Why is Bookkeeping Important for Artists and Creative Professionals?

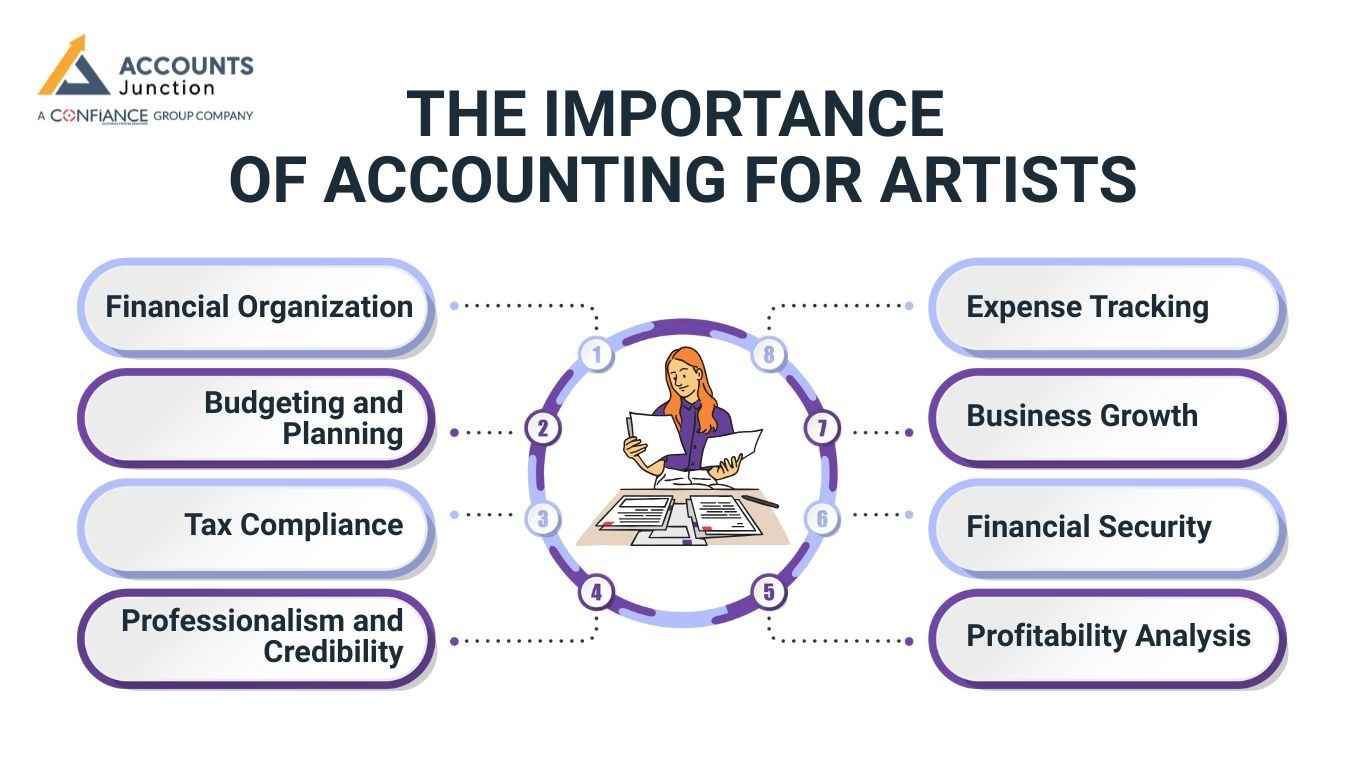

The Importance of Accounting for Artists

Here are several reasons why bookkeeping for artists is crucial for artists and creative professionals.

-

Financial Organization

Bookkeeping helps artists keep their financial affairs organized. By maintaining accurate and up-to-date records of income and expenses, artists can easily track their financial transactions. This organization is essential for budgeting, planning, and making informed financial decisions.

-

Budgeting and Planning

Artists often work on a project basis or have irregular income streams. Effective accounting for artists allows them to create budgets and financial plans. This helps in allocating resources efficiently, managing cash flow, and avoiding financial pitfalls. Having a clear understanding of their financial situation empowers artists to make informed decisions about their creative projects and career development.

-

Tax Compliance

Proper bookkeeping ensures that artists comply with tax regulations. By keeping accurate records of income, expenses, and applicable deductions, artists can minimize their tax liability and avoid legal issues. Understanding tax obligations also helps in planning for tax payments and avoiding financial surprises at tax time.

