How Accounting for the Legal Industry Differs from Regular Business Accounting

Accounting is the base of every successful business, but not all accounting systems work the same way. When it comes to law firms, there are many rules and unique needs that make their accounting different from other businesses. Accounting for the legal industry involves complex tasks like handling trust accounts, managing client retainers, and ensuring compliance with state bar regulations.

In this blog, we’ll explore how accounting for the legal industry differs from regular business accounting, why law firms need specialized help, and how an accountant for the legal industry supports growth and compliance.

Understanding the Core of Accounting for the Legal Industry

What Makes Legal Accounting Unique

Every business keeps track of its income, spending, and profits. However, law firms go beyond this. They must also manage trust funds, client retainers, and settlements, all under strict legal rules. This means a simple mistake can lead to serious penalties.

An accountant for the Legal Industry understands these complex tasks. They follow client money rules, manage trust accounts, and make sure no funds are mixed with business accounts. Regular accountants may know general accounting principles, but they might not be trained in accounting for the legal industry or legal trust compliance.

The Role of Trust Accounting

Trust accounting is one of the biggest differences between accounting for the legal industry and standard business accounting. Law firms often hold money for clients, such as settlement funds or retainers. These funds are not part of the firm’s income until earned.

An expert accountant knows how to:

- Track every dollar in and out of the trust account.

- Reconcile accounts every month.

- Ensure complete separation between firm and client funds.

Even a small error in trust accounting can lead to legal issues or even license loss for a lawyer.

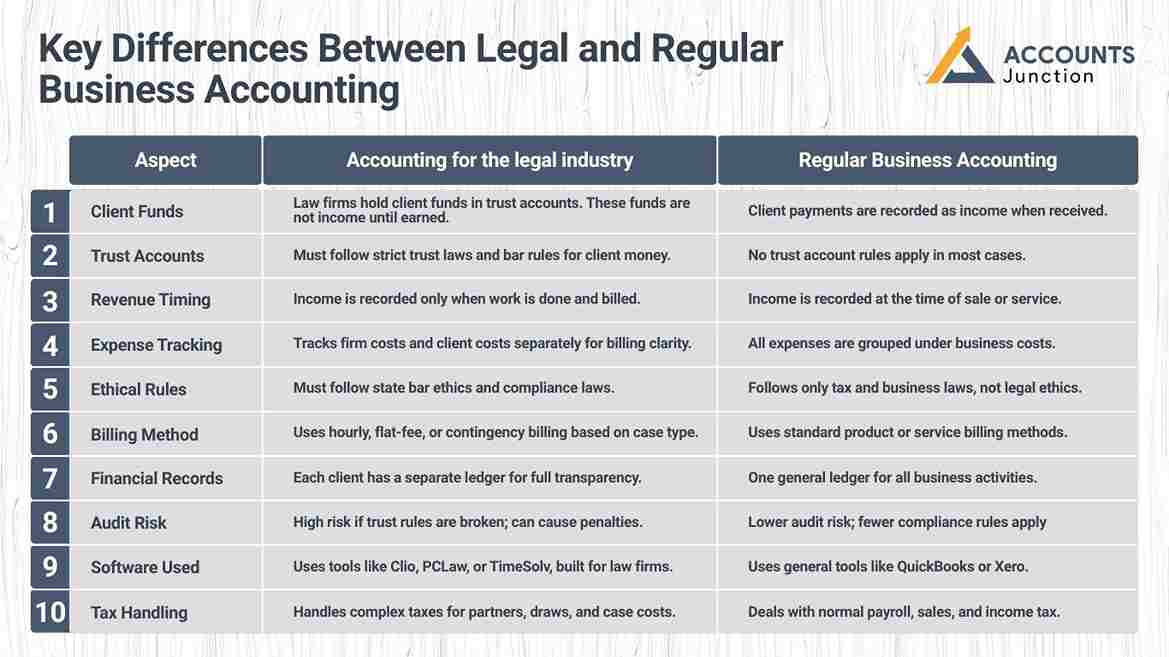

Key Differences Between Legal and Regular Business Accounting

|

Aspect |

Accounting for the legal industry |

Regular Business Accounting |

|

Client Funds |

Law firms hold client funds in trust accounts. These funds are not income until earned. |

Client payments are recorded as income when received. |

|

Trust Accounts |

Must follow strict trust laws and bar rules for client money. |

No trust account rules apply in most cases. |

|

Revenue Timing |

Income is recorded only when work is done and billed. |

Income is recorded at the time of sale or service. |

|

Expense Tracking |

Tracks firm costs and client costs separately for billing clarity. |

All expenses are grouped under business costs. |

|

Ethical Rules |

Must follow state bar ethics and compliance laws. |

Follows only tax and business laws, not legal ethics. |

|

Billing Method |

Uses hourly, flat-fee, or contingency billing based on case type. |

Uses standard product or service billing methods. |

|

Financial Records |

Each client has a separate ledger for full transparency. |

One general ledger for all business activities. |

|

Audit Risk |

High risk if trust rules are broken; can cause penalties. |

Lower audit risk; fewer compliance rules apply. |

|

Software Used |

Uses tools like Clio, PCLaw, or TimeSolv, built for law firms. |

Uses general tools like QuickBooks or Xero. |

|

Tax Handling |

Handles complex taxes for partners, draws, and case costs. |

Deals with normal payroll, sales, and income tax. |

Why Law Firms Need a Specialized Accountant

1. Understanding Legal Billing

Legal billing is not like normal invoicing. It often includes:

- Hourly billing

- Flat fees

- Contingency fees (paid only if the case wins)

An accountant for the legal industry must align these billing models with accounting reports and ensure they match client agreements.

