Accounting in Hospitals and the Role of Hospital Accounting Software

Managing money inside a hospital involves constant care, and Accounting in Hospitals helps keep this work clear and steady. Daily charges, staff pay, and supply costs change without pause. Because of this pace, clear financial tracking becomes very important. Many teams rely on structured systems to keep control steady. In this space, accounting in hospitals supports smooth care delivery.

Financial planning inside care centers also needs long-term thinking. Patient flow may rise or fall across weeks or months. Clear records from accounting for hospitals help leaders adjust plans with less stress. When data stays clean, better choices often follow. This is where accounting in hospitals adds steady value.

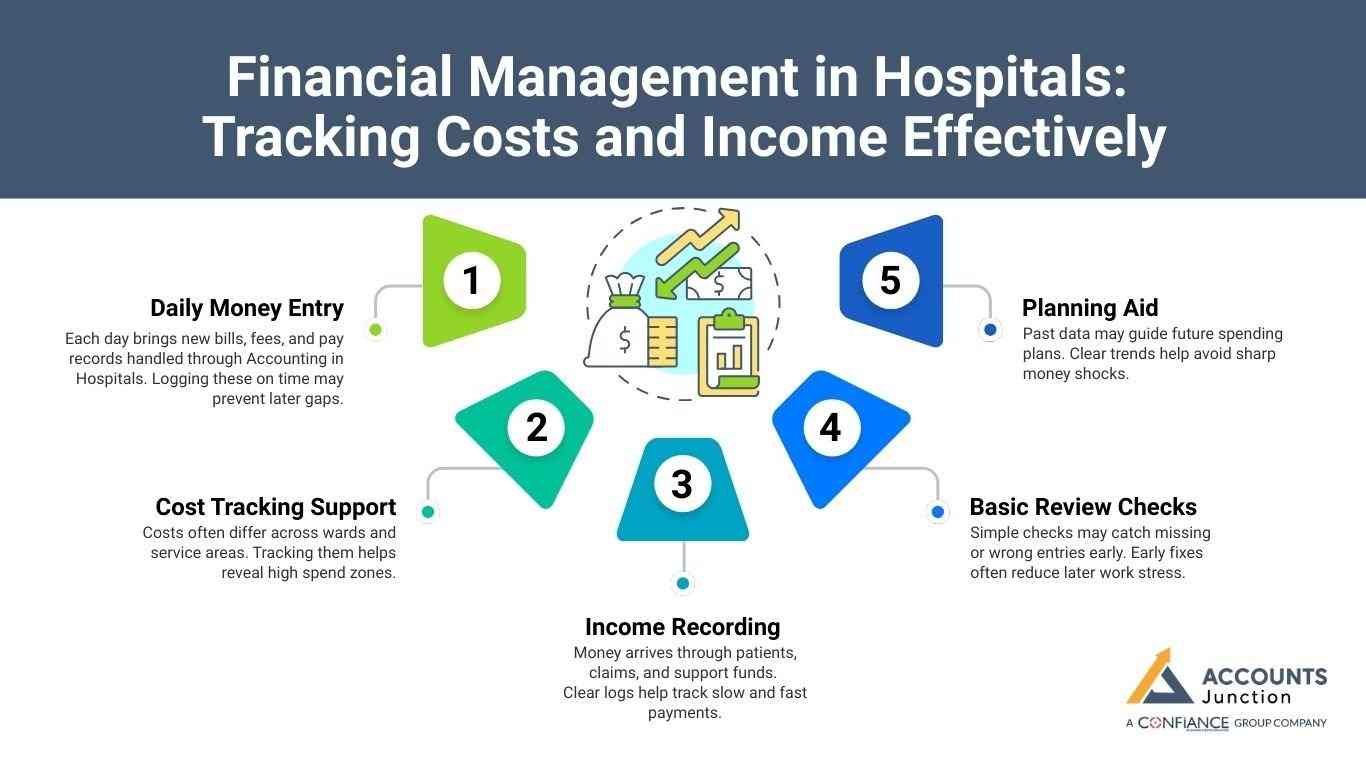

Financial Management in Hospitals: Tracking Costs and Income Effectively

The main goal of hospital accounting involves tracking money use across care units. Clear records help teams understand income and spending flow.

