What are the steps in balance sheet reconciliation?

Keeping the proper track of all the financial statements of a business is important for any business. A balance sheet is one of the important financial statements for any business.

It gives a proper view of the expenses, profits, revenues, and other financial aspects of the business. So, proper balance sheet reconciliation is important to ensure that there is accuracy in it.

Here, all the components of the balance sheets are cross-checked properly. In order to achieve accuracy, you must follow the proper balance sheet reconciliation process. You must understand the proper steps that must be followed while doing a reconciliation of the balance sheet.

What is balance sheet reconciliation?

It is the verification of the balance sheet accuracy by comparing the numbers recorded in the accounting books to the different documentation and other aspects.

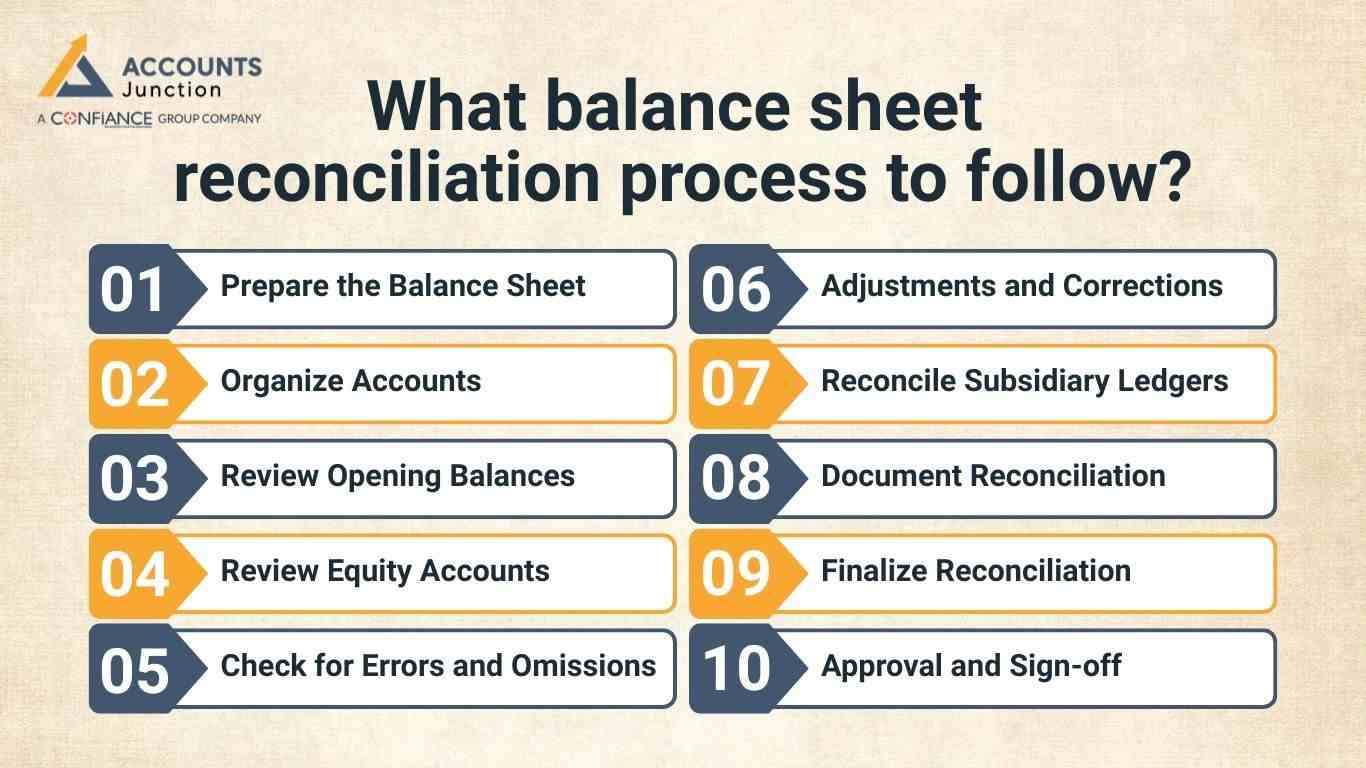

What balance sheet reconciliation process to follow?

