Accounting for Film Production

The film industry is one of those industries which require highly qualified accounting services. These highly qualified and professional accountants are known as Production Accountants. There are high requirements in accounting for film production ranging from complex tax arrangements, uneven cash flows to hefty payrolls.

A Production Accountant looks after all the finances in the film production and manages the record of bookkeeping and accounting. Their overall work revolves around calculating outgoings, cost productions, liaising with financers, and managing the cash flow in the industry. Their skills fall into bookkeeping, auditing, reporting, good communication skills, and in-depth knowledge of filmmaking.

Key Aspects of Financial Requirement for Production Accountants

Budget: This requires an estimation of cost items for each phase of the filmmaking. These stages of film making involve – development phase, pre-production, production, post-production, and distribution. It determines the budget set by a business for the number of production units produced during the filmmaking.

Financial Plan: A financial statement wherein the accountant has to specify the amount of money needed to make the project and how to obtain the required amount. It states the incoming and outgoing flow of cash during production.

Managing Expenses: They are required to make a financial statement of accounting stating all the expenditure and income for the production. Managing the cash flow includes the crew wages, payroll management, production design, live studio, studio cost.

Cash Reports: A firm hold of bookkeeping and accounting is essential. They may even be required to carry out their independent auditing or preparing an estimated cast report.

Forecasting: It is necessary to process current and previous cost data structures to predict an estimate of the costing. This is one of the major aspects involved in financial planning required in the initial stage of production.

While accounting for film production, all the above-mentioned aspects are considered.

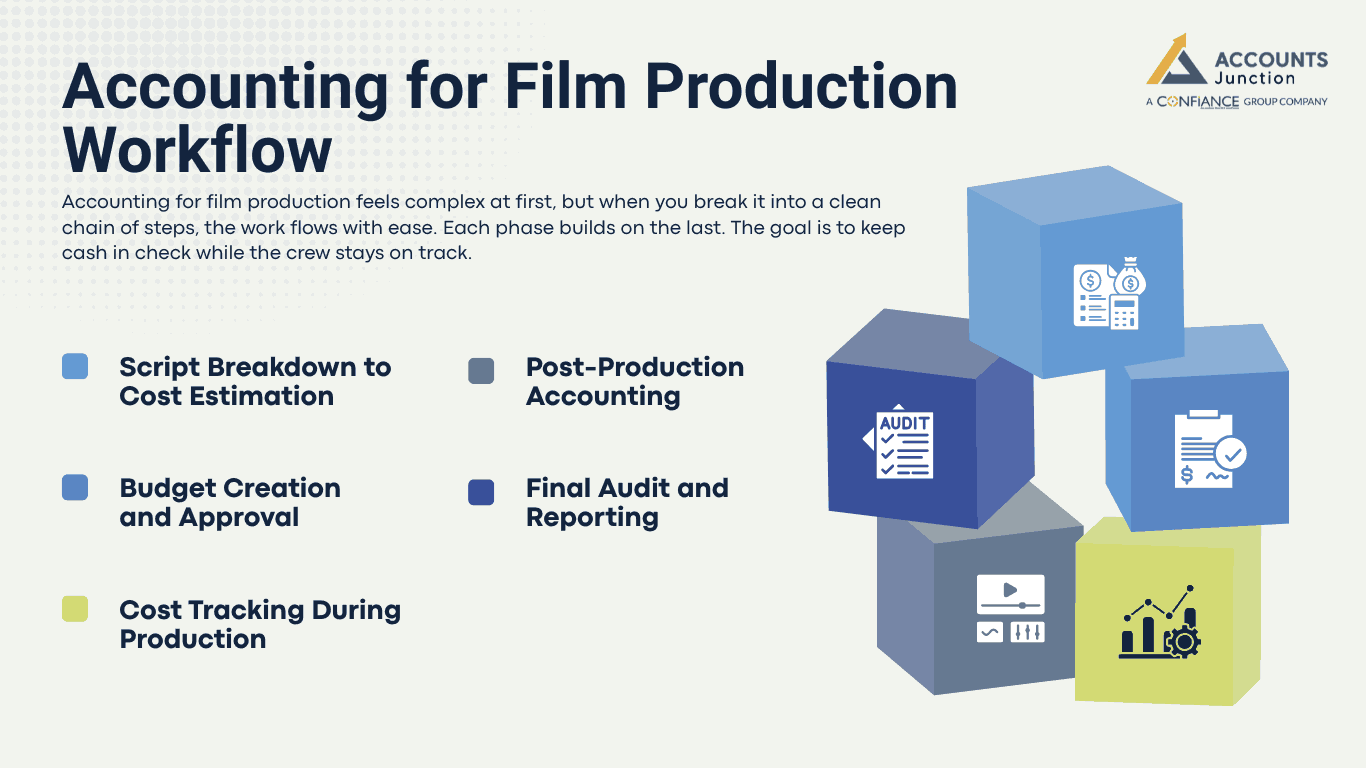

Accounting for Film Production Workflow

Accounting for film production feels complex at first, but when you break it into a clean chain of steps, the work flows with ease. Each phase builds on the last. The goal is to keep cash in check while the crew stays on track.