-

Professionalism and Credibility

Whether dealing with clients, galleries, or potential collaborators, maintaining organized and transparent financial records enhances an artist's professionalism and credibility. Clear financial documentation instills confidence in stakeholders, potentially leading to better business relationships and opportunities.

-

Profitability Analysis

Bookkeeping allows artists to analyze the profitability of their projects. By tracking income and expenses associated with specific endeavors, artists can identify which projects are most financially successful and focus their efforts accordingly. This insight helps in making strategic decisions to maximize profitability and sustain a successful career.

-

Financial Security

Artists, like any other professionals, face financial uncertainties. Proper accounting for artists provides a foundation for financial security. By having reserves for lean times, understanding their financial position, and managing debt effectively, artists can navigate economic challenges with greater resilience.

-

Business Growth

For artists aiming to expand their practice or business, accurate financial records are essential. Investors, lenders, or grant providers often require detailed financial information before providing support. Well-maintained books demonstrate a commitment to financial responsibility, increasing the likelihood of securing funding for future projects.

-

Expense Tracking

Creative professionals often incur various expenses related to their work, such as art supplies, studio rent, and promotional activities. Bookkeeping allows them to track these expenses systematically, helping to identify areas where costs can be controlled or reduced, contributing to better financial management.

Managing Cash Flow in a Creative Career

Artists may deal with money that comes in waves. Some months feel rich with paid work. Other months may feel slow and dry. A simple cash flow plan and strong bookkeeping for artists can support a stable creative life.

1. Finding Patterns in Income

Even when income feels random, artists may still find loose trends. Some may earn more during festival seasons or exhibition months. Seeing these patterns lets them prepare for slow patches with clear accounting for artists.

2. Planning for Gaps in Work

When a gap shows up, a cash reserve can make life easier. A reserve may help with rent, supplies, or travel. It can also prevent panic choices that may hurt future growth.

3. Setting Aside Money for Goals

Some artists dream of a bigger studio or new tools. Clear cash records can show when those dreams may be possible. Small steps toward those goals feel less scary with real numbers.

4. Watching Daily Spending

Some creative projects use more money than expected. Simple notes on daily costs can stop small leaks before they grow. A basic sheet or app can keep all spending visible.

5. Keeping Personal and Art Money Apart

When the money mixes, it can confuse taxes and budgets. Two accounts may give clarity about what is personal and what is for the craft. This simple act can reduce stress and improve decision-making.

How Bookkeeping Supports Creative Decision Making

Good financial notes and smart accounting for artists can guide choices without limiting imagination. When artists know what they can spend or save, they may feel freer to create.

1. Choice of Projects

Some projects may bring joy. Others may bring money. Bookkeeping may show which ones bring both. This insight lets artists strike a helpful balance.

2. Timing of New Work

If a month looks tight, an artist may pause a high-cost project. During strong months, they may invest in bigger ideas. These shifts can help protect long-term success.

3. Evaluating Whether a Project Helped

After a painting series or show, artists may wonder if it paid off. Tracking time, cost, and income gives a clear picture. This helps in deciding what to repeat or avoid next time.

4. Understanding Production Costs

Some media cost more than others. Strong bookkeeping for artists can show which materials eat into the budget. Artists may adjust sizes, tools, or batch production to stay stable.

5. Pricing Artwork with Confidence

Artists may struggle with pricing. Clear numbers on cost, hours, and past sales can guide them. They can set fair prices without selling themselves short.

6. Planning for Growth Moments

Growth may come through classes, shows, or travel. A financial view helps decide when these steps fit the budget. With planning, risk becomes manageable.

Tools and Methods That Can Make Bookkeeping Easier for Artists

Some artists dislike numbers. Simple tools can lighten the load. They do not need complex systems to stay organized.

1. Simple Record Apps

There are easy apps where artists tap and add income or cost. These apps may keep totals clear and organized, which helps with daily accounting for artists. They also reduce the need for long manual work.

2. Basic Spreadsheets

A simple sheet with dates, cost, income, and notes may be enough. The sheet can grow with the business over time. It offers flexibility for different creative styles.

3. Cloud-Based Storage

Many artists travel often or change studios. Online storage may keep files safe and easy to reach from anywhere. This also protects records from loss or damage.

4. Folder Systems for Receipts

Keeping receipts in labeled folders may help during tax time. A digital photo of each receipt works as well. Both methods reduce confusion later and keep bookkeeping for artists clean and simple.

5. Templates for Invoices

Clear invoices look professional. Templates may save time and keep all jobs consistent. This leads to fewer errors and faster payments.