Following a proper reconciliation process can help you achieve accuracy in the balance sheet to achieve financial discipline.

Here are important steps to follow in balance sheet reconciliation:

Prepare the Balance Sheet

Begin by obtaining a copy of the company's balance sheet for the period you are reconciling. This serves as the starting point for your reconciliation process of the balance sheet.

Organize Accounts

Organize the balance sheet accounts into asset accounts, liability accounts, and equity accounts. This will help you focus on specific sections of the balance sheet during the reconciliation to organize the accounts properly.

Review Opening Balances

Compare the opening balances on the current balance sheet to the closing balances on the previous period's balance sheet. Ensure that these carryover balances match in the balance sheets properly.

Review Equity Accounts

- Common Stock: Ensure the common stock balance matches the number of shares issued and their par value.

- Retained Earnings: Verify retained earnings by reconciling the net income or loss for the period with previous financial statements.

Check for Errors and Omissions

Carefully review the balance sheet for any errors or omissions. Look for discrepancies in account balances or missing entries in any of the accounting books.

Adjustments and Corrections

Make any necessary adjustments or corrections to the balance sheet. This will be effective to ensure it accurately reflects the financial position of the company.

Reconcile Subsidiary Ledgers

If you maintain subsidiary ledgers for certain accounts (e.g., accounts receivable, accounts payable), reconcile these ledgers with the corresponding balance sheet accounts. This will correct all the errors that might have happened.

Document Reconciliation

Document all the steps taken during the reconciliation process, including any adjustments made. Attach all the supporting documents reviewed and the reasons for changes made.

Finalize Reconciliation

Once you have resolved any discrepancies and are confident that the balance sheet is accurate, finalize the reconciliation.

Approval and Sign-off

Checking the reconciliation from the concern manage regarding compliance and accuracy. It will make sure that the balance sheet is accurate.

These are some of the steps to follow in the balance sheet reconciliation process. This will be an effective way to achieve accuracy in the balance sheet ensuring better accounting.

Why Balance Sheet Reconciliation is Important

Even though some may see balance sheet reconciliation as a routine task, the impact may run deeper. A good check may lead to many benefits.

-

Builds Trust In The Books

A clean sheet may give teams and leaders comfort. A proper balance sheet reconciliation process ensures numbers look right and choices flow with fewer doubts.

-

Protects The Firm From Risk

A wrong record may grow into a threat if left unchecked. A timely reconciliation may stop risk from moving forward.

-

Helps Spot Fraud

Small slips may hide fraud attempts. Regular balance sheet reconciliation may reveal strange moves in the books that need review.

-

Supports Smooth Audits

When outside auditors arrive, a clear trail may shorten the audit time. A clean sheet may also improve the trust rating of the firm.

Common Issues Seen During Reconciliation

Teams often meet the same type of issues across firms. Knowing these issues may save time.

-

Missing Records

Some slips or notes may not reach the books. When these papers are missing, the team may need to dig deeper.

-

Wrong Period Entries

A record may fall into the wrong period. This may cause errors in opening and closing balances.

-

Duplicate Entries

Sometimes two entries may come from the same event. Finding these early may protect the sheet from inflation.

-

Unclear Ledger Trails

If ledgers are not maintained well, teams may struggle to track back. This may slow down the check.

How Technology Supports the Reconciliation Work

Many firms may now use smart tools that help with checks. These tools may not replace teams, but they may make work lighter.

-

Automated Match Tools

Some tools may match entries with bank logs or ledger lines. A tool may catch a mismatch in seconds.

-

Cloud-Based Books

Cloud tools may give teams quick access to the sheet from any place. Real-time updates may keep the sheet clean.

-

Alerts For Errors

Some tools may show alerts when a figure looks strange. This may push teams to act early.

