Accounts and bookkeeping management for Educational Institute

Education is one of the most valuable industries and holds prime importance in everyone’s life because knowledge is power. It is a long-surviving industry with ever-changing dynamics that needs to maintain a profit or gain to run a successful institution. Like other industries, education also needs finance to maintain their day to day operating activities. Hence, accounting for Educational Institute also contributes majorly to its success.

Proper bookkeeping and maintenance of different accounts and ledgers are very essential to make the necessary decisions for the management of educational institutions – school, college and universities. They need constant financial guidance, information and advice. There are several things to manage such as inventories, budgets, events and other activities of the institution.

Why choose Accounts Junction for Accounting for Educational Institute?

We at Accounts Junction are great at handling and serving clients of different industries and one such niche of ours is an educational institute. We provide bookkeeping, accounting, tax preparation and other accounting related services to our clients from the education industry.

You can count on us because:

Vast experience: We are experienced professionals who know how the education industry works, and the various levels of facts associated with it. We streamline each aspect for our clients for accounting for educational institute and provide a complete array of services such as registering students after admission to maintain payable, cost per student, the marginal cost of new students, etc. so that you can focus on your core business.

Accounting and Bookkeeping expertise: Today, everyone needs a professional to handle their finances. At Accounts Junction, we have highly qualified professional teams of CPAs, character accountants, and accountants that have mastered the art of bookkeeping and other related services. We have been associated with different countries such as the US, UK and Australia for providing valuable services.

Quality service: We always thrive to give the best to our clients. Our experts use various accounting software such as Xero, Zoho Books, QuickBooks, MYOB, NETSUITE and more that helps you to access your information anytime in an easy, comprehensible and presentable manner. We provide cloud accounting service at an affordable cost and save your time and cost.

Importance of Professional Accounting for Educational Institutes

The following points show the importance of professional accounting for educational institutes:

Clean and Trustworthy Records

- Accurate records build trust with parents, boards, donors, and regulators. Clean books also help leaders see the real health of the institute.

Better Planning and Control

- Strong accounting allows better plans for fees, events, staff needs, and long term goals. It also helps spot waste and avoid cash flow stress.

Smooth Operations Across Departments

- Every department depends on money planning. Proper accounting makes fee desks, admin teams, and finance units work in sync.

Support for Audits and Compliance

- Schools face strict checks. Professional accounting ensures audit ready books, neat trails, and correct compliance.

Challenges Faced by Educational Institutions in Accounting

Following are some common challenges in accounting for educational institutes:

1. Complex Fee Structures

- Many different fee types

- Late payments

- Manual updates

- Scholarship adjustments

2. Vendor and Expense Management Issues

- Slow bill approval

- Wrong entries

- Unclear vendor ledgers

3. Payroll Complications

- Changing teacher hours

- Extra classes

- Many staff categories

- Shifting rules and deductions

4. Budget Pressure

- Limited funds

- Unplanned purchases

- No real time tracking

5. Inventory and Asset Confusion

- Lost items

- Missing tags

- No updated asset list

6. Audit Stress

- Missing documents

- Old or wrong entries

- Poorly prepared reports

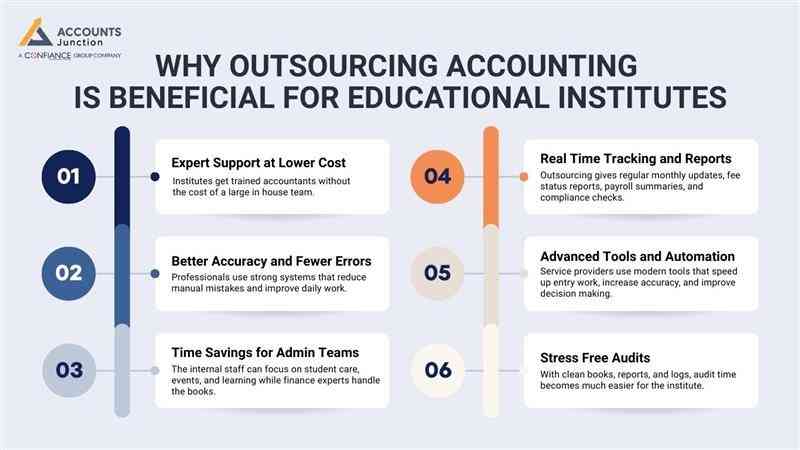

Why Outsourcing Accounting is Beneficial for Educational Institutes

Outsourcing accounting for educational institutes is beneficial for the following reasons:

Expert Support at Lower Cost

Institutes get trained accountants without the cost of a large in house team.