This process may support planning without guess-based choices. Many leaders depend on such clarity for calm decisions.

-

Daily Money Entry

Each day brings new bills, fees, and pay records handled through Accounting in Hospitals. Logging these on time may prevent later gaps.

-

Cost Tracking Support

Costs often differ across wards and service areas. Tracking them helps reveal high spend zones.

-

Income Recording

Money arrives through patients, claims, and support funds. Clear logs help track slow and fast payments.

-

Basic Review Checks

Simple checks may catch missing or wrong entries early. Early fixes often reduce later work stress.

-

Planning Aid

Past data may guide future spending plans. Clear trends help avoid sharp money shocks.

Role of Accounting in Hospitals in Daily Operations

Each workday includes several repeat money tasks supported by Accounting in Hospitals. These tasks help keep records fresh and useful. Without daily updates, data may lose value.

-

Vendor Bill Records

Bills from suppliers may arrive every day. Recording them early helps manage due dates.

-

Patient Fee Records

Service charges vary by type of care, and proper tracking helps monitor them clearly. Accurate records help avoid payment disputes later.

-

Staff Pay Records

Pay data forms a large part of the records. Clean logs help review staff cost levels.

-

Cash Receipt Records

Cash in hand needs close daily watch. This helps plan short-term needs.

-

End Day Review

A short review may catch missed entries. This habit supports clean data flow.

Hospital Accounting Unit-Wise Cost Analysis

Cost control improves when accounting for hospitals splits records by unit. Each ward shows a unique spending pattern under accounting in hospitals. This view helps balance fund use fairly.

-

Ward Cost View

Beds, tools, and staff drive ward costs in accounting in hospitals. Comparing wards helps spot cost pressure.

-

Lab Cost View

Tests and kits add steady lab expenses. Tracking in hospital accounting helps plan supply needs better.

-

Care Tool Cost View

Machines and tools carry high price value. Clear logs in accounting for hospitals help manage tool life costs.

-

Support Unit Cost View

Cleaning and security add fixed monthly costs. Tracking through accounting in hospitals helps avoid unnoticed rises.

-

Shared Cost Split

Power and space serve many areas. Fair split rules improve cost clarity in accounting in hospitals.

Hospital Accounting Income Flow Management

Income comes from many paths, and Accounting in Hospitals helps track each one clearly. Some payments arrive fast while others take more time. Clear tracking helps plan cash use across all units. Strong income flow control supports steady hospital plans.

Patient Payment Records

- Direct payments follow care delivery steps in hospitals.

- Clear bills reduce later pay delays and disputes.

- Patient payment logs improve the daily cash view in accounting for hospitals.

- Regular checks ensure income matches the care given.

Insurance Claim Records

- Claims often move through long review steps.

- Tracking helps manage follow-ups in calm ways.

- Clear claim logs reduce rejects and rework in accounting in hospitals.

- Steady checks support smooth insurance cash flow.

Late Payment Records

- Late payments may affect short-term cash plans.

- Early alerts help avoid sudden cash gaps.

- Late pay tracking in accounting in hospitals supports timely calls and notes.

- Clear logs reduce stress during low cash times.

Grant Fund Records

- Some funds carry strict use rules.

- Clear logs help follow such rules fully.

- Grant tracking ensures proper use of funds.

- Good records support clean grant reports.

Other Income Records

- Small income sources add value over time.

- Tracking keeps the total income views clear.

- Other income logs prevent missed cash entries.

- Full tracking supports better hospital income control.

Accounting for Hospitals: Cash Flow Review

Cash flow shows how funds move over time in accounting for hospitals. Regular review helps plan safe spending. This view supports steady operations.

Daily Cash Check

- Short checks help meet daily money needs.

- Early checks avoid sudden cash shortfalls.

- Daily review keeps funds ready for use.

- Logs show where the money goes each day.

Weekly Cash Review

- Weekly checks show early cash warning signs.

- Trends help take fast action if needed.

- Weekly review keeps accounts clear and safe in accounting in hospitals.

- Checks show areas where cash may lag.