Best Practices For Smooth Balance Sheet Reconciliation

Below are practices that may make the reconciliation process simple, clear, and repeatable.

-

Keep Records Clean

Firms may try to store each support document in one place. A clean store may reduce search time.

-

Fix Errors Early

Once an error appears, fixing it soon may keep the trail short and easy.

-

Train Teams Often

Some rules may change over time. Small training sessions may help teams stay ready.

-

Set A Consistent Calendar

A fixed schedule may keep checks on track. Many firms may choose monthly checks.

If you are looking for experts to manage your balance sheet reconciliation, then Accounts Junction is a nice choice. Accounts Junction provides balance sheet reconciliation services for businesses.

Our team follows a systematic balance sheet reconciliation process to achieve better accuracy in it. Accounts Junction is an expert in balance sheet reconciliation services across the globe.

FAQs

1. What is the purpose of balance sheet reconciliation?

- It checks assets, debts, and equity with support records. This helps keep financial statements clear and correct.

2. How do you reconcile a balance sheet account effectively?

- Compare account totals with ledgers, bills, and bank records. Fix any differences found using proper proof or notes.

3. Which accounts need regular reconciliation in a balance sheet?

- Assets, debts, and equity accounts need regular review. Sub-ledgers should also match the main account totals.

4. How can opening balances affect balance sheet reconciliation?

- Wrong opening balances may cause errors in the books. A strong balance sheet reconciliation process checks these opening balances against prior totals to avoid mistakes.

5. Why is reconciling subsidiary ledgers important for balance sheets?

- It checks that ledger totals match main account totals. This lowers errors and keeps reports accurate for audits.

6. What common errors occur during balance sheet reconciliation?

- Duplicate entries, missing bills, or wrong postings appear often. These can make the financial position look wrong or off.

7. How often should balance sheet reconciliation be performed?

- Monthly or quarterly checks keep accounts correct and clear. Regular reviews also spot problems before they grow bigger.

8. Can reconciliation detect fraud or unauthorized accounting entries?

- Yes, wrong or strange entries may be found early. This lets managers act and stop possible financial loss.

9. What role does documentation play in balance sheet reconciliation?

- It keeps proof of changes for audits or review. It also explains why updates were done for the records.

10. How can adjustments be made without impacting accuracy?

- Make changes with support documents and clear reasoning. Each change should be logged to keep trust in accounts.

11. Which tools can support balance sheet reconciliation efficiently?

- Software or cloud tools may check accounts fast and clear. They can also track fixes and reduce human mistakes.

12. What steps are involved in reconciling equity accounts?

- Compare stock and retained earnings with supporting papers. Check that totals match issued shares and profits correctly.

13. How do you resolve discrepancies between ledgers and the balance sheet?

- Find the source, check documents, adjust, and record changes. This keeps all accounts true and correct in the books.

14. Can balance sheet reconciliation improve financial reporting accuracy?

- Yes, correcting differences makes numbers reflect the true state. It also gives leaders and investors more trust in reports.

15. What is the difference between a trial balance and reconciliation?

- Trial balance totals accounts; reconciliation checks these totals. Reconciliation makes sure numbers match supporting ledgers or records.

16. How do missing invoices affect balance sheet reconciliation?

- Missing invoices may cause overstatement or under-reporting of accounts. Finding or adjusting them keeps the accounts correct and clear.

17. Can reconciliation identify timing differences in transactions?

- Yes, wrong-period transactions can be found and corrected. This helps avoid errors in the current period’s books.

18. What is a reconciliation report in the balance sheet process?

- It lists differences, fixes, and supporting proof for review. Managers use it to see all adjustments clearly and quickly.

19. How should errors in prior periods be handled during reconciliation?

- Fix mistakes in the current period with clear notes. Include references to original errors to keep the audit trail.

20. Can frequent reconciliation reduce audit risks for a company?

- Yes, regular checks may prevent errors during audits. Frequent reviews also make audits faster and less stressful.