Better Accuracy and Fewer Errors

Professionals use strong systems that reduce manual mistakes and improve daily work.

Time Savings for Admin Teams

The internal staff can focus on student care, events, and learning while finance experts handle the books.

Real Time Tracking and Reports

Outsourcing gives regular monthly updates, fee status reports, payroll summaries, and compliance checks.

Advanced Tools and Automation

Service providers use modern tools that speed up entry work, increase accuracy, and improve decision making.

Stress Free Audits

With clean books, reports, and logs, audit time becomes much easier for the institute.

Our Accounting Services for Educational Institutions

We offer the following in accounting for educational institutes:

1. Student Fee and Receivable Management

What we do

- Fee posting

- Tracking overdue amounts

- Sending reminders to parents

- Full fee reconciliation

- Clean fee ledger reports

2. Vendor and Payable Management

What we do

- Record supplier invoices

- Process payments on agreed dates

- Maintain ledger accuracy

- Check rates and terms

- Monthly payable reports

3. Payroll Processing

What we do

- Prepare salary sheets

- Track overtime and extra class hours

- Include bonuses and allowances

- Add all required deductions

- Provide clear payslips and payroll reports

4. Budget Creation and Monitoring

What we do

- Create department wise budgets

- Prepare event budgets

- Track actual spending

- Share variance reports

- Guide on cost control

5. Inventory and Asset Tracking

What we do

- Track books and notebooks

- Maintain lists of lab tools

- Record sports gear and uniforms

- Manage digital device records

- Help with audits and updates

6. Financial Reporting and Audit Support

What we do

- Monthly financial statements

- Income and expense reports

- Balance sheets

- Cash flow reports

- Full support during internal and external audits

7. Grant and Donation Accounting

What we do

- Track grants and donor funds

- Allocate funds to approved activities

- Maintain compliance logs

- Prepare donor ready reports

What services do we provide?

Our services for the educational institute include:

- Bookkeeping

- Receivable Management

- Payable management

- Payroll planning

- Tax planning etc

We understand the uniqueness of the education industry and the unique requirements of it. So, we provide you with regular financial attention to give insight about the viability of the business, monthly financial statements and reports for the management of finance.

Satisfied Customer service is our key motive as clients are the centre of our work. We believe in delivering quality service and best accounting practices to our clients. We are cost-effective and don’t charge for inquiries, feel free to contact us at Accounts Junction.

FAQs

1. Why do institutes need professional accounting?

- It keeps money records clean and supports better plans and decisions.

2. What is the main cause of fee mistakes?

- Manual updates and late posting create most errors.

3. Can outsourcing reduce admin load?

- Yes, it removes routine tasks from the internal team.

4. Do you send fee reminders?

- Yes, we send due alerts and follow ups.

5. How do you manage vendor ledgers?

- We record each bill and match balances with care.

6. Do you handle payroll for all staff types?

- Yes, for teachers, support staff, and part time staff.

7. Do you prepare department wise budgets?

- Yes, we build, track, and revise them.

8. How do you track school assets?

- We maintain lists and run checks for books, tools, and devices.

9. Do you support audits?

- Yes, with audit ready reports and clear logs.

10. Can you track grant funds?

- Yes, we handle full grant and donation accounting.

11. Is my financial data safe?

- Yes, we use secure systems to protect all records.

12. How often will reports be shared?

- Monthly or as per the institute request.

13. Can you help reduce overdue fees?

- Yes, through alerts and regular follow ups.

14. How do you manage changes in salary?

- We update payroll sheets whenever changes happen.

15. Do you process vendor payments on time?

- Yes, we process vendor payments with scheduled payment cycles.

16. Will you keep a clear audit trail?

- Yes, every entry has time and detail.

17. Do you guide with yearly budgets for educational institute?

- Yes, we help plan full year budgets for your educational institute.

18. Do your reports help reduce cost in an educational institution?

- Yes, our reports show areas where spending can be reduced.

19. Do you serve both small and large institutes?

- Yes, our services fit schools, colleges, and training centers of all sizes.