Monthly Cash Review

- Monthly trends guide hospital budget talks.

- Review helps plan future spending better.

- Logs show patterns in income and outgo.

- Monthly review supports steady financial decisions in accounting for hospitals.

Inflow Trend Review

- Tracking inflow shows payment times and patterns.

- Review helps plan follow-ups for slow pay.

- Logs help predict which income arrives late.

- Checks guide staff on money collection steps.

Outflow Trend Review

- Spending trends show where waste may occur.

- Logs help spot cost rise in departments.

- Trend review guides better spending control.

- Checks help plan a safe and smart outflow.

Hospital Accounting Software: System Support Role

Digital tools like hospital accounting software support faster money work. They reduce paper use and repeat tasks. Clear systems save time for teams.

Fast Data Entry

- Entries post quickly using digital tools.

- This reduces the manual work staff do.

- Quick posting helps keep accounts up to date.

- Staff spend less time on routine data work.

Central Data Storage

- All records stay in one secure place using hospital accounting software.

- This avoids file loss and document mix-ups.

- Central storage helps teams find files fast.

- It keeps hospital data safe and clear.

Unit Wise Reports

- Reports from hospital accounting software show cost and income by unit.

- Unit heads can review finances quickly.

- Data helps spot units with high or low spend.

- Reports guide better decisions for each ward.

Error Alert Support

- Systems in hospital accounting software flag missing or wrong data fast.

- Alerts reduce later work to fix mistakes.

- Staff correct errors early before reports close.

- Alerts help maintain smooth and accurate records.

History Record Access

- Old data is easy to find in hospital accounting software systems.

- Access helps during audits and finance reviews.

- Staff can check past trends quickly and clearly.

- Historical data support planning and control tasks.

Accounting in Hospital: Planning and Control

Strong records from Accounting in Hospitals support future planning efforts. Past data guides safer spending choices. This helps reduce money stress.

Budget Planning

- Budgets rely on past spending data from accounting records in hospitals.

- Clear records shape realistic budget limits.

- Data helps avoid over or underspending.

- Budget checks guide safe money use.

Tool Purchase Planning

- Large buys need careful timing in hospitals.

- Clear data avoids cash flow strain.

- Tracking past purchases helps plan future buys.

- Proper planning ensures tools are ready on time.

Staff Planning

- Cost views guide staff mix and duty planning.

- Data helps balance care quality with costs.

- Staff logs show where more help is needed.

- Planning ensures smooth workflow and care delivery.

Risk Spotting

- Trends reveal risk signs early for action.

- Early action helps limit financial loss.

- Tracking patterns avoids surprises in spending.

- Data alerts guide safer hospital operations.

Leadership Support

- Clear data from accounting for hospitals supports calm team discussions.

- Records help reach fair and smart choices.

- Data shows facts for better group decisions.

- Leaders rely on records to guide hospital work.

Hospital finance work supports care through steady control. Clear records help teams manage costs calmly.

Daily tracking reduces stress during busy hours. Balanced data support both care and planning needs.

Digital systems add ease and speed to this work. Manual effort drops while data trust improves. With hospital accounting software, accounting for hospitals feels manageable. This allows teams to focus more on patient care.

Accounts Junction provides accounting and bookkeeping services for hospitals and keeps all financial records clear and in order. Our team uses simple systems and steady workflows. Our Certified experts handle these tasks with care and accuracy. With Accounts Junction, hospitals can stay focused on their main services. Partner with us to make your financial work easy.

FAQs

1. What is hospital accounting, and why is it important?

- Accounting in hospitals helps track daily costs and income. It may support care work through clear money control.

2. How does accounting in hospitals work on a daily basis?

- Accounting in hospital records, bills, fees, and pay tasks. Daily work may help keep records clean and useful.

3. What is the purpose of hospital accounting in healthcare facilities?

- Accounting in hospitals helps manage costs by care unit. It may guide spending plans and cash flow checks.

4. Why do hospitals need accounting for hospital systems?

- Accounting for hospitals may help track cash from many paths. It may support a balance between spending and care goals.

5. What are the benefits of hospital accounting software?

- Hospital accounting software may speed up record-keeping. It may reduce hand labor and lower error risk.