Benefits of CPA - Certified Public Accountant

When it comes to managing money, planning taxes, or growing a business, having the right financial expert makes a big difference. A Certified Public Accountant (CPA) is one of the most trusted and skilled financial professionals you can hire. Whether you are a business owner, a startup founder, or an individual who wants clear financial guidance, a CPA brings real value.

In this blog, we explore the main benefits of working with a CPA and why their expertise matters.

Introduction to Certified Public Accountants (CPA)

A Certified Public Accountant is more than just someone who handles the numbers. They are professionals who are trained to manage money, give financial advice, and help with taxes. If you are running a small business or managing personal finances, a certified accountant can help you.

How does a certified public accountant stand apart from a general accountant? They have passed strict exams, earned licenses, and continue to stay updated with changing laws. Simply put, when you hire a public accountant, you are hiring someone who truly understands the rules of money and how to use them to your advantage.

Key Qualifications of a Certified Accountant

To start the journey, A certified accountant must have a degree in accounting, finance, or a related field. This gives them a strong foundation in managing numbers, understanding laws, and handling financial reports.

Real-World Experience

- Before they can even sit for the CPA exam, most states require candidates to gain professional experience. This hands-on work prepares them to solve real financial problems for both individuals and businesses.

The CPA Exam

- The CPA exam is one of the toughest tests financial world. It covers topics like accounting principles, tax laws, auditing, and financial regulations. Passing it proves that the certified public accountant has deep knowledge and can handle complex financial tasks.

Ongoing Learning

- Even the getting the license, Certified accountants are required to keep learning. They must update with changing laws, take continuing education courses, business rules, and accounting standards.

Ethical Standards and Licensing

- A CPA must obey the strict ethical standards. They are licensed by state boards and must meet a professional code of conduct. This ensures the public can trust their financial advice and the way they handle financial conditions.

Professional Memberships

- Most Certified Public Accountants join an organization like the American Institute of CPAs(AICPA). These memberships give them access to tools, resources, and networks that help them offer even better services to clients.

