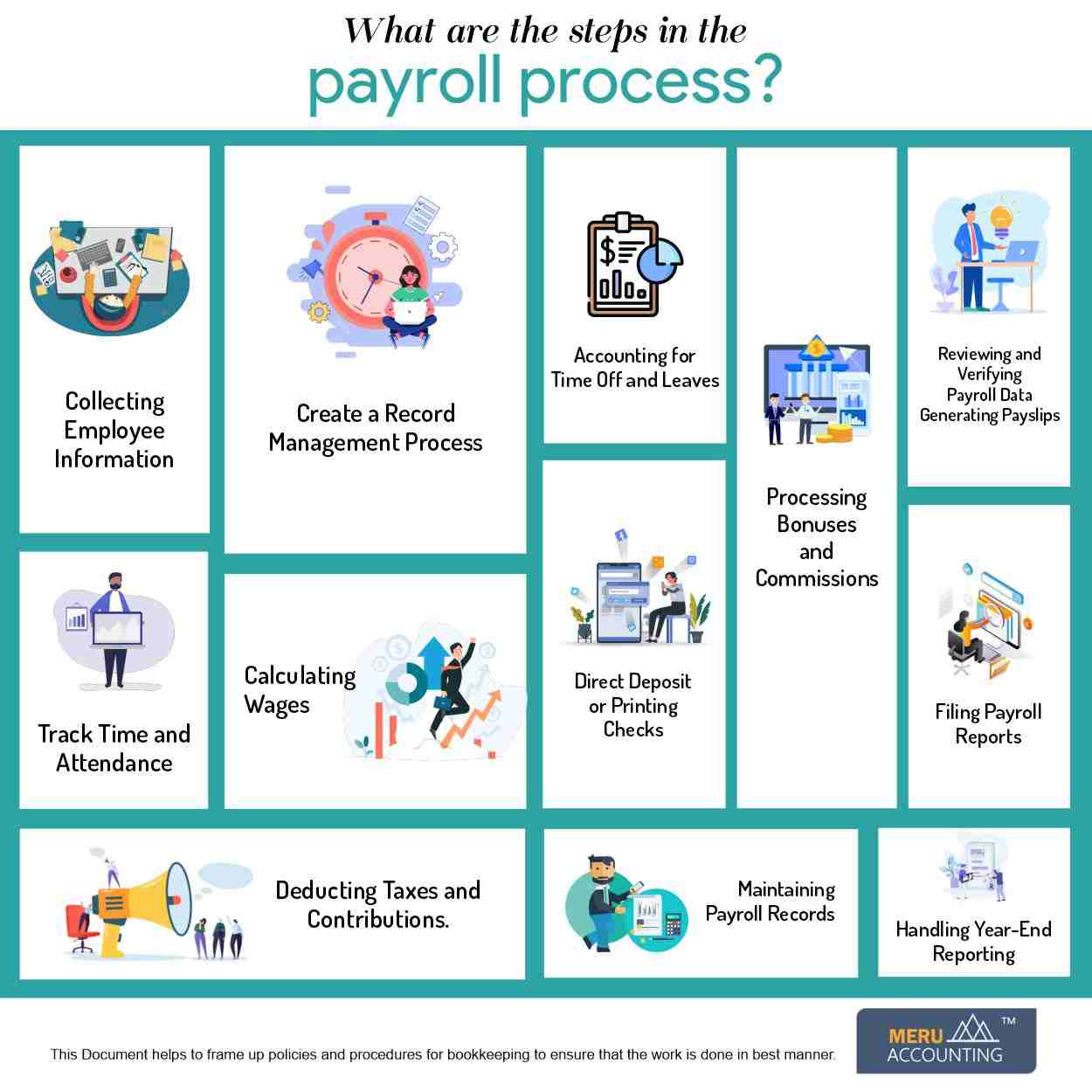

What are the steps in payroll process?

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

- Collecting Employee Information: Obtain essential information for each employee, including their full name, contact details, tax information, bank account for direct deposit, employment status, hours worked, and any deductions or benefits they are eligible for.

- Create a Record Management Process: Businesses have to maintain several documents such as employee contracts, tax forms, employee handbooks, and training on behalf of their employees. Such documents need signatures and are stored for compliance. There should also be documentation for benefits and retirement for proper payroll deductions.

- Track Time and Attendance: Time tracking is important for payroll processing. Keeping track of employee work hours through timesheets, time-tracking systems, or clock-in/clock-out procedures. It is crucial to streamline the time and attendance process to ensure an accurate record of working hours for an effective payroll management process.