2. Managing Retainers and Deposits

Law firms often ask for retainers, advance payments for future work. This money stays in a trust account until used. A general accountant may treat it as income right away, which is wrong and can cause compliance problems.

An experienced accountant for the legal industry records it as unearned income and moves it to revenue only when the service is completed. This process ensures compliance and accuracy in accounting for the legal industry.

3. Handling Case Costs

Every case involves costs like filing fees or expert reports. These expenses are either billed to the client or absorbed by the firm. A proper accounting system ensures each case cost is recorded correctly to avoid confusion.

Core Functions of an Accountant for the Legal Industry

1. Bookkeeping and Trust Reconciliation

- Daily bookkeeping keeps all records clean and current. Trust account reconciliation ensures that balances match bank statements. Both are essential to prevent errors and stay compliant.

2. Payroll and Partner Distributions

- Law firms often have multiple partners. Their pay may depend on performance or profit-sharing agreements. A law firm accountant manages these complex payroll setups while ensuring fair distribution.

3. Tax Preparation and Planning

- Legal professionals face unique tax challenges from partner draws to reimbursed expenses. Expert accounting for the legal industry helps partners understand profitability, expenses, and billing patterns for smarter business planning.

4. Financial Reporting and Analysis

- Beyond compliance, law firms also need insights. With detailed reports, an accountant helps partners understand profits, costs, and client billing trends. This supports better decision-making.

Common Challenges in Legal Industry Accounting

-

Managing Multiple Trust Accounts

A mid-sized law firm might have dozens of client trust accounts. Each must be handled individually, with no overlap. Manual errors are common without proper software or expertise.

-

Handling Client Advances and Settlements

Client funds often come in before the work is done. Tracking when funds become revenue is a common problem. An accountant for the legal industry ensures these are handled correctly.

-

Compliance with Bar Association Rules

Bar associations have strict rules about how firms handle money. A small mistake can cause audits, fines, or loss of license. With expert help, law firms can stay audit-ready at all times.

Benefits of Hiring an Accountant for the Legal Industry

1. Reduced Risk of Non-Compliance

- Professional accountants ensure that the firm follows all trust laws and ethical standards. This prevents penalties and builds a strong reputation.

2. Better Cash Flow Management

- Expert accounting for the legal industry helps firms manage retainers, track receivables, and maintain a healthy cash flow.

3. Accurate Financial Insights

- By tracking every dollar, accountants give law firms a clear view of profits, costs, and opportunities for growth.

4. Stress-Free Tax Season

- Law firms often struggle during tax season due to mixed records. With proper accounting systems, taxes become simpler and error-free.

Tools and Software Used in Accounting for the Legal Industry

Modern law firms use accounting tools made for their needs. Some popular ones include:

- Clio Manage – Combines case and billing management.

- QuickBooks for Lawyers – Tracks income, trust accounts, and client bills.

- PCLaw – Designed for law firms with strong reporting tools.

- TimeSolv – Great for time tracking and billing.

An expert accountant for the legal industry helps choose and set up the right tool, ensuring smooth workflows.

Best Practices in Legal Accounting

1. Maintain Clear Separation of Funds

- Always keep client and firm money separate. This protects both parties and meets bar rules.

2. Reconcile Monthly

- Reconciliation ensures that every transaction is correct and that all accounts balance.

3. Keep Detailed Records

- Transparency is key in the legal field. Every expense, retainer, and client transaction should be recorded clearly.

4. Train Staff

- Law firm staff should know the basics of trust rules and billing systems to avoid mistakes.

Accurate accounting for the legal industry is essential for compliance, transparency, and financial health. Managing trust accounts, retainers, and client funds requires more than basic bookkeeping. At Accounts Junction, we offer expert trust accounting, client billing, payroll, tax planning, and financial reporting services tailored to the law industry. Our accounting team uses advanced tools like Clio and QuickBooks for Lawyers to ensure records stay accurate, compliant, and transparent. With Accounts Junction, law firms can maintain financial stability, meet ethical standards, and focus more on client service and firm growth.

FAQs

1. Why is legal accounting different?

- Law firms handle client funds and must follow strict money rules.

2. What is a trust account?

- It’s a separate bank account for holding client money until it’s earned.

3. Can any accountant manage a law firm?

- No. Only an accountant for the legal industry understands trust and compliance rules.

4. Why is compliance key in law firms?

- Breaking money rules can bring fines or loss of license.

5. How do accountants help with compliance?

- They track client funds and check that all reports are correct.

6. What makes legal billing complex?

- It can include hourly rates, flat fees, or case-based pay.

7. Why can’t retainers count as income right away?

- The funds stay with the client until the work is complete.

8. How often should trust accounts be checked?

- Every month, to keep all numbers right.

9. What are common law firm mistakes?

- Mixing client and firm money or recording income too soon.

10. How does software help legal accountants?

- It tracks billing, time, and client funds in one place.

11. What reports do law firms need most?

- Reports that show income, costs, and trust account balance.

12. What tax issues do law firms face?

- Partner draws, case costs, and service-based income.

13. How do accountants improve cash flow in law firms?

- They track unpaid bills and manage retainers better.

14. What happens if trust funds are misused?

- The firm could face audits, fines, or lose its license.

15. Why hire a legal accounting expert?

- They know bar rules, billing, and trust compliance.

16. How does good accounting help growth?

- It keeps money clear and helps plan smart moves.

17. What are the key IPs for law firm accounting?

- Keep client money separate, check monthly, and log all deals.