1. Script Breakdown to Cost Estimation

The process of accounting for film production starts with a script read. Line by line, the team marks each scene, prop, stunt, cast call, and set need. This is called a script breakdown. From that breakdown, the accountant and line producer list each cost point. They use past jobs, crew rates, gear prices, set build plans, and shoot days to guess how much the film may cost. This is the first rough picture of the fund needed for the film.

2. Budget Creation and Approval

Next comes the full budget. This budget shows each line item: cast pay, crew pay, sets, lights, sound, travel, food, edit work, rights, tax, and more. The budget is then shared with the producer, studio, or client. They review, cut, add, and tune it until it fits both the creative plan and the cash limit. Once all key folks agree, the budget gets a sign-off. This approved budget becomes the film’s baseline.

3. Cost Tracking During Production

Once the shoot starts, money moves fast. Crew time sheets, cast fees, rental bills, set builds, fuel slips, hotel bills, and daily spend show up each day. The accountant logs each cost and checks it against the budget. Daily Production Reports (DPRs) help track spend per day. If any cost grows past plan, the team flags it at once. This keeps the film from slipping off budget.

4. Post-Production Accounting

When the shoot is done, the process moves to edit, VFX, sound, and color. New costs are now added: edit suites, VFX shots, foley, music rights, voice work, and mix work. The accountant keeps track of each new invoice and matches it with the post-production plan. Cost control stays strong in this stage because edit work can stretch if left unchecked.

5. Final Audit and Reporting

At the end, all receipts, time sheets, vendor bills, tax forms, and bank logs are matched and closed. A final audit checks that each cost is legit and that the film stayed within the approved budget or with documented changes. Final Cost Reports are shared with producers, investors, and in some cases, tax authorities. Once the audit passes, the books close.

Types of Film Production Budgets

Film budgets are grouped into clear blocks so that each area of work stays easy to plan and track.

1. Above-the-Line Costs

These are the creative lead roles that shape the film.

They include:

- Lead and support actors

- Directors

- Writers

- Producers

- Key creative heads

These roles are set early, so their rates shape the core of the budget.

2. Below-the-Line Costs

These costs cover the crew and the hands-on work on set.

They include:

- Camera crew

- Lights and sound crew

- Makeup and costume

- Set build team

- Location fees

- Gear and tech rentals

- Props and set dressings

This section is often the largest part of the budget.

3. Post-Production Budget

Once the shoot ends, these costs come in:

- Editing

- Color grade

- VFX and CGI

- Sound design

- Music and score

- ADR and voice work

Post-production can rise fast if the film has many effects or sound-heavy scenes.

4. Contingency Budgeting

This is a safety net. Most films use a 5 to 10 percent buffer to cover risk, delays, reshoots, weather issues, or price jumps. A strong contingency plan stops budget shocks when things change on set.

5. Marketing and Distribution Budget

Once the film is done, it must reach the crowd.

This cost group covers:

- Trailers

- Posters

- PR

- Online ads

- Festival fees

- Distribution deals

- Prints and digital copies

Marketing can equal or even exceed the full cost of the shoot for large films.

Incentives, Rebates & Film Tax Credits

Film production teams love incentives. They cut costs and pull more films to a state or country that offer financial benefits, such as tax credits, rebates, grants, or subsidies.

1. State and Country-Specific Incentives

Many regions offer cash-back, tax credits, or rebates to lure film shoots.

Popular hubs include:

- Canada

- UK

- US states like Georgia, New York, New Mexico

- Australia

- Several EU nations

Each has its own rules, spend cap, and grant size.

2. How Rebates Work

A rebate gives you a percent of your spend back.

For example, if a state gives a 20 percent rebate and you spend a set amount there, you get 20 percent of that amount returned after review.

Some rebates are cash. Some are tax credits you can sell or use later.

3. Eligibility Rules

Rules differ with each region but often include:

- Spend must be in that region

- Crew must be local or part local

- A minimum spend limit

- Proof of work done in the region

- Script review for content rules

If the film meets the rules, it may claim the incentive.

4. Documentation Required

You must keep solid proof, such as:

- Invoices

- Time sheets

- Bank logs

- Local hire lists

- Vendor contracts

- Production reports

- Proof of on-site work

All must match the region’s rules.

