Accounting for Medical Practice: A Complete Guide for Doctors and Clinics

Accounting for medical practice plays a key role in daily clinic work. It gives doctors clear views of cash flow and the real state of the clinic. Many clinics run smoothly only when strong systems track money well. When these systems fail, teams face delays and stress in routine tasks. Accounting for medical practice keeps each part of the workflow calm and clear.

For many clinics, the main issue lies not in skill but in loose record habits. A missed bill or late claim can harm cash flow fast. Proper methods reduce that risk with clean steps in each task. Many clinics now use strong tools that track income and cost with ease. Accounting services for medical practices bring order and reduce daily errors.

Why Accounting for Medical Practice Matters

-

Clear View of Daily Cash

A clinic needs clear views of income each day to stay stable. Clean records show cash gaps early and guide better plans.

-

Better Use of Clinic Funds

Doctors need fair insight into clinic costs to guide smart plans. These views help leaders cut waste and use funds with care.

-

Smooth Tax Work

Tax tasks need clear books and proof for each entry and claim. Strong accounting for medical practice keeps all tax files clean.

-

Less Staff Stress

Teams work with ease when records stay neat and well-tracked. It also cuts repeat tasks and frees time for core clinic work.

-

Easy Growth Plans

Leaders use reports to plan new units or new care lines. Regular reports show patterns that help shape future plans.

Core Parts of Accounting for Medical Practice

-

Income Records

Clean income records track each bill and each claim with care. These records help clinics trace delays and missed payments.

-

Expense Records

A clinic needs clean logs of all costs, which is a base step in accounting services for medical practices. Expense logs guide teams to cut waste in each step.

-

Payroll Steps

Staff need timely pay and fair records, and strong accounting for medical practice helps guide this. Strong payroll tasks keep staff trust and smooth team flow.

-

Tax Steps

Tax files need clear lines for income and costs each month. Clean books make tax time quick and reduce audit risk.

-

Bank Checks

Bank checks match the clinic books with the real bank statement. This task stops errors before they harm cash flow.

-

Monthly Reports

Reports give leaders a view of gains and losses each month. Reports also show trends that help shape clinic goals.

Key Challenges in Clinic Accounting

-

Late Bills

Late bills slow cash and harm pay cycles, so accounting services for medical practices must track bills well. Strong systems send bills on time and track their status.

-

Missed Claims

Claims need clean data to pass with no delay or drop. Good tools keep claims neat and ready for quick checks.

-

High Staff Load

Teams face high loads when books stay loose or unclear. Better steps cut that load and raise real staff output.

-

Weak Data Flow

Weak data flow hides issues, so accounting services for medical practices must fix gaps fast. Reports fix this by showing key signs in fast views.

-

Multi-Site Issues

More sites mean more books and more room for errors. Clear systems keep each site neat and linked to one view.

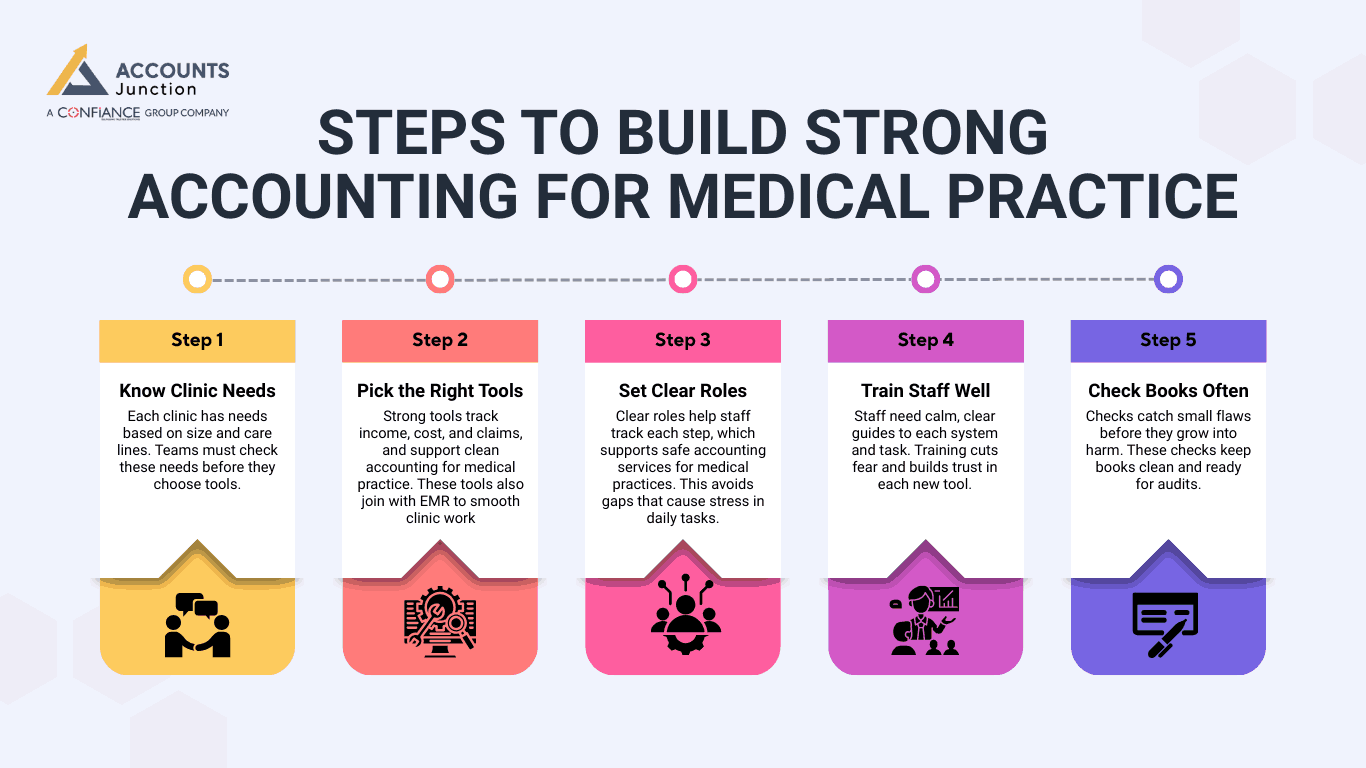

Steps to Build Strong Accounting for Medical Practice

-

Know Clinic Needs

Each clinic has needs based on size and care lines. Teams must check these needs before they choose tools.

