Can I submit a VAT return online?

Ever wondered if sending your VAT return can be done from your laptop or phone? Many business owners ask the same thing. The process may seem full of rules, but in truth, it can be much simpler than one might expect. The digital path of submitting a VAT return online has opened an easier way for businesses to stay on track with their tax duties.

Let’s understand how it works, what it means, and why so many business owners may prefer to submit VAT return online.

What is a VAT Return?

To understand how you can send your VAT return online, you must first know what it is.

A VAT return is a report a business sends to the tax authority, showing the amount of value-added tax collected on sales and paid on purchases. This helps calculate how much VAT the business owes or can reclaim.

In simpler words, it’s like a short report of your business's tax activity during a period—usually every three months.

If your sales include VAT, you collect it from customers and then pay it to the government, minus the VAT you already paid on your business expenses. The return tells that story.

Can a Business Submit VAT Return Online?

Yes, it can. In fact, many tax offices now prefer online submissions. Instead of filling paper forms, businesses may use digital systems to send their VAT details.

Online submission can help reduce mistakes and save time. Many countries have already moved to digital reporting to make the process faster and smoother for both taxpayers and tax offices.

But let’s see how this actually works in real practice.

Why Businesses Choose to Submit VAT Return Online

1. Ease and Speed

- Filling forms online can take minutes instead of hours. No printing, no mailing. You log in, enter numbers, and press submit.

2. Error Reduction

- Online tools can alert you when something looks off. A missing figure or wrong entry may be spotted before submission.

3. Automatic Records

- Once you submit your VAT return online, it stays in the system. You can view old returns anytime without digging through files.

4. Environmental Benefit

- Less paper, less waste. The online method may not only save time but also help reduce clutter.

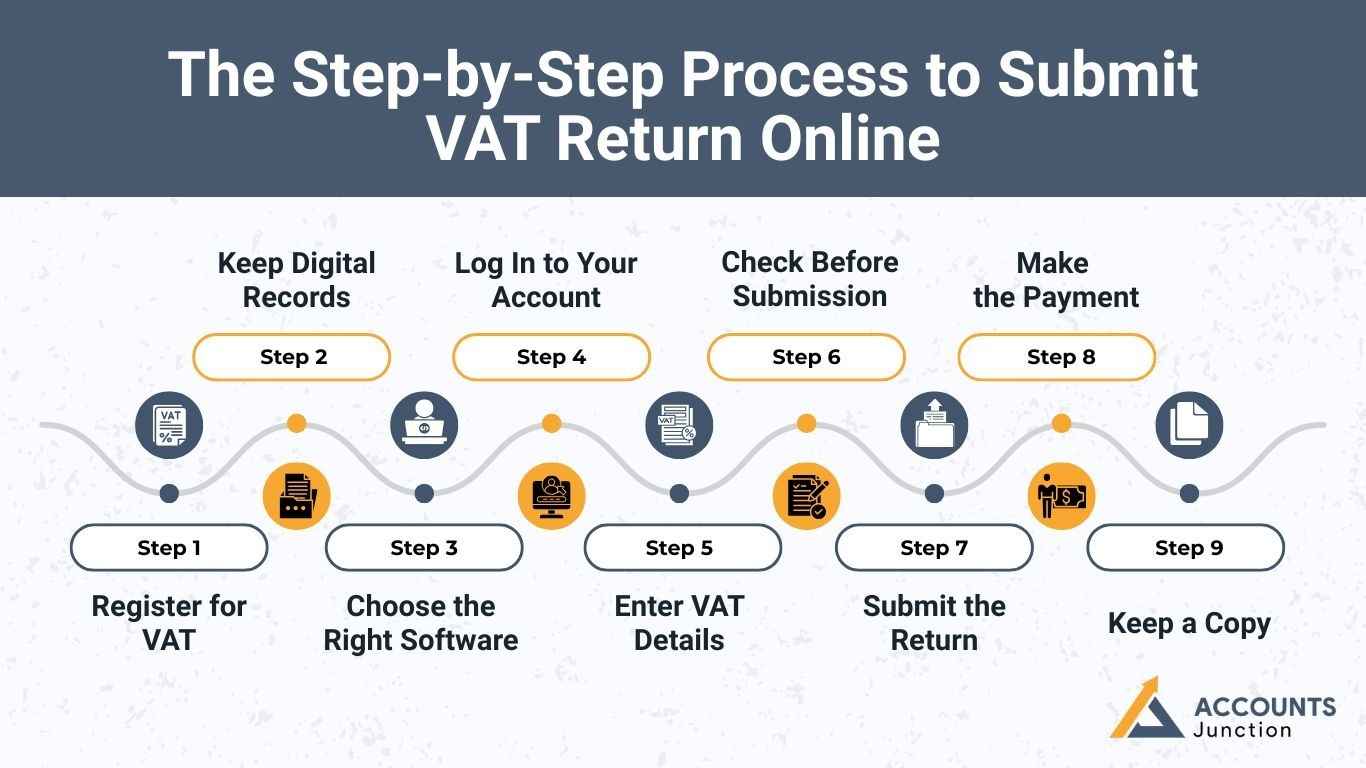

The Step-by-Step Process to Submit VAT Return Online

Let’s break down how one may go through the online submission process.

Step 1: Register for VAT

- Before you can file a return, your business must be registered for VAT. Most tax offices provide an online registration service. Once approved, you’ll get a VAT number and access to your online account.

Step 2: Keep Digital Records

- You’ll need to maintain records of all your sales, purchases, and expenses that include VAT. This is usually done through accounting software or spreadsheets.

