What are the benefits of cpa tax services?

Taxes always arrive every year and yet feel overwhelming. Paper forms pile up, rules shift unexpectedly, and deadlines approach without warning. In such situations, CPA Tax Services can help you out. Learning the benefits of CPA tax services in this blog will help you recognize its potential. These services help people manage numbers that often seem confusing.

A Certified Public Accountant, known as a CPA, does more than add figures. They may organize records, suggest financial steps, and help plan for future seasons. The benefits of CPA Tax Services reach beyond simple filings. They can save time, reduce worry, and sometimes reveal insights hidden within numbers.

What CPA Tax Services Include

Before exploring benefits, it helps to know what these services cover. CPA Tax Services prepare returns, review finances, and plan for taxes ahead. Some also provide guidance on investments, estates, and audits.

Individuals, families, and businesses use CPA Tax Services. A CPA may spot patterns in spending or identify deductions that others might miss. Businesses often rely on CPAs to review books, maintain compliance, and suggest cost savings.

Overall, we can say that CPA Tax Services have a structure that brings clarity to finances that otherwise feel confusing.

Why People Turn to CPA Tax Services

Taxes may look easy until forms are opened. Mistakes can appear quickly, and deadlines add pressure. CPA Tax Services act as support in these situations.

They improve accuracy, save time, and ease stress. A CPA handles complexities so clients can focus elsewhere. When tax season arrives, having an expert reduces tension and builds confidence.

People often seek CPA help not only to file taxes correctly but also to get relief from those responsibilities.

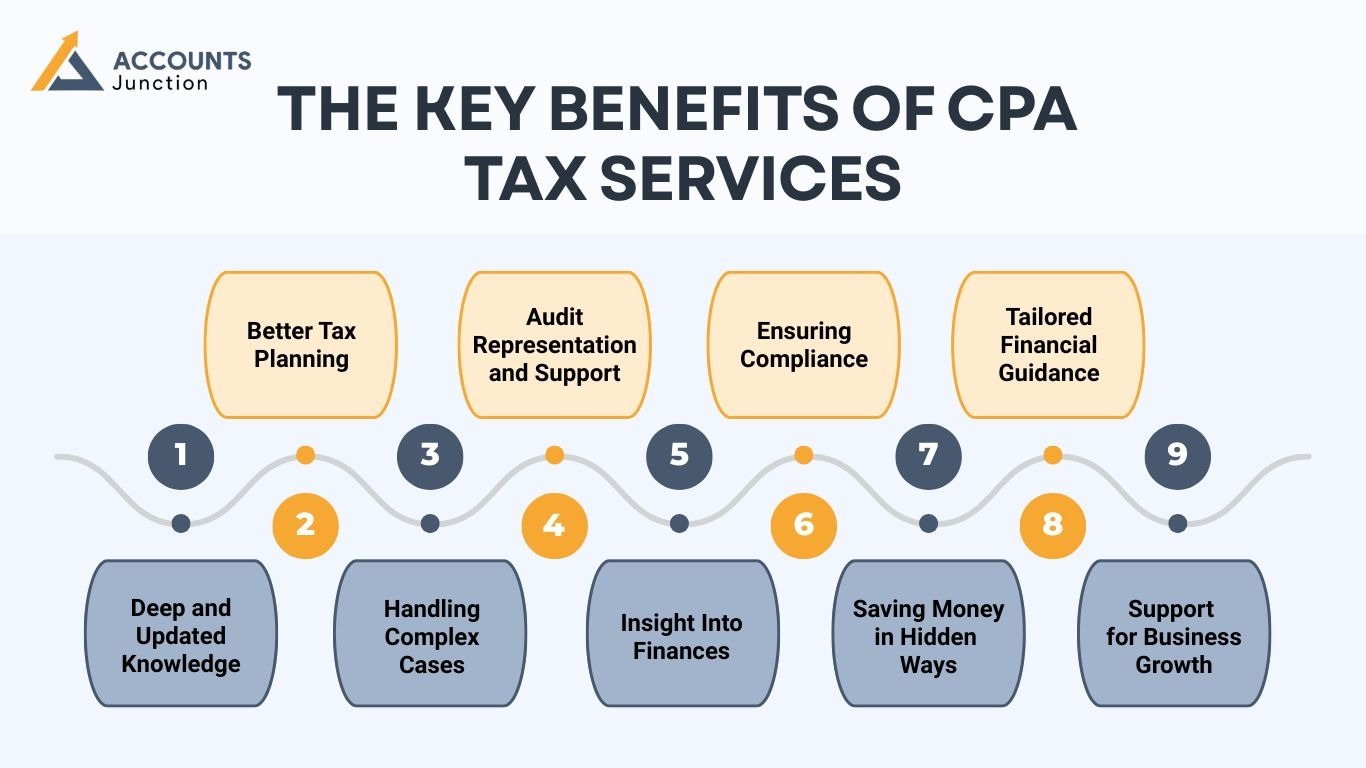

The Key Benefits of CPA Tax Services

The benefits of CPA Tax Services unfold in several ways. Some appear immediately, and others develop over time. Below are key benefits worth considering:

1. Deep and Updated Knowledge

Tax laws rarely stay the same. What applied last year may no longer fit today. CPAs stay informed about updates and changes.