- Calculating Wages: Calculate gross wages based on employees' hourly rates, salaries, overtime, commissions, or any other applicable payment structures.

- Deducting Taxes and Contributions: Subtract income taxes, Social Security, Medicare, and other relevant deductions from the gross wages. These deductions may also include retirement contributions, health insurance premiums, and other benefits.

- Accounting for Time Off and Leaves: Factor in any paid time off, sick leave, or vacation days taken by employees, adjusting their wages accordingly.

- Processing Bonuses and Commissions: If applicable, include bonuses, commissions, or other incentive payments in the payroll calculations.

- Reviewing and Verifying Payroll Data: Conduct a thorough review of all payroll information to ensure accuracy and resolve any discrepancies.

- Generating Payslips: Generate and distribute payslips to employees, detailing their gross wages, deductions, net pay, and any other relevant information.

- Direct Deposit or Printing Checks: Transfer the funds directly to employees' bank accounts through direct deposit or prepare and distribute physical paychecks.

- Submitting Payroll Taxes: Calculate and submit payroll taxes, including employer contributions, to the appropriate tax authorities.

- Filing Payroll Reports: File necessary payroll reports and documentation with relevant government agencies and authorities.

- Maintaining Payroll Records: It includes maintaining detailed payroll records for each pay period, including payslips, tax forms, and other related documents, as required by law.

- Handling Year-End Reporting: Prepare and submit annual payroll reports, such as W-2 forms in the United States, summarizing employees' earnings and taxes for the year.

How to begin with payroll processing?

- Payroll processing can be complex, and many companies utilize specialized payroll software or outsource the process to third-party payroll providers to ensure accuracy and compliance with legal requirements. Additionally, payroll laws and regulations can vary by country and region, so it's crucial for businesses to stay up-to-date with the latest changes to remain compliant.

Start your payroll processing with us

Meru Accounting is one of the leading outsourcing payroll service providers, we have experienced payroll experts that help you guide through the payroll processing

The payroll process can be confusing and tiring if you have just started doing it. You need to compensate your employee for their work. Every company or business entity, irrespective of size and industry, has to ensure accurate and timely payroll processing. Hence, it is important to understand the payroll process and determine the best workflow to compensate its employees.

What is a payroll management process?

The payroll management process involves several steps to ensure that employees are accurately compensated for their work. It includes the calculation of employee wages, tracking of total working hours of employees, withholding of taxes, etc.

The payroll system is either manual or automated; it depends on the requirements and size of the company. But as the company grows with the adding new employees to the workforce, leveraging professional assistance helps you to stay compliant. You can either outsource to a payroll vendor or a certified professional accountant.

