many SMB and individual accountants are collaborating with external service providers to enjoy multiple benefits of outsourcing. Even medium and large-scale companies are availing the services of an accounting firm like Accounts Junction to boost their growth. Companies view outsourcing as a strategy to get their work done cost-effectively.

The Challenges CPA Firms Face

Before using CPA outsourcing, firms face many real problems.

-

Staff Shortages and Turnover

Finding skilled staff is hard and slows down daily work. High turnover delays client tasks and raises hiring costs.

-

Rising Client Expectations

Clients want advice, insights, and clear business help. They expect more than just simple tax preparation work.

-

Increasing Complexity of Compliance

Tax laws and rules change often and cause issues. Firms must stay up to date to avoid fines.

-

Technology Integration Challenges

New tools like cloud software need trained staff. Many firms struggle to use tech while keeping quality.

-

Pressure on Profit Margins

Manual bookkeeping and staff raise costs for the firm. Firms need ways to cut costs and earn more.

These problems make CPA outsourcing services key for growth.

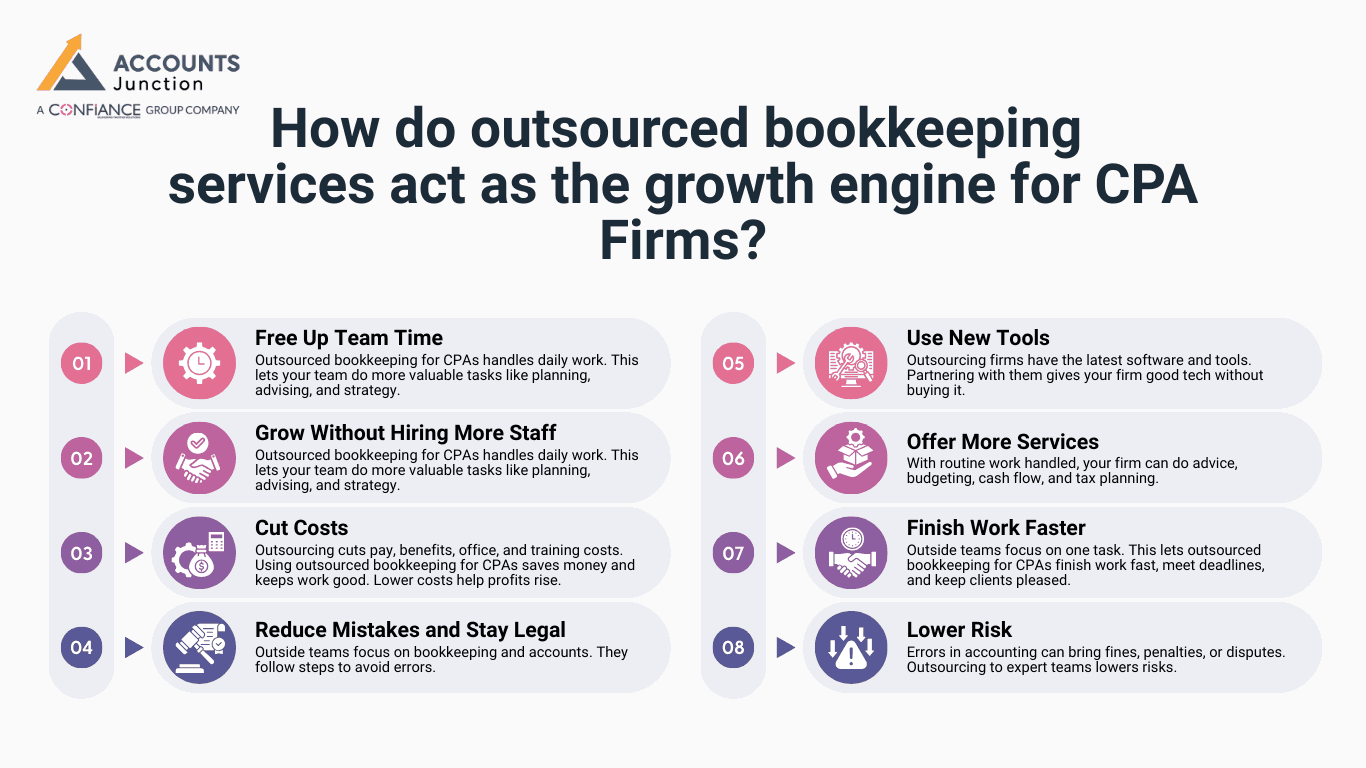

How do outsourced bookkeeping services act as the growth engine for CPA Firms?

