A Complete Guide for NGO Accounting and Accountability.

Bookkeeping for Nonprofit organization

A non-profit organization’s accounting and bookkeeping are different from those of a for-profit organization. The NGO accounting tasks and principles are a bit customized for tracking and analyzing the financial transaction for the non-profit organization.

NGO is a non-profit making organization so the accounting and bookkeeping requirements are unique. Get in detail with this complete guide for NGO accounting and accountability. Organizing your business’s bookkeeping can be difficult. With that in mind, our bookkeeping service is the perfect solution.

NGO accounting

Usually, an NGO has a treasurer or a financial officer to take care of the finances. Here are some important things that treasure must know to perform the accounting job. Here are some unique requirements to account for the financial transaction.

Select an accounting method:

A proper bookkeeping depends upon choosing an accounting method for recording inflow and outflow of money. Just like any business, it needs adequate cash flows to pay for employees’ wages, utility bills, rent, etc. It has sources of revenue such as contributions from the donors, membership fees, etc. Thus, to account for all the incoming receipts and outgoing payments. These two methods of accounting are to follow: cash basis of accounting and accrual basis of accounting. The cash basis works on the actual exchange of cash whereas the accrual basis works on when a transaction occurs irrespective of receipt/payment of cash.

Know tax compliances:

If an NGO applies and qualifies for tax-exemption status, there is no tax obligation, but you have to file a business tax return. Submission of all the forms that qualify a business for tax exemption is also necessary. Irrespective of no tax payable, an NGO business is still required to report revenue and expenses. So, keeping accurate records and reports of business activities and finances is crucial for an NGO accounting.

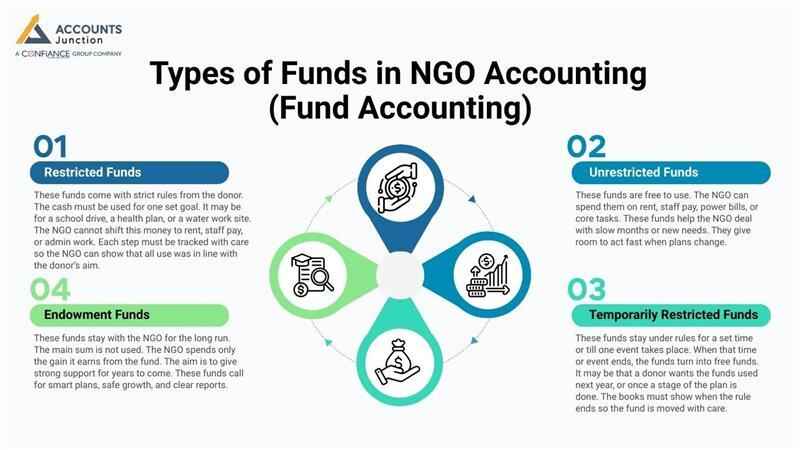

Types of Funds in NGO Accounting (Fund Accounting)

NGOs do not use the same style of books that a normal firm uses. They use fund accounting, which helps them track each pool of money based on its use and the donor’s wish. Each fund has its own rules, so it is easy to see what went in, what went out, and what is still left.

Restricted Funds

These funds come with strict rules from the donor. The cash must be used for one set goal. It may be for a school drive, a health plan, or a water work site. The NGO cannot shift this money to rent, staff pay, or admin work. Each step must be tracked with care so the NGO can show that all use was in line with the donor’s aim.

Unrestricted Funds

These funds are free to use. The NGO can spend them on rent, staff pay, power bills, or core tasks. These funds help the NGO deal with slow months or new needs. They give room to act fast when plans change.

Temporarily Restricted Funds

These funds stay under rules for a set time or till one event takes place. When that time or event ends, the funds turn into free funds. It may be that a donor wants the funds used next year, or once a stage of the plan is done. The books must show when the rule ends so the fund is moved with care.

Endowment Funds

These funds stay with the NGO for the long run. The main sum is not used. The NGO spends only the gain it earns from the fund. The aim is to give strong support for years to come. These funds call for smart plans, safe growth, and clear reports.

Donor Management and Grant Accounting

Donor and grant work is a top search for NGO teams. Donors want to see that their gift did real good. Good records build trust, draw new funds, and help the NGO stand strong.

Tracking Donor Contributions

Each gift must be logged with care. The books must show the donor’s name, date, mode of pay, sum, and any rule on its use. Clean logs make it easy to send thanks, track fund use, and prepare for audits.

Grant Restrictions

Grants often come with dedicated rules. These rules decide what the NGO can buy, what it must track, and when it must send a report. Some grants need strict proof of each cost. Careless use of funds can lead to a block of future help.

Grant Reporting Requirements

Most grants need reports at set dates. These reports show:

- how much was spent

- what the team did with the funds

- how the plan moved

- bills or proof of cost

Late or weak reports can harm ties with the donor.

Donor Communication Best Practices

Donors like to know how their help made a change. NGOs should send quick thanks, share short notes on progress, send clean books, and respond on time. Warm and real talk helps keep the donor tied for years.

Multi-Year Grants Handling

Some grants cover more than one year. The NGO must split the funds by year, track what is used, and note what is saved for the next year. This keeps the books clean and stops mix ups in fund use.

Revenue Sources and Their Accounting Treatment

NGOs earn money in many ways. Each type of income needs its own set of rules in the books. NGO accounting depends on the following type of sources:

Donations

These are gifts from people or groups. They can be free to use or tied to one plan. NGOs must issue a receipt, track the fund type, and follow tax laws on such gifts.