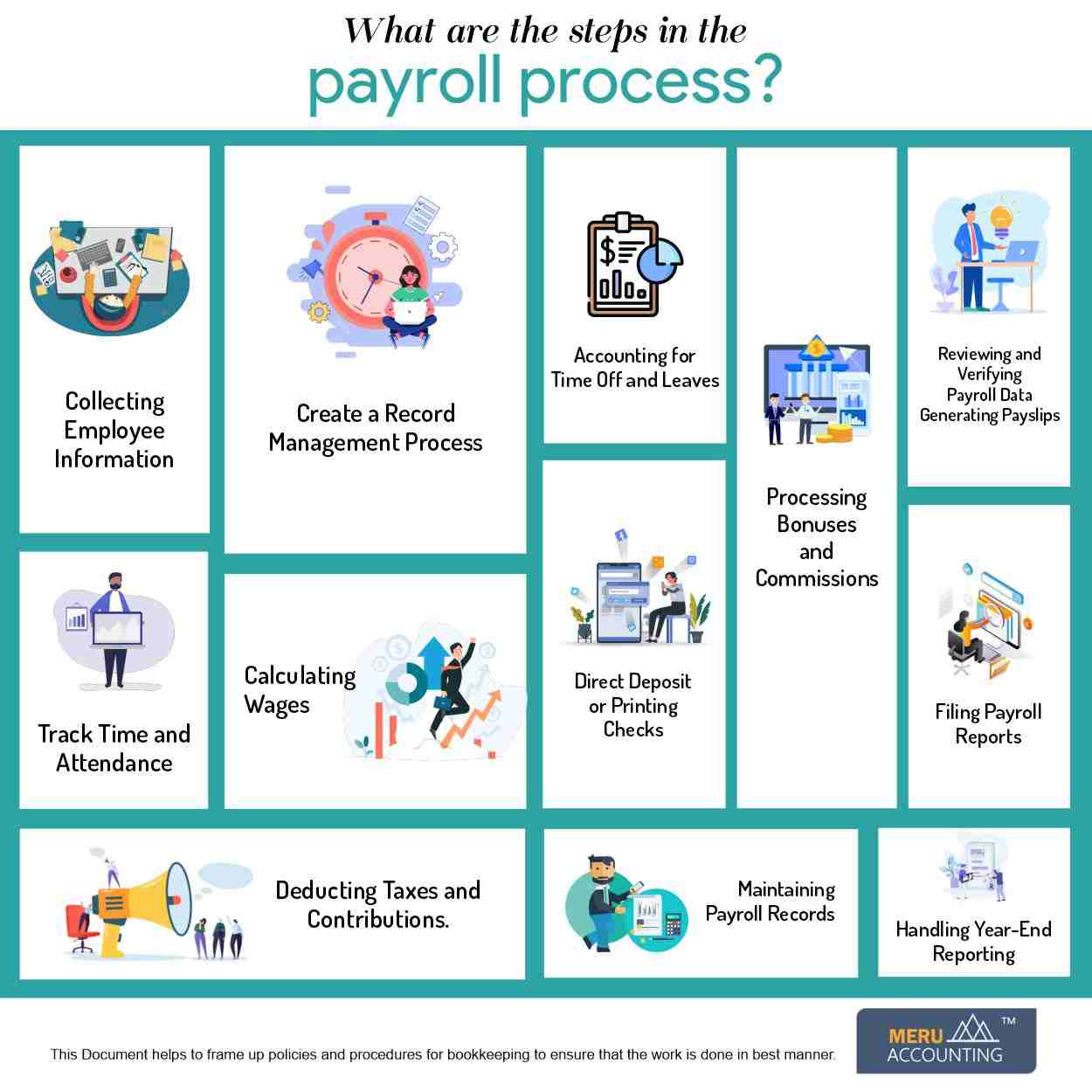

Steps in the payroll process

While specific steps may vary depending on the company's size, location, and payroll system, the following are the typical steps involved in the payroll process:

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

- Collecting Employee Information: Obtain essential information for each employee, including their full name, contact details, tax information, bank account for direct deposit, employment status, hours worked, and any deductions or benefits they are eligible for.

- Create a Record Management Process: Businesses have to maintain several documents such as employee contracts, tax forms, employee handbooks, and training on behalf of their employees. Such documents need signatures and are stored for compliance. There should also be documentation for benefits and retirement for proper payroll deductions.

- Track Time and Attendance: Time tracking is important for payroll processing. Keeping track of employee work hours through timesheets, time-tracking systems, or clock-in/clock-out procedures. It is crucial to streamline the time and attendance process to ensure an accurate record of working hours for an effective payroll management process.

- Calculating Wages: Calculate gross wages based on employees' hourly rates, salaries, overtime, commissions, or any other applicable payment structures.

- Deducting Taxes and Contributions: Subtract income taxes, Social Security, Medicare, and other relevant deductions from the gross wages. These deductions may also include retirement contributions, health insurance premiums, and other benefits.

- Accounting for Time Off and Leaves: Factor in any paid time off, sick leave, or vacation days taken by employees, adjusting their wages accordingly.

- Processing Bonuses and Commissions: If applicable, include bonuses, commissions, or other incentive payments in the payroll calculations.

- Reviewing and Verifying Payroll Data: Conduct a thorough review of all payroll information to ensure accuracy and resolve any discrepancies.

- Generating Payslips: Generate and distribute payslips to employees, detailing their gross wages, deductions, net pay, and any other relevant information.

- Direct Deposit or Printing Checks: Transfer the funds directly to employees' bank accounts through direct deposit or prepare and distribute physical paychecks.

- Submitting Payroll Taxes: Calculate and submit payroll taxes, including employer contributions, to the appropriate tax authorities.

- Filing Payroll Reports: File necessary payroll reports and documentation with relevant government agencies and authorities.

- Maintaining Payroll Records: It includes maintaining detailed payroll records for each pay period, including payslips, tax forms, and other related documents, as required by law.

- Handling Year-End Reporting: Prepare and submit annual payroll reports, such as W-2 forms in the United States, summarizing employees' earnings and taxes for the year.

How to begin with payroll processing?

- Payroll processing can be complex, and many companies utilize specialized payroll software or outsource the process to third-party payroll providers to ensure accuracy and compliance with legal requirements. Additionally, payroll laws and regulations can vary by country and region, so it's crucial for businesses to stay up-to-date with the latest changes to remain compliant.

Start your payroll processing with us

Meru Accounting is one of the leading outsourcing payroll service providers, we have experienced payroll experts that help you guide through the payroll processing