Best Practices for Small Law Firm Accounting in 2025

Running a law firm in today is not easy. You must manage clients, cases, and staff at the same time. In all this, one thing is often missed: accounting. Small law firm accounting is more than just tracking bills and payments. It helps your firm grow, follow the law, and make smart money choices.

In 2025, the legal world is changing fast. New tools, software, and rules make it key to handle finances the right way. Even small firms can stay ahead by using simple, clear, and correct accounting methods.

This guide covers the main accounting practices every small law firm should use. From managing client trust accounts to tracking income and costs, and using the right software, you can make your firm stronger and more ready for the future.

Why Small Law Firm Accounting Is Important

Good accounting helps a firm see its money, pay taxes on time, and plan for the future. Many small law firms miss chances to grow because they ignore financial management. Small law firm accounting gives a clear view of income, expenses, and overall money health.

Clear View of Money

A clear system shows where money comes from and goes. This helps law firms decide on hiring, marketing, or buying new tools. Without proper accounting, law firms may face late payments or tax issues.

Follow Rules and Avoid Risk

Law firms must follow strict financial rules. Correct accounting helps avoid legal problems and keeps client trust. Small law firm accounting helps with IRS rules, state laws, and trust account rules.

Understanding Small Law Firm Accounting Basics

Before using software, lawyers must know the basics. Simple knowledge makes small law firm accounting easier and more effective.

1. Key Terms

- Revenue – money your firm earns

- Expenses – money your firm spends

- Profit – what is left after costs

- Bills to Pay – money you owe

- Money Due – money clients owe you

Knowing these words helps you check reports and make good choices.

2. How Money Moves

Money comes in from clients and goes out to pay staff, rent, and office costs. Watching this flow keeps money safe and helps with planning.

3. Track Sources and Uses of Money

List where money comes from and where it goes. A small chart or sheet can show missing payments or extra spending.

4. Why Basics Matter

Small law firms can face trouble without these basics. Knowing terms and money flow helps with planning, taxes, and using tools.

Key Challenges in Small Law Firm Accounting

Small law firms face unique money issues. Knowing these challenges helps plan well and avoid errors.

1. Late Client Payments

Clients may pay late. This can make it hard to pay staff or bills. Track invoices each week. Send reminders to clients. Doing this keeps cash flow steady.

2. Managing Many Cases

Handling money in many cases is hard. Each case has costs, client payments, and fees. Keep a clear record for each case. Even a small notebook or simple spreadsheet helps. Clear records prevent mistakes.

3. Following Rules

Law firms must follow strict tax and client fund rules. Mistakes can lead to fines or legal issues. Learn the rules for trust funds and taxes. Check records often. Sticking to the rules keeps the firm safe and clients satisfied.

4. Small Staff and Time

Small firms often have few staff for accounting. Tasks can pile up quickly. Use simple systems or basic software. Even one well-organized person can keep accounts correct. This avoids errors and saves time.