5. Application and Claim Process

Most places ask for:

- A pre-approval form

- A full budget

- A shoot plan

- Mid-shoot spend reports

- A final audit

- A claim form

Once the claim checks out, the region pays out or issues a credit.

How can Accounts Junction help in accounting for film production?

Accounts Junction has renounced a history of providing outsourced accounting for film production worldwide. With a wide range of expertise and experience in the sectors of accounting and bookkeeping, we can deliver tailored solutions best suited for your film industry.

We have experience with scalable accounting for film producers. We provide services such as payroll management, budgeting (petty cash and foreign currency), and keeping accurate financial records. Our services help you to monitor budgets, analyze expenditure, and provide weekly cost reports with utmost transparency and full proof planning.

Benefits of having Accounts Junction

Cost Management: We manage the expenses, analyze the cash flow, monitor budgets, calculate estimates of cost requirements, provide cash reports, and keep records of financial accounting. Accounts Junction’s expertise lies in the experience of accounting for film production.

Qualified Team: Our team has highly qualified CPAs who supervise the entire workflow of the production accounting. We hold meetings to monitor and provide expertise.

Cost-Effective: We offer their clients 50% cost savings, charging only $15 per hour. The services and consultancy make Accounts Junction highly cost-effective.

Provision of Tailored Solutions: With services such as cash flow management, payroll processing, business plan operations, auditing, financial analytics, and maintaining bookkeeping records, we can provide tailored accounting for film production.

FAQs

1. What does a film production accountant do?

- A film production accountant tracks all money that comes in and goes out during the film. They plan the budget, log each cost, check time sheets, handle invoices, watch for cost spikes, and help the producer stay on track.

2. Why is a script breakdown key for cost planning?

- A script breakdown shows every scene, cast call, stunt, prop, and set need. It helps the team see what the film needs and what each part will cost. Without it, the budget is just a guess.

3. How long does it take to build a film budget?

- It can take a few days for a small film and a few weeks for a big one. It depends on cast size, shoot scale, and how fast the team can lock rates and plans.

4. What makes above-the-line costs so high?

- These roles—actors, directors, writers—shape the film. They have fixed fees and strong market rates. Since their names help sell the film, their pay forms a big part of the budget.

5. Why do below-the-line costs shift during the shoot?

- Crew needs change, gear breaks, sets take longer, or scenes run late. Weather, travel, and new notes from the director can also raise costs. This part of the budget moves the most.

6. How do films track daily spend?

- Teams use time sheets, vendor bills, fuel slips, and rental logs each day. All this goes into a cost tracker or an accounting tool. Daily Production Reports help track trends.

7. What is a production report?

- It is a daily log that shows what the team shot, who was on set, how long they worked, and what it cost. It helps producers track progress and spot cost spikes.

8. Why is cost control vital in post-production?

- Edit work, VFX shots, and sound tasks can grow fast. If no one checks spend, the film can blow past its plan. Strong cost control keeps post work within the set limit.

9. What is a final audit in film accounting?

- It is the last check of all bills, slips, bank logs, and reports. Auditors confirm that each cost is real and that the film stayed within its approved plan or changes.

10. What makes film budgets different from normal business budgets?

- Film budgets change more often, have many small cost points, and are tied to creative needs. A film also has a set start and end, so all costs hit in a short time frame.

11. Why do films add a contingency buffer?

- It acts as a safety net. Delays, reshoots, gear issues, or price jumps can happen at any time. A buffer keeps the film safe from sudden cost shocks.

12. What are the main parts of a post-production budget?

- Key parts include editing, VFX, CGI, sound design, music, voice work, color grade, and mix work. These make up the bulk of post-production spend.

13. How do film tax credits help reduce costs?

- They give back a part of what the film spends in a region. This lowers the real cost of the shoot and makes the budget stretch further.

14. What is the difference between a rebate and a tax credit?

- A rebate gives cash back after review. A tax credit cuts tax or can sometimes be sold. Both save money, but they work in different ways.

15. Which regions are known for strong film incentives?

- Places like Canada, the UK, Australia, and US states like Georgia, New York, and New Mexico offer solid incentives for film teams.

16. Do small indie films also get rebates?

- Yes, many regions allow indie films to claim rebates if they meet the spend rules and keep proper proof.

17. What documents are needed to claim incentives?

- You need invoices, time sheets, bank logs, vendor deals, local hire lists, and proof of work done in that region.

18. When should a film apply for pre-approval for incentives?

- Most films apply before the shoot starts. Some places need approval even before casting or location deals are signed.

20. Can a film lose its incentive if rules are not met?

- Yes. If the film breaks spend rules, skips documents, or fails to hire local crew as required, the incentive can be cut or denied.

21. Who reviews the final reports for an incentive claim?

- The region’s film office, tax board, or a third-party auditor checks all reports. They confirm that the film met each rule.