They often identify deductions or credits that clients would not notice alone. Complex rules are explained in simple language. This knowledge reduces errors and helps make informed choices.

2. Better Tax Planning

Tax planning is not just a one-time task. When you choose CPA Tax Services, you get year-round support.

They suggest how to calculate income, expenses, and investments that result in tax deductions. Planning early prevents unwanted situations and allows financial moves to feel less risky.

Smart planning often results in smoother filings and possible savings.

3. Handling Complex Cases

Taxes can be complicated to deal with. Some include multiple income sources, business transactions, or property investments. CPA Tax Services handle these situations carefully.

They manage deductions, capital gains, and foreign income. Complex scenarios are made understandable and manageable. Expertise in such cases gives clients confidence.

4. Audit Representation and Support

Receiving an audit notice can feel intimidating. CPA Tax Services reduce anxiety during audits.

They represent clients before authorities, organize documents, and explain records clearly. Professional guidance ensures submissions are correct and complete.

Support in audits often turns stress into relief.

5. Insight Into Finances

Numbers tell stories beyond taxes. CPA Tax Services help clients understand spending, investments, and cash flow.

They may reveal patterns that suggest better ways to save or invest. Advice from CPAs can guide smarter financial decisions for the future.

Even routine filings can uncover insights that improve broader financial planning.

6. Ensuring Compliance

Tax rules change often. CPA Tax Services ensure filings follow current regulations.

Accurate reports reduce penalties and errors. Organized records support audits or queries if they occur.

Compliance protects both finances and reputation.

7. Saving Money in Hidden Ways

Some savings are hard to notice. CPA Tax Services often uncover deductions or credits overlooked by clients.

By reviewing expenses and investments, CPAs find opportunities to reduce tax payments. Small savings over time may grow into significant amounts.

8. Tailored Financial Guidance

No two clients have the same financial situation. CPA Tax Services offer advice suited to individual needs.

They guide business owners on managing expenses and families on planning for school, homes, or retirement. Each recommendation is specific rather than generic.

Tailored guidance strengthens confidence in financial decisions.

9. Support for Business Growth

CPA Tax Services help businesses beyond filing taxes.

They review budgets, cash flow, and expansion plans. Advice from CPAs identifies opportunities while controlling expenses.

Strategic guidance transforms uncertainty into growth potential.

How CPA Tax Services Differ from Regular Accountants

All accountants work with numbers. CPAs offer a deeper level of expertise.

They represent clients in audits, advise on complex taxes, and plan long-term strategies. Their work is detailed, strategic, and often proactive.

Clients experience both accuracy and confidence when relying on CPAs rather than standard accountants.

Tips for Choosing the Right CPA

The benefits of CPA Tax Services increase when the right professional is chosen. Here are some tips for choosing the right CPA:

- Experience: Look for someone familiar with your type of finances.

- References: Ask for feedback from previous clients.

- Fees: Understand what services are included.

- Comfort: Choose someone approachable and communicative.

Finding the right CPA ensures the best outcomes and smoother financial management.

The benefits of CPA Tax Services extend far beyond tax season. They bring clarity, reduce stress, and guide decisions. From saving money to planning for the future, these services provide confidence.

CPAs combine skill with oversight. They prevent errors, ensure compliance, and offer advice that supports goals. Taxes may remain, but confusion does not. The true benefit lies not only in filings completed but in the confidence and clarity that follow. At Accounts Junction, we offer CPA tax services that can help you form a clear financial path. Our experts deal with everything from tax planning to tax filing.

FAQs

1. What are CPA Tax Services?

- They include filing, planning, and financial guidance managed by certified professionals.

2. Who should use CPA Tax Services?

- Anyone wanting accurate filings or financial advice can benefit.

3. Can CPAs reduce taxes?

- They often identify deductions and credits that clients may miss.

4. Do CPAs handle business taxes?

- Yes, they manage returns, payroll, and compliance for businesses.

5. Are CPA Tax Services helpful for individuals?

- Yes, personal returns gain accuracy and planning support.

6. What if I face an audit?

- A CPA can represent you and prepare necessary documents.

7. Do CPAs keep up with tax law changes?

- Yes, they track updates to provide current advice.

8. Can CPA services save time?

- They manage complex work, freeing clients to focus elsewhere.

9. Are CPA services expensive?

- Fees exist, but benefits and potential savings often exceed costs.

10. Do CPAs work year-round?

- Most provide advice and planning outside tax season.

11. Can CPAs assist small businesses?

- Yes, they handle filings, planning, and financial growth.

12. Do they provide investment advice?

- Some offer insights to align investments with tax planning.

13. Are CPA services confidential?

- Yes, they follow strict privacy and ethical rules.

14. Can they correct past mistakes?

- Yes, they help with amendments and communication with authorities.

15. Do CPAs prepare state and federal returns?

- Yes, both are handled accurately and efficiently.

16. Can they manage multiple income streams?

- Yes, salary, rental, and investment income are all reviewed.

17. Are CPA Tax Services only for wealthy clients?

- No, anyone with complex finances can benefit.

18. How do I find a reliable CPA?

- Check credentials, reviews, and communication style before hiring.

19. Do CPAs plan future taxes?

- Yes, proactive guidance is often part of their work.

20. Can CPA services prevent errors?

- Yes, reviews reduce mistakes and ensure compliance.