CPA outsourcing services let firms send routine, time-consuming work to outside teams. This includes bookkeeping, payroll, tax work, bills, and reports.

Here’s why outsourcing accounting can help CPA firms grow:

1. Free Up Team Time

Outsourced bookkeeping for CPAs handles daily work. This lets your team do more valuable tasks like planning, advising, and strategy. Staff can focus on work that grows income and keeps clients happy.

2. Grow Without Hiring More Staff

Hiring costs money and takes time. CPA outsourcing services let firms grow without new staff. During busy tax time or sudden client growth, outsourcing gives room to work without stress.

3. Cut Costs

Outsourcing cuts pay, benefits, office, and training costs. Using outsourced bookkeeping for CPAs saves money and keeps work good. Lower costs help profits rise.

4. Reduce Mistakes and Stay Legal

Outside teams focus on bookkeeping and accounts. They follow steps to avoid errors. Firms using CPA outsourcing services get more correct work and fewer client problems.

5. Use New Tools

Outsourcing firms have the latest software and tools. Partnering with them gives your firm good tech without buying it. Outsourced bookkeeping for CPAs helps you work fast and report well.

6. Offer More Services

With routine work handled, your firm can do advice, budgeting, cash flow, and tax planning. CPA outsourcing services let firms offer more and earn extra income.

7. Finish Work Faster

Outside teams focus on one task. This lets outsourced bookkeeping for CPAs finish work fast, meet deadlines, and keep clients pleased.

8. Lower Risk

Errors in accounting can bring fines, penalties, or disputes. Outsourcing to expert teams lowers risks. CPA outsourcing services follow rules to keep your firm safe and sound.

The Role of Outsourced Bookkeeping for CPAs

Outsourced bookkeeping for CPAs is a key part of CPA outsourcing services. It helps firms grow with ease and speed.

- Accurate Financial Records

Outsourced teams keep clean and clear books. This gives CPA firms a strong base for audits, reports, and advice work.

- Timely Reporting

Outsourced bookkeeping gives fast and fresh reports. This helps clients make smart and quick money plans.

- Simplified Tax Preparation

Good books make tax work smooth and quick. It cuts stress during tax time.

- Cost-Effective Solution

Outsourcing costs less than in-house staff. Still, firms get high-skill work and tight control.

- Focus on Strategy

With basic tasks done by the team offshore, CPAs can spend more time on advice, plans, and client growth.

Outsourced bookkeeping for CPAs turns day-to-day tasks into a strong path for firm growth.

Key Benefits of Using CPA Outsourcing Services

Let’s look at the key gains that come from the use of CPA outsourcing. These gains show why more firms now treat this model as a path to strong and steady growth.

-

Efficiency

With clear steps, clean tools, and trained staff, work moves fast. Teams meet tight dates with ease and keep a smooth flow in all tasks.

-

Flexibility

Your team can grow or shrink to match the rush or slow times in the year. This helps you stay lean while still meeting all client needs.

-

Cost Savings

You save on pay, skill training, space, gear, and tech. These cuts free funds for other firm goals.

-

Accuracy

Skilled teams check all data with care. This lowers the chance of error and helps you meet all rules and laws.

-

Client Satisfaction

Fast work and clean books help you give a great client experience. Happy clients stay with your firm for a long time.

-

Business Growth

When you hand off low-skill tasks, your team can focus on advice, client care, and new plans. This helps build strong growth.

All these gains show that CPA outsourcing services are a smart move for long-term growth. They do more than cut costs; they help your firm reach new peak goals.

Choosing the Right CPA Outsourcing Partner

To get the best value, your firm must pick the right group to work with. These points help you make a sound choice:

-

Expertise and Experience

Pick teams that know the needs of CPA firms. They should have work proof with firms like yours.

-

Data Security

Money data is very private. Make sure the team uses safe tools, strong locks, and secure ways to share files.

-

Technology Stack

Choose a group that works with top tools in tax, books, and pay. Their tools must sync well with your own tools.

-

Scalability

Your partner must grow with your client list. They must handle peak seasons with ease.

-

Communication and Support

Good talk and quick help make the work flow smooth. Your firm must feel heard at each step.

A strong choice ensures your CPA outsourcing services give top value and help your firm rise fast.

Real-World Impact of Outsourcing Accounting

Many firms that use outsourced bookkeeping for CPAs see clear wins in day-to-day work. These gains show why this model is now a key part of firm plans.

- Tax work and reports done 30–50% faster

- Firm costs cut by 20–40%

- Higher client trust and long-term ties with clients

- New advice and planning services were added with ease

- Staff use more time for high-value tasks

These points show that outsourcing is not just a back-room step. It is now a core part of growth for strong and smart CPA firms.