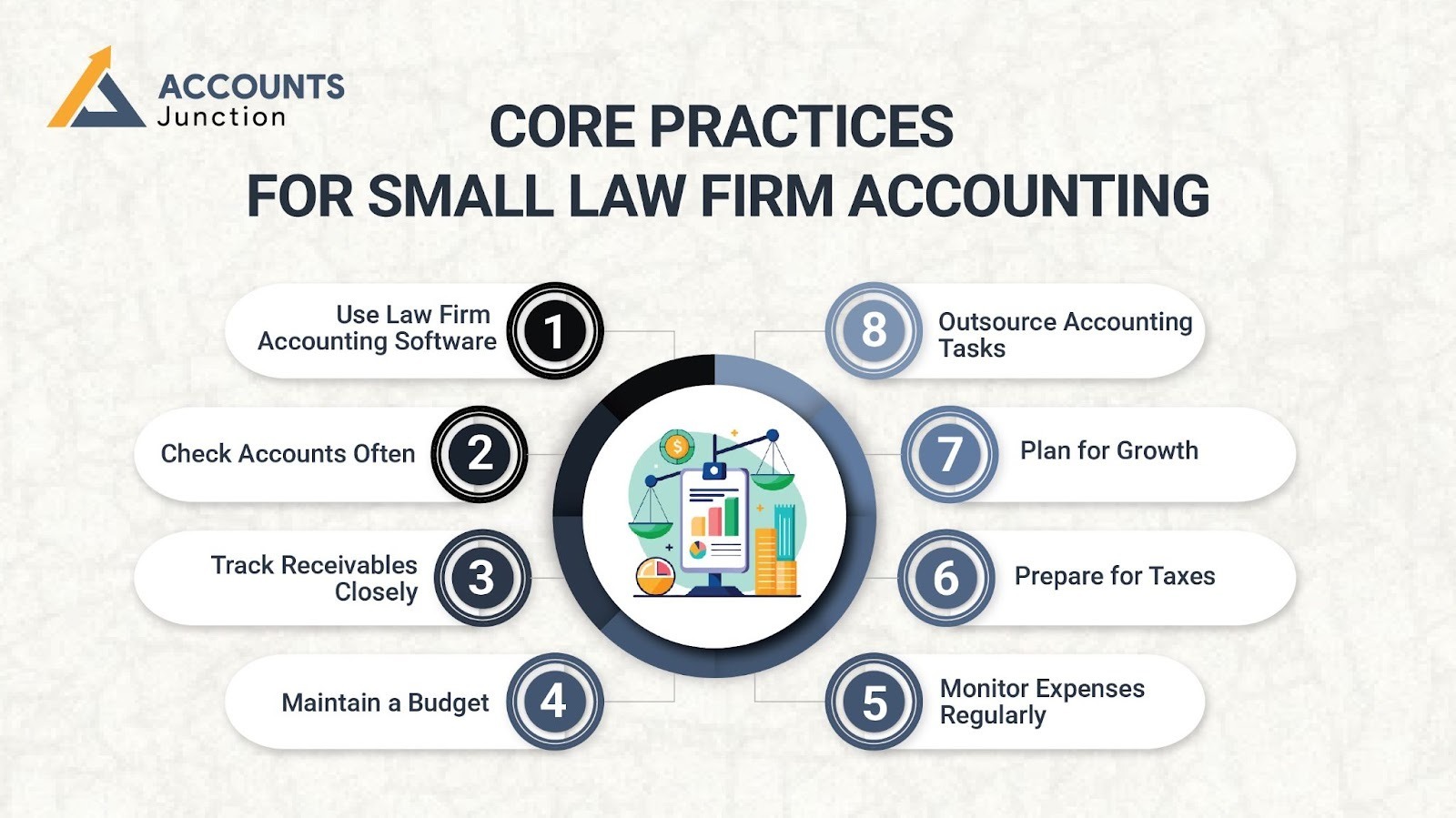

Core Practices for Small Law Firm Accounting

These practices make small law firm accounting simple, clear, and useful for growth.

1. Use Law Firm Accounting Software

Use software to track hours, bills, and costs. Automation cuts mistakes and gives fast reports.

2. Check Accounts Often

Look at bank statements and records every month. This finds errors and stops missed or double payments.

3. Track Receivables Closely

Watch the money clients owe. Check unpaid bills each week. This keeps cash moving and lowers lost payments.

4. Maintain a Budget

Plan pay, rent, and other firm costs. A set budget guides spending and stops waste. Accounting stays easy when you track where money goes.

5. Monitor Expenses Regularly

Check each month’s costs for office and case work. Spot waste fast. Cutting spend saves cash and boosts profit.

6. Prepare for Taxes

Keep clear records of pay, spend, and client funds. Ask tax help when needed. This finds savings and keeps rules met.

7. Plan for Growth

Use money data to plan hires, new work, or office space. Cash and profit reports show where growth fits.