Grants

Grants come from big groups, firms, or the state. These funds have rules on how the NGO may use them. The NGO must log the grant in line with what the rule says. Some grants are earned when the task is done, not when the cash comes in.

Membership Fees

When people pay a fee to join an NGO group, it is seen as earned income. The fee may give them access to events, talks, tools, or a voice in the group. The NGO must track how much came in and where it went.

CSR Funds

Firms often give CSR funds to NGOs. These funds need clean logs, clear proof of cost, and strict use in line with the firm’s plan. Photos, bills, and field notes are often needed. If the funds come from a firm outside the land, there may be more rules to follow.

Fundraising Events

NGOs may run walks, fairs, or drives to raise funds. The books must track ticket sales, sponsor pay, and event costs. After all costs, the net sum goes to the main goal. These funds are free to use unless a donor sets a rule.

Program Service Revenue

This is income from tasks the NGO runs, like skill camps or workshops. These are part of its core work. This income is earned and is often free to use.

Outsourcing Accounting for NGOs

A lot of NGOs now choose to hand their books to a skilled team. At Meru Accounting, we provide remote bookkeeping services for NGOs. With our team, you get clean books, less stress, and complete compliance.

Benefits of Outsourcing

You get more time for field work while pros handle fund logs, donor reports, grant work, tax needs, and audits. This cuts errors and boosts trust.

Cost Savings

A full in-house team costs more. With us, you save on pay, tools, and time. You also avoid fines or lost funds due to poor logs.

Scalability

As your NGO grows, so does the load on your books. Our team can scale fast. You get more help when you need it and less when you do not.

Expertise in Nonprofit Compliance

Meru Accounting knows fund rules, FCRA needs, CSR norms, and audit work. You get clean books, smooth reports, and strong support all year.

Prepare appropriate financial statements:

A nonprofit accounting also requires them to prepare financial statements to report their finances. There are three main financial statements:

Statement of activities.

Statement of financial position.

Statement of cash flows.

- Statement of activities is the nonprofit accounting version of the income statement. Just like an income statement, it tells the revenue and expenses of the organization over a period of time. Since nonprofits don’t earn profits, thus it calculates the changes in net assets of the business.

- Statements of financial position provide a clear view of the financials of the nonprofit organizations at a particular point. It shows what they own, what they owe, and how money is left with them. It has nets assets that express the excess of assets over liabilities. It is the balance sheet equation for nonprofit accounting.

- Statement of cash flows: It helps to track all the cash flows of the organization. It represents the cash generated from the investing, operating, and financing activities. The nonprofit version of the cash flow statement shows the change in the net assets and lists cash flows restricted to certain uses. It will have items such as membership fees, fundraising proceeds, and donor contributions, program fees, etc.

Once a bookkeeping system is in place, you can start preparing financial statements. These financial statements track how much money you have, where your money is, how and why your money got there.

QuickBooks Aplos, Freshbooks, Nonprofit treasures, etc., are some of the bookkeeping software for nonprofit organizations that allows you to generate financial transactions automatically. Even though you can generate financial statements manually from your ledger or spreadsheet, it will require proper NGO accounting knowledge and plenty of time to do so. The best way is to outsource and let Accounts Junction take over this task.

FAQs

1. What is fund accounting in an NGO?

- Fund accounting is a way to track money by its use. Each fund has its own rules and aims.

2. Why do NGOs need fund accounting?

- It helps show donors that each rupee was used in the right way. It builds trust and keeps the books clear.

3. What are restricted funds?

- These are funds that donors allow for one set goal only.

4. What are unrestricted funds?

- These funds can be used for any core need like rent, staff pay, or admin work.

5. What are temporarily restricted funds?

- These funds stay locked by rules for a set time or till one task is done.

6. What are endowment funds?

- These are long-term funds where the main sum is not used. Only the gain is spent.

7. Why must NGOs track donor gifts with care?

- It helps show clean use of funds and makes audits easy. It also keeps donors happy.

8. What is a grant in NGO terms?

- A grant is a fund given by a group, firm, or state with rules on how to use it.

9. Do grants have strict rules?

- Yes. Most grants have rules on cost, time, records, and reports.

10. What is grant reporting?

- It is a set of notes and proof an NGO sends to the grantor to show where the funds went.

11. Why are donor reports so key?

- Donors want to see clear proof of impact. Good reports build long-term ties.

12. How should NGOs track multi-year grants?

- They must split the income by year, track use, and log what is saved for later years.

13. How are donations logged in the books?

- Each gift is logged with date, sum, mode, donor name, and fund type.

14. How is CSR income tracked?

- CSR funds must be kept in a clean, separate log with strict proof of use.

15. How are funds from events logged?

- Ticket sales, sponsor pay, and event costs are tracked. The net sum goes to the main goal.

16. What is program service income?

- It is income from NGO tasks, like skill camps or workshops.

17. Why do NGOs face audit risk?

- Weak logs, late reports, or use of funds in the wrong area can cause audit issues.

18. Should NGOs outsource their books?

- Yes, many do. It cuts cost, saves time, and boosts book accuracy.

19. How does outsourced accounting help NGOs grow?

- It gives them a team that can scale fast as work expands.

20. Why pick Meru Accounting for NGO accounting?

- We know fund rules, grant needs, CSR norms, and all key compliance laws. Our team keeps your books clean and your donors at ease.