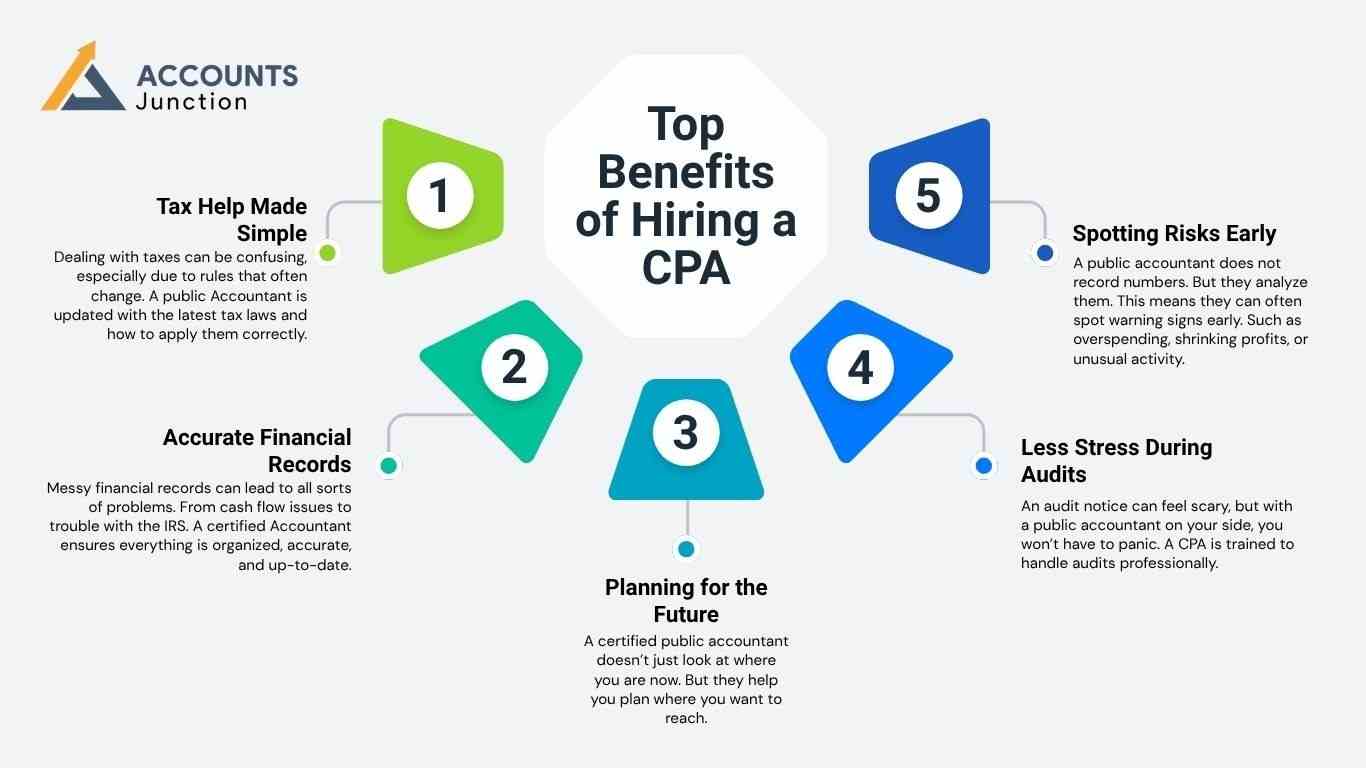

Top Benefits of Hiring a CPA

When a company hires a CPA can make a big difference for individuals and businesses. From money-saving to planning for the future, here are the reasons why you should work with them.

1. Tax Help Made Simple

- Dealing with taxes can be confusing, especially due to rules that often change. A public Accountant is updated with the latest tax laws and how to apply them correctly.

2. Accurate Financial Records

- Messy financial records can lead to all sorts of problems. From cash flow issues to trouble with the IRS. A certified Accountant ensures everything is organized, accurate, and up-to-date.

3. Planning for the Future

- A certified public accountant doesn’t just look at where you are now. But they help you plan where you want to reach. If you want to grow your business, they help you where you can invest your money and get high returns, and also they guide you on retirement savings plans.

4. Less Stress During Audits

- An audit notice can feel scary, but with a public accountant on your side, you won’t have to panic. A CPA is trained to handle audits professionally. They prepare the necessary documents, explain the process, and even represent you in front of tax authorities if needed.

5. Spotting Risks Early

- A public accountant does not record numbers. But they analyze them. This means they can often spot warning signs early. Such as overspending, shrinking profits, or unusual activity.

Certified Financial Accountant vs. General Accountant

|

Feature |

Certified Financial Accountant |

General Accountant |

|

Education & Training |

Advanced education + CPA certification |

Basic degree in accounting or finance |

|

Licensing |

Licensed by state boards; regulated |

No license required |

|

Scope of Services |

Tax planning, auditing, financial advising, and legal representation |

Bookkeeping, payroll, basic financial reporting |

|

Representation Rights (e.g., IRS) |

Can legally represent clients before tax authorities |

Cannot represent clients before tax bodies |

|

Decision-Making Support |

Offers strategic financial planning and risk analysis |

Limited to recording and reporting past transactions |

|

Regulatory Compliance |

Stays updated with changing laws and compliance requirements |

May not be trained on complex regulations |

|

Continuing Education |

Must take ongoing professional education |

No formal continuing education is required |

|

Ideal For |

Business owners, investors, and individuals needing tax/legal help |

Small business owners needing basic financial help |

Choosing the Right Certified Public Accountant for Your Needs

A person just getting the license of a certified accountant is not enough. The right accountant always knows your needs, communicates early, and offers personalized support.

5.1 Tips on Selecting a Trustworthy and Experienced CPA

Choosing the right certified public accountant takes careful thought. Here are a few helpful tips to guide you:

- Confirm their license – Make sure your CPA is officially licensed. A licensed certified accountant meets strict educational and ethical standards.