6. Scheduling a Weekly Review

One short weekly session can keep records healthy. This habit may stop issues from piling up. It also builds confidence around money tasks.

Long-Term Benefits of Strong Bookkeeping Habits for Creative Professionals

Over time, good bookkeeping builds a strong base. This base may support an art career for many years ahead.

1. Stability During Market Shifts

Art markets may move up or down. Strong financial records help artists stay calm during changes. They can adjust plans early and avoid sudden shots in the dark with clear bookkeeping for artists.

2. Ability to Seek Funding

Many grants or loans ask for clear financial proof. Good bookkeeping for artists may open doors to these funds. It shows that the artist handles money with care.

3. Clearer Talks with Galleries and Agents

When artists know their numbers, talks with partners feel easier. They can speak openly about costs or shared earnings. This clarity may reduce misunderstandings.

4. Easier Tax Filing Each Year

Tax season may turn stressful for artists. Strong books reduce panic and save time. They may even help uncover helpful deductions.

5. Better Mental Peace

Money stress often blocks creative flow. With solid records, artists may worry less. A calm mindset may lead to richer ideas and smoother workdays.

6. Building a Sustainable Creative Business

An art career may start small. With strong habits, it can grow into a lasting business. Bookkeeping acts like the quiet spine that keeps everything steady.

Bookkeeping is a fundamental aspect of a successful and sustainable career for artists and creative professionals. It provides the financial clarity needed to make informed decisions, ensures compliance with tax regulations, and enhances professionalism. By incorporating sound bookkeeping practices from Accounts Junction into their routine, artists can focus more on their creative pursuits while building a strong foundation for long-term success in the arts.

FAQs

1. Why may bookkeeping play a key role in an artist’s career?

- It can reveal what the artist earns, spends, and keeps. This clarity may support stronger planning and steady growth, which is why bookkeeping for artists matters so much.

2. How does bookkeeping help artists with irregular income?

- It shows when money rises or dips across months. This helps artists plan for lean seasons with calm and build better accounting for artists habits.

3. What records should creative professionals keep for smooth bookkeeping?

- Income notes, receipts, supply costs, and travel logs are useful. These records may support tax needs and budget choices.

4. How can bookkeeping help artists avoid overspending on supplies?

- Tracked costs show which items drain the budget. This insight may guide better material choices and improve daily accounting for artists.

5. Why does bookkeeping matter when pricing artwork?

- It shows the true cost of time, tools, and effort. Artists can set fair prices with more confidence.

6. How may bookkeeping improve an artist’s cash flow?

- Clear entries reveal late payments and slow months. This helps the artist plan reserves and stay stable.

7. How does bookkeeping support tax compliance for creative workers?

- Recorded expenses and income make tax filing simpler. It also reduces the chance of missed deductions.

8. Why should artists keep business and personal money separate?

- This separation makes tracking and reporting cleaner. It also protects the artist from confusing mixed numbers.

9. How may bookkeeping help artists understand which projects perform well?

- It reveals which projects bring profit and which do not. This helps artists choose what to invest in next.

10. Can bookkeeping support artists in getting grants or funding?

- Grant bodies often ask for organised financial records. Good bookkeeping may increase approval chances.

11. How does bookkeeping help artists who sell work in many locations?

- It keeps track of online, gallery, and event sales. This creates a full view of income streams.

12. Why may bookkeeping help artists negotiate better with galleries?

- Knowing real costs gives artists a stronger voice. They can discuss commission terms with more clarity.

13. How can bookkeeping show if an exhibition was worth the cost?

- It compares framing, rent, travel, and sales in one place. This helps artists judge if the show should be repeated.

14. How does bookkeeping support long-term career planning for creatives?

It reveals trends that may affect future goals. This helps artists plan training, travel, or bigger projects.

15. How does tracking expenses help new artists who are still learning the craft?

- It shows where money is slipping away early on. This helps new artists adjust before habits get costly.

16. How can bookkeeping help artists reduce financial stress?

- Clear numbers reduce fear of the unknown. This allows more mental space for creative work.

17. Why should freelance artists track client payments closely?

- Late or missed payments can harm cash flow. Bookkeeping notes help follow up with ease.

18. Can bookkeeping help creative teams or studios work better together?

- Shared records show who spent what and when. This builds trust and fair decision-making.

19. How may bookkeeping help artists plan for equipment upgrades?

- Records show that when tools cost more to repair than replace. Artists can save ahead for new gear with less pressure.

20. Why does bookkeeping matter for creative professionals who travel often?

- Travel costs may pile up fast without tracking. Bookkeeping keeps each trip clear for tax and budget planning.