8. Outsource Accounting Tasks

Hire outside help for books and tax work. It keeps records right and saves time.

Advanced Practices for Small Law Firm Accounting

Beyond basic accounting, these steps take your firm to the next level.

1. Implement Key Metrics

Track revenue per lawyer, collection rates, and billable hours. Metrics show strong and weak areas and guide strategic decisions.

2. Use Forecasting

Plan for future income and costs. Predicting money flow helps avoid surprises. This makes growth safer and decisions easier.

3. Adopt Digital Workflows

Go paperless and use digital approvals. This saves time, cuts mistakes, and keeps records safe.

4. Review Profitability by Client or Case

See which clients or cases make the most money. Focus on high-value work to raise total income.

How Small Law Firm Accounting Practices Drive Growth

Following good small law firm accounting practices directly helps a firm grow.

1. Keep Cash Flow Steady

Send bills on time and track spending. This keeps money moving and pays staff, bills, and costs on time.

2. Make Smart Decisions

Reports show income, costs, and profit. This helps you hire staff, spend money wisely, and plan for growth.

3. Lower Risk

Keep client money separate and follow all rules. This avoids errors and legal trouble.

4. Build Systems That Grow

Use software, cloud tools, or outside help. These systems handle more clients and cases without mistakes.

5. Focus on Profitable Work

See which clients or cases earn the most. Focus on them to make more money and grow the firm.

Following the best small law firm accounting practices helps your firm grow, stay safe, and manage money well. Track client payments, check expenses, and use simple systems. This makes your firm more efficient and ready for the future.

At Accounts Junction, we provide trusted accounting and bookkeeping services for small law firms. With our team of certified experts, we ensure accurate tracking of income, management of expenses, and precise tax preparation, allowing your firm to operate with confidence and efficiency. Partner with us and increase your law firm’s performance, compliance, and profitability.

FAQs

1. What is small law firm accounting?

- Small law firm accounting tracks money in and out. It helps manage costs, client funds, and profit.

2. Why is accounting important for small law firms?

- It shows where money goes, helps follow rules, and guides growth.

3. How can I track client payments?

- Check unpaid bills each week. Send notes to clients to keep cash flow steady.

4. What are the key terms to know in accounting?

- Revenue, costs, profit, bills to pay, and money due. These help read reports and make good choices.

5. How does money flow in a law firm?

- Clients pay for work. Money goes to staff, rent, and office costs. Tracking this stops errors.

6. What are common challenges in small law firm accounting?

- Late payments, many cases, strict rules, and a small staff. Simple plans and systems help avoid mistakes.

7. How can I maintain a budget?

- Set clear limits for salaries, rent, and office costs. Track spending each month to avoid extra costs.

8. Why monitor expenses regularly?

- Spot extra spending or waste. This saves money and grows profit.

9. How should small firms prepare for taxes?

- Keep full records of income, costs, and client funds. Work with tax experts if needed.

10. What is the role of accounting software?

- Software tracks hours, bills, and payments. It cuts mistakes and gives fast reports.

11. How can forecasting help my firm?

- Plan future income and costs. This avoids surprises and helps growth.

12. Why adopt digital workflows?

- Paperless files and digital approvals save time, cut mistakes, and keep records safe.

13. How to focus on profitable work?

- Check which clients or cases earn the most. Focus on them to raise total income.

14. How can accounting lower risks?

- Keep client money separate and follow all rules. This avoids fines and legal issues.

15. Why outsource accounting tasks?

- Outside experts handle bookkeeping and taxes. This saves time and keeps records correct.

16. How do proper accounting practices drive growth?

- Good accounting helps cash flow, guides spending, lowers risk, and plans hiring or services.

17. How can small law firms plan for the future?

- Use reports and data to set goals. Plan hiring, growth, and new services based on numbers.

18. Can small law firms start accounting with little staff?

- Yes. Even one well-organized person can track income, costs, and client funds. Using simple systems or basic software keeps records correct and saves time.