-

Pick the Right Tools

Strong tools track income, cost, and claims, and support clean accounting for medical practice. These tools also join with EMR to smooth clinic work.

-

Set Clear Roles

Clear roles help staff track each step, which supports safe accounting services for medical practices. This avoids gaps that cause stress in daily tasks.

-

Train Staff Well

Staff need calm, clear guides to each system and task. Training cuts fear and builds trust in each new tool.

-

Check Books Often

Checks catch small flaws before they grow into harm. These checks keep books clean and ready for audits.

Main Features to Seek in Accounting Services for Medical Practices

-

Real Time Dashboards

Dashboards show cash, cost, and gains in live views. Leaders use these screens to act fast and stay aware.

-

Auto Bills

Auto bills send invoices with no delay or staff load. This tool cuts missed bills and boosts smooth cash flow.

-

Claim Tools

Claim tools track each claim from start to end stage. They cut drop rates and raise the rate of quick pay.

-

Expense Tags

Tags sort each cost, so teams see trends with ease. They guide wise cuts and boost smart fund use.

-

Strong Payroll Tools

Payroll tools in good accounting services for medical practices keep pay smooth and fair. Staff trust these tools when pay stays fair and on time.

-

Multi-Site Views

Multi-site views give leaders one screen for all sites. This view helps plan growth and track each unit well.

How Strong Accounting for Medical Practice Boosts Clinic Work

-

Clear Cash Flow

Clear cash flow views help teams plan each step with care. These views keep clinics safe from cash gaps and stress.

-

Low Error Rates

Auto tasks cut errors in books and billing lines. Staff stay calm and avoid repeating work due to bad data.

-

Fast Tax Tasks

Good records make tax time short and smooth for teams. This also cuts the risk of fines or audits from missed data.

-

Fair Staff Pay

Strong payroll keeps pay fair and clear for all staff. This builds trust and boosts teamwork in the clinic.

-

Smart Growth

Clear reports show high gains and weak spots in care lines. This leads to real growth plans with low money risks.

Best Practices for Accounting for Medical Practice

-

Daily Record Steps

Daily steps keep books fresh and clean for audits. Staff fix flaws fast when they track tasks each day.

-

Use Cloud Tools

Cloud tools store data safely and give wide access. Teams work with ease from any place when tools link well.

-

Keep Cash Logs Clean

Cash logs show the real state of funds in the clinic. These logs help staff plan pay cycles with a calm pace.

-

Run Report Checks

Report checks show trends and warn of real risks. Teams use these checks to plan safe and smart moves.

-

Split Roles

Split roles keep books clean and free from bias. This rule also keeps audits smooth and stress-free.

-

Track Claims Daily

Daily claim checks fix errors fast and raise pay speed. Teams that track claims often see fewer claim drops.

Common Mistakes in Accounting for Medical Practice

-

Loose Books

Loose books hide flaws and harm tax tasks later. Tight books cut that risk and keep tasks clear.

-

Late Pay Cycles

Late pay harms staff trust and slows clinic pace. Strong payroll steps keep all pay tasks on track.

-

Missed Bills

Missed bills hurt long-term plans, so good accounting for medical practice must track all bills. Auto tools fix this with on-time bill flows.

-

Weak Report Use

Many ignore reports and miss key trends in cash. Reports guide good plans and avoid huge risks.

-

One Person Control

One person controls harm checks and audit flow. Split roles fix this and keep books clear.

Accounting for medical practice gives clinics a firm base for growth. It keeps books clean and ready for each tax task. It gives leaders clear views of all gains and losses. It guides smart moves that shape the clinic path. It also cuts stress for teams that need clean data daily.

Accounts Junction offers full accounting and bookkeeping services for medical clinics. We use clean systems that track income, costs, and monthly reports with care. Our certified experts work with strict checks to keep each record correct. We handle daily tasks, payroll, and tax lines with smooth and clear steps. Partner with us for stable growth and long-term financial peace.

FAQs

1. What does accounting for medical practice include?

- It includes income records, cost logs, payroll, tax tasks, and reports. These steps keep clinic books clean and ready for each review.

2. Why do clinics need accounting services for medical practices?

- These services track bills, claims, and costs with clear methods. They also cut errors and help clinics plan safe growth.

3. How does accounting for medical practice improve cash flow?

- It tracks each bill, claim, and pay cycle with neat steps. This keeps cash flow smooth and reduces late pay risks.

4. Can accounting services for medical practices reduce claim denials?

- Yes, they keep claim data clean and ready for checks. This also cuts drop rates and boosts fast claim pay.

5. What reports are key in accounting for medical practice?

- Clinics need cash flow, cost, gain, and claim reports. These reports guide leaders toward smart clinic plans.

6. How do accounting services help multi-site medical practices?

- They link all sites and show one view for all units. This helps leaders plan growth with clear data.

7. Do medical clinics need monthly or weekly report checks?

- Weekly checks show early signs of issues in cash flow. Monthly checks help plan long-term clinic moves.