Future of CPA Firms

The field of accounts and tax is now in a state of rapid change mode. Firms that rely on local teams alone may fall behind. Firms that use CPA outsourcing services are set to lead.

-

Automation and AI Integration

Work steps get faster and more clear with new tech. Outsourced teams use these tools to cut time and boost quality.

-

Focus on Advisory Services

CPA firms now shift from pure tax work to full business advice. With outside help for books, they have more time for this role.

-

Global Talent Access

Outsourcing gives access to skilled teams in many parts of the world. You get high-skill work without high local costs.

-

Enhanced Client Experience

Fast, neat, and clear reports help build strong client ties. Firms that offer more value gain more trust.

Firms that use outsourced bookkeeping for CPAs are ready to lead in this new age of smart, tech-driven accounting.

Outsourcing is now a core strategy for CPA firms that want to grow with speed and stability. By using CPA outsourcing services and outsourced bookkeeping for CPAs, firms gain more time, stronger systems, and a clear path to long-term expansion. These services bring better accuracy, lower costs, and more room for high-value work. Firms that adopt this model can increase profits, raise client trust, and run their operations with more control and less stress.

Accounts Junction works with CPA firms that want clean books, smooth workflow, and reliable financial support. We offer full accounting and bookkeeping services with a team that understands the exact needs of CPA firms. Our process is simple, our work is consistent, and we have certified experts who deliver quality in every task. Partner with us to build a stronger and more scalable future for your firm.

FAQs

1. What are CPA outsourcing services?

- CPA outsourcing services are accounting tasks that CPA firms hand over to outside experts. These tasks include bookkeeping, tax prep, payroll, and financial reporting.

2. What is outsourced bookkeeping for CPAs?

- Outsourced bookkeeping for CPAs means a CPA firm hires an external team to handle day-to-day bookkeeping work like entries, reconciliations, and reports.

3. Why do CPA firms outsource accounting work?

- CPA firms outsource to save time, cut costs, and reduce workload. It helps them focus on advisory and tax planning.

4. How do CPA outsourcing services help firms grow?

- They help firms handle more clients, reduce errors, speed up work, and improve service quality. This leads to higher revenue and better client trust.

5. Is outsourced bookkeeping for CPAs safe?

- Yes, reputable outsourcing partners follow strict data security rules and use secure systems to protect client information.

6. Can outsourcing reduce staff workload?

- Yes, CPA outsourcing services take over routine tasks so the in-house team can work on higher-value jobs.

7. Will outsourcing lower my firm’s costs?

- Yes, it reduces hiring costs, training costs, and office expenses. You pay only for the services you need.

8. Does outsourced bookkeeping for CPAs improve accuracy?

- Yes, outsourced teams are trained in bookkeeping and use the best tools to reduce mistakes.

9. Can outsourcing help during tax season?

- Yes, CPA outsourcing services allow firms to scale their team quickly and handle seasonal workload spikes without stress.

10. Do outsourcing providers use modern accounting tools?

- Most providers use cloud systems, automation, and advanced software, giving CPA firms better and faster workflows.

11. How does outsourcing support client satisfaction?

- Clients get faster reports, accurate books, and more value from the CPA firm because the team has more time for advisory.

12. Does outsourced bookkeeping for CPAs make audits easier?

- Yes, clean and updated books make audits faster and smoother.

13. Can small CPA firms benefit from outsourcing?

- Absolutely, outsourcing helps small firms compete with larger firms by giving them access to skilled staff at low cost.

14. What tasks can be outsourced by CPA firms?

- Bookkeeping, payroll, tax prep, AP/AR, reconciliations, financial reports, and admin accounting work.

15. How fast can CPA outsourcing services be scaled?

- Very fast, outsourcing partners can add more people during high workload periods and scale down when the workload drops.

16. Will outsourced bookkeeping for CPAs replace my core team?

- No, it supports your core team so they can focus on strategic and advisory tasks.

17. Can outsourcing help firms offer new services?

- Yes. With routine work handled externally, firms can offer cash flow planning, budgeting, and business advisory services.

18. How do I choose the right CPA outsourcing partner?

- Check their experience, security, software skills, service quality, and ability to scale.

19. Is outsourcing a long-term strategy for CPA firms?

- Yes, many firms use outsourcing to grow, reduce costs, and improve performance year after year.

20. Will outsourcing help improve firm profitability?

- Yes, it cuts overhead, boosts efficiency, and frees time for high-value work. This increases overall profit and growth.