Step 3: Choose the Right Software

- Some countries have special rules about software for digital tax submissions. Choose a tool that links directly with the tax system. Software like QuickBooks, Xero, or Sage may offer features to help you file your VAT return online easily.

Step 4: Log In to Your Account

- Use your tax authority’s online portal. Enter your ID and password to open your VAT dashboard.

Step 5: Enter VAT Details

- Input your sales and purchase data. The system will usually calculate the amount owed or due for refund.

Step 6: Check Before Submission

- Take a moment to review the numbers. Ensure they match your records.

Step 7: Submit the Return

- Once confirmed, click submit. You’ll get a confirmation message or receipt.

Step 8: Make the Payment

- If you owe VAT, pay the due amount before the deadline. Online payment options like bank transfer or card may be available.

Step 9: Keep a Copy

- Always keep a digital copy of your return for future reference.

Important Dates and Deadlines

Each country may have its own filing schedule, but most businesses file VAT returns every quarter. For example:

- Quarter 1: January to March

- Quarter 2: April to June

- Quarter 3: July to September

- Quarter 4: October to December

Returns are often due within one month after each quarter ends. Missing the date may lead to penalties or interest, so it’s wise to mark those dates early.

What Happens After You Submit VAT Return Online?

After you send your VAT return online, the system checks it and confirms receipt. If there’s any refund due, it’s processed and sent to your bank. If payment is owed, it’s recorded once paid.

Some tax offices may send follow-up messages if they notice unusual entries or missing data. That’s why keeping your records tidy helps.

Common Issues When Submitting VAT Return Online

Even though online filing can be easy, a few common problems might come up:

1. Forgotten Login Details

- If you lose your password or ID, you may request recovery through the tax website.

2. Incorrect Data Entry

- One wrong digit can change the entire total. Always double-check before submission.

3. Late Filing

- Deadlines are fixed. Submitting late may cause fines or interest.

4. Software Connection Errors

- Sometimes the system link between your accounting tool and tax portal may fail. Restarting or re-authorizing the connection can help.

5. Internet Issues

- Unstable connection may interrupt submission. Always ensure a proper network before sending your return.

Tips to Make VAT Return Online Easier

- Record Daily – Enter transactions daily or weekly instead of waiting for the deadline.

- Use Reliable Software – A good accounting tool can track VAT automatically.

- Keep Proofs – Save invoices and receipts in one place.

- Set Reminders – Mark due dates to avoid missing deadlines.

- Stay Updated – Tax rules may change, so keep an eye on new updates.

What if a Mistake Happens?

No need to panic. If an error slips in, you may amend it in the next return or request correction through your online account. Each tax authority has its own process for adjustments.

The goal is to fix mistakes early to prevent bigger problems later.

Is It Safe to File VAT Return Online?

Yes, the process can be secure if done through official portals. Government tax systems often use encrypted connections to protect your data. Always ensure the website starts with “https” before logging in.

Avoid sharing your login details or using public Wi-Fi for tax filing.

Advantages of Filing VAT Return Online

|

Benefit |

Explanation |

|

Speed |

Submissions can be done in minutes |

|

Accuracy |

Digital checks reduce common errors |

|

Record Access |

All past returns stay available online |

|

Convenience |

File anytime, anywhere with internet |

|

Eco-Friendly |

No paper or manual handling needed |

What Businesses May Gain from Digital Filing

Businesses that use online filing may see better control of their cash flow. The process may also encourage proper record-keeping and smoother audits. It may even help business owners understand their sales trends by reviewing VAT records over time.

If you manage a business, consider going through this blog and start submitting VAT return online. A few clicks may change how you handle VAT forever. Need help with your tax or VAT return? Accounts Junction provides complete VAT return filing services along with tax services. Contact us now outsource your VAT return filing.

FAQs

1. Can every business file VAT return online?

- Most registered businesses can file online if they have internet access and valid credentials.

2. Do I need special software for filing VAT return online?

- Some countries require approved software that connects directly to their tax system.

3. Can I correct a VAT return after submission?

- Yes, most systems allow corrections in the next return or through a request form.

4. Is filing VAT return online secure?

- Yes, if you use official tax portals with encrypted connections.

5. Can I view past VAT returns online?

- Yes, submitted returns remain available in your account history.

6. What happens if I miss the VAT return deadline?

- You may face penalties or interest depending on how late the submission is.

7. Can I file VAT returns from my mobile phone?

- Yes, many portals and software tools now support mobile access.

8. Do I get confirmation after filing VAT return online?

- Yes, you receive a digital receipt or reference number once it’s submitted.

9. How often should VAT returns be filed?

- Usually every three months, though it may vary by country.

10. Can I claim a refund through online VAT filing?

- Yes, if you paid more VAT than collected, you may request a refund.

11. Can my accountant submit the VAT return online for me?

- Yes, if you authorize them to manage your account.

12. What if my VAT software fails during submission?

- Try reconnecting or use the official tax portal directly.

13. Can I save a draft before submitting the return?

- Yes, most systems let you save and continue later.

14. Do I need to print the return after submitting online?

- Not required, but you can download a copy for your records.

15. Can I change the payment method after submission?

- Some portals allow changes before the payment is processed.

16. What details do I need to file my VAT return online?

- You’ll need sales data, purchase records, VAT amounts, and business info.

17. Can I submit my VAT return early?

- Yes, early submission is usually accepted before the due date.

18. Is there a fee for filing VAT return online?

- No, submission through official portals is usually free.

19. Can small businesses use online VAT filing?

- Yes, small and large businesses both can use the same digital process.

20. What if I lose my VAT login details?

- You can recover them through the tax authority’s password reset system.