- Check reviews and references – Ask for referrals and look at online reviews. This helps you understand how they work with clients and what you can expect.

- Ask about their specialties – Not every certified financial accountant has the same focus. Some are great with taxes, while others are experts in business strategy or audits.

- Understand their fees – Transparency is important. A good public accountant will clearly explain their pricing structure with no hidden charges.

- Evaluate communication skills – Choose a CPA who listens to you and explains things in a way you understand. Good communication builds trust and avoids confusion.

A certified public accountant brings far more than just managing numbers. From tax savings to guiding businesses toward long-term success, a CPA’s role is crucial in both personal and professional finance. If you are planning your future or growing a business, a good certified accountant can help a lot. At Accounts Junction, our CPA experts bring deep industry insight, clear financial structure, and efficient tax strategies tailored to your needs. We focus on accuracy, transparency, and smooth financial operations so you can stay stress-free. With our certified specialists, you gain reliable support that strengthens your financial base and fuels steady growth.

FAQ

1. What may a certified public accountant do?

- A certified public accountant may manage taxes, reports, audits, and long-term planning.

- They can also study money trends and share insights that improve decisions.

2. Can a CPA support small businesses?

- Yes, a CPA may assist with tax work, record checks, and growth plans.

- Their guidance can make daily money tasks easier to handle.

3. Do CPAs work only during tax season?

- No, many CPAs work all year on planning and financial reviews.

- They may help with budgets, cash flow, and long-term strategy.

4. What makes a CPA different from a general accountant?

- A CPA is trained under strict exams and advanced financial rules.

- A general accountant may focus more on basic record work.

5. Can a CPA assist during an audit?

- Yes, a CPA can prepare documents and explain each stage of the audit.

- They may also represent you before tax authorities when needed.

6. Do CPAs help with personal financial planning?

- Yes, they may assist with savings plans, debt management, and retirement ideas.

- Many individuals work with CPAs for long-term money clarity.

7. Can a CPA improve business planning?

- They may study your financial patterns and show possible growth paths.

- This insight can bring more structure to important decisions.

8. Should startup owners work with CPAs?

- A CPA may help a startup build strong financial systems from day one.

- They can also point out risks that new owners often miss.

9. Can a CPA manage complex tax situations?

- Yes, they may handle complex filings, deductions, and rule changes.

- This keeps your tax work clean, safe, and stress-free.

10. Do CPAs handle financial audits for companies?

- Yes, many CPAs are trained in audit review and compliance checks.

- They may confirm if your records follow the required standards.

11. Can a CPA review business risks?

- A CPA may read your reports and see early signs of financial issues.

- This allows you to correct problems before they grow.

12. Do CPAs help with budgeting for families?

- Yes, they may create simple and clear budget plans for households.

- These plans can guide monthly spending and future savings.

13. Can a CPA assist with long-term wealth planning?

- They may show safe ways to build and protect wealth.

- Their approach often looks at goals, time, and financial habits.

14. Do CPAs help in preparing financial reports?

- Yes, they may prepare clean and detailed reports for review.

- These reports help you understand where your money stands.

15. Can CPAs work with freelancers and self-employed people?

- Yes, many freelancers use CPAs for tax planning and income tracking.

- A CPA may bring structure to irregular earnings.

16. Is it costly to hire a CPA?

- The cost may depend on the work and expertise you need.

- Many people feel the value they gain is worth the fee.

17. Can a CPA help during major life changes?

- Yes, they may guide you through events like marriage, new jobs, or home purchases.

- They look at how these changes affect your long-term plans.

18. Do CPAs work with investment planning?

- They may offer insights on financial choices linked to investment goals.

- Their role often focuses on structure and clarity, not selling products.

19. Can a CPA help reduce financial mistakes?

- Yes, they may catch errors early and keep your records accurate.

- This reduces stress and avoids future trouble.

20. Are CPAs useful for long-term business stability?

- Yes, a CPA may bring steady advice that supports growth and compliance.

- Many firms rely on them